Scott Olson/Getty Images

Scott Olson/Getty Images

In the era of cryptocurrencies and meme stocks, the overall stock market is surprisingly a sea of calm.

The Cboe Volatility Index, or the VIX, closed below 16 last week, which marked its first print below 16 since February last year, according to S&P Global.

To put it in perspective, the VIX surged to 41 exactly one year ago, Goldman Sachs strategists led by chief equity strategist David Kostin pointed out in a June 11 research note.

Since then, volatility has steadily declined while the S&P 500 ascended and returned 14% this year as of Friday.

Kostin adds that the combination of high return and low volatility explains the high year-to-date Sharpe ratio of 2.4 (1.4 on a 6-month basis) for the S&P. While not perfect, the Sharpe ratio is considered a solid measure for how much excess return investors receive for the volatility of holding a riskier asset.

In that sense, the S&P's 2.4 YTD Sharpe ratio also means that it's a better investment than bitcoin, which had an annualized risk-adjusted return of 0.8 as of Friday, just one-third that of the S&P 500.

Looking ahead, there are still many undercurrents lurking in the market, which can manifest through sustained inflation surprises, higher interest rates, potential corporate and capital gains tax reform, tech regulation, and geopolitics. These factors could bring about higher levels of volatility and even roil markets, according to Kostin.

With all these risk factors at work, Goldman has rebalanced its high Sharpe ratio basket, which comprises 50 stocks with the highest prospective risk-adjusted returns. The team defines each stock's prospective Sharpe ratio as "the return to the consensus 12-month price target divided by 6-month option-implied volatility."

While the basket typically tilts towards value stocks, many of the 37 new stocks entering the portfolio are large-cap growth names, which have underperformed the market for the past seven months due to rising rates and accelerating economic growth. However, Kostin and his team believe that the dynamic may not last.

"Based on our economists' forecasts, we expect continued factor volatility but that value will continue to outperform in the near term whereas growth should regain leadership in late 2021 or early 2022," Kostin said in the note.

Without further ado, below is the list of 37 stocks entering the high Sharpe ratio basket. The preexisting 13 stocks are Activision Blizzard (ATVI), AutoZone (AZO), Kimberly-Clark (KMB), Cabot Oil & Gas (COG), Assurant (AIZ), Hartford Financial (HIG), Merck & Co. (MRK), Cigna (CI), Masco (MAS), Fiserv (FISV), Citrix Systems (CTXS), Fidelity National Info Services (FIS), and Skyworks Solutions (SWKS).

The newly added 37 stocks, along with their tickers, market capitalizations, expected returns, and six-month implied volatilities, are listed below. The market cap data were recorded on Monday and all other data are as of June 10.

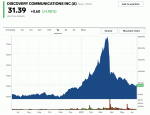

1. DiscoveryMarkets InsiderTicker: DISCA

Market cap: $15.58 billion

Expected return: 41%

6-month implied volatility: 42%

Source: Goldman Sachs

2. NetflixMarkets Insider

Ticker: NFLX

Market cap: $216.99 billion

Expected return: 26%

6-month implied volatility: 31%

Source: Goldman Sachs

3. Walt DisneyMarkets Insider

Ticker: DIS

Market cap: $322.69 billion

Expected return: 17%

6-month implied volatility: 25%

Source: Goldman Sachs

4. Take-Two Interactive SoftwareMarkets Insider

Ticker: TTWO

Market cap: $21.59 billion

Expected return: 20%

6-month implied volatility: 30%

Source: Goldman Sachs

5. ComcastMarkets Insider

Ticker: CMCSA

Market cap: $261.65 billion

Expected return: 14%

6-month implied volatility: 23%

Source: Goldman Sachs

See the rest of the story at Business Insider

See Also:

- These 5 stocks are prime candidates for an explosive AMC-style short squeeze right now, according to data from Fintel

- Cathie Wood and Ark Invest analysts break down how bitcoin mining could increase the overall share of renewable energy — and explain why they remain highly convicted in bitcoin and ethereum

- 'Inflation could destroy today's darlings': An equities chief overseeing $7.5 billion has been preparing for inflation since June. Here's his playbook and 2 sectors set to surge