Outdoor specialty retailer Sportsman's Warehouse (NASDAQ:SPWH) announced better-than-expected revenue in Q3 CY2024, but sales fell by 4.8% year on year to $324.3 million. The company’s full-year revenue guidance of $1.19 billion at the midpoint came in 3.8% above analysts’ estimates. Its non-GAAP profit of $0.04 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Sportsman's Warehouse? Find out by accessing our full research report, it’s free.

Sportsman's Warehouse (SPWH) Q3 CY2024 Highlights:

- Revenue: $324.3 million vs analyst estimates of $300.5 million (4.8% year-on-year decline, 7.9% beat)

- Adjusted EPS: $0.04 vs analyst estimates of -$0.02 (significant beat)

- Adjusted EBITDA: $16.38 million vs analyst estimates of $12.74 million (5.1% margin, 28.6% beat)

- The company lifted its revenue guidance for the full year to $1.19 billion at the midpoint from $1.15 billion, a 3.5% increase

- EBITDA guidance for the full year is $26 million at the midpoint, above analyst estimates of $23.6 million

- Operating Margin: 1%, in line with the same quarter last year

- Free Cash Flow was -$6.16 million, down from $22.49 million in the same quarter last year

- Same-Store Sales fell 5.7% year on year (-11.4% in the same quarter last year)

- Market Capitalization: $87.05 million

“Despite a pressured consumer and complex macroeconomic environment, we focused our efforts on driving sales and achieved growth in our fishing, camping and gift bar categories during the quarter,” said Paul Stone, Sportsman’s Warehouse President and Chief Executive Officer.

Company Overview

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ:SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

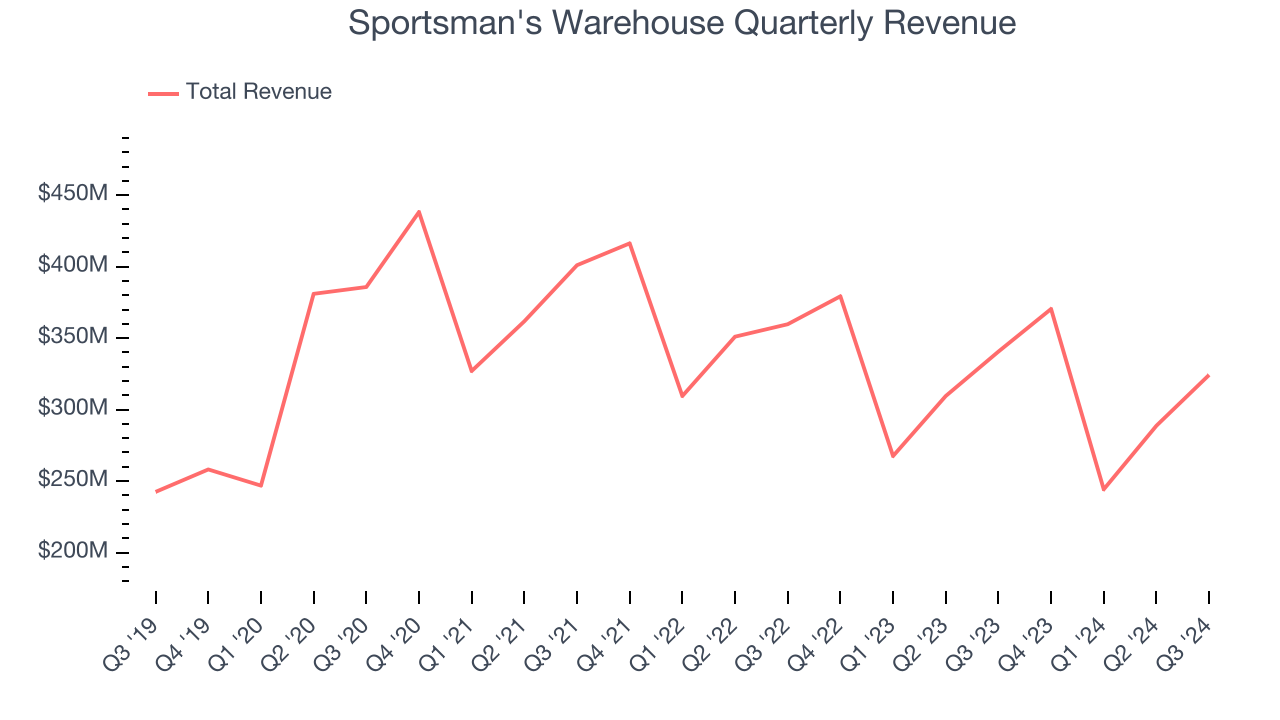

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Sportsman's Warehouse is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

As you can see below, Sportsman's Warehouse grew its sales at a tepid 7.1% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Sportsman's Warehouse’s revenue fell by 4.8% year on year to $324.3 million but beat Wall Street’s estimates by 7.9%.

Looking ahead, sell-side analysts expect revenue to decline by 6.4% over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and implies its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

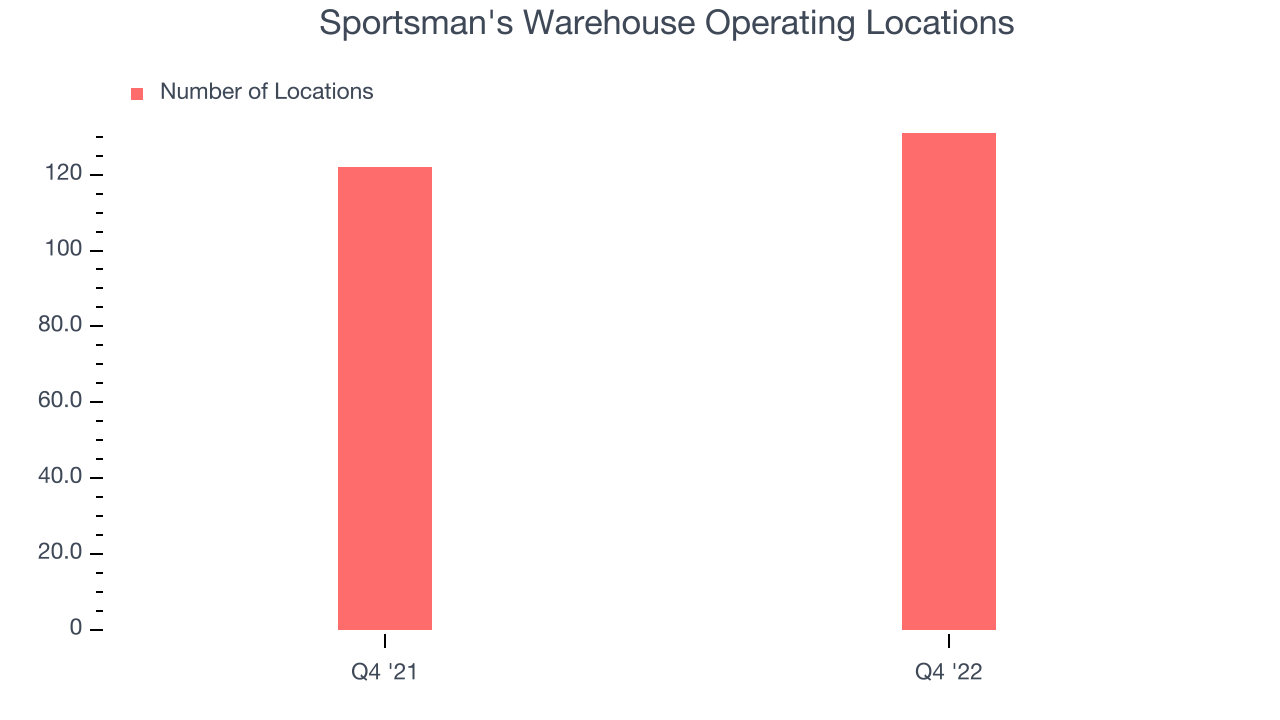

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Over the last two years, Sportsman's Warehouse opened new stores at a rapid clip, averaging 7.4% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Sportsman's Warehouse reports its store count intermittently, so some data points are missing in the chart below.

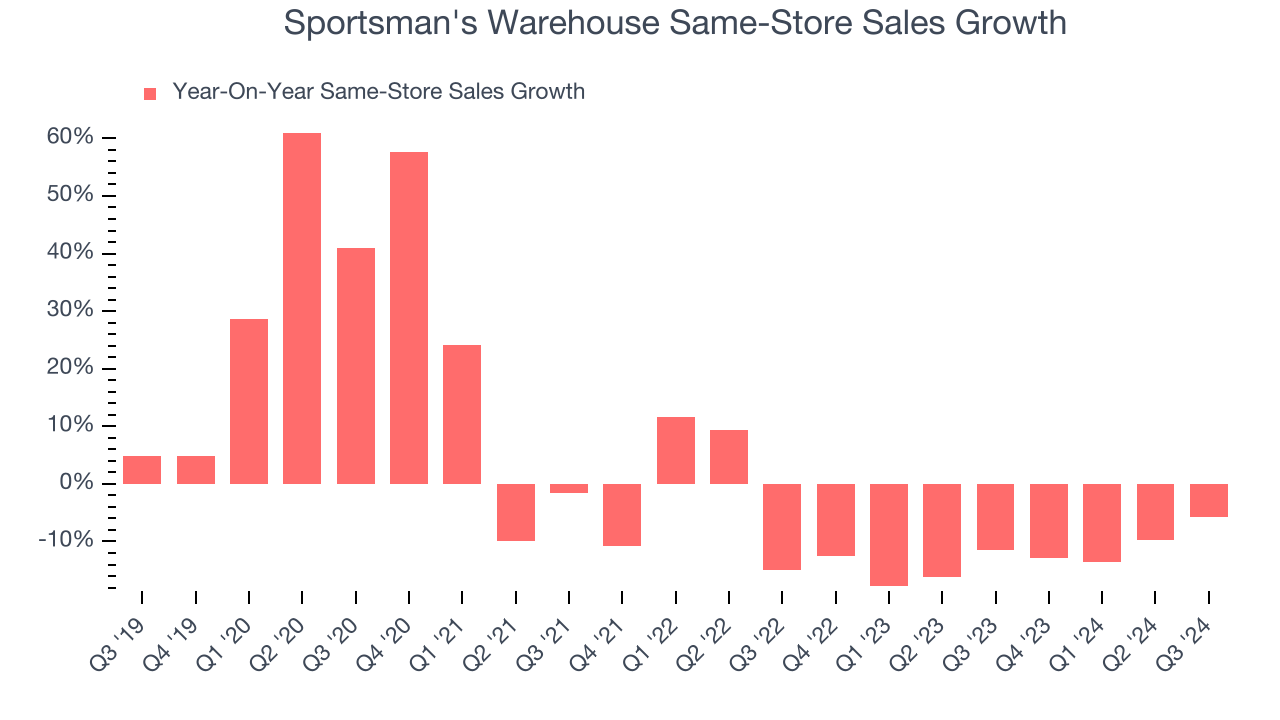

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sportsman's Warehouse’s demand has been shrinking over the last two years as its same-store sales have averaged 12.5% annual declines. This performance is concerning - it shows Sportsman's Warehouse artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Sportsman's Warehouse’s same-store sales fell by 5.7% year on year. This decrease was an improvement from its historical levels. It’s always great to see a business’s demand trends improve.

Key Takeaways from Sportsman's Warehouse’s Q3 Results

We were impressed by how significantly Sportsman's Warehouse blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year revenue and EBITDA guidance beat Wall Street's estimates. Zooming out, we think this was a solid "beat-and-raise" quarter. The stock traded up 8.6% to $2.66 immediately following the results.

Sportsman's Warehouse had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.