Footwear and accessories discount retailer Designer Brands (NYSE:DBI) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 1.2% year on year to $777.2 million. Its non-GAAP profit of $0.27 per share was 23.5% below analysts’ consensus estimates.

Is now the time to buy Designer Brands? Find out by accessing our full research report, it’s free.

Designer Brands (DBI) Q3 CY2024 Highlights:

- Revenue: $777.2 million vs analyst estimates of $802.1 million (1.2% year-on-year decline, 3.1% miss)

- Adjusted EPS: $0.27 vs analyst expectations of $0.35 (23.5% miss)

- Management lowered its full-year Adjusted EPS guidance to $0.20 at the midpoint, a 63.6% decrease

- Operating Margin: 2.9%, in line with the same quarter last year

- Locations: 675 at quarter end, up from 643 in the same quarter last year

- Same-Store Sales fell 3.1% year on year (-9.3% in the same quarter last year)

- Market Capitalization: $321.3 million

Doug Howe, Chief Executive Officer stated, "The third quarter started strong, driven by back-to-school season and the success of our athletic and athleisure offerings, bolstering our confidence that we had reached a turning point in our business. However, we had a difficult transition into the fall season, with unseasonably warm weather and ongoing macroeconomic uncertainty placing pressure on consumer discretionary spending, specifically in our seasonal category. As a result, we saw our total Company comparable sales decline 3.1% for the quarter. According to Circana, footwear sales excluding boots remained flat to prior year in the footwear market while U.S. Retail segment sales excluding boots grew 8% versus prior year, outpacing the footwear market results. This gives us further confidence that we are investing our time and resources into the right areas as we continue to transform our business."

Company Overview

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Designer Brands is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

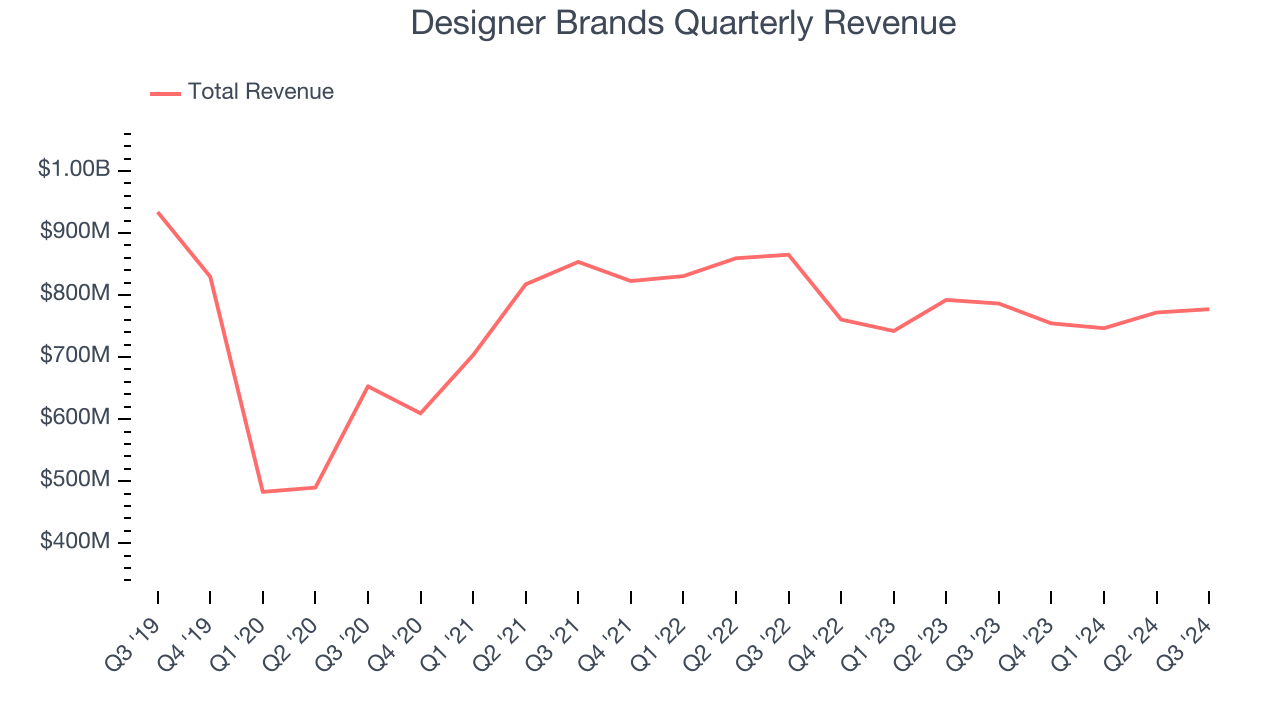

As you can see below, Designer Brands’s revenue declined by 2.7% per year over the last five years (we compare to 2019 to normalize for COVID-19 impacts) despite opening new stores. This implies its underperformance was driven by lower sales at existing, established locations.

This quarter, Designer Brands missed Wall Street’s estimates and reported a rather uninspiring 1.2% year-on-year revenue decline, generating $777.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months. While this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

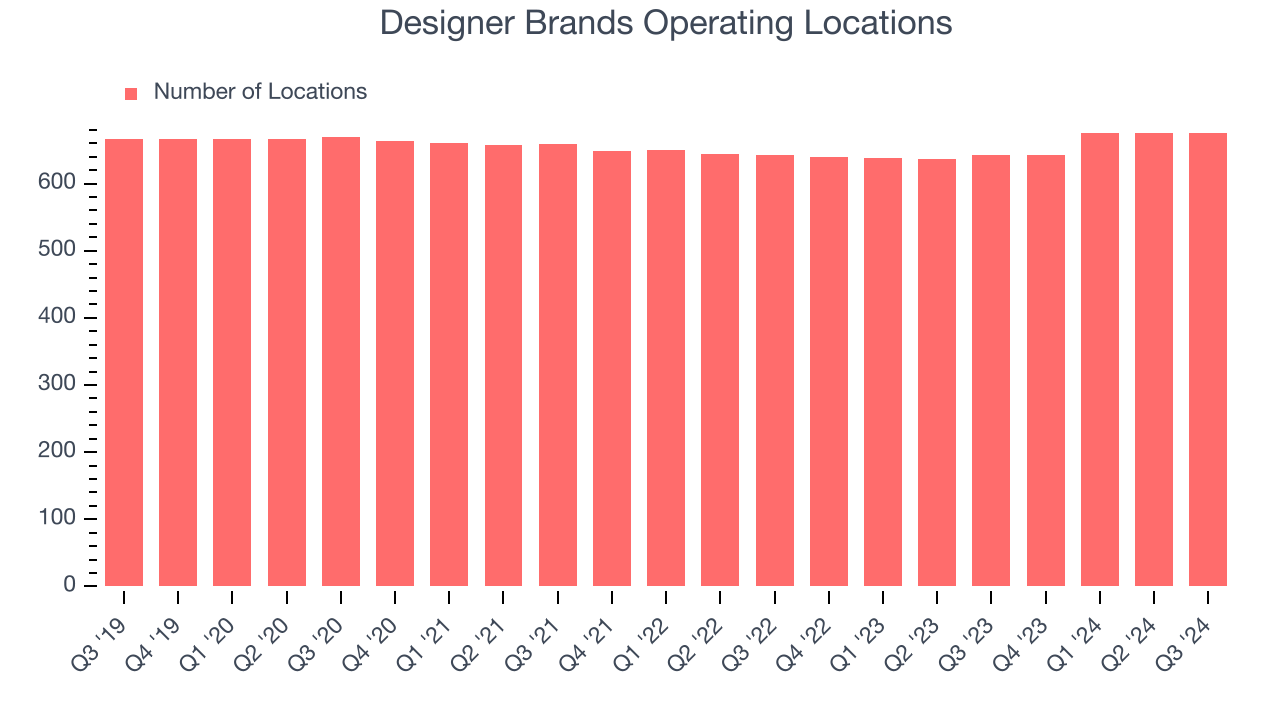

Designer Brands operated 675 locations in the latest quarter. It has opened new stores quickly over the last two years by averaging 1.7% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

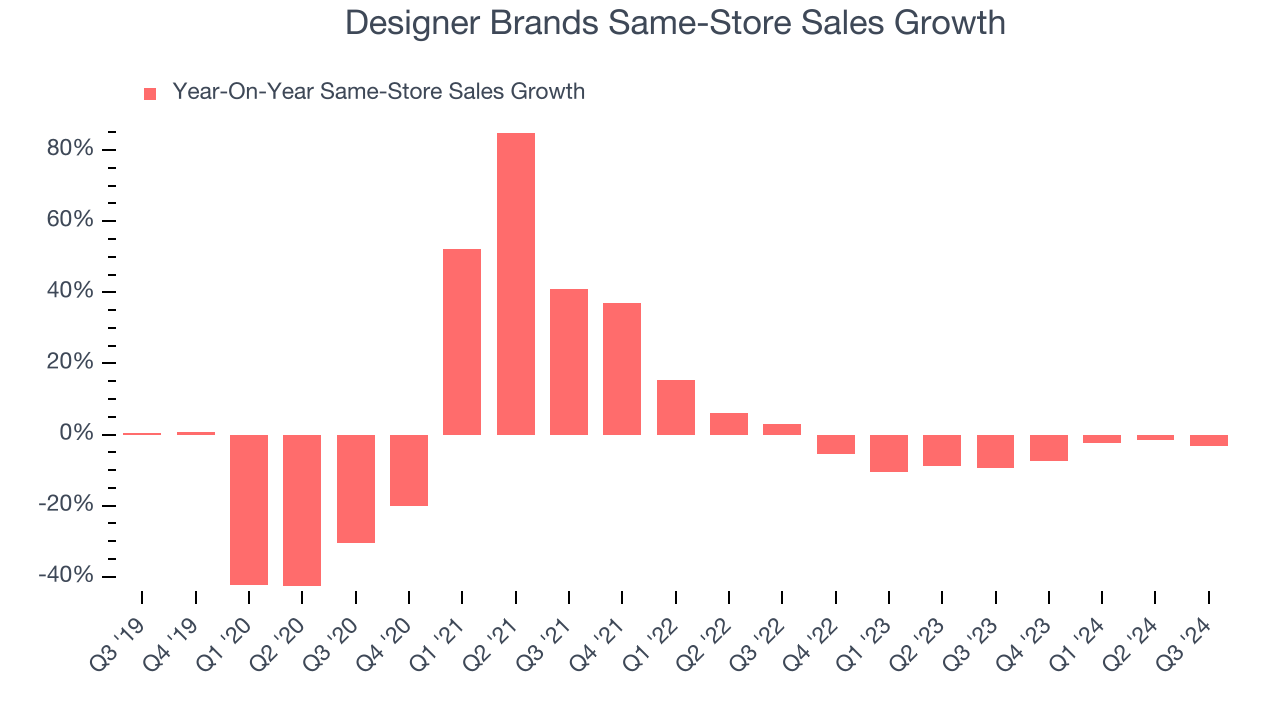

Designer Brands’s demand has been shrinking over the last two years as its same-store sales have averaged 6.1% annual declines. This performance is concerning - it shows Designer Brands artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Designer Brands’s same-store sales fell by 3.1% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Designer Brands’s Q3 Results

We struggled to find many resounding positives in these results. Its revenue missed on a same-store sales decline. Full-year EPS guidance was lowered and missed significantly. Overall, this was a very bad quarter. The stock traded down 19.6% to $4.65 immediately following the results.

Designer Brands’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.