The term "forward dividend yield" sounds complicated, but it's not. Investors often use this metric to consider adding to their portfolios when evaluating dividend-paying stocks. It can be a valuable measure to help determine the potential income a stock can deliver. It can also help gauge when the risk is high or low for the stock's price. As an investor, it pays to be aware of the forward dividend and yield and how to calculate forward dividend yield. This article will explain the forward dividend yield and how to use it when analyzing stocks effectively.

What is a Forward Dividend Yield?

What is forward dividend and yield, exactly?A forward dividend yield is the expected annual dividend payment expressed as a percentage of the stock's current price. It may sound complicated initially, so we'll break down the parts as a forward dividend and yield. A dividend is a distribution of a piece of a company's profits, cash or equity paid out to its shareholders periodically. These periods can vary from month to quarter, semi-annually or annually. Usually, a dividend is distributed quarterly to shareholders who own shares on or before the date on record.

The ex-dividend date is the first business day after the dividend is distributed and is no longer available for new buyers. Shareholders must hold their shares on the opening of the ex-dividend date to be entitled to receive the dividend. Investors are free to sell their shares on or after the ex-dividend date. Buyers on the ex-dividend date will not receive the dividend. New stockholders will have to wait for the next dividend payout, which the company will announce along with the record date and ex-dividend date. The actual dividend payout is proportional to the number of shares owned by the shareholder.

Some investors like to employ a dividend capture strategy by acquiring dividend stocks on or before the day of record and selling them on the ex-dividend date. This strategy works better with a list of viable dividend capture stocks. The dividend yield is the annual dividend income relative to the stock's current price expressed as a percentage. A forward dividend yield is the expected dividend yield over the next year.

Understanding Forward Dividend Yield

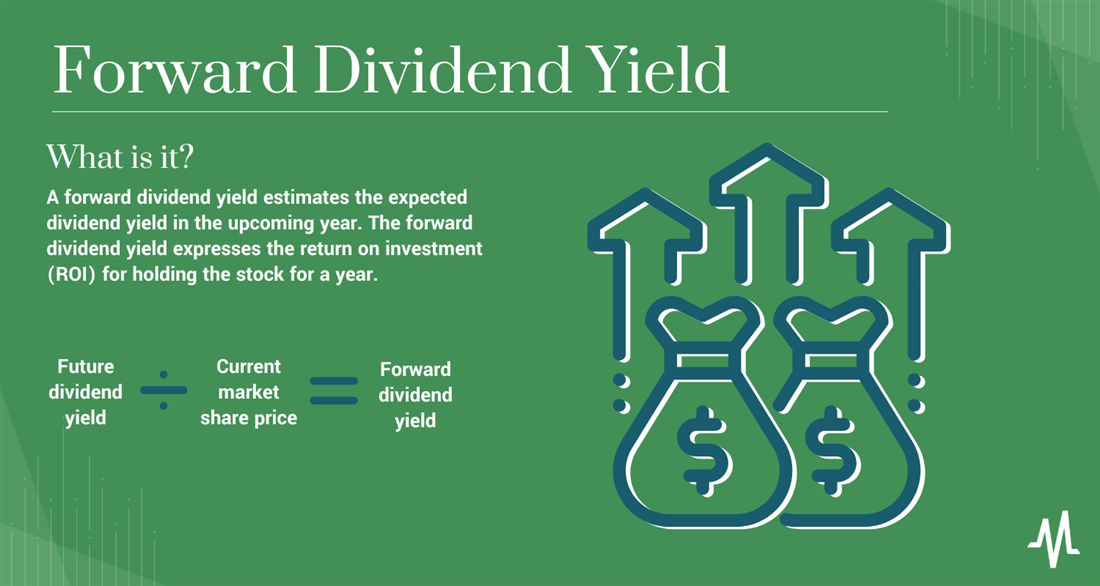

Since a stock's price is always dynamic and moving, the dividend yield can change with the value of the stock. The dividend yield can also change when companies raise or cut quarterly dividends, affecting its forward annual dividend rate. An annual dividend yield is based on the dividends paid in the past year divided by the current stock price. A forward dividend yield estimates the expected dividend yield in the upcoming year. Knowing the forward dividend yield of a stock can be helpful when evaluating potential stocks for income purposes. The forward dividend & yield expresses the return on investment (ROI) for holding the stock for a year.

How to Calculate Dividend Yield

How do you calculate yield forward? To calculate a forward dividend yield, you take the most recent dividend payout amount, annualize it and divide it by the current share price. For example, if XYZ pays a 25-cent quarterly dividend, the annual dividend is $1.

Divide the annual dividend payout of $1 by the current stock price of XYZ at $20, resulting in a forward dividend yield of 5%. The exact dividend yield will vary as the underlying stock price fluctuates, and the company may raise or lower its dividend. Therefore, forward dividend yields are an estimation.

Importance of Dividend Yield

A dividend yield is significant because it shows how much income you can collect from holding stock. It's a measure of ROI. You can use the dividend yield to determine how much income you will receive for holding a stock or how much of a hedge you may have against market volatility. For example, if a $100 stock has a $2 annual dividend, you can expect a 2% dividend yield. You can also expect a 2% safety buffer on volatility during the year. Dividend yield provides an income stream in addition to capital appreciation.

If the underlying stock price falls, the dividend yield increases, and vice versa. Dividend stocks, especially dividend aristocrats, tend to have less volatility. Dividend yield helps investors evaluate stocks for potential income, valuation and volatility.

Difference Between Forward, Indicated and Trailing Dividend Yields

There are different measures of a company's dividend payouts. These measures vary by how you calculate them, considering different periods and assumptions on future dividend payments. Here are three different types of dividend yields:

- Forward dividend yield: Forward dividend yield is the expected dividend payout for the future year. You can calculate it by dividing the estimated dividend payments for the next 12 months and dividing it by the current stock price. For example, XYZ just raised its annual dividend to $1, and the stock trades at $50.The forward dividend yield would be the $1 annual dividend payout divided by the $50 stock price, which produces a 2% forward dividend yield.

- Indicated dividend yield: Indicated dividend yield measures the annual dividend payout based on the most recent dividend payment, calculated by annualizing the most recent dividend payment and dividing it by the current stock price. For example, XYZ paid a 15-cent dividend last quarter, and the stock is trading at $50. The annualized dividend payment of 60 cents is divided by the $50 share price to produce a 1.2% indicated dividend yield.

- Trailing dividend yield: Trailing dividend yield is based on actual total dividends paid out in the prior 12 months as a percentage of the current stock price. For example, XYZ raised its dividend every quarter, resulting in actual quarterly dividend payments of 22 cents, 25 cents, 29 cents and 33 cents in the prior year. The trailing 12-month dividend payments total $1.09, divided by the current stock price of $50, producing a 2.18% trailing dividend yield.

The MarketBeat dividend yield calculator comes in handy when calculating the various dividend measures.

Dividend Safety

While many investors assume dividends are a safe income source, they overlook that the underlying stock can depreciate. For this reason, understanding the underlying stock's fundamentals is essential.

Excessively high 10% or higher dividends may seem like no-brainers for investing, but there is a reason for a high dividend yield. It's likely because the stock's price may be too low. Cheap stocks tend to be cheap for a reason. There's usually a problem with the business that has gotten investors to sell, thus depressing the share price and boosting the dividend yield.

Stocks with double-digit annual dividends tend to be companies facing financial difficulties that may result in a cutting or eliminating the dividend or even bankruptcy. It's always crucial to research and protect your principal investment in the stock before considering how much money you can earn from a dividend. Risk is proportionate to the reward in the stock market. For this reason, most dividend aristocrat stocks tend to have lower-yielding dividends than riskier stocks for a reason. Comparing dividends to a risk-free interest-bearing asset like FDIC-insured certificates of deposit (CDs) is also essential.

When interest rates rise, it's common to find risk-free investments like CDs that pay more than dividend stocks. While you may not reap the rewards of capital appreciation if the stock price rises, you are free from the risk of capital depreciation if the stock price falls.

FAQs

Let's go beyond "What is a forward dividend and yield?"and look at some answers to some frequently asked questions about forward dividend yields.

Is a higher forward dividend yield better?

Initially, a higher forward dividend yield may look appealing, but it's prudent to research the underlying business operations. The market tends to make rewards proportionate to risk. Higher dividend yields mean lower stock prices. Lower stock prices result from macro market conditions, as in bull, bear market, or company-specific conditions. By researching the underlying stock's recent quarterly reports and analyst notes, you can determine if shares are depressed for a reason. If that reason is significant, you may be better off with a lower-risk stock with a lower forward dividend yield. Be wary of stocks with double-digit dividend yields as they often get their dividends cut or eliminated, as the underlying business operations may need that cash desperately. The MarketBeat dividend screener can help you find dividend stocks to suit your risk profile.

What is forward vs trailing dividend yield?

Forward dividend yield estimates how much dividends will be paid out in the next 12 months and expressed as a percentage of the current stock price. Note that this is an estimate since the company may increase or decrease the size of its dividend quarterly. A trailing dividend yield is based on the actual dividend payouts for the past 12 months expressed as a percentage compared to the current stock price. There tends to be a slight variance in the two dividend yield types unless there's extreme market volatility.

Is a dividend yield of 3% good?

Comparing dividend yields to risk-free interest yields like CD rates is also good. If a one-year CD interest rate is 4%, a 3% yield may not be good. The wild card is how the stock will perform in the next 12 months. If the stock rises 10% for the year, then a 3% yield is excellent. But if the stock falls 10%, then a 3% yield is not as good as the safety of a one-year CD paying a fixed 4% interest rate. Also, remember that the forward dividend yield drops as the stock price rises, which means a 3% yield at the beginning of the year may result in a 1% yield since the stock price rose in value by the end of the year.

On the flip side, a stock may start the year with a 3% yield that ends up being a 6% yield because the stock dropped 50% in value by the end of the year. The context of the 3% dividend yield and the market risk of the underlying stock is essential when determining if a dividend yield is good. Unfortunately, the stock market can be unpredictable, so assessing your risk profile and planning if the stock falls below a specific price level is necessary to keep a stop-loss.