Pandemic-driven rebound could help capital markets industry accelerate technology investments to protect against disruption

With near-record revenue levels in 2020 for investment banks (sell-side) and strong assets under management (AUM) growth for wealth and asset managers (buy-side), the capital markets industry faces a critical opportunity to accelerate technology investments to modernize its operations, enhance the client experience, and protect against disruption, according to a new report from Accenture (NYSE: ACN).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210601006130/en/

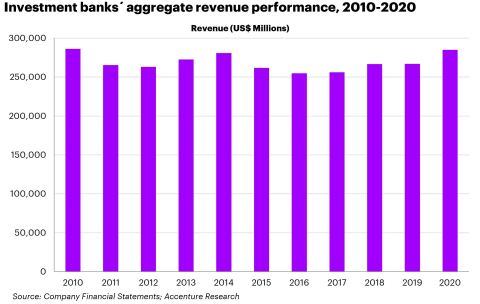

Before 2020, investment banking revenues hadn’t increased much over the last decade. (Graphic: Business Wire)

The report, titled “Towards the Markets of Tomorrow: Capital Markets Vision 2025,” is based on Accenture’s proprietary financial analysis of the global capital markets industry for 2020 and builds upon a previous report and analysis of 2017 data. In 2020, the capital markets industry reported revenues of US$1.12 trillion and profits* of US$119 billion. The buy-side generated 90% of the industry’s profits, up from 87% in 2017, despite investment banks’ revenues reaching levels not seen for more than a decade at over US$285 billion.

While investment banks have been restructuring and cutting costs since the financial crisis, these actions have achieved limited success, according to the report. Banks’ cost-income ratios, which measure how efficiently the bank is run, have remained at similar levels over the past decade. On average, cost-income ratios came in at 61% in 2020, down only 1% from 2010 levels, with some banks reporting ratios of up to 100% last year.

“2020 was a strong year financially for investment banks, but the critical question is whether this is the start of a new trajectory or an anomaly due to increased market volatility,” said Matt Long, a managing director who leads Accenture’s Capital Markets industry group in Europe and co-author of the report. “Investment banks’ role as the critical nexus that connects corporates with investors could be threatened as other players step in to take market share using technology to disrupt the industry. Investment banks should accelerate investments in new technologies, coupled with data and analytics, to transform their operations and infrastructure, and enhance the client and employee experiences.”

The report recommends that investment banks reinvest their 2020 profits to permanently bend the cost curve, using automation to help reduce front-office processing costs and reshape support functions, and adjust their real estate footprints to account for staff working remotely or in lower-cost locations. Banks also have an opportunity to reevaluate their business strategies to focus on products, businesses, geographies, and customers where they have a competitive advantage and to use data and analytics to create more targeted customer interactions.

Wealth management assets skyrocket but rising costs cannibalize revenues; asset management revenues decline

While the buy-side generates the vast majority of the industry’s profits, revenue growth is showing signs of slowing as costs remain high. For asset managers, the gap between AUM and revenues continues to widen, with AUM up 4.4% in 2020 and revenues decreasing 2.6% despite a slight reduction in costs by 0.4%. The report suggests that asset managers go beyond reducing costs and tackle larger structural issues, including product and fee pressures, distribution challenges, and operational inefficiencies.

Meanwhile, the wealth management industry has grown tremendously but has also become more crowded and competitive, with costs cannibalizing revenues. Despite a 24.6% rise in AUM in 2020, revenues only rose slightly at 1.8%, and costs were up 1.4%. The report notes that more flexible operational processes and the wider adoption of technology solutions, like artificial intelligence (AI) and cloud, could help create a more cost-effective operating model and enable firms to create better client experiences. This would improve both sides of the cost-income ratio.

Another area of the buy-side that is growing rapidly is private markets, made up of firms in the private equity and alternative asset management space. They have been the direct beneficiary of historically low interest rates, changing central bank monetary policy and a flood of cheap debt and inflated equities. AUM rose 19.5% in 2020 and revenues increased by 3.9%, but the rapid rise in costs at 9.3% is offsetting positive gains. By embracing cutting-edge data and analytics solutions, private market firms could optimize the investment process, ultimately helping them move faster and reduce costs, according to the report.

“The decoupling of assets under management and revenues is becoming more pronounced for the buy-side, and these firms can’t just use cost-cutting tactics to achieve the necessary growth; they need to digitize much of their operations,” said Laurie McGraw, a managing director who leads Accenture’s Capital Markets industry group in North America. “Firms need to take decisive action and fully embrace AI and data and analytics for faster decisioning and to provide clients with more targeted and personalized experiences.”

The full report can be accessed here.

*The reference to profits throughout the release is calculated as economic profit (revenues minus credit losses, full operating costs, taxes and the cost of equity capital).

About the Research

Accenture analyzed publicly available information from global capital markets firms to define a clear view of profitability at the industry and sector level (investment banking, asset management, wealth management, private markets, exchanges and asset servicing) using 2020 business financial results as a baseline. Accenture calculated economic profit for the industry, defined as revenues minus credit losses, full operating costs, taxes and the cost of equity capital. The analysis and key management challenges were validated through discussions with executives at leading capital markets firms.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 537,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at www.accenture.com.

Accenture’s Capital Markets industry group helps wealth and asset managers, investment banks and exchanges rethink their business models, manage risk, redefine workplace strategies and improve operational efficiency to prepare for the digital future. To learn more, visit www.accenture.com/CapitalMarkets.

Copyright © 2021 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210601006130/en/

Contacts

Michael McGinn

Accenture

+1 312 693 5707

m.mcginn@accenture.com