Telecom software provider Amdocs (NASDAQ: DOX) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 9.4% year on year to $1.13 billion. The company expects next quarter’s revenue to be around $1.13 billion, close to analysts’ estimates. Its non-GAAP profit of $1.78 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Amdocs? Find out by accessing our full research report, it’s free.

Amdocs (DOX) Q1 CY2025 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.12 billion (9.4% year-on-year decline, in line)

- Adjusted EPS: $1.78 vs analyst estimates of $1.70 (4.5% beat)

- Adjusted EBITDA: $217.6 million vs analyst estimates of $279.9 million (19.3% margin, 22.3% miss)

- Revenue Guidance for Q2 CY2025 is $1.13 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the full year is $8.50 at the midpoint, beating analyst estimates by 21.9%

- Operating Margin: 17.5%, up from 12.5% in the same quarter last year

- Free Cash Flow Margin: 13.9%, up from 9.1% in the same quarter last year

- Backlog: $4.17 billion at quarter end, down 1.4% year on year

- Market Capitalization: $10.02 billion

"Q2 was a good quarter for Amdocs as we executed our strategy to deliver the cloud, digital, and AI-based solutions our customers need to ensure amazing experiences and seamless connectivity for billions of people each day. Revenue of $1.13 billion was up 4% from a year ago in pro forma(1) constant currency(2), and deal conversion was strong, led by continued sales momentum in cloud. Amdocs has won a deal to facilitate the migration of both Amdocs and non-Amdocs applications to Microsoft Azure for a Tier-1 European service provider, and we were also selected for the next phase of PLDT's cloud modernization journey in Philippines. Consumer Cellular, a new US client for Amdocs, has chosen our SaaS-based connectX solution to expedite the launch of new digital brands. We also extended our collaboration with NVIDIA and other GenAI partners to further evolve Amdocs' amAIz platform and to support the data and GenAI requirements of our customers," said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Company Overview

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ: DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.75 billion in revenue over the past 12 months, Amdocs is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, Amdocs likely needs to tweak its prices, innovate with new offerings, or enter new markets.

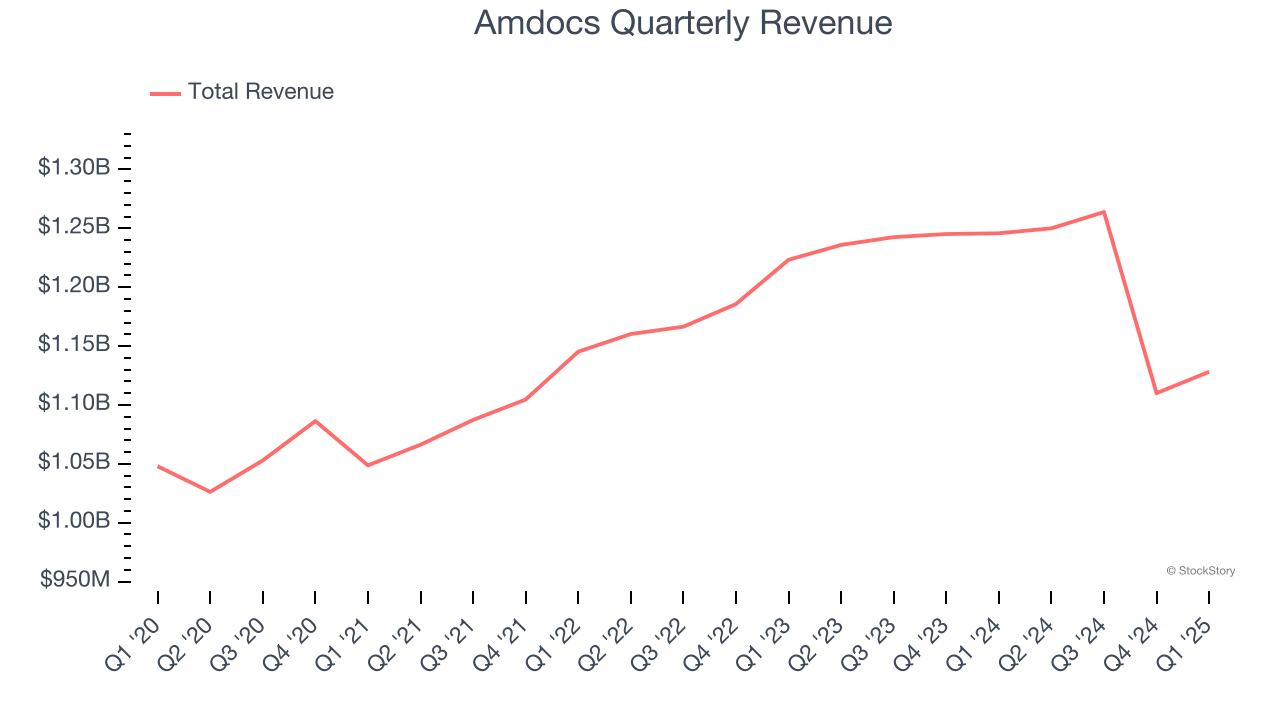

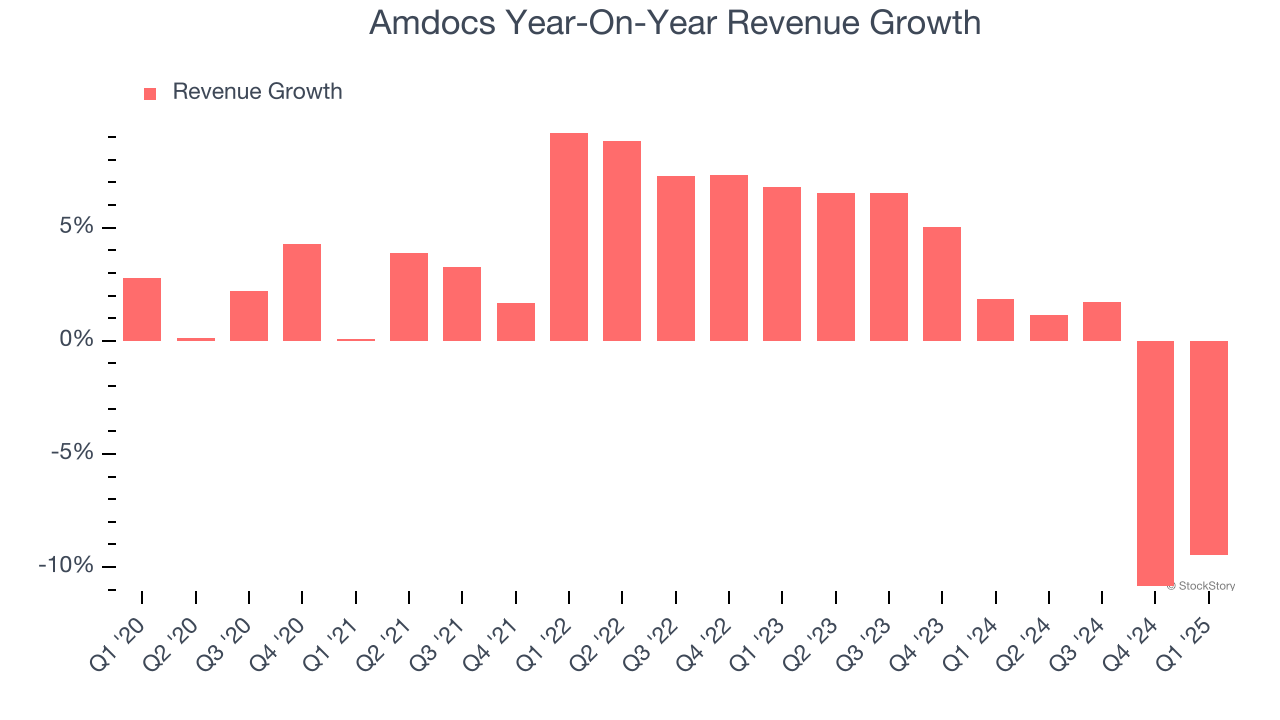

As you can see below, Amdocs’s sales grew at a sluggish 2.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Amdocs’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

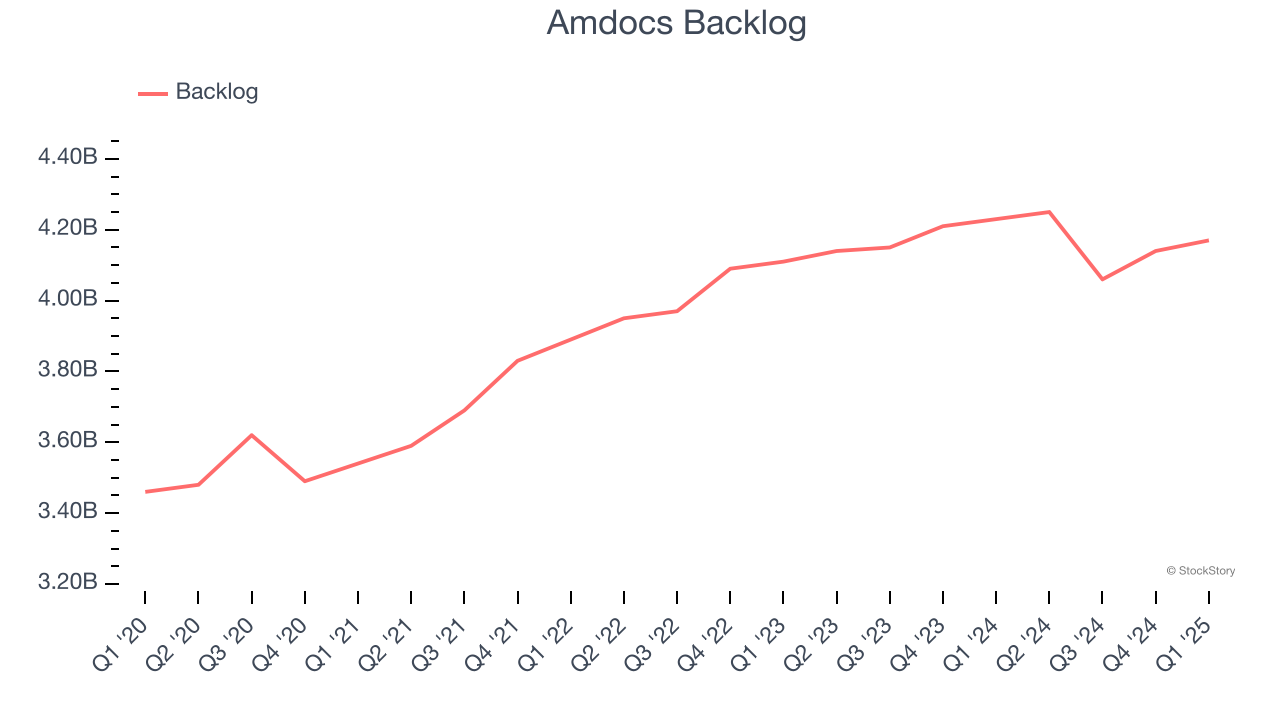

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Amdocs’s backlog reached $4.17 billion in the latest quarter and averaged 1.6% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, Amdocs reported a rather uninspiring 9.4% year-on-year revenue decline to $1.13 billion of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 9.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

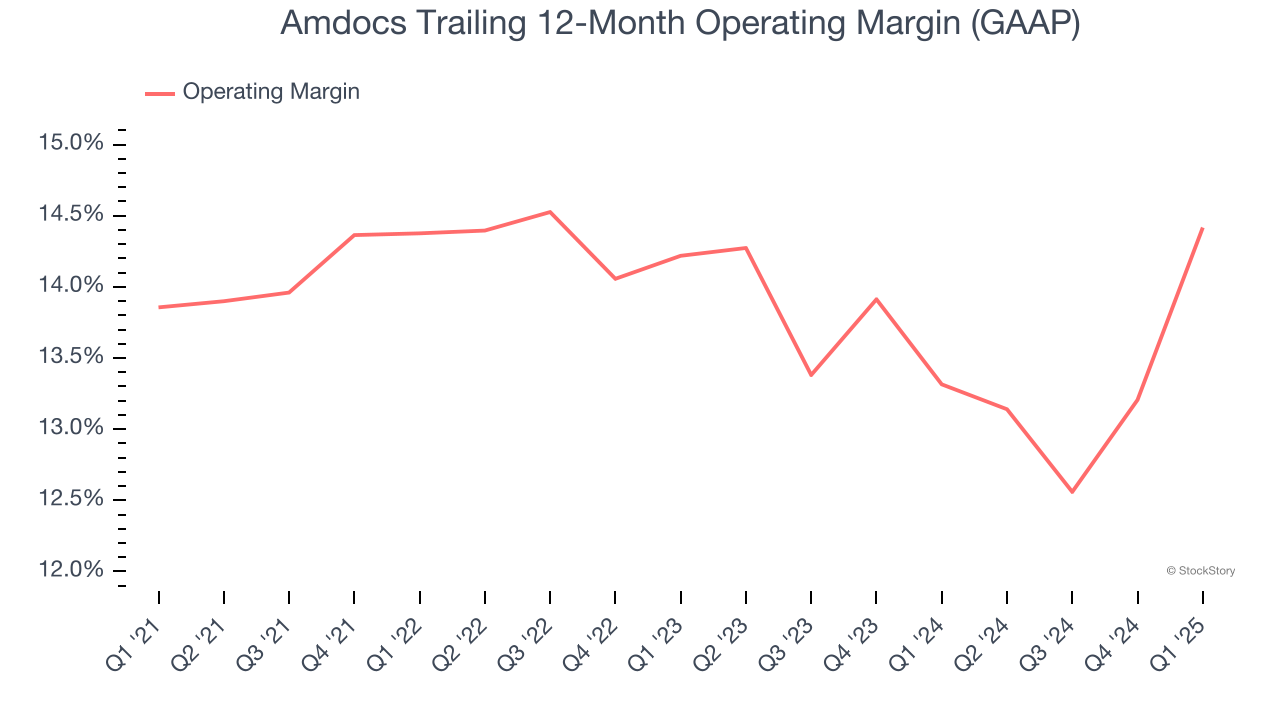

Amdocs has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14%.

Analyzing the trend in its profitability, Amdocs’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Amdocs generated an operating profit margin of 17.5%, up 5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

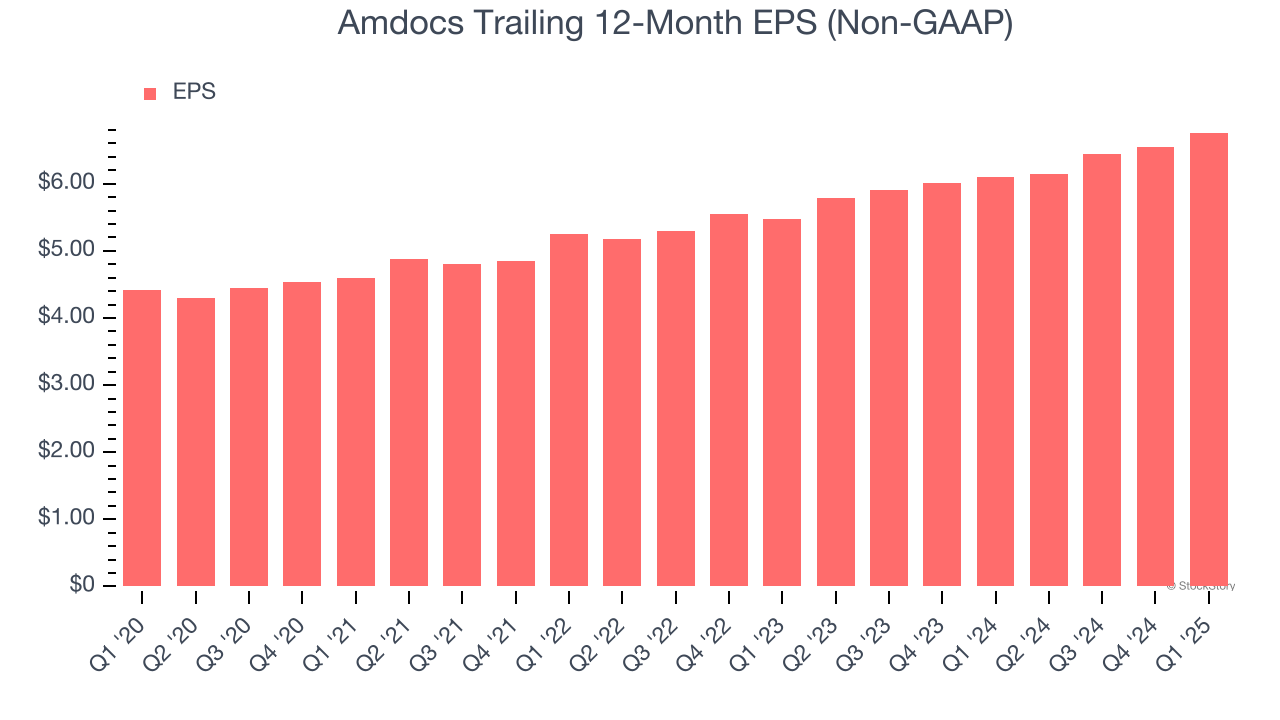

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

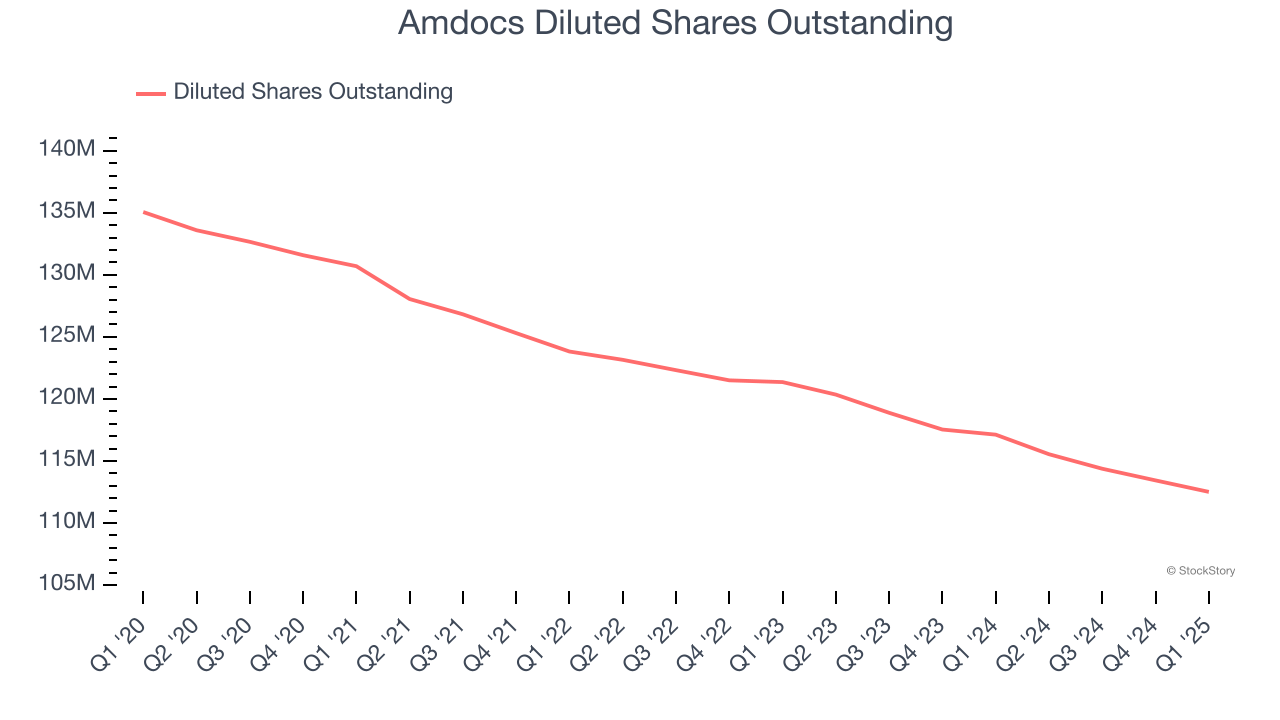

Amdocs’s EPS grew at a decent 8.9% compounded annual growth rate over the last five years, higher than its 2.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into Amdocs’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Amdocs has repurchased its stock, shrinking its share count by 16.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Amdocs reported EPS at $1.78, up from $1.56 in the same quarter last year. This print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Amdocs’s full-year EPS of $6.76 to grow 7.8%.

Key Takeaways from Amdocs’s Q1 Results

We were impressed by how significantly Amdocs blew past analysts’ full-year EPS guidance expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, EBITDA missed and its EPS guidance for next quarter missed. Overall, this print was mixed. The areas below expectations seem to be driving the move, and the stock traded down 3.5% to $86.26 immediately after reporting.

So should you invest in Amdocs right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.