Over the last six months, KB Home’s shares have sunk to $64.70, producing a disappointing 19.2% loss - a stark contrast to the S&P 500’s 5.3% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in KB Home, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than KBH and a stock we'd rather own.

Why Is KB Home Not Exciting?

The first homebuilder to be listed on the NYSE, KB Home (NYSE: KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

1. Backlog Declines as Orders Drop

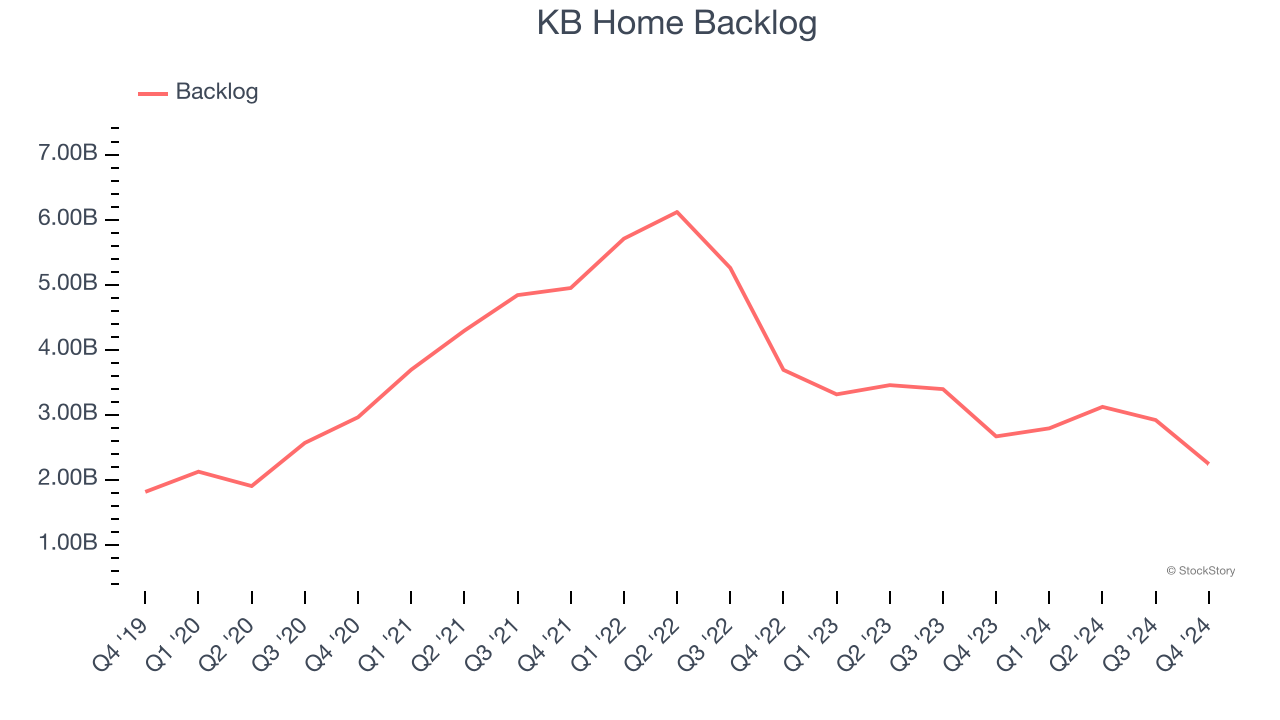

We can better understand Home Builders companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into KB Home’s future revenue streams.

KB Home’s backlog came in at $2.24 billion in the latest quarter, and it averaged 25.5% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect KB Home’s revenue to rise by 3.2%. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

3. EPS Took a Dip Over the Last Two Years

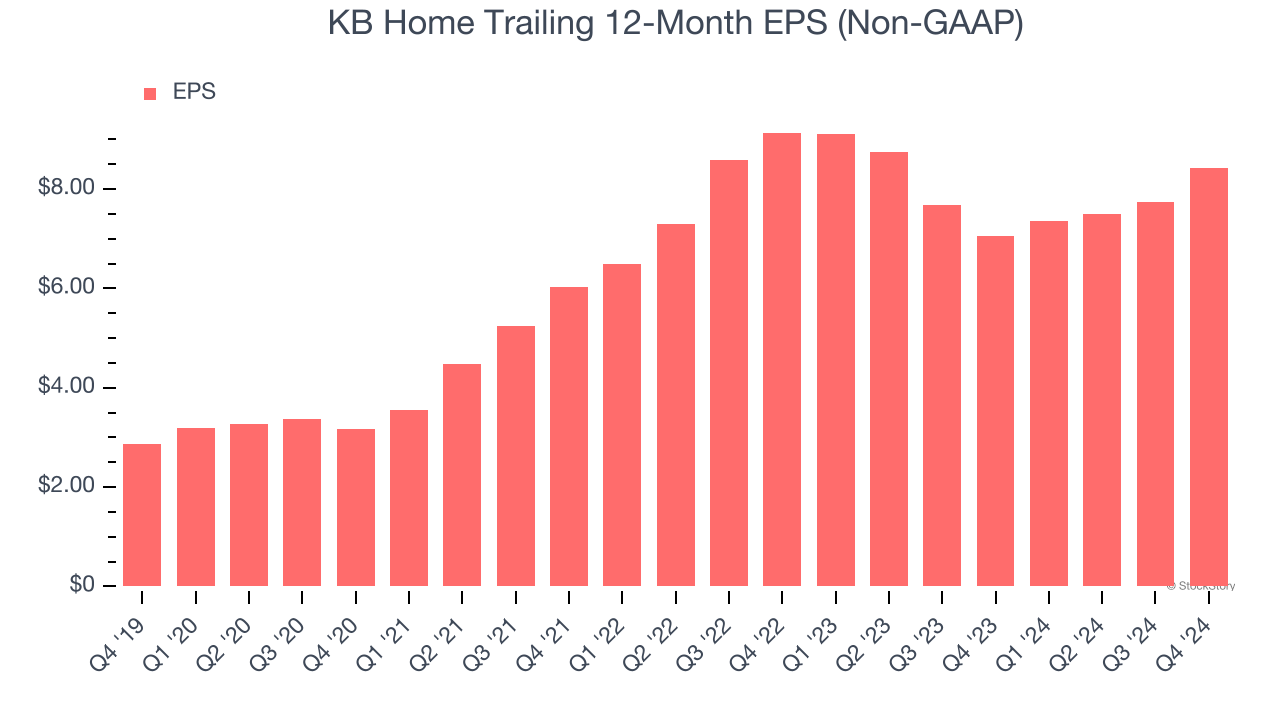

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for KB Home, its EPS declined by 4% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

Final Judgment

KB Home isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 7.4× forward price-to-earnings (or $64.70 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than KB Home

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.