Footwear, apparel, and accessories retailer Genesco (NYSE: GCO) fell short of the market’s revenue expectations in Q4 CY2024, with sales flat year on year at $745.9 million. Its non-GAAP profit of $3.26 per share was 1.4% below analysts’ consensus estimates.

Is now the time to buy Genesco? Find out by accessing our full research report, it’s free.

Genesco (GCO) Q4 CY2024 Highlights:

- Revenue: $745.9 million vs analyst estimates of $785.1 million (flat year on year, 5% miss)

- Adjusted EPS: $3.26 vs analyst expectations of $3.31 (1.4% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.50 at the midpoint, missing analyst estimates by 36%

- Operating Margin: 6.2%, in line with the same quarter last year

- Locations: 1,278 at quarter end, down from 1,341 in the same quarter last year

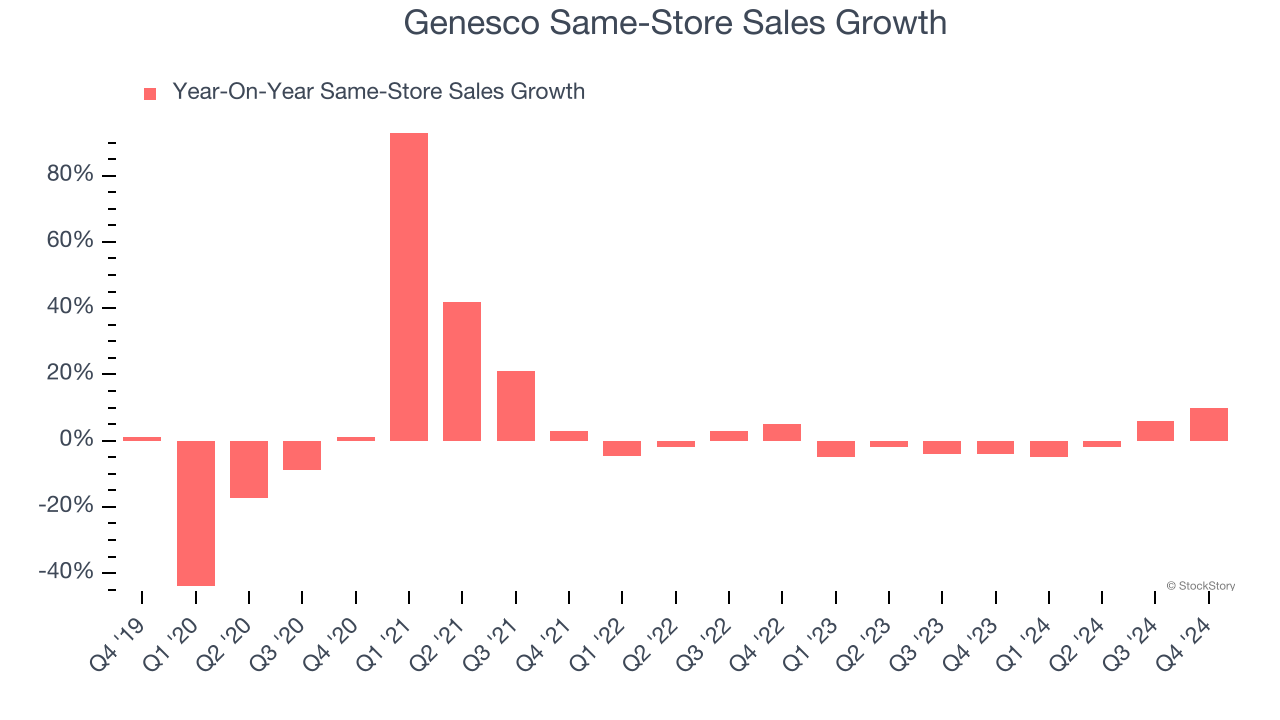

- Same-Store Sales rose 10% year on year (-4% in the same quarter last year)

- Market Capitalization: $363.3 million

Company Overview

Spanning a broad range of styles, brands, and prices, Genesco (NYSE: GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

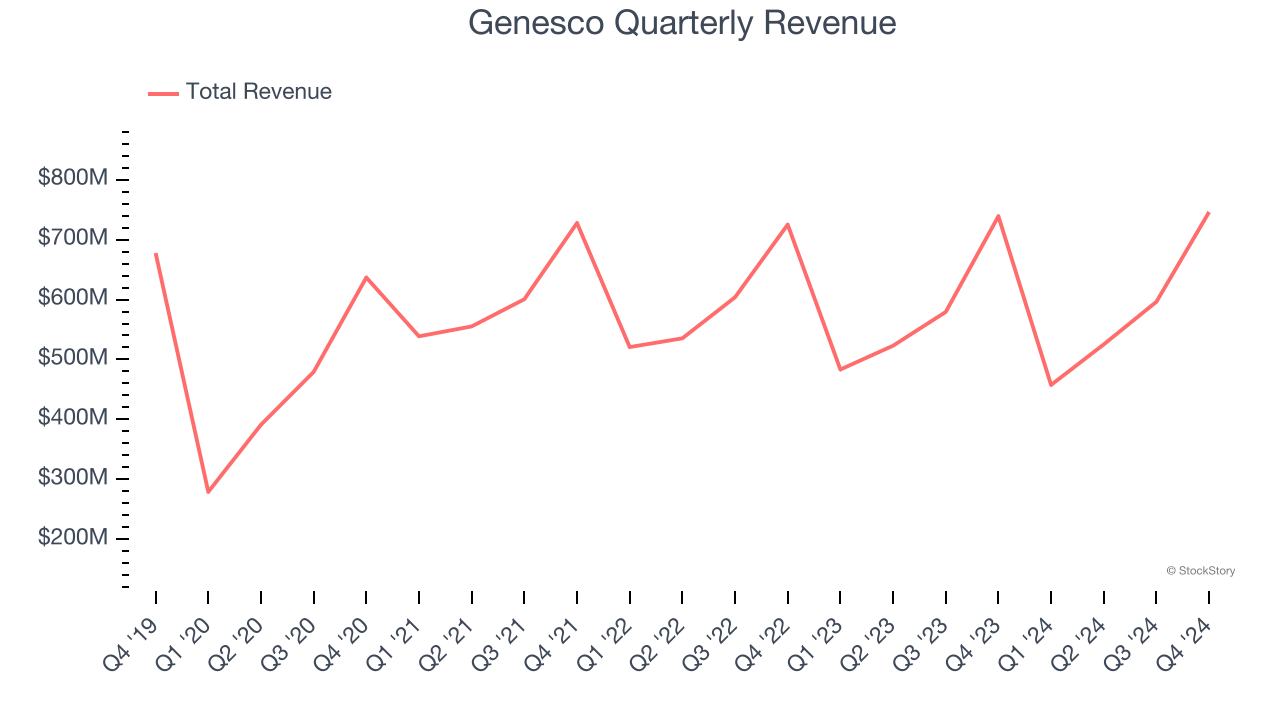

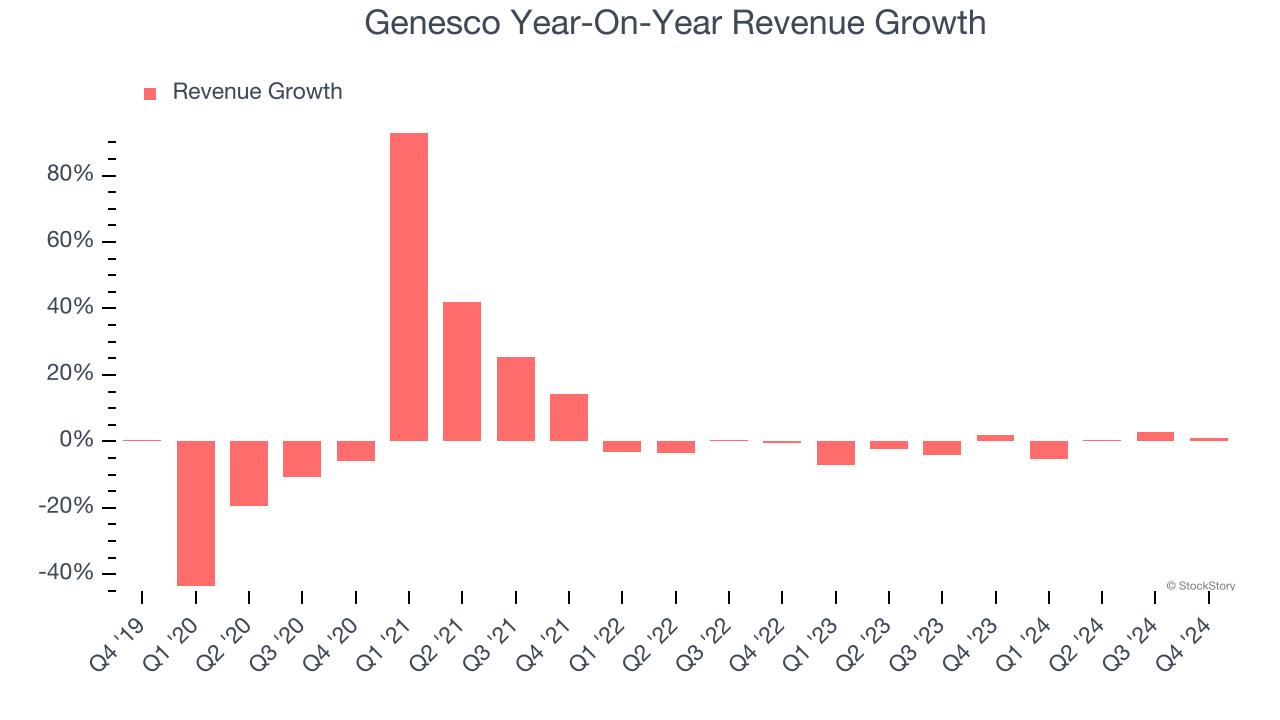

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Genesco’s sales grew at a weak 1.1% compounded annual growth rate over the last five years. This was below our standards and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Genesco’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.3% annually.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Genesco’s same-store sales were flat. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Genesco’s $745.9 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

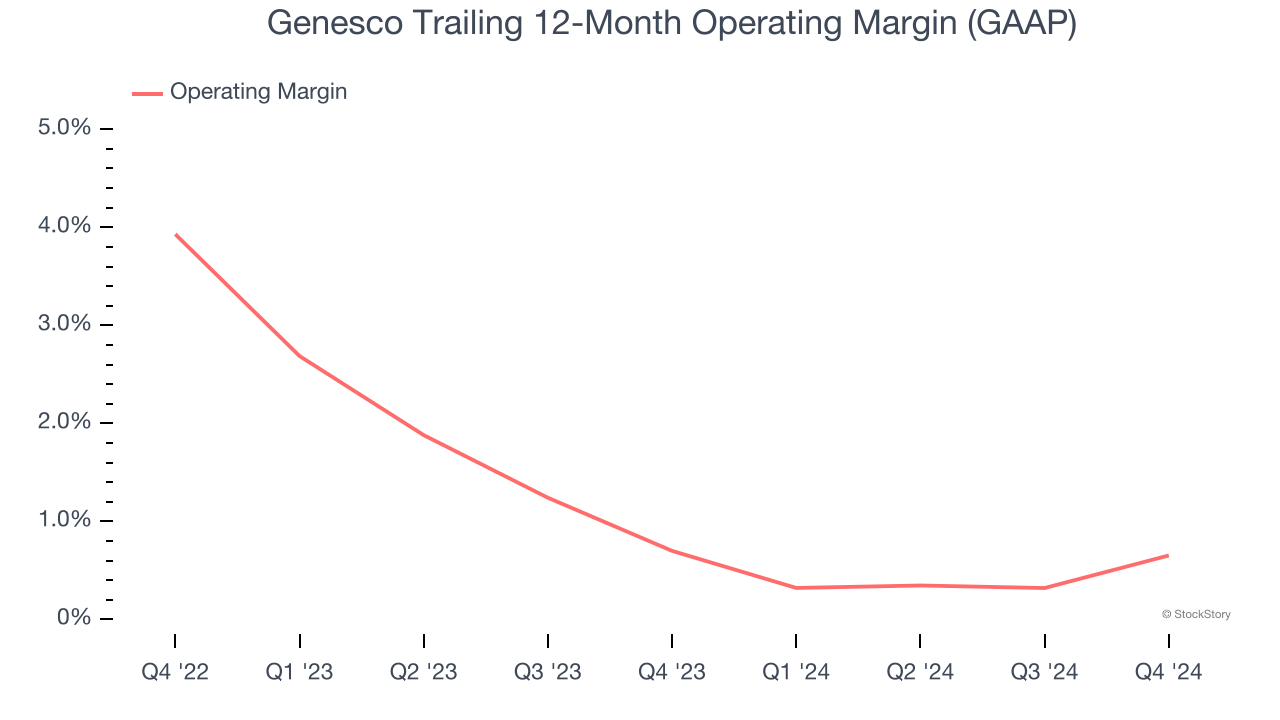

Genesco’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same. The company broke even over the last two years, inadequate for a consumer discretionary business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

In Q4, Genesco generated an operating profit margin of 6.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

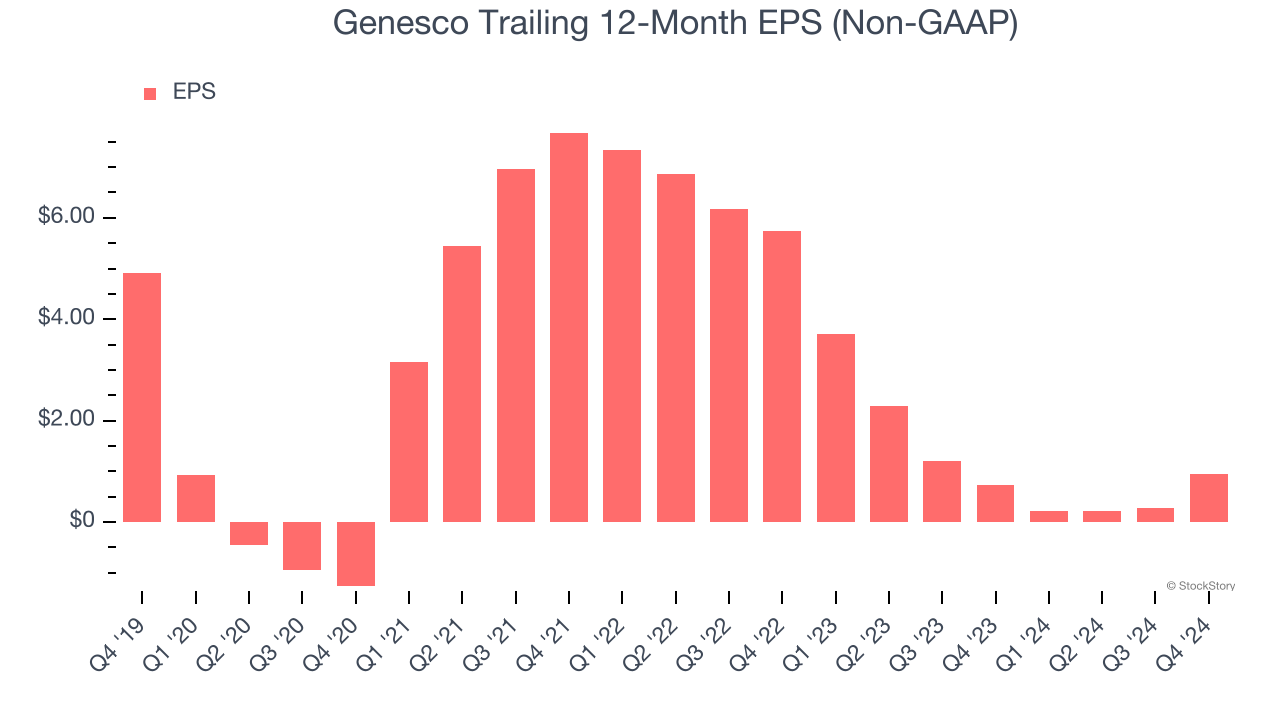

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Genesco, its EPS declined by 28.1% annually over the last five years while its revenue grew by 1.1%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q4, Genesco reported EPS at $3.26, up from $2.59 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Genesco’s full-year EPS of $0.94 to grow 186%.

Key Takeaways from Genesco’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.7% to $30.95 immediately after reporting.

The latest quarter from Genesco’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.