Unity currently trades at $22.90 per share and has shown little upside over the past six months, posting a middling return of 2.5%.

Is there a buying opportunity in Unity, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We're cautious about Unity. Here are three reasons why there are better opportunities than U and a stock we'd rather own.

Why Do We Think Unity Will Underperform?

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE: U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

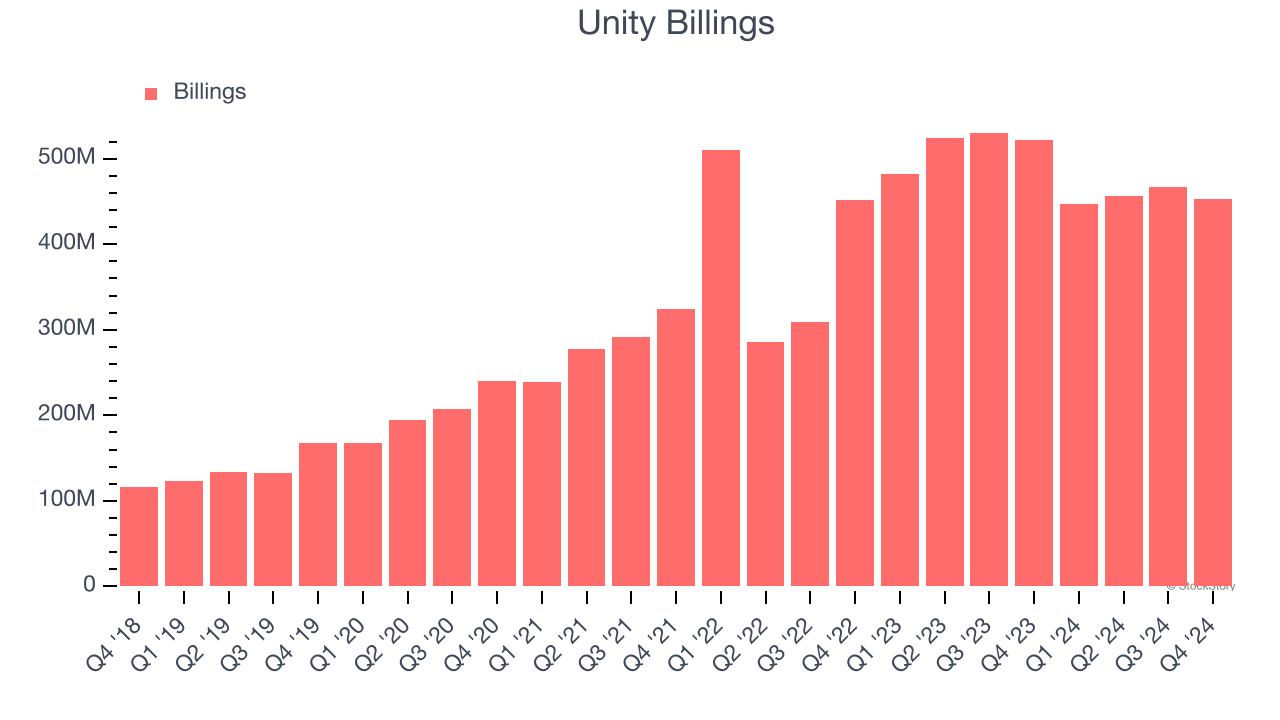

1. Declining Billings Reflect Product and Sales Weakness

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Unity’s billings came in at $453.2 million in Q4, and it averaged 11.3% year-on-year declines over the last four quarters. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

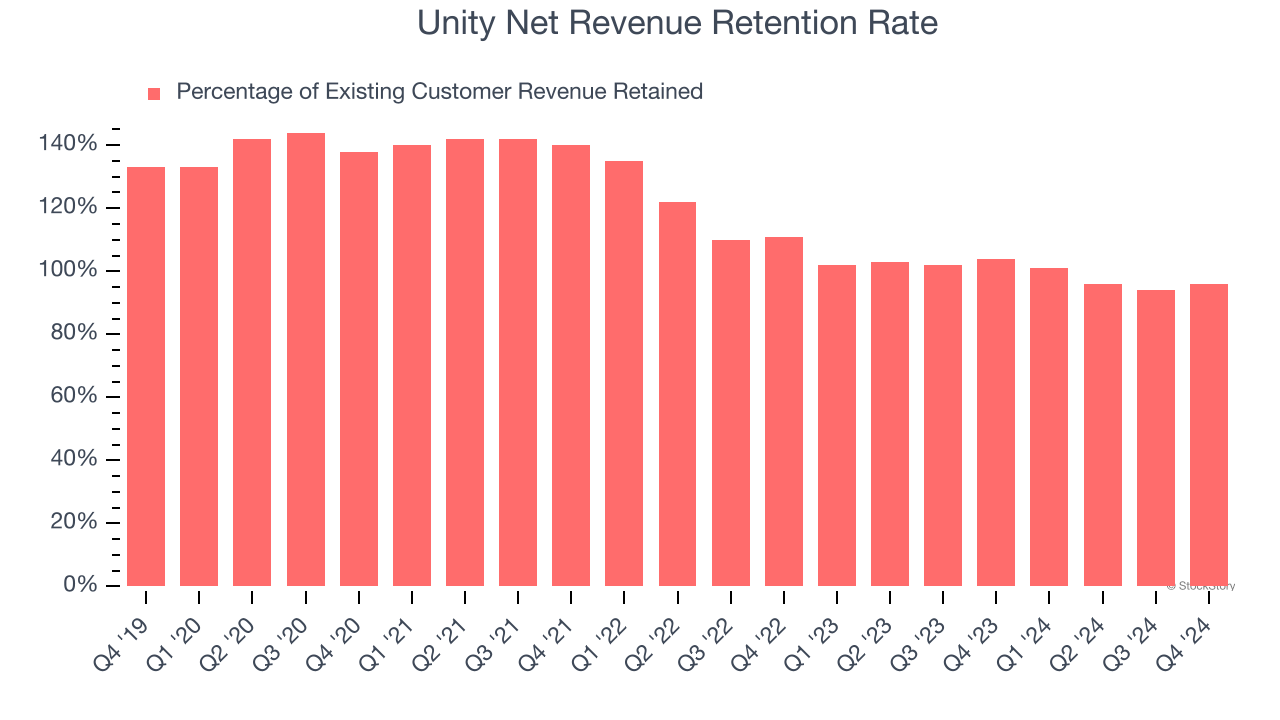

2. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Unity’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 96.8% in Q4. This means Unity’s revenue would’ve decreased by 3.2% over the last 12 months if it didn’t win any new customers.

Unity’s already weak net retention rate has been dropping the last year, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Unity’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Unity’s products and its peers.

Final Judgment

Unity doesn’t pass our quality test. That said, the stock currently trades at 5.2× forward price-to-sales (or $22.90 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Unity

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.