Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at La-Z-Boy (NYSE: LZB) and its peers.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 6 home furnishings stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was above.

While some home furnishings stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.8% since the latest earnings results.

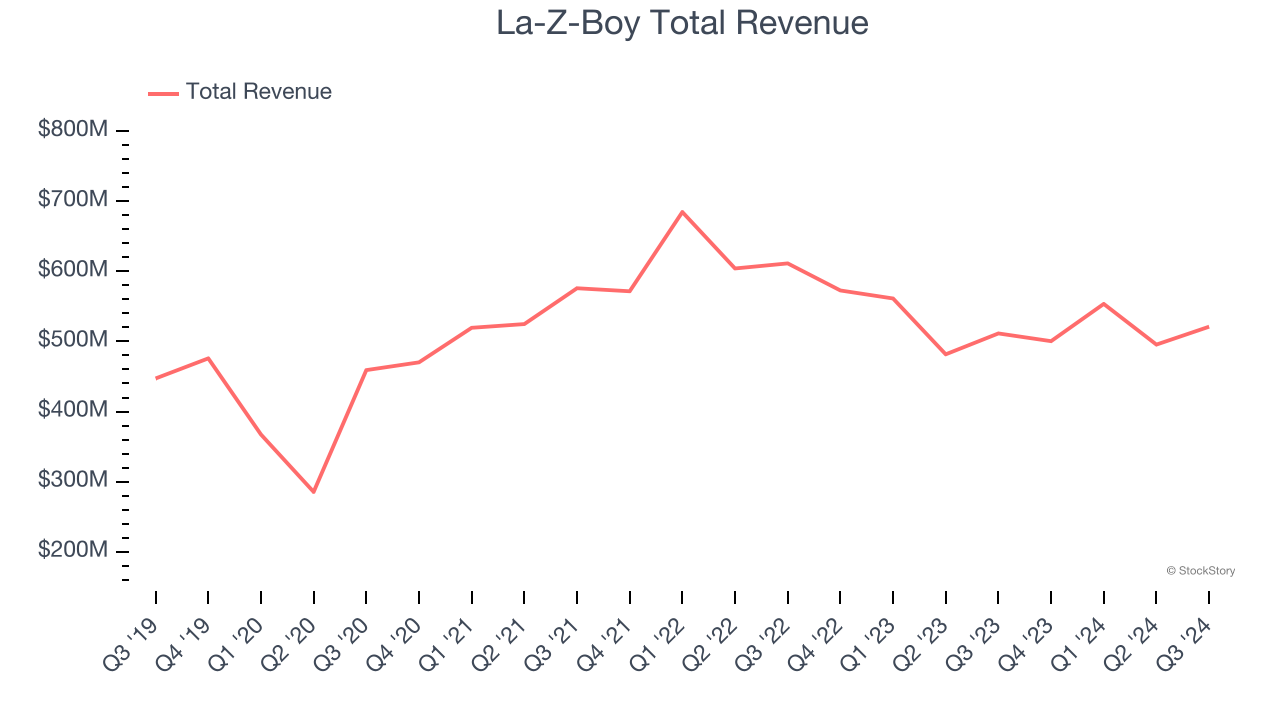

Best Q3: La-Z-Boy (NYSE: LZB)

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

La-Z-Boy reported revenues of $521 million, up 1.9% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

Melinda D. Whittington, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “Our second quarter results demonstrate the continued progress we are making against our strategic pillars and our strong execution throughout the enterprise. ”

La-Z-Boy pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 10.4% since reporting and currently trades at $46.65.

Is now the time to buy La-Z-Boy? Access our full analysis of the earnings results here, it’s free.

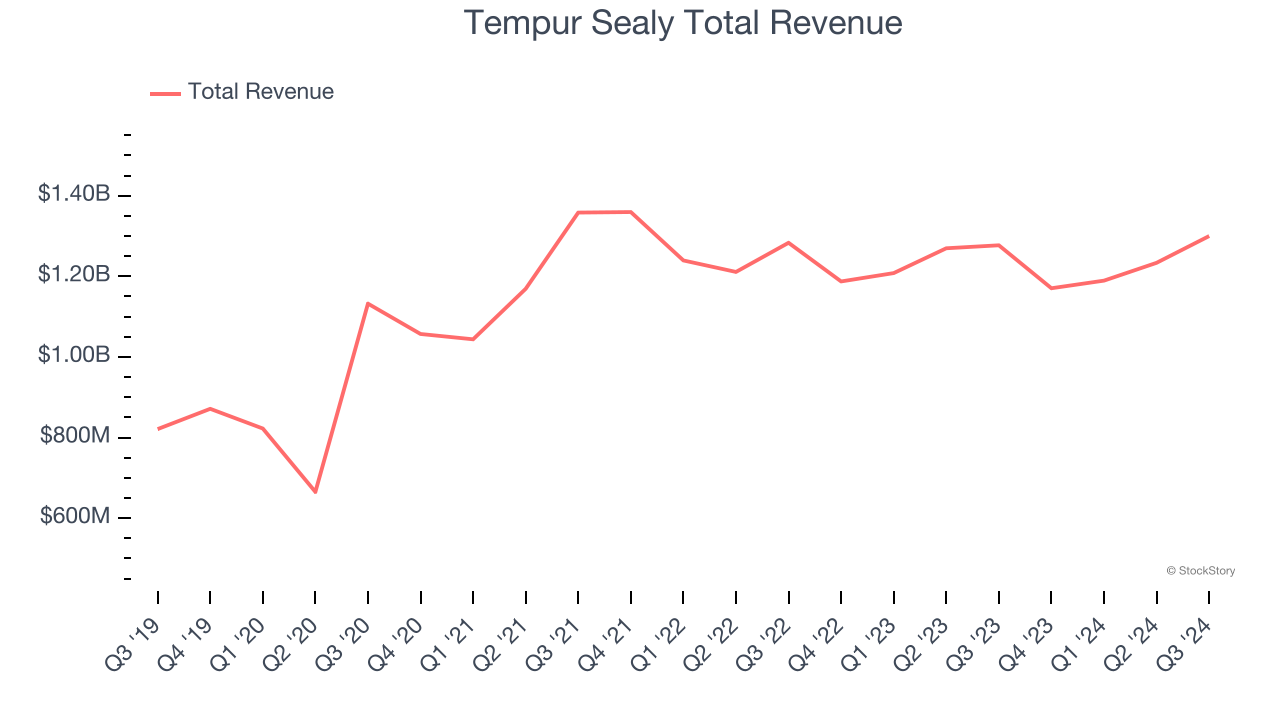

Tempur Sealy (NYSE: TPX)

Established through the merger of Tempur-Pedic and Sealy in 2012, Tempur Sealy (NYSE: TPX) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Tempur Sealy reported revenues of $1.3 billion, up 1.8% year on year, outperforming analysts’ expectations by 0.9%. The business performed better than its peers, but it was unfortunately a mixed quarter with a decent beat of analysts’ EPS estimates but full-year EPS guidance slightly missing analysts’ expectations.

The market seems happy with the results as the stock is up 26.7% since reporting. It currently trades at $63.20.

Is now the time to buy Tempur Sealy? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Lovesac (NASDAQ: LOVE)

Known for its oversized, premium beanbags, Lovesac (NASDAQ: LOVE) is a specialty furniture brand selling modular furniture.

Lovesac reported revenues of $149.9 million, down 2.7% year on year, falling short of analysts’ expectations by 3.5%. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

Lovesac delivered the weakest full-year guidance update in the group. The stock is down 32.1% since the results and currently trades at $25.56.

Read our full analysis of Lovesac’s results here.

Mohawk Industries (NYSE: MHK)

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Mohawk Industries reported revenues of $2.72 billion, down 1.7% year on year. This result met analysts’ expectations. More broadly, it was a slower quarter as it produced EPS guidance for the next quarter, missing analysts’ expectations significantly and organic revenue in line with analysts’ estimates.

The stock is down 20% since reporting and currently trades at $121.51.

Read our full, actionable report on Mohawk Industries here, it’s free.

Purple (NASDAQ: PRPL)

Founded by two brothers, Purple (NASDAQ: PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple reported revenues of $118.6 million, down 15.3% year on year. This number missed analysts’ expectations by 6%. More broadly, it was a mixed quarter as it also logged full-year EBITDA guidance exceeding analysts’ expectations.

Purple delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates among its peers. The stock is up 18.1% since reporting and currently trades at $1.11.

Read our full, actionable report on Purple here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.