Industrial fluid and energy systems manufacturer Graham Corporation (NYSE: GHM) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 18.8% year on year to $53.56 million. The company expects the full year’s revenue to be around $205 million, close to analysts’ estimates. Its GAAP profit of $0.30 per share was also 150% above analysts’ consensus estimates.

Is now the time to buy Graham Corporation? Find out by accessing our full research report, it’s free.

Graham Corporation (GHM) Q3 CY2024 Highlights:

- Revenue: $53.56 million vs analyst estimates of $49.7 million (7.8% beat)

- EPS: $0.30 vs analyst estimates of $0.12 ($0.18 beat)

- EBITDA: $5.62 million vs analyst estimates of $4.02 million ($1.6 million beat)

- The company reconfirmed its revenue guidance for the full year of $205 million at the midpoint

- EBITDA guidance for the full year is $19.5 million at the midpoint, above analyst estimates of $18.48 million

- Gross Margin (GAAP): 23.9%, up from 16% in the same quarter last year

- Operating Margin: 7.9%, up from 1.8% in the same quarter last year

- EBITDA Margin: 10.5%, up from 4.2% in the same quarter last year

- Free Cash Flow Margin: 19.5%, up from 3.3% in the same quarter last year

- Market Capitalization: $363.6 million

“Our team’s efforts to diversify and strengthen the business over the past few years are clearly yielding results, as shown by our record second-quarter performance,” commented Daniel J. Thoren, President and Chief Executive Officer.

Company Overview

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE: GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

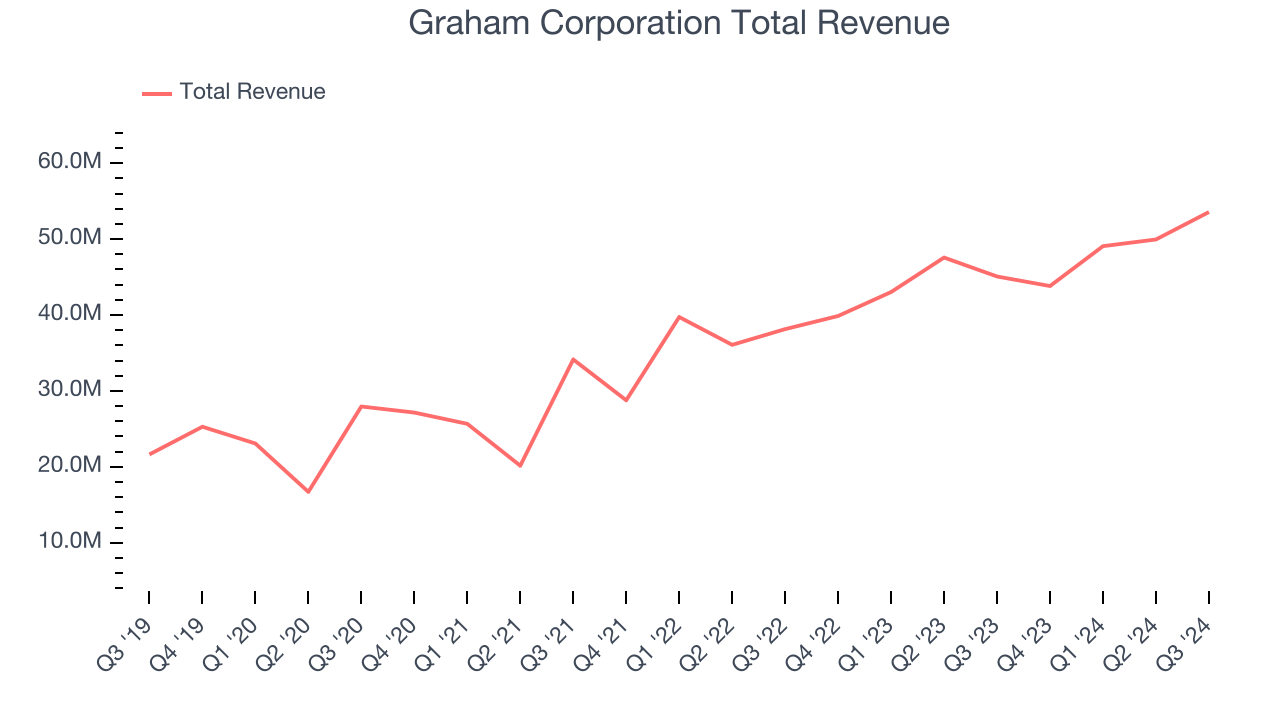

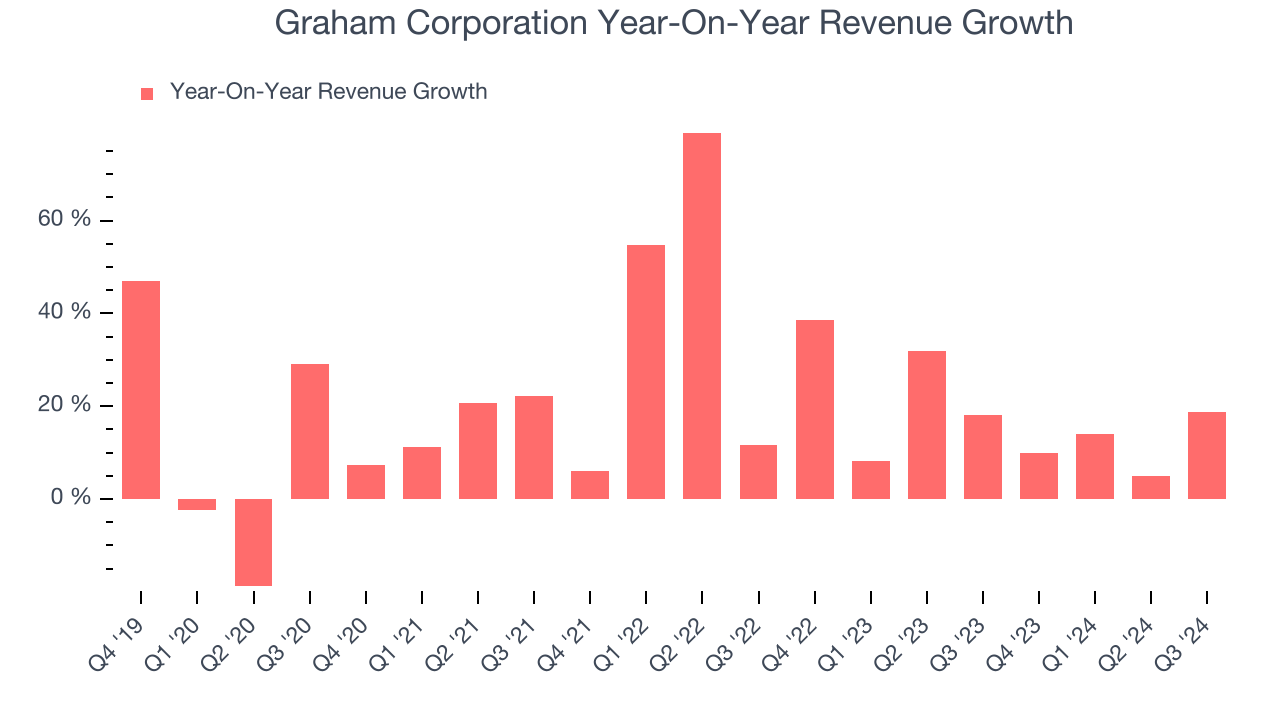

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Graham Corporation’s 18.8% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows Graham Corporation’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Graham Corporation’s annualized revenue growth of 17.3% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Graham Corporation reported year-on-year revenue growth of 18.8%, and its $53.56 million of revenue exceeded Wall Street’s estimates by 7.8%.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market sees success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

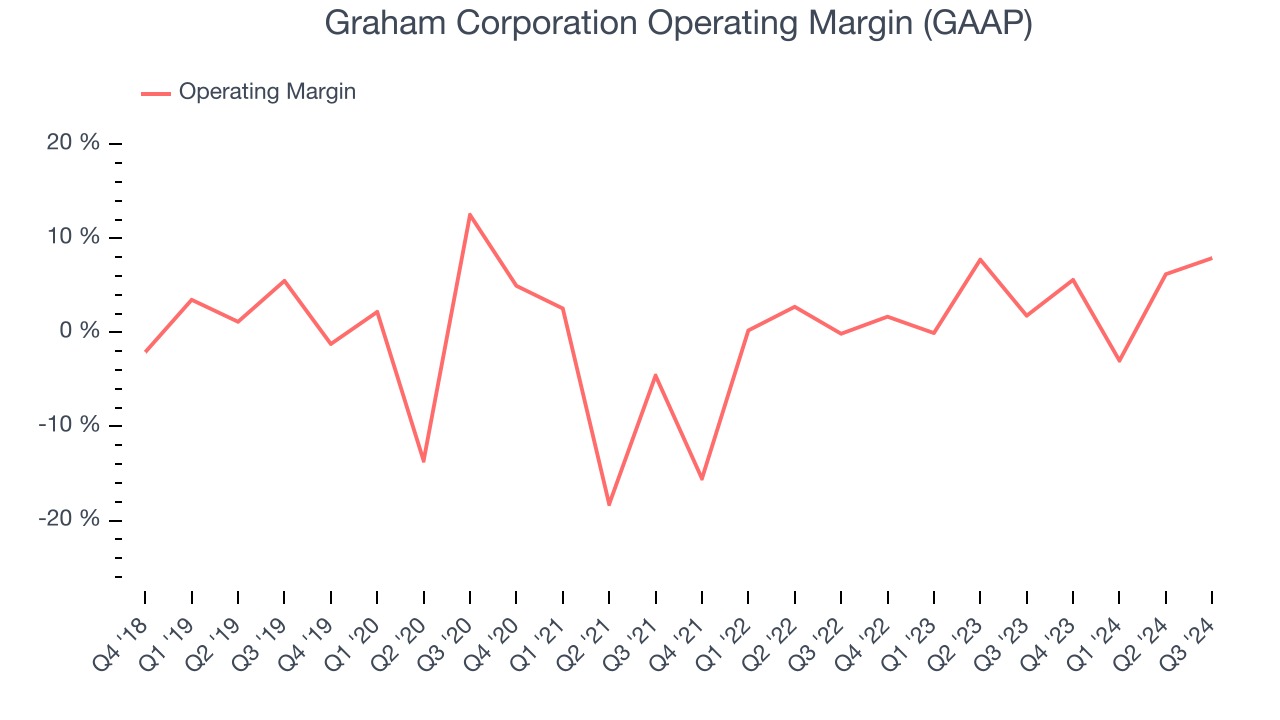

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Graham Corporation was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Graham Corporation’s annual operating margin rose by 2.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Graham Corporation generated an operating profit margin of 7.9%, up 6.1 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

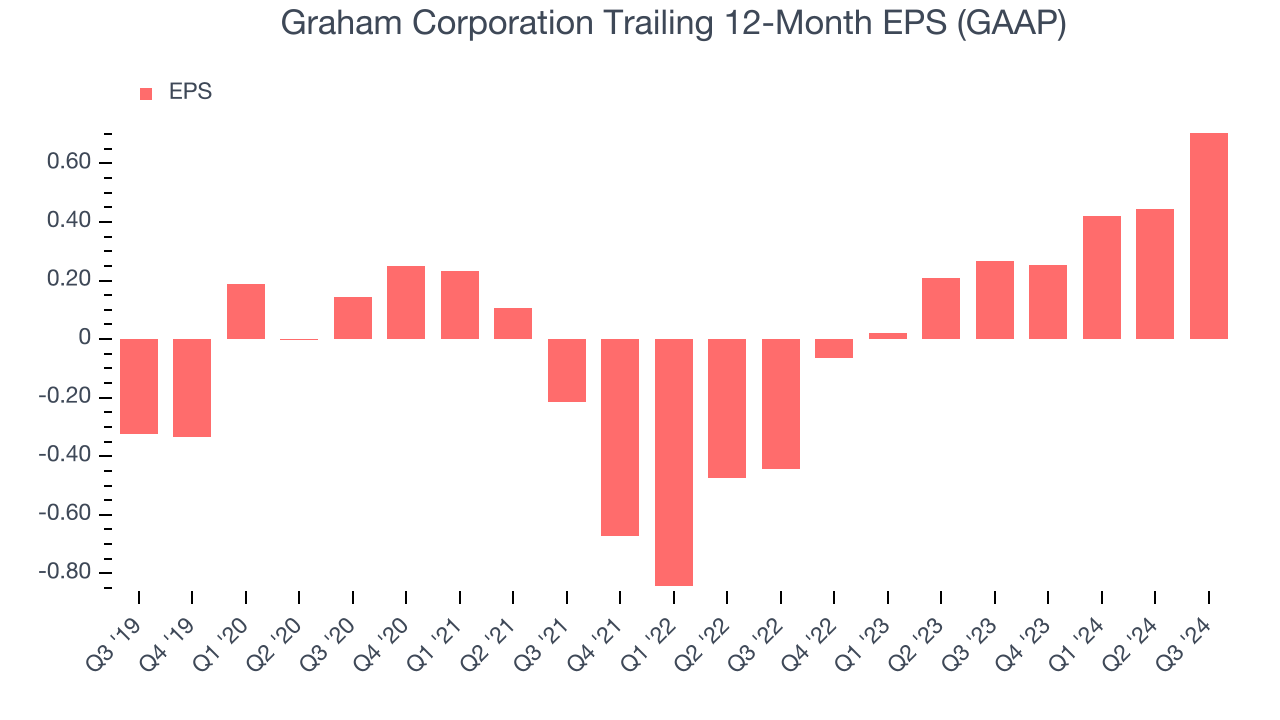

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Graham Corporation’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graham Corporation, its two-year annual EPS growth of 89.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Graham Corporation reported EPS at $0.30, up from $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Graham Corporation’s full-year EPS of $0.71 to grow by 5.9%.

Key Takeaways from Graham Corporation’s Q3 Results

We liked how Graham Corporation beat analysts’ EBITDA and EPS expectations this quarter. We were also excited its EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this quarter was a very good one. The stock traded up 11.2% to $37 immediately after reporting.

Graham Corporation had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.