The two largest iconic publicly traded toy companies released their Q3 2023 earnings reports. While the reports were starkly different, the reactions were similar in that they both saw their shares sell off. Two particular pieces of entertainment were lynchpins for each company in 2023. Ironically, it was their intellectual property (IP) and not actual toy sales that made for a remarkable year. The Barbie motion picture was a critically acclaimed smashing success, breaking records for the highest-grossing movie of the year at $1.44 billion for one company. Baldur's Gate 3 was a vast, highly acclaimed video game release garnering more profits than all the movies combined for the other toy company. Investors may consider adding these to their consumer discretionary shopping list heading into the holiday shopping season.

Mattel Inc. (NYSE: MAT)

Mattel saw its sales spike thanks to the Barbie movie driving up sales of dolls and strength in its Hot Wheels brand. Barbie broke many records, including the highest-grossing movie produced for Warner Bros. Discovery Inc. (NYSE: WBD). While the company expects the global toy industry to decline by mid-single digits, Mattel is well-positioned and expects a strong holiday season. It's releasing a broad-based lineup of toys and play patterns at various price points. Mattel is also looking to capitalize on the upcoming Trolls Band Together movie release on November 17, 2023, and The Walt Disney Co. (NYSE: DIS) Wish movie release on November 22, 2023. The live-action Hot Wheels movie release date hasn't been announced yet. Hot Wheels, Let's Race animated series will launch on Netflix Inc. (NASDAQ: NFLX) in spring 2024.

Solid Q3 2023 earnings

On October 25, 2023, Mattel reported its Q3 2023 earnings for the third quarter ending September 2023. The company reported EPS of $1.08, beating 86 cents consensus analyst estimates by 22 cents. Revenues grew 9.3% YoY to $1.92 billion, beating analyst estimates of $1.84 billion. Gross billings in North America rose 10%, driven by Dolls and Vehicles, offset by Action Figures, Building Sets, Games and Infant, Toddler and Preschool sales. Gross billings for International rose 9% YoY, driven by Dolls (Barbie) and Vehicles (Hot Wheels). Gross margins rose 280 bps to 51% versus 48.2% in the year-ago period. Operating income grew by $82 million to $474 million. Net income was $146 million, which includes a non-cash charge of $212 million relating to the establishment of valuation allowance on foreign deferred assets. The company bought back $60 million of stock in its buyback program for a year-to-date (YTD) total of $110 million.

Balance sheet improvements

Mattel finished the quarter with $456 million in cash, up from $349 million in the year-ago period. Total debt declined to $2.329 billion from $2.574 billion last year. Accounts receivables rose by $190 million to $1.571 billion due to increased net sales. Inventory continued to fall to $791 million from $1.84 billion in the year-ago period. Its leverage ratio was 2.7X and generated $40 million in cost savings.

Worldwide segment billings

Mattel's gross billings on Barbie brands spiked 16%, driving overall Dolls sales to $884.5 million, up 27% YoY. Its American Girl segment experienced its eighth quarter of gross billings decline. Action figures, games, building sets and toys experienced a 19% YoY drop in gross billings. Worldwide gross billings for Dolls rose 27% to $884 million. This was driven by growth in Barbie, Monster High, Disney Princess and Frozen. Worldwide gross billings for Infant, Toddler, and Preschool fell 2% to $361 million due to declines in Thomas & Friends. Worldwide gross billings for Action Figures, Building Sets, Games, and Other fell 19% to $358 million. Worldwide gross billings for Vehicles rose 18% to 518 million, driven by strength in Hot Wheels.

Strong Barbie and Hot Wheels versus weak Fisher-Price sales are expected

Mattel took the cautionary approach with its guidance, perhaps setting the bar too low. While they expect to reap more benefits from Barbie, the overall toy industry declines will offset some benefits. They expect growth in Dolls and Vehicles, offset by declines in Infant, Toddler Preschool and challenger brands. In a nutshell, Mattel expects Barbie and Hot Wheels to grow while Fisher-Price sales decline.

Lowball revenue guidance tanks the stock

For full-year 2023, Mattel raised EPS guidance to $1.15 to $1.25, up from $1.10 to $1.20 previous estimates versus $1.20 consensus analyst estimates. Full-year 2023 revenues were lowballed to $5.425 billion versus $5.49 billion analyst estimates. This is what torpedoed the stock in the after-hours. Adjusted EBITDA was raised from $925 million to $975 million, up from $900 million to $950 million.

A strong holiday season is expected

Mattel CEO Ynon Kreiz said, "We look forward to a strong holiday season for Mattel and expect to achieve our updated full-year guidance and continue to grow market share. Looking beyond 2023, we believe we are well positioned to grow our IP-driven toy business and expand our entertainment offering."

Mattel analyst ratings and price targets are at MarketBeat. Mattel peers and competitor stocks can be found with the MarketBeat stock screener.

Daily ascending triangle breakdown

The daily candlestick chart on MAT illustrates the ascending triangle pattern heading into its Q3 2023 earnings release. The ascending trendline commenced after bouncing off its swing low at $16.66 on April 21, 2023. MAT triggered the daily market structure low (MSL) breakout above $18.29. MAT continued to form the ascending trendline with higher lows on pullbacks and higher highs until the flat-top upper trendline resistance formed at $22.30. The daily relative strength index (RSI) started to fall in a choppy manner, pulling down MAT to test the ascending trendline support at $20.31 before the earnings dumper crashed shares to $16.20 before staging a rebound as the RSI dipped under the 30-band. Pullback support levels are at $16.66, $15.54, $15.08 and $14.52.

Hasbro Inc. (NYSE: HAS)

Hasbro will continue to grow its direct initiatives behind IP brands, including the Transformers, G.I. Joe, Power Rangers, Star Wars and Dungeons & Dragons. The company has more than 30 projects in development, from Transformers One, produced by Paramount Global Inc (NASDAQ: PARA), to an animated Magic series on Netflix and Odd-Paws series on Alphabet Inc. (NASDAQ: GOOGL) owned YouTube. Hasbro has lowered its inventory levels by 27% YoY with the goal of 20% to 25% below 2022 levels by year's end. Gross cost savings of $250 million to $300 million by 2025 is expected to be achieved earlier than scheduled. Baldur's Gate 3 has helped drive up Wizards of the Coast digital gaming revenues by 11% YoY. The company announced a new collaboration with the videogame series Fallout.

Cost savings initiatives are driven by improved supply chain

The company has exceeded its 2023 cost savings target of $150 million to achieve $200 million gross savings. Its supply chain has improved, enabling production costs down mid-single digits despite more than a 4% rise in inflation. The supply chain improvements have been responsible for $100 million of gross cost savings.

Q3 2023 earnings flop

Hasbro reported its Q3 2023 EPS of $1.64 versus $1.72 consensus analyst estimates, missing 8 cents. Revenues fell 10.3% YoY to $1.5 billion, falling short of $1.62 billion analyst estimates.

Lowered guidance

Hasbro stated that its guidance was based on a "cautious outlook." Full-year 2023 revenues are expected to fall 13% to 15% YoY or $4.976 billion to $5.093 billion, down from earlier guidance of $5.51 billion to $5.56 billion versus $5.5 billion analyst estimates. The company cut revenues by nearly $500 million. This triggered shares to collapse by 15% in the post-market.

Hasbro CEO Chris Cocks stated, "Wrapping up our results in Q3 show we are making progress across many of our key initiatives, but that we also have more to do, particularly in returning consumer products to growth."

Hasbro analyst ratings and price targets are at MarketBeat.

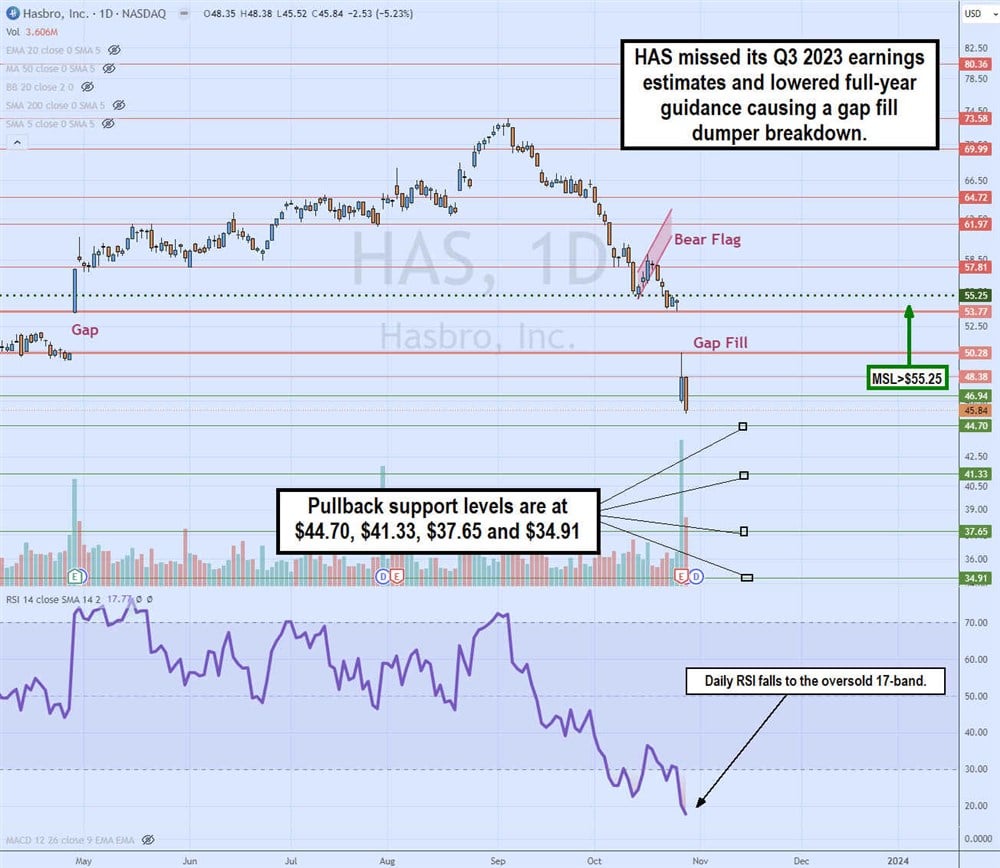

Daily bear flag to gap-fill breakdown

The daily candlestick chart on HAS formed a bear flag ahead of earnings falling under the daily MSL trigger at $55.25 to the $53.77 gap level from the prior earnings results. Incidentally, the Q3 2023 earnings caused HAS to gap down and fill the gap caused by the gap up from its Q2 2023 earnings results. This gap filled at $50.28 became a ceiling as shares couldn't break through the resistance after bouncing from $46.56 on the new gap down. The HAS bounce was short-lived as shares fell under the swing low as the daily RSI plunged back under the 30-band to the 17-band. Pullback support levels are at $44.70, $41.33, $37.65 and $34.91. HAS results were worse than MAT. This may be why MAT was able to bounce back stronger and retain its swing low as opposed to HAS, which made a new swing low.