Netflix, Inc. (NASDAQ: NFLX) stock shot up more than 16% in midday trading the day after it reported blockbuster earnings. But after rocketing past its 200-day and 50-day simple moving averages, is there still room for investors to get involved with NFLX stock?

The streaming giant added nearly 9 million subscribers. Many of these subscribers were the result of the company's crackdown on password sharing.

This will be sticky revenue for the company because consumers are spoiled for choice in the streaming sector. So, the fact that they are choosing Netflix will make them more likely to stick around for more than The Crown's final season, which the company says will drop sometime in November 2023.

It also means that any concerns about customers rejecting an ad-supported tier were likely overblown. That insight is meaningful to Netflix as well. The company now realizes that its old business model, predicated on ad-free viewing and password sharing, is no longer the key to streamer’s hearts.

Sharing is Caring, but Ad Revenue is a Cure

Netflix plans on raising the price of its premium subscription service to $22.99 from $19.99. With inflation on the rise, this may seem wrongheaded or, at the very least, a bit tone-deaf. But there's a method to what may seem like madness.

Netflix knows that raising prices may nudge those premium subscribers off that ad-free tier and over to the company's less expensive, ad-supported tier. And the reason for that comes down to the profit the company earns from those short ads interrupting your streaming time.

That's an important takeaway from the company's earnings report. Revenue came in flat at $8.54 billion. However, the company beat earnings expectations by 6.8%.

One of the Achilles heels for Netfiix has been its insatiable need for original content. As the novelty of streaming wore off and competition increased along with a loss of syndication rights, the company turned to producing its own content.

Production has been suspended during the ongoing SAG-AFTRA strike. The writers are back, but without actors, there's no production going on. That added about $1 billion to the company's free cash flow estimate for the year. However, that production will resume once the strike ends.

Netflix May be Upping Its Live Sports Game

However, Netflix is also taking a page out of the playbook of other streaming services such as Apple TV, YouTube TV, Peacock, and Amazon Prime by trying to carve out a niche in live sports. The company will start with "The Netflix Club," a golf match featuring four players on the PGA tour and four Formula 1 drivers. The event will be held on the eve of the first Formula 1 race of the year.

And why is there such an emphasis on sports? Nielsen said broadcast sports viewership was up 360% versus 222% last year. Cable TV saw a 25% increase in sports viewership. The takeaway is that consumers are willing to pay to watch live sports. And increasingly, professional sports leagues are doing everything they can to shift to streaming. One of the most notable examples is the National Football League, which moved its coveted Sunday Ticket service to Alphabet, Inc. (NASDAQ: GOOGL) and its YouTube TV.

Netflix co-CEO Ted Sarandso says investors shouldn't read too much into its foray into live sports as part of a broader strategy. However, the company did lose a bid to carry Formula 1 races to ESPN. And it's also worth noting that the company said it wouldn't have an ad-supported model. Things change.

Is NFLX a Buy?

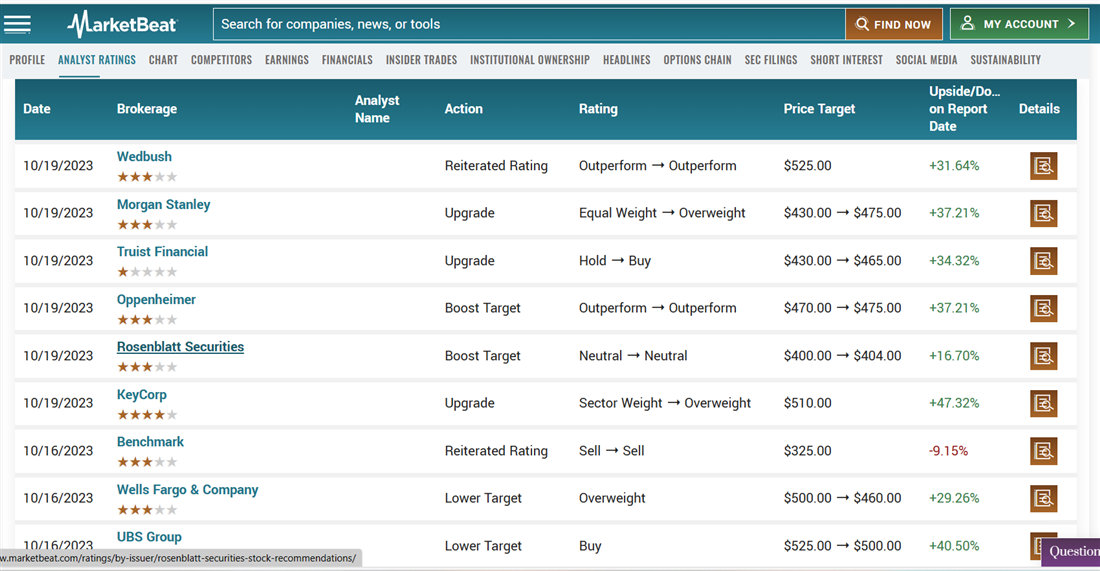

Netflix is covered by 40 analysts tracked by MarketBeat. They give NFLX stock a Moderate Buy rating with a consensus price target of $433.53. However, on October 19, 2023, alone, the stock received three upgrades and two raised price targets. Most importantly, Wedbush, an analyst firm that is perhaps the most bullish on Netflix stock, reiterated its outperform rating with a $525 price target.