Strong ecommerce grocery sales in May continue a months-long trend fueled by new online shoppers in the vertical and more frequent digital shopping trips, commerce protection provider Signifyd finds

Online grocery sales continued their torrid pace in May, powered by lower prices and an influx of new online food shoppers, according to ecommerce sales data from Signifyd.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240617850702/en/

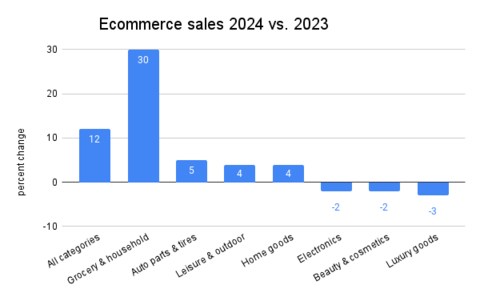

Ecommerce Sales 2024 vs. 2023 (Graphic: Business Wire)

Overall, grocery spending was up 30% year over year in May, according to Signifyd’s monthly Ecommerce Pulse data report. That far outstrips inflation and indicates that consumers’ robust spending spree in grocery has not let up. Together the trends may point to the long-discussed, post-pandemic “new normal.”

Ecommerce sales in the grocery category, which include curbside pickup, surged during the pandemic for obvious reasons. But now that the concern about in-person shopping has passed, there is no sign the category is ever going back to online sales anything close to pre-pandemic levels.

“Grocery sales have remained consistently strong throughout the year — up 23% overall,” said Signifyd Data Analyst Phelim Killough, who prepares Signifyd’s monthly Pulse report. “This is being heavily driven by an increase in order count — and we found these orders are coming from a significantly higher number of online grocery shoppers than were buying online just a year ago.”

The evidence of a lasting transformation in grocery shopping can be found in Signifyd’s data through the first five months of the year. Signifyd Ecommerce Pulse data shows that since January:

- Online grocery sales are up 23% over the same period last year.

- The number of orders is up 31% over last year.

- The average value of each order placed is down 6%.

- The number of new online grocery shoppers is up 10%.

- Orders placed per shopper (as identified by a unique combination of digital signals) is up 19%.

- Home delivery orders grew by 25% while curbside pickup was up 21%.

The sales surge is happening as ecommerce inflation in grocery has flattened, down 0.1% from a year ago. That compared to a year-over-year inflation rate that reached 6.7% in the grocery category in May 2023.

Looking past all the up arrows for the grocery category, the numbers describe a growing group of shoppers who watch carefully what they spend while turning to online ordering more frequently than a year ago. The trends mean merchants and brands need to approach pricing decisions strategically to appeal to their growing and increasingly price-sensitive market.

Ecommerce sales May 2024 vs. May 2023 |

All categories |

+12% |

Auto parts & tires |

+5% |

Beauty & cosmetics |

-2% |

Electronics |

-2% |

Grocery & household |

+30% |

Home goods |

+4% |

Leisure & outdoor |

+4% |

Luxury goods |

-3% |

Fraud pressure |

+35% |

Overall, ecommerce sales for May were up 12% over a year ago, according to Signifyd Pulse data. Other popular categories, along with grocery, that saw gains included auto parts and tires, which were up 5% over May 2023. Home goods and leisure and outdoor were both up 4% year over year. Luxury goods were down 3% year over year. The beauty category and electronics category were each down 2% annually.

Meanwhile, fraud pressure in May was up 35% over a year ago. Fraud pressure is a measure of the rise and fall of orders determined by Signifyd’s AI models to be very risky and therefore likely fraudulent.

For more May data, including fraud trends; buy online, pickup in store; buy now, pay later; sustainable goods trends and private label sales; visit Signifyd’s Ecommerce Pulse Hub.

Methodology

Signifyd’s Ecommerce Pulse data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from millions of transactions to detect and block fraudulent activity while increasing the number of good orders approved. Signifyd has seen more than 600 million unique shopper wallets1 globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly.

About Signifyd

Signifyd provides an end-to-end Commerce Protection Platform that leverages its Commerce Network to maximize conversion, automate customer experience and eliminate fraud and consumer abuse risk for retailers. Signifyd, which is the leading provider of payment security and fraud prevention for the Digital Commerce 360 Top 1000 Retailers, is headquartered in San Jose, CA, with locations in Denver, New York, Mexico City, São Paulo, Belfast and London.

1 A digital wallet is a distinct combination of signals present in an online transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240617850702/en/

Strong ecommerce grocery sales in May continue a months-long trend fueled by new online shoppers in the vertical and more frequent digital shopping trips, according to Signifyd

Contacts

Mike Cassidy

Signifyd head of PR & storytelling

mike.cassidy@signifyd.com