- Results of the Natixis Center for Investor Insight mid-year survey of more than 30 strategy experts reveals that only 19% see a significant risk of recession in H2

- While big tech drove an equity rally in H1, 66% of strategists are concerned about corporate earnings and predict the rally will moderate in the second half of the year

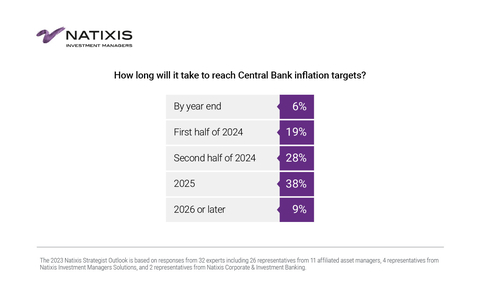

- Inflation is easing but the majority of strategists believe it will take 18-24 months before central bank targets are met

- When asked specifically about AI, 88% believe it can unlock investment opportunities that were previously undetectable

After a robust start to the year with inflation easing, some stock markets reaching double digit returns, and bond yields reaching 15-year highs, economists and investment strategists are feeling more confident that recession risk is receding in H2 2023, according to a survey by Natixis Investment Managers conducted at the end of June 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230725891532/en/

How long will it take to reach Central Bank inflation targets? (Graphic: Business Wire)

Drawing on the insights of 32 market strategists, portfolio managers, research analysts and economists at Natixis Investment Managers and 13 of its affiliated investment managers, as well as Natixis Corporate and Investment Banking, the survey reveals that 50% rate recession as a low risk in H2, but that said, they remain cautious, warning that market headwinds are intensifying with an uncertain picture for H2 emerging.

Nearly three quarters (72%) are concerned that inflation may linger longer than expected and 38% think rates could stay high for longer than anticipated, as 66% also worry about corporate earnings, finds the mid-year survey.

Surprising start to the year

The first half of 2023 surprised strategists and investors. In November 2022, 59% of institutional investors believed recession in 2023 was “inevitable” and 54% said recession was “absolutely necessary” to curb inflation.* The reality is a different picture as markets delivered solid returns, bonds generated attractive yields, and inflation began to ease around the world, dropping to 3% in the US.

The survey reveals that over the rest of 2023 just 6% of strategists believe a recession is “inevitable”, 53% say there is a “distinct possibility”, and 9% think recession is “highly unlikely”.

Inflation: from high anxiety to easing prices

After a painful run of increasing costs, central bank efforts to ease the pressure began to produce results in H1. In the US, inflation shrank from 6.5% in June 2022 to 3% by the end of H1 2023, while in the Eurozone it fell from 9.2% to 5.5%. The UK has failed to keep pace, but is starting to show signs of inflation easing, falling from 10.5% at year-end to 8.7% in May.

Only 22% of strategists surveyed say inflation is a “high risk” in the second half of the year, however, 38% of strategists do not believe inflation targets will be met until 2025, and 9% say they may not be met until at least 2026.

Investors shouldn’t be complacent as headwinds remain

Geopolitics (72%) and central bank policy (72%) draw the strongest consensus when it comes to headwinds. However, a quarter (25%) of strategists do not think geopolitics will impact markets in the second half of the year, instead calling geopolitical issues “noise”. Bank policy concerns centre around the question of how high and for how long rates will remain restrictive before inflation is back to target levels.

Corporate earnings are a potential headwind for 66%, however 25% are optimistic and say earnings may act as a catalyst in the second half of the year. Strategists are also split on the outlook for consumer spending as half worry a slowdown in spending will serve as a headwind, while 28% believe consumer spending will increase providing a catalyst for market growth.

“Inflation is cooling off, but we aren’t through the woods yet. Strong consumer spending, inflated cost of services, and geopolitical tensions may keep inflation lingering for longer which will result in higher rates for some time yet. Strategists generally think it will take until 2025 until targets are met,” said Mabrouk Chetouane, Head of Global Market Strategy, Solutions, Natixis IM.

Finding opportunities

When considering the headwinds and opportunities, 34% of the market strategists say the US is best positioned for the rest of the year, and 22% think either Japan or emerging markets (excluding China) will be the winner. Just 16% think Europe will be the leading market, while only 6% believe it will be China. None of the strategists are backing the UK. There is strong consensus that large caps (81%) will outperform small caps (19%), in part due to tighter credit standards set in the wake of Q1’s banking crisis.

Strategists are torn between whether growth or value will outperform to year end, seeing a 50/50 split.

Bond markets

After 15 years of low and negative yields, yield returned in 2023. As central banks hiked rates to the highest levels since the global financial crisis, investors took advantage. Yields on 10-year Treasuries reached 3.84% in June as 10-year Eurozone Central Bonds reached 3.21%. Asked for their outlook on H2:

- 47% think US Treasury yields will come in at 3.5%-4%

- 41% see rates receding, leading 28% expecting 10-year Treasuries to drop to the 3%-3.5% range

- 13% think rates could move to between 2.5%-3%

However, there are still concerns for fixed income investors:

- 72% worry inflation may linger longer than expected

- 38% think rates could go higher than anticipated, 38% also believe they could stay high for longer than expected, and 38% are worried about corporate defaults and downgrades

- Largely strategists are not worried about consumer credit and the housing market as only 13% say they are concerned, but 69% see central bank mistakes as a risk (53% medium risk and 16% high risk)

With all things considered, 56% of those surveyed think long-duration bonds will outperform short-duration bonds by the end of 2023.

Equity rally likely to cool

Markets rallied in the first half of the year, largely due to the re-emergence of tech. The NASDAQ delivered returns of 30% - the best H1 in the index’s 52-year history. The tech rally, driven by excitement around artificial intelligence (AI), also helped the S&P 500 gain 15.91%. In Japan, corporate reforms and a focus on sustainable growth saw the Nikkei to see returns of 27.91% by June 30 – the biggest gain in 33 years.

However, none expect the tech rally to intensify, less than a third (31%) expect it to “continue steadily” and 6% of strategists think the “bubble will burst”, so expectations should remain realistic. Half think equities more generally will cool off in H2 and prices will dip to reflect the fundamentals.

When asked specifically about AI, while 88% believe it can unlock previously undetectable investment opportunities and 69% believe it will accelerate day trading, 100% of the strategists surveyed believe it will increase potentially fraudulent behaviour.

“Compared to expectations at the end of 2022, 2023 has been surprisingly positive so far, but investors need to stay alert to ongoing headwinds to prevent complacency. Inflation has gone from an all-consuming concern to a manageable situation in most developed markets, but it could take some time before aggressive targets set by central banks are met.

“Big tech helped equities come roaring back in the first half of the year but, while few predict a major downturn, most are concerned about corporate earnings across H2 and expect the rally to fade away by the end of the year. Recession is still a real possibility, but most expect a softer landing. The successes of H1 may dissipate, but our strategists and economists still believe there are good opportunities if you look carefully,” said Mabrouk Chetouane.

The full survey report can be found here: https://im.natixis.com/us/markets/2023-strategist-outlook-turn-the-page

Notes to Editors

*2022 Natixis Investment Managers Institutional Investor Market Outlook survey

About the Natixis Strategist Outlook

The 2023 Natixis Strategist Outlook is based on responses from 32 experts including 26 representatives from 11 affiliated asset managers, 4 representatives from Natixis Investment Managers Solutions, and 2 representatives from Natixis Corporate & Investment Banking.

Jack Janasiewicz, CFA® |

Portfolio Manager and Lead Portfolio Strategist |

Natixis Investment Managers Solutions |

Garrett Melson, CFA® |

Portfolio Strategist |

Natixis Investment Managers Solutions |

Chris Sharpe, CFA® |

Chief Investment Officer, and Portfolio Manager |

Natixis Investment Managers Solutions |

Dirk Schumacher |

Head of European Macro Research |

Natixis Corporate & Investment Banking |

Cyril Regnat |

Head of Research Solutions |

Natixis Corporate & Investment Banking |

Michael J. Acton, CFA® |

Managing Director, Head of Research |

AEW Capital Management |

Hans Vrensen, CFA®, MRE |

Head of Research & Strategy |

AEW Europe |

Jean-Charles Mériaux |

Chief Investment Officer |

DNCA Investments |

Pascal Gilbert |

Bond Fund Manager |

DNCA Investments |

Isaac Chebar |

Fund Manager, European Value Equity |

DNCA Investments |

Carl Auffret, CFA® |

Fund Manager, European Growth Equity |

DNCA Investments |

Michael Buckius, CFA® |

Chief Executive Officer, President, Chief Investment Officer, and Portfolio Manager |

Gateway Investment Advisers |

Adam Abbas |

Portfolio Manager and Co-Head of Fixed Income |

Harris Associates |

Brian Horrigan, CFA® |

Chief Economist |

Loomis, Sayles & Company |

James Grabovac, CFA® |

Municipal Bond Investment Strategist |

Loomis, Sayles & Company |

Brian P. Kennedy |

Portfolio Manager, Full Discretion Team |

Loomis, Sayles & Company |

Lynda L. Schweitzer, CFA® |

Portfolio Manager, Co-Team Leader of Global Fixed Income Team |

Loomis, Sayles & Company |

Michael Crowell |

Co-Director of Macro Strategies and Director of Quantitative Research Risk Analysis |

Loomis, Sayles & Company |

Craig Burelle |

Global Macro Strategist, Credit |

Loomis, Sayles & Company |

Elisabeth Colleran, CFA® |

Portfolio Manager, Emerging Markets Debt Team |

Loomis, Sayles & Company |

Lynne Royer |

Portfolio Manager, Co-Head of Disciplined Alpha Team |

Loomis, Sayles & Company |

Jens Peers, CFA® |

CEO and CIO |

Mirova (US) |

Rafael Calvo |

Managing Partner, Chief Investment Officer |

MV Credit |

Carmine de Franco, PhD |

Head of Fundamental Research |

Ossiam |

Axel Botte |

Global Strategist |

Ostrum Asset Management |

Philippe Waechter |

Chief Economist |

Ostrum Asset Management |

Chris D. Wallis, CFA®, CPA® |

CEO, CIO, Senior Portfolio Manager |

Vaughan Nelson Investment Management |

Mabrouk Chetouane |

Head of Global Market Strategy |

Natixis Investment Managers Solutions |

Nicole Downer |

Managing Partner and Head of Investor Solutions |

MV Credit |

Yan Gao |

Portfolio Manager & Business Analyst |

WCM Investment Management |

Philippe Berthelot |

CIO Credit Management & Money Markets |

Ostrum Asset Management |

Alexandre Caminade |

CIO Core Fixed Income and Liquid Alternatives |

Ostrum Asset Management |

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1.2 trillion assets under management2 (€1.1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2022 ranked Natixis Investment Managers as the 18th largest asset manager in the world based on assets under management as of December 31, 2021.

2 Assets under management (“AUM”) of current affiliated entities measured as of March 31, 2023 are $1,208.2 billion (€1,111.9 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230725891532/en/

Contacts

Press:

Kelly Cameron (US)

Natixis Investment Managers

+ 1 617 449 2543

Kelly.Cameron@natixis.com