Continues Growth in its Four Core Businesses: Insurance, Asset Management, Distribution and Credit

Phoenix Holdings Ltd., a leading Israel-based diversified financial, insurance, and investment group (TASE: PHOE) (“Phoenix,” the “Group,” or the “Company”), today reported its results for the first quarter of 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230531005646/en/

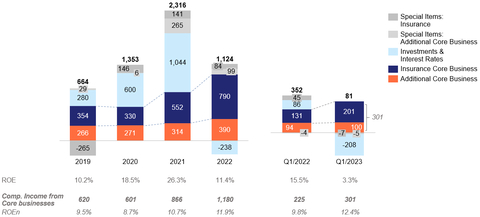

Comprehensive income (NISm, after tax) (Graphic: Business Wire)

Highlights

- The Group reports comprehensive income of 81 million NIS, reflecting an annual return on equity of 3.3% (normalized ROE 12.4%). Performance was impacted negatively by capital market performance (net 208 million NIS), due primarily to Israeli market volatility.

- Continued growth in income from core businesses, with 34% year-over-year growth to 301 million NIS, compared to 225 million NIS in the corresponding period last year, including improved P&C performance.

- Assets under management as of March 31, 2023 grew to 386 billion NIS. AUM growth in Q1 2023 resulted from continued inflows and 8 billion NIS of new AUM from acquisition of Epsilon & Psagot’s assets; The Group believes its investment management capabilities is a significant competitive advantage.

- As of March 31, 2023, equity amounted to 10 billion NIS after distributing dividends of 177 million NIS with respects to 2022 profits.

- The Phoenix Insurance Company Ltd. (“Phoenix Insurance”) published an updated Solvency ratio of 211% with transitional measures and 149% without transitional measures as of December 31, 2022.

- Moody’s, the international credit ratings agency, assigned an A2 insurance financial strength rating (IFSR) to the Phoenix Insurance with a stable outlook - the first time an Israeli insurance group was assigned an international rating.

- The Group continues to execute its strategic plan according to medium-term targets focusing on growth and high return on equity in all four-core business: Insurance, Asset Management, Distribution and Credit.

- In accordance with the Group’s strategy of creating and unlocking value across Group activities, the Company is assessing the possibility of introducing an international investor to the Phoenix Agencies, which is Israel’s leading insurance and financial distribution network.

- Core non-insurance activities (asset management, agencies, and credit) contributed an after-tax comprehensive income of 100 million NIS in the first quarter of 2023, an increase of 6.4% compared to the corresponding period last year.

- Insurance activities recorded a net underwriting profit of 201 million NIS, an increase of 53% compared to the corresponding period last year, mainly due to P&C activities.

- Premiums grew by 20% and 15% in the P&C and Health insurance businesses, respectively, while total premiums & contributions in the Life & Savings segment decreased due to capital market performance and savings policy contributions. Total premiums and contributions in Q1 2023 amounted to NIS 4.4 billion, compared to NIS 5.5 billion in the corresponding period last year.

- The equity attributable to the Company's shareholders amounted to 10.0 billion NIS as of March 31, 2023, following the distribution of a dividend of 177 million NIS from 2022 profits, paid in April 2023, and the buyback of approximately 6 million NIS in shares during the Q1 2023, as part of the Company’s 100 million NIS 2023 buyback program.

- As of December, 31 2022, the Phoenix Insurance solvency ratio was 211% (including transitional measures), compared to 190% as of December 31, 2021 (149% without transitional measures compared to 117%), a significant improvement. The Group’s management believes that its capital adequacy and high liquidity serve as significant competitive advantages for meeting its strategic targets, create high ROE and maximizes business opportunities.

- The Phoenix continues to execute against strategic objectives, while maintaining its investing in infrastructure (people and technology) for the benefit of its clients.

Eyal Ben Simon, CEO of Phoenix Holdings:

“Phoenix’s core business results in the first quarter of 2023 reflect the continued implementation of our profitable growth strategy in all four areas: Insurance, Asset Management, Distribution and Credit. They also demonstrate significant competitive advantage in our diversified business activities amid a changing market environment.

Profits were impacted by volatility in the Israeli capital markets in the first quarter, but we are seeing an improvement in the second quarter. The Phoenix, as the largest diversified financial group in Israel, operates to ensure compelling value propositions for our clients and value creation for our investors. The investments we have made and continue to make to broaden our range of solutions, creates the highest standard of customer experience. Sharing our values and commitment to excellence at the individual and Group level help position the Phoenix as the leading financial group in Israel.

We will continue to focus on return on equity by actively managing all levels of the Group to optimize business opportunities. The Phoenix continues to maintain a high capital adequacy ratio, high profitability and a market leading position that will allow us to meet the medium-term targets of our strategic plan.

I am proud that Phoenix Insurance became the first large insurance company in Israel to receive an international credit rating, when Moody’s assigned it an A2 insurance financial strength rating (IFSR) with a stable outlook. Moody’s rating is similar to ratings it has assigned to Israeli banks, and we believe this reflects the status of the Group as a leading financial institution in the eyes of Israeli and foreign investors.

I would like to thank our customers, employees, as well as our business partners and board members for the contributions they have made to ensure the success of the Phoenix.”

The Phoenix reports its financial results for the Q1 2023, which reflect the continued execution of the Company’s strategic plan.

The following are highlights from the Q1 2023 financial statements:

Comprehensive income to shareholders:

The total comprehensive income to shareholders in Q1 2023 was 81 million NIS, reflecting a return on equity to shareholders of 3.3%. The profit in Q1 2022 amounted to 352 million NIS.

The decline in profit compared to the prior year relates mainly to the effects of capital markets and a lower impact of interest rate increases on insurance liabilities compared to the corresponding period last year.

Comprehensive income before tax from core activities and the impact of the interest rate increase and the capital markets:

Comprehensive income before tax for Q1 2023 was 132 million NIS, compared to 529 million NIS in the corresponding period last year.

Comprehensive income before tax from core activities in Q1 2023 was 473 million NIS, mainly due to improved performance of the P&C business, including in motor insurance. The Group’s comprehensive income before tax was offset by a negative net capital market impact of 317 million NIS and some positive effect of interest rates on insurance liabilities.

Shareholders’ equity and Assets Under Management:

The equity attributable to the Company’s shareholders amounted to 10.0 billion NIS as of March 31, 2023.

Assets under management as of March 31, 2023 grew to 386 billion NIS.

The following are the main financial results of the Group's activity segments:

(For more details regarding changes in financial results, see the Company’s Financial Statements and investor presentation)

P&C:

The total pre-tax profit in Q1 2023 was 76 million NIS, compared to a total pre-tax loss of 142 million NIS in the corresponding period last year. The increase in profit is mainly attributable to the improvement in underwriting results, mainly in the motor insurance industry. The Phoenix achieved an improvement in the loss ratio in the casco line of business, including the impact of the full implementation of its advanced data model.

Health Insurance (including long-term care, medical insurance, and travel insurance):

The total pre-tax profit in Q1 2023 was 150 million NIS, compared to a total pre-tax profit of 655 million NIS in the corresponding period last year. The difference is due primarily to a smaller contribution from rising interest rates compared to last year.

Life and Savings:

The total pre-tax loss for Q1 2023 was 77 million NIS, compared to a profit of 164 million NIS in the corresponding period last year. The decrease in profit is attributed mainly to capital market effects with lower offset from rising interest rates compared to 2022.

As of publication date, the variable management fee deficit was 637 million NIS.

Asset Management - Provident and Pension Funds:

The total pre-tax profit for Q1 2023 was 20 million NIS, compared to 21 million NIS in the corresponding period last year.

Asset Management – Investment Services (including Phoenix Investment House, formerly Excellence):

The total pre-tax profit for Q1 2023 was 51 million NIS, compared to 22 million NIS in the corresponding period last year. The increase in profit is mainly attributable to profit of the brokerage business, partly offset by lower recognition of variable ETF fees.

Agencies:

The total pre-tax profit for Q1 2023 was 73 million NIS, compared to a profit of 72 million NIS in the corresponding period last year. The result of this segment is stable despite the economic slowdown and the resulting decrease in one-time fees from new policies.

Credit (including Gama):

The total pre-tax profit for Q1 2023 was 28 million NIS, compared to NIS 12 million in the corresponding period last year. The increase in profit is mainly attributable to improved margins, with a growing credit portfolio in most activities and proactive exposure reduction in specific areas.

Conference Call Information

Phoenix Holdings will hold a conference call on Wednesday, May 31, 2023 at 1pm local time in Hebrew and at 5pm local time / 3pm UK / 10am ET in English, and has published dial-in details and the presentation through the Tel Aviv Stock Exchange website.

About Phoenix Holdings

Phoenix Holdings is a leading Israel-based financial, insurance, and investment group traded on the Tel Aviv Stock Exchange (TASE: PHOE). Group activities include multi-line insurance, asset management, credit, and financial product distribution, and have demonstrated strong growth and performance across the cycle. The Phoenix serves a significant portion of Israeli households with a broad set of activities and solutions across businesses and client segments. Managing over $100 billion in assets, the Phoenix accesses Israel’s vibrant and innovative economic activity through a robust investment portfolio, creating value for both clients and shareholders.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230531005646/en/

Contacts

David Alexander

Phoenix Holdings, Deputy CEO

Email: davidal@fnx.co.il

Tel: +972 (3) 733-2979

Robert Brinberg

Rose & Company

Email: phoenix@roseandco.com

Tel: +1 (212) 517-0810