Phoenix Delivers Continued Growth in its Four Core Businesses: Insurance, Asset Management, Distribution, and Credit

Phoenix Holdings Ltd., a leading Israel-based financial, insurance and investment group (TASE: PHOE) (“The Phoenix,” the “Group,” or the “Company”), today reported results for 2022 and the fourth quarter of 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230323005586/en/

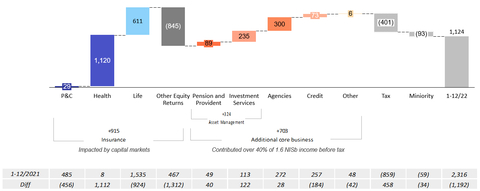

Comprehensive income by segment (2022, in NIS millions) (Graphic: Business Wire)

Highlights

- The Group reported comprehensive income of NIS 1,124 million for 2022 and NIS 526 million for the fourth quarter, reflecting a 11.4% annual return on equity and 23.0% in the quarter.

- The results reflect a 45% improvement in profit from operations before tax over last year - from NIS 1,248 million in 2021 to NIS 1,796 million in 2022. Total profit from asset management, distribution (agencies) and credit contributed NIS 624 million before tax in 2022, compared with NIS 453 million in 2021.

- The Phoenix's 2022 results were affected by the challenging economic environment and declines in the financial markets. The total negative impact, before tax, of the declines in the markets on Phoenix results, net of the interest rate increase, amounted to NIS 359 million compared to a positive effect of NIS 1,595 million in 2021. During the fourth quarter of 2022, the total positive effect before tax amounted to NIS 362 million compared to NIS 738 million in the same period last year.

- Pursuant to the Company’s dividend policy of distributing at least 30% of the total annual comprehensive income, The Phoenix is announcing a dividend of NIS 177 million for the second half of 2022, resulting in total dividend distributions of NIS 337 million for 2022, which equates to 30% of 2022 income.

- In the insurance segment, total premiums and contributions towards benefits grew 3.1% in 2022 compared with last year, totaling NIS 19.7 billion.

- The Company makes acquisitions that are in line with its strategy and financial targets in the areas of asset management, agencies, and credit. Total assets under management as of December 31, 2022 reached NIS 371 billion., Including the recently signed acquisitions of Epsilon Investment House and selected assets from Psagot Investment House, AUMs amount to an aggregate of NIS 399 billion, on a pro forma basis as at the end of 2022, subject to receiving required approvals.

- As of December 31, 2022, equity capital totaled NIS 10.1 billion, following the NIS 160 million dividend distribution from 2022 first half income and a share buyback of NIS 56 million. The Phoenix announced a share buyback plan for 2023, totaling NIS 100 million. As of the date of this report, the Company has repurchased approximately NIS 6 million of shares under its 2023 buyback plan.

- The Phoenix Insurance Solvency ratio has improved following the increase in interest rates, reaching 202% as of June 30, 2022, including transitional measures, compared to 190% as of December 31, 2021 (137% compared to 117% in 2021 without transitional measures). The Phoenix sees its substantial financial resilience and liquidity as a distinct competitive advantage that will allow it to continue advancing its strategic goals, generate excess returns and maximize business opportunities.

- The Group continues focus on client value propositions and to make significant investments in its infrastructure and digital capabilities.

Eyal Ben Simon, CEO of Phoenix Holdings:

The Group's results reflect the continued execution of our growth strategy in the areas of insurance, asset management, distribution and credit. Our focus is on accelerated growth in areas that provide a high return on equity, innovation and efficiency to drive competitive advantage, active group management, and improvements to our capital structure.

Our strategy reflects our belief that creating value for the Group's clients by offering a diverse set of best-in-class products and services creates sustainable value for the Group's shareholders. These significant efforts bear fruit and run across all organizations and teams - from senior executives to each employee. These include substantial investments in building digital capabilities and technological services to improve our client value propositions. These efforts are also shared by brokers, agents, and advisors who regard the Phoenix Group as their partner.

I would like to thank the Group's clients for their continued trust and confidence in our products and services, the Group's employees and our business partners for sharing our path together, and the Group's Board of Directors, who provide confidence and stability in supporting strategic leadership.

Key figures from the financial statements:

Comprehensive income attributable to shareholders

Comprehensive income attributable to shareholders amounted to NIS 1,124 million in 2022 and NIS 526 in the fourth quarter of 2022, reflecting a return on equity of 11.4% and 23.0% attributable to the shareholders, respectively. This compares to a total of NIS 2,316 million and NIS 759 million in the corresponding periods in 2021. The year over year decrease in profit is mainly due to the effect of capital markets, which was offset by the effect of rising interest rates on the insurance liabilities, and special items.

Profit from operations (before tax) amounted to NIS 1,796 million in 2022 and NIS 458 million in the fourth quarter of 2022. This compares to a total of NIS 1,239 million and NIS 283 million in the corresponding periods in 2021.

Equity capital and solvency ratio

The equity capital attributable to the Company’s shareholders amounted to NIS 10.1 billion as of December 31, 2022.

The economic solvency ratio as of June 30, 2022, with transitional measures, was 202% (137% without transitional measures). The Solvency ratio as of December 31, 2021 was 190% (117% without transitional measures). The Phoenix Insurance's mid-term target for its solvency ratio is in the range of 150-170%. The minimum economic solvency ratio target (the minimum for dividend distribution), without transitional provisions, is 111%.

The effect of the decline in capital markets and rising interest rates

Pre-tax profit from operations net of the effects of the capital markets, special items, and interest increased by NIS 557 million to NIS 1,796 million in 2022.

In 2022, the nominal return from corporate account (Nostro investments) was 1.9%, and the real return in the reporting period was (3.2%). Compared to an annual real return of 3% and related variable management fees, the negative impact of capital markets returns was NIS 2,004 million, before the positive impact of interest rates.

Premiums and contributions

Premiums and contributions in 2022 amounted to NIS 19.7 billion, compared to NIS 19.1 billion in 2021.

Updated the strategic plan

As part of the strategic review in March 2022, the Phoenix updated profitability targets reflecting an increase of 30-50% in comprehensive income to NIS 1.3-1.5 billion in the medium term.

ESG

In July 2022, Maala published its 2021 index, in which the Company’s overall rating improved from Gold to Platinum. Additionally, the Company was awarded an A rating in the ESG index published by the TASE and in August 2022, the Company’s 2021 Greeneye ESG rating was upgraded to 77/100.

Below are the main financial results of the Group's operating segments (for more details regarding the changes in the financial results, see the Report of the Board of Directors on the State of the Corporation's Affairs and the Analyst Presentation)

P&C insurance (includes the liability and property subsegments)

The comprehensive income before tax amounted to NIS 29 million in 2022 and NIS 213 million in the fourth quarter of 2022, compared to a comprehensive income of NIS 485 million before tax and a total of NIS 26 million in the corresponding periods last year. The decrease in profitability is mainly due to the decrease in investment income and the increase in frequency and severity of claims in the motor property subsegment. However, The Phoenix consistently strives to improve underwriting results and makes necessary adjustments, including the full implementation of an advanced data analytics model, as reflected in the underwriting profit. In the fourth quarter of 2022, The Phoenix recorded an underwriting profit of NIS 168 million in the P&C segment, mainly due to an improvement in the profit from compulsory motor and liability subsegments.

Life insurance and savings

The comprehensive income in 2022 and in the fourth quarter of 2022 amounted to NIS 611 million and NIS 115 million, respectively. This compares to a comprehensive income of NIS 1,535 million before tax and a total of NIS 669 million in the corresponding periods last year.

Compared with last year, the results for the full year and the fourth quarter of 2022 were mainly impacted by the decrease in investment income variable management fees, which was partially offset by the increase in the risk-free interest rate curve that triggered a decrease in insurance reserves, and special items.

Special items in the reporting year mainly include (a) research effects on retirement ages and benefit uptake rates, which resulted in a pre-tax profit of approximately NIS 462 million; (b) application of a circular regarding updated mortality assumptions, which resulted in a pre-tax loss of NIS 364 million.

It should also be noted that as of the date of this report, receivable variable management fees amount to NIS 643 million (as of the report publication date - approximately NIS 728 million before tax).

Pension and provident funds

The comprehensive income before tax for 2022 and the fourth quarter of 2022 amounted to NIS 89 million and a profit of NIS 16 million, respectively. This compares to a comprehensive income of NIS 49 million before tax and a total of NIS 5 million in the corresponding periods last year.

Health insurance segment (includes long-term care, medical expenses, dental, travel and foreign workers insurance)

The comprehensive income in 2022 and in the fourth quarter of 2022 amounted to NIS 1,120 million and a profit of NIS 172 million, respectively. This compares to a comprehensive income of NIS 8 million before tax and a total loss of NIS 172 million in the corresponding periods last year. The increase in profitability in 2022 is mainly due to the increase in the risk-free rate curve which resulted in a decrease in insurance liabilities and special items (mainly due to the transfer of interests in Phoeniclass Ltd. to The Phoenix Insurance during the first quarter of 2022) offset by a decrease in investment income.

Investment services (includes Phoenix Investment House and Phoenix Advanced Investments)

The comprehensive income in 2022 and in the fourth quarter of 2022 amounted to NIS 235 million and a profit of NIS 53 million, respectively. This compares to a comprehensive income of NIS 113 million before tax and a total of NIS 18 million in the corresponding periods last year. The increase is mainly due to an increase in operating profit and a non-recurring effect in the amount of NIS 86 million resulting from recording a profit for assuming control of The Phoenix Capital.

Agencies (includes the activity of employee benefits agencies and other consolidated insurance agencies)

The comprehensive income in 2022 and in the fourth quarter of 2022 amounted to NIS 300 million and a profit of NIS 69 million, respectively. This compares to a comprehensive income of NIS 272 million before tax and a total of NIS 99 million in the corresponding periods last year. The increase in profit results from an increase in operating profit and the recording of a non-recurring profit of NIS 22 million as a result assuming control of an agency held by a subsidiary agency of the Company.

Credit (includes Gama)

The comprehensive income in 2022 and in the fourth quarter of 2022 amounted to NIS 73 million and a profit of NIS 25 million, respectively. This compares to a comprehensive income of NIS 257 million before tax and a total of NIS 11 million in the corresponding periods last year. The increase in operating profit in 2022 and in the fourth quarter of 2022 compared with the corresponding periods in 2021 is mainly attributed to an improvement in Gama’s credit spreads and an increase in total credit portfolio. In 2021, a profit totaling approximately NIS 220 million was recorded in special items due to the recording of a non-recurring capital gain as a result of assuming control over Gama.

Other Equity Returns

The decrease in comprehensive income before tax in 2022 and in the fourth quarter of 2022 amounted to NIS (958) million and NIS (202) million, respectively. This compares to a comprehensive income of NIS 107 million before tax and a total of NIS (12) million in the corresponding periods last year. The change is mainly due to a decrease in investment income as a result of declines in capital markets in Israel and internationally.

Conference Call Information

Phoenix Holdings will hold a conference call on Thursday, March 23, 2023 at 1pm local time in Hebrew and at 4pm local time / 2pm UK / 10am EDT in English, and has published dial-in details and the presentation through the Tel Aviv Stock Exchange website.

The conference calls will be accompanied by a presentation which will be published on the Phoenix website at https://investor-relations.fnx.co.il, the Israel Securities Authority reporting website, and the Tel Aviv Stock Exchange website. Archived recordings of the conference calls will be available on the Phoenix website the following business day.

About Phoenix Holdings

Phoenix Holdings is a leading Israel-based financial, insurance, and investment group traded on the Tel Aviv Stock Exchange (TASE: PHOE). Group activities include multi-line insurance, asset management, distribution, and credit, and have demonstrated strong growth and performance across the cycle. The Phoenix serves a significant portion of Israeli households with a broad set of activities and solutions across businesses and client segments. Managing over $100 billion in assets, the Phoenix accesses Israel’s vibrant and innovative economic activity through a robust investment portfolio, creating value for both clients and shareholders.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230323005586/en/

Contacts

For further information, please contact:

David Alexander

Phoenix Holdings, Deputy CEO

Email: davidal@fnx.co.il

Tel: +972 (3) 733-2979

Robert Brinberg

Rose & Company

Email: phoenix@roseandco.com

Tel: +1 (212) 517-0810