Phoenix Holdings Ltd., a leading Israel-based financial, insurance and investment group (TASE: PHOE) (“The Phoenix,” the “Group,” or the “Company”), published today its results for the full year and three months ended December 31, 2021

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220329005723/en/

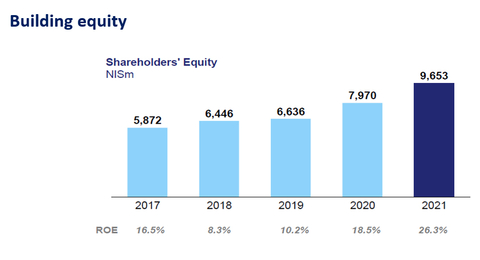

Building equity

Phoenix concludes year of growth with comprehensive income of 2.316 billion NIS reflecting a return on equity of 26.3% and a profit of 759 million NIS in the fourth quarter reflecting a return of 36.5%

Phoenix Increases Shareholders’ Equity and Dividends

Shareholders’ equity as of December 31, 2021 amounted to 9.7 billion NIS

Cash dividends from 2021 earnings total 621 million NIS, which is 2.47 NIS per share (421 million NIS will be distributed in April, 2022, in addition to 200 million NIS already distributed in December 2021); Phoenix also repurchased shares in the amount of 74 million NIS

The Phoenix is updating its dividend policy starting from 2022 and separating the distribution of cash dividends and share buybacks. The Group will work to distribute a cash dividend twice a year at an annual rate of not less than 30% of the annual comprehensive profit

Phoenix Holdings has a credit rating of AA and Phoenix Insurance of AA+

Phoenix shows strong growth in core businesses, surpassing initial strategic targets

Total managed assets at the end of 2021 amounted 369 billion NIS, compared with 234 billion NIS at the end of 2020. Total premiums and benefit contributions amounted to 29.9 billion NIS in 2021, compared with 19.2 billion NIS in 2020

In light of Group performance, the Phoenix raises the bar for strategic targets

A target of managed assets of 450-550 billion NIS (compared to a previous target of 300 billion NIS), a total profit target of 1.3-1.5 billion NIS (compared to 1 billion NIS) and an equity target of 11-13 billion NIS (compared to 9 billion NIS). In this plan, a new target of efficiency ratios in insurance activities is added.

In addition, a multi-year work plan for ESG initiatives has been approved and the company will publish the first full ESG report in the second quarter of 2022

* * *

Phoenix works strategically and builds business and financial resilience for a period of challenges and opportunities

The Phoenix continued to execute its strategy in 2021 to strengthen the Group's focus on products and services, offering the highest return on capital (26.3%) while maintaining market leadership in the insurance sector. The results of the strategy are clearly reflected in the Group's profits (2.316 billion NIS) the AUM amount (369 billion NIS) and the dividend distributed (621 Million NIS- 2.47 DPS).

The Company’s financial resilience and achievements in capital management enable the Group to increase core activities in the areas of insurance (which is based more than ever on technology and digitalization tools to enhance operational efficiency, data-driven underwriting and high quality customer service), asset management (pension, provident and financial services), distribution (insurance agencies and direct) and credit.

In investments and asset management, where the Phoenix has a leading rankings in yield performance indexes for savings, the Phoenix's total managed assets reached 369 billion NIS, following the development of strong organic capabilities as well as the merger and integration of Hellman Aldubi's activities into the Group. The Group offers a wide range of investment products (from pensions and provident funds to investments services, including mutual funds, ETFs, alternative investments, and brokerage services), and continues to build capabilities and differentiation in both Israeli and global asset classes. The Phoenix is currently a leading and preferred partner in many of the investment opportunities in Israel, which serves to strengthen the Company’s position in the investment, finance and insurance markets.

The Group has expanded its capabilities in key strategic areas by investing in people and technology infrastructure and making structural changes, improved the return-risk profile by diversifying profit sources and balancing the activities mix, enhancing the financial strength by creating sources of cash flow for liquidity and growth, and optimizing back book insurance portfolios.

As part of managing its investment portfolio, the Phoenix unlocked value in 2021 through a number of strategic transactions, including obtaining control over Gama Management and Clearing Ltd. (“Gama”) during Gama’s initial public offering, resulting with profit after tax of 220 Million NIS and selling control of the senior citizen housing network “Ad 120” resulting with a profit after tax of 270 Million NIS. The Group intends to actively consider additional strategic transactions to supplement continued organic growth.

Eyal Ben Simon, Phoenix Holdings CEO:

"The Group’s managers and employees are focused on realizing our goals and are committed to continuing to work vigorously to create value to the Group's clients and shareholders.

I am proud of the Group's achievements over the past year and confident in its ability to continue to lead in the coming years in strong growth while continuing to enhance its financial resilience. We continue to build our team and technology infrastructures to allow us to meet the challenges ahead and will allow us to increase our competitive advantage while capturing market opportunities.

I would like to thank the Phoenix Board of Directors for their support and our partners and employees for their commitment for success. Together, we look forward for strong cooperation and shared success in the years to come."

* * *

The following are the main financial results of the Group’s in the operating segments:

Insurance

General Insurance: The total pre-tax profit in 2021 amounted to 485 million NIS, compared to a total pre-tax profit of 524 million NIS in the corresponding period. Premium grew by 10% and Phoenix implemented data driven pricing.

Health Insurance: The total pre-tax profit in 2021 amounted to 8 million NIS, compared to a profit of 219 million NIS in the corresponding period. The decrease is mainly due to the decline in interest rates and strengthening reserves.

Life insurance: The total pre-tax profit in 2021 amounted to 1,535 million NIS, compared to a total profit of 679 million NIS in the corresponding period. The increase mainly due to the impact of the capital markets.

In addition, Phoenix Insurance published an economic solvency ratio for June 30, 2021 according to which the solvency ratio given the deployment provisions is 196%. Without considering the transition provisions for the deployment period the ratio is 120%, after the dividend distributed in 2021. The capital target set by the Board of Directors is at a rate of 108% without transitional provisions and 150% - 170% considering the deployment provisions.

Asset Management

Provident and pension: The total profit before tax in 2021 amounted to 49 million NIS, compared to a profit of 28 million NIS in the corresponding period. The Company has shown high growth and merged Hellman Aldubi in late 2021, the full results of which will be reflected in 2022.

Financial services (including Excellence Investment House activity and alternative investments): The total pre-tax profit in 2021 amounted to 113 million NIS, compared to 148 million NIS in the corresponding period. After the date of the report, the company announced a restructuring that will contribute to the strengthening of the investment house.

Insurance Agencies

The total pre-tax profit in 2021 amounted to 272 million NIS, compared to a profit of 237 million NIS in the corresponding period, reflecting strong revenue and profit growth.

Credit (including ‘Gama’ activity)

The total pre-tax profit in 2021 amounted to 257 million NIS, compared to 18 million NIS in the corresponding period. The profit for the period includes a special impact of 220 million NIS, reflecting the profit resulting from the IPO of Gama and the Company’s obtaining control in Gama. Gama is focused on continuing to accelerate growth, diversify profit sources, and strengthen management and technological infrastructures.

* * *

Conference Call Information

Phoenix Holdings will hold a conference call on Tuesday, March 29, 2022 at 1pm local time in Hebrew and at 5pm local time / 3pm UK / 10am ET in English, and has published dial-in details and the presentation through the Tel Aviv Stock Exchange website.

About Phoenix Holdings

Phoenix Holdings is a leading Israel-based financial, insurance, and investment group traded on the Tel Aviv Stock Exchange (TASE: PHOE). Group activities include multi-line insurance, investment and asset management, credit, and financial product distribution, and have demonstrated strong growth and performance across the cycle. The Phoenix serves a significant portion of Israeli households with a broad set of activities and solutions across businesses and client segments. Managing $100 billion in assets, the Phoenix accesses Israel’s vibrant and innovative economic activity through a robust investment portfolio, creating value for both clients and shareholders.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220329005723/en/

Contacts

David Alexander

Phoenix Holdings, Deputy CEO

Email: davidal@fnx.co.il

Tel: +972 (3) 733-2979

Robert Brinberg

Rose & Company

Email: phoenix@roseandco.com

Tel: +1 (212) 517-0810