WHITE ROCK, BC / ACCESSWIRE / May 17, 2022 / TDG Gold Corp - (TSXV:TDG) (the "Company" or "TDG") is pleased to announce an initial National Instrument 43-101 Mineral Resource Estimate ("MRE") following the conclusion of its 2021 - Phase 1 drill program its former producing Shasta gold-silver ("Au-Ag") mine. An updated technical report will be filed on the Company's website and SEDAR within 45 calendar days of this disclosure.

Highlights:

- TDG presents the MRE for its former producing Shasta mine with an Inferred Resource of: 709,200 oz of gold equivalent* ("AuEq") at 1.00 ("grams per tonne") g/t AuEq* grade [0.79 g/t Au, 26.7 g.t Ag].

- The Mineral Resource is amenable to open pit mining with a strip ratio of the total resource pit of 4.7 (waste:mineralized material) and significant mineralization near surface.

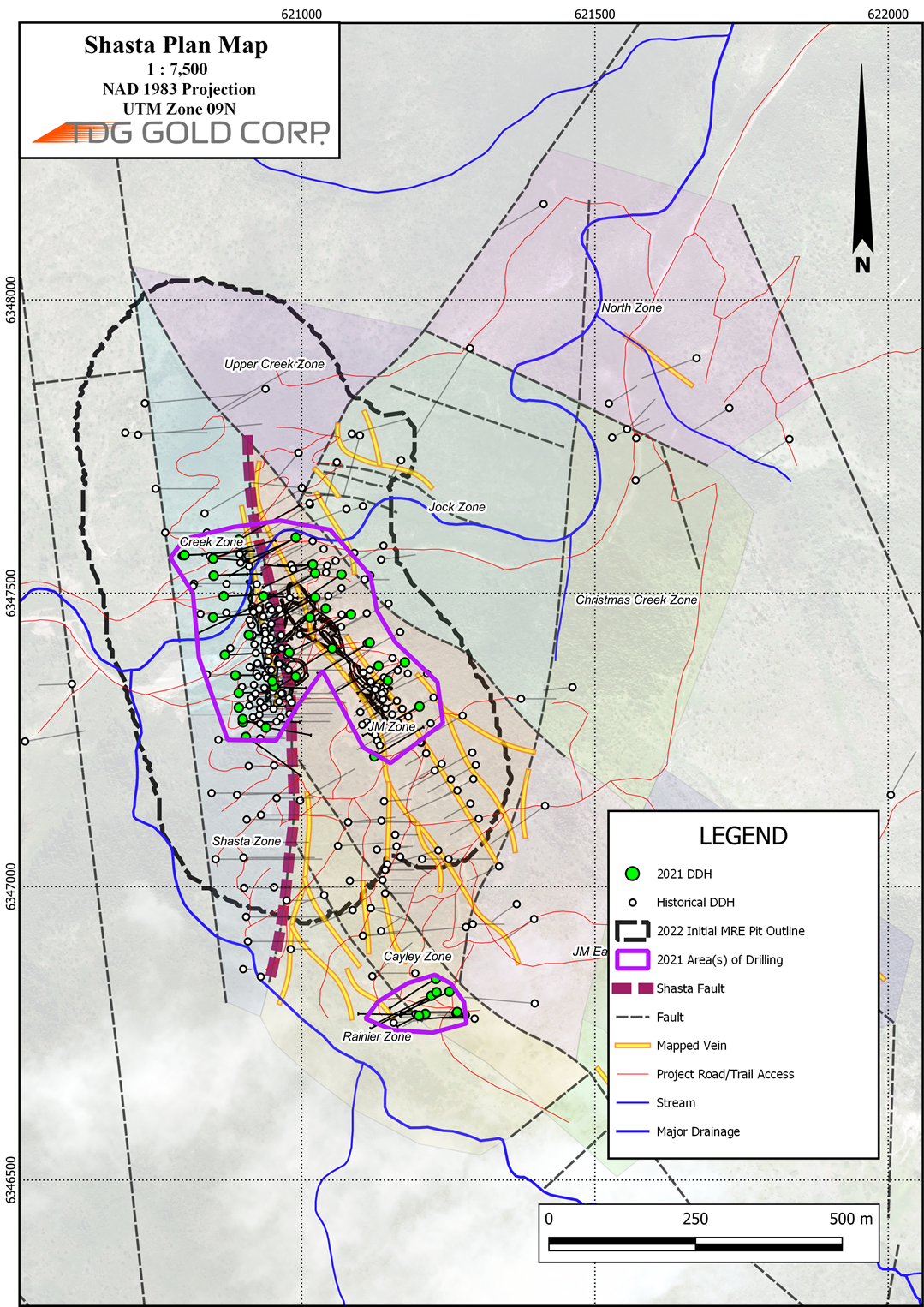

- This mineral resource is restricted to the central zone of the Shasta deposit (see Figure 1) in which 2021 drillholes confirmed historical drill results and the location of historical drilling was verified (the southern Cayley-Ranier zone has not been included).

*The resulting AuEq equation is: AuEq = Au + Ag*0.008

Figure 1: Shasta Plan Map with MRE Pit Outline.

Fletcher Morgan, TDG's CEO, commented: "This initial mineral resource estimate represents a solid start by our team towards redefining Shasta as a bulk tonnage gold-silver project.

We've managed to define an initial 709,200 gold-equivalent Inferred ounces for just over 8,000 metres drilled in our first phase of drilling and which tested around 40% of the mineralized footprint included within our published exploration target range area at Shasta. The estimate excludes the higher-grade gold-silver mineralization we drilled to the south in the Cayley-Rainier Zone, which was the only step-out we tested in 2021.

In summary, we see a direct roadmap to resource improvement and growth at Shasta in 2022 and which we're fully funded to execute."

Shasta Initial Mineral Resource Estimate

The Shasta project database consists of 333 drillholes with 12,007 metres ("m") from 1983 through 2021. The MRE is based on drillholes from 2021 drilling and historical drilling surrounding the 2021 drilling in the central area of the deposit. The MRE database contains 236 drill holes and 13,875 m of assaying for Au and Ag within the domains and area used for estimation. Three domains were generated based on the major north-south Shasta fault system as well as the NW trending, sub-vertical JM Zone. The block model has a 5 m x 5 m x 5 m selective mining unit, with interpolation of gold and silver done by Inverse distance cubed (ID3). The interpolations were limited by the domain boundaries and were clipped to the overburden surface. Previous underground mining was removed from the resource. Blocks were assigned a classification of Inferred due to uncertainties in potential low bias of the 2021 assaying, based on Certified Reference Materials ("CRMs") analyses as discussed in TDG's May 12, 2022 News Release.

The base case cut-off grade within the "reasonable prospects of eventual economic extraction" pit is 0.30 g/t AuEq, which covers the Processing + General and Administrative ("G&A") costs of CDN$17.00/tonne processed. At a 0.30 g/t AuEq cut-off, the Mineral Resource is estimated at 22 million tonnes ("Mt") at 1.00 g/t AuEq, 0.79 g/t Au, and 26.7 g/t Ag for a total of 709.2 thousand AuEq ounces. The Mineral Resource Estimate and sensitivity to cut-off grade is summarized in Table 1, below.

Table 1 - Mineral Resource Sensitivity (effective date of May 16, 2022)

Class | AuEq Cutoff | In Situ Tonnage and Grade | AuEq Metal | "In situ" Strip Ratio | ||||

Tonnage | AuEq | Au | Ag | NSR | Waste / | |||

| (g/t) | (ktonnes) | (g/t) | (g/t) | (g/t) | ($CDN) | (kOz) | Mineralized Material | |

Inferred | 0.15 | 34,120 | 0.72 | 0.57 | 19.3 | 51.88 | 794.1 | 2.7 |

0.2 | 29,418 | 0.81 | 0.64 | 21.6 | 58.17 | 767.7 | 3.3 | |

0.25 | 25,283 | 0.91 | 0.71 | 24.2 | 65.06 | 738.0 | 4.0 | |

0.3 | 22,011 | 1.00 | 0.79 | 26.7 | 71.83 | 709.2 | 4.7 | |

0.4 | 17,425 | 1.17 | 0.92 | 31.3 | 84.20 | 658.2 | 6.3 | |

0.5 | 14,120 | 1.35 | 1.06 | 35.7 | 96.41 | 610.7 | 8.0 | |

1 | 6,209 | 2.17 | 1.71 | 56.4 | 155.23 | 432.4 | 19.4 | |

Notes to the MRE table:

- The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person.

- Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource has been confined by a "reasonable prospects of eventual economic extraction" pit using the following assumptions:

- Au price of US$1,800/oz, Ag price of US$20/oz at an exchange rate of 0.75 US$ per CDN$;

- 99.8% payable Au; 95.0% payable Ag; US$4.25/oz Au and US$1.53/oz Ag offsite costs (refining, transport and insurance);

- a 1.5% NSR royalty; and uses a 94.8% metallurgical recovery for Au and 77.2% recovery for Ag;

- Mining costs of CDN$2.56/tonne mineralized material, CDN$2.40/tonne waste, CDN$1.8/tonne overburden;

- Processing Costs of CDN$12/tonne and G&A of CDN$5.00/tonne processed

- Pit slopes of 45 degrees.

- The resulting NSR equation is: NSR (CDN$) = 75.67*AuGrade*0.948 + 0.74*AgGrade*0.772

- The resulting AuEq equation is: AuEq = Au + Ag*0.008

- The bulk density of the deposit is based on 2021 measurements and is 2.61 throughout the deposit and 2.0 for overburden.

- Numbers may not add due to rounding.

There are no other known factors or issues that materially affect the MRE other than normal risks faced by mining projects in the province of British Columbia, Canada, in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors and additional risk factors as listed in the "Cautionary Note Regarding Forward-Looking Information" section below.

Data Verification

TDG followed Quality Assurance/Quality Control ("QA/QC") protocols close to industry standards for the 2021 drill program by inserting 118 blanks (1 in 48 samples) and 183 blind CRMs, (1 in 31) into a sample stream of 5,609 core samples at regular intervals. In addition, defined 58 core intervals (1% of total) for field duplicate sampling and 83 samples (1.5%) for pulp duplicate preparation at the lab at SGS Canada Inc. ("SGS"). A full review of all QA/QC data was performed. Significant contamination was not identified and both field duplicates and pulp duplicates indicate acceptable sample and prep precision for Au and Ag. However, the CRM data suggests an accuracy issue, with a potential low bias of Au as discussed in the News Release of May 12, 2022.

Five of the 2021 drill holes are twin holes of historical 1987-2010 drilling with twins showing no significant bias.

Key Assumptions and Methods Used for the Mineral Resource Estimate

Grade Capping

Cumulative probability plot ("CPPs") for the assays within each domain have been used to determine high grade outliers which were capped. CPPs of the composited data (composited at 2m) have been used to determine the Outlier Restriction during interpolation. Outlier restriction values are applied for distances beyond 5m from the composite locations.

Table 2 - Capping and Outlier Restriction Values

Capping Values | Outlier | |||

DOM | Au | Ag | Au | Ag |

(g/t) | (g/t) | (g/t) | (g/t) | |

1 | 100 | 2000 | 50 | 1000 |

2 | 50 | 3000 | 50 | 1000 |

3 | 10 | 200 | NA | NA |

Variography and Interpolations

Variography was completed on each domain for Au and Ag to determine appropriate search parameters. Interpolation has been done by inverse distance cubed (ID3) in 4 passes with increasing search parameters up to 150 m for the major and minor axes. The modelled grades have been validated using de-clustered composites (Nearest Neighbour or Polygonal model) and indicate no global bias with appropriate smoothing throughout the grade-tonnage curves.

Qualified Persons

The geologically related technical content of this new release has been reviewed and approved by Steven Kramar, P.Geo., Senior Geologist for TDG and a Qualified Person, as defined under National Instrument 43-101.

The technical information relating to the resource estimate was prepared by Sue Bird, P.Eng. (Moose Mountain Technical Services) a Qualified Person, as defined under National Instrument 43-101 and who is independent of TDG.

This news release includes historical information that has been reviewed by the Company's geological team. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. In 2022, TDG will prioritize drilling the known mineralization at Shasta which extends south for ~700 metres from the historical JM Pit. TDG currently has 96,343,142 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/701728/TDG-Gold-Corp-Publishes-Initial-Mineral-Resource-Estimate-for-Shasta-Toodoggone-District-BC