Investors eyeing the growth potential of the pharmaceutical industry can have a novel addition to their watchlist in May — Neurocrine Biosciences, Inc. (NBIX). With a projected global market volume of $1.44 trillion by 2027 and an expected annual growth rate of 5.4%, the pharmaceutical industry could be a good destination for investors. Of this volume, the United States is expected to contribute a large portion of the revenues.

For the fiscal fourth quarter (ended December 31), NBIX’s total revenues increased 32.1% year-over-year to $412 million. Non-GAAP net income and non-GAAP EPS came in at $124.70 million and $1.24, up significantly from their respective year-ago values. The company is set to report its first-quarter financials next week, in which the analysts expect a 145.1% year-over-year growth in its EPS to $0.74.

Let’s take a look at the key financial metrics of NBIX.

Analysis of Neurocrine Biosciences Inc. (NBIX) Trends 2020-2022

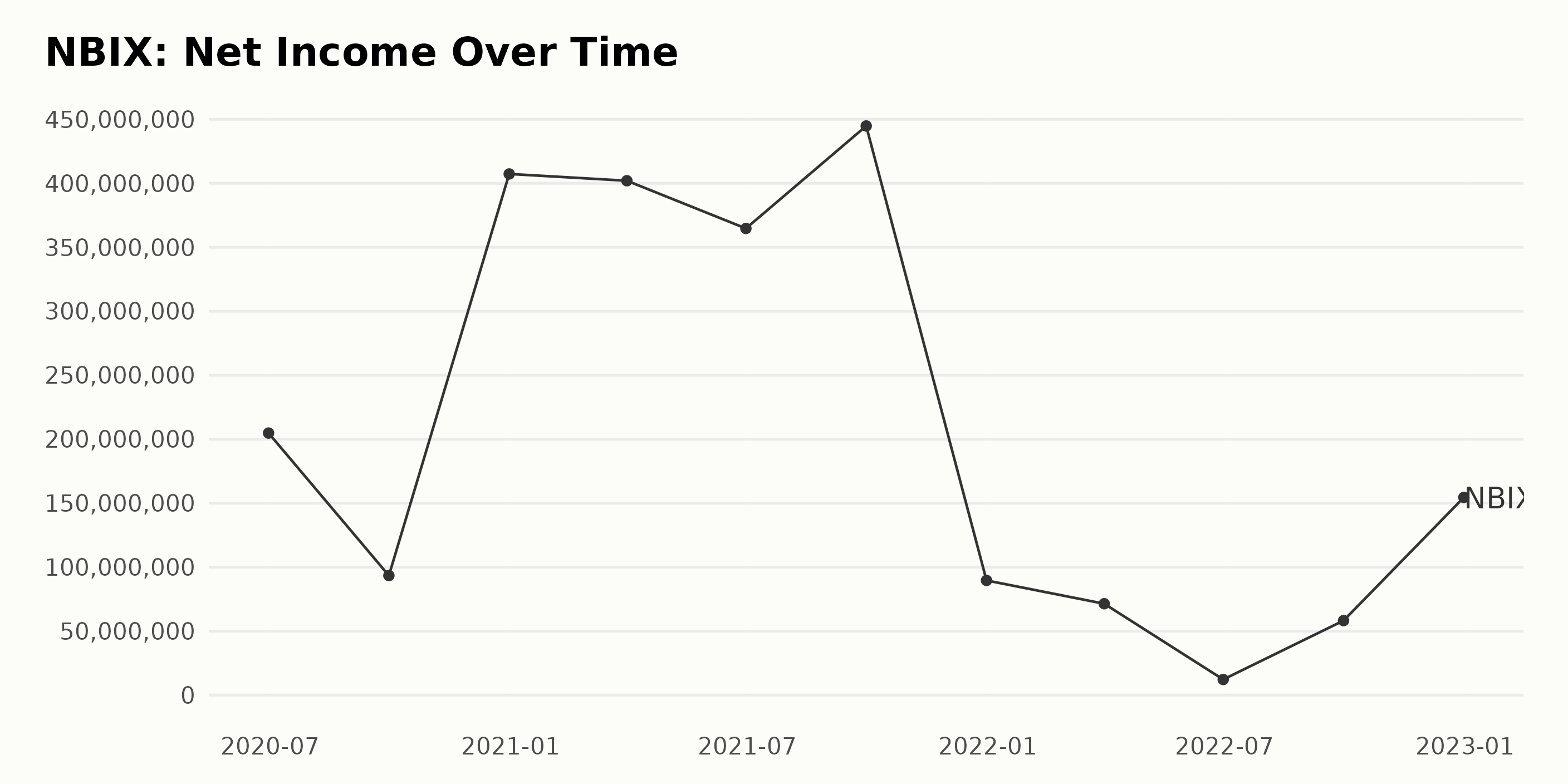

The net income of NBIX over the period of 2020-2022 has exhibited a fluctuating trend. In the first quarter of 2020, NBIX reported a net income of $204.8 million. This steadily declined throughout the year, dropping to $93.4 million by the fourth quarter of 2020. In 2021, NBIX saw an impressive rebound in its net income, increasing to a peak of $407.3 million in the final quarter of the year.

However, the net income significantly declined again in the subsequent quarters, falling to $364.7 million by the second quarter of 2022 and finishing at $154.5 million in the fourth quarter of 2022. Overall, NBIX's net income has declined by 26% from the first quarter of 2020 to the last quarter of 2022.

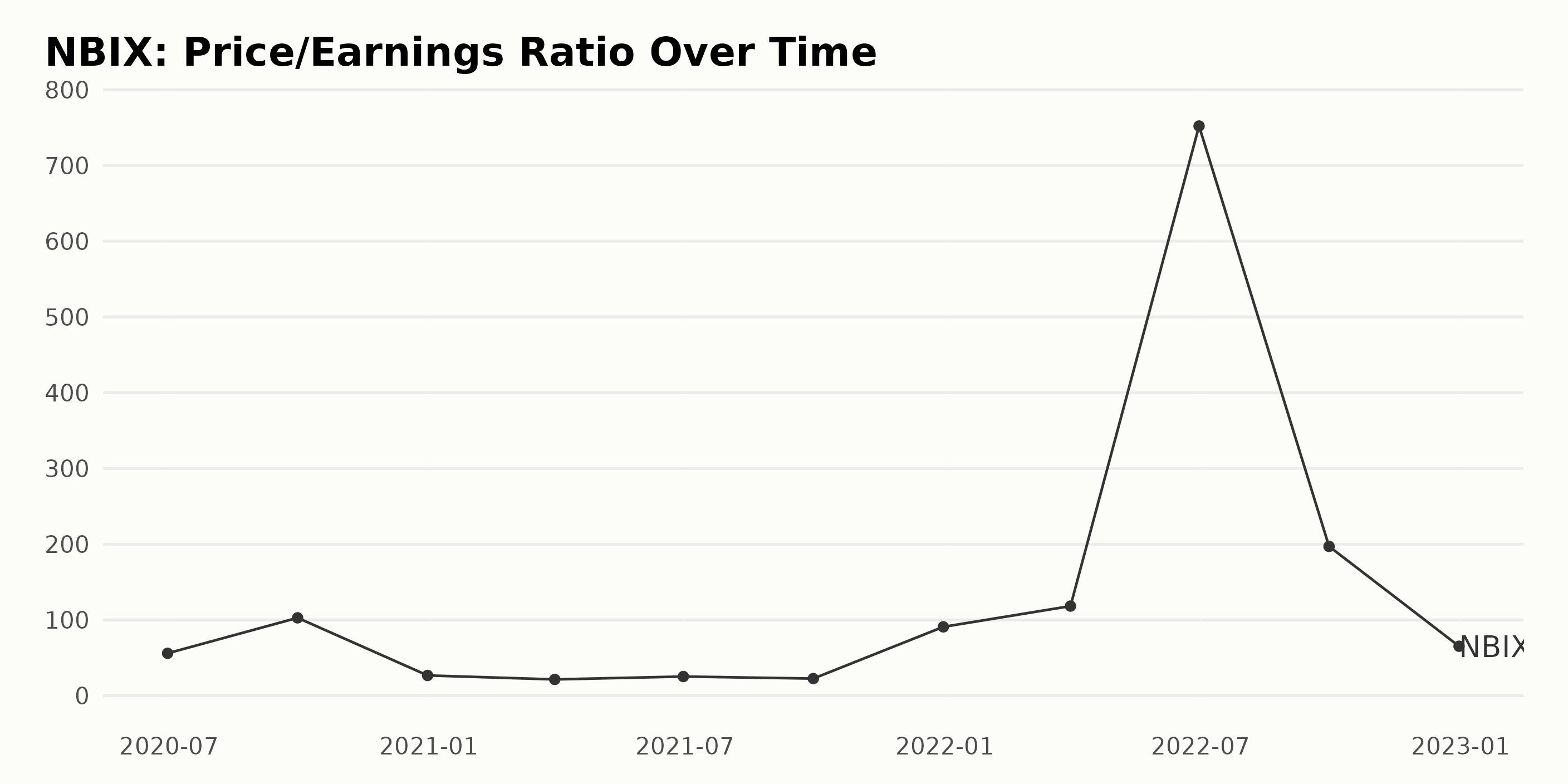

The Price/Earnings Ratio (P/E) of NBIX has fluctuated substantially over the past two years, beginning at 56.02 at June 30, 2020, reaching highs of 752.02 in June 2022 and lows of 21.54 in March 2021. The most recent P/E ratio, recorded on December 31, 2022, stands at 65.34, representing a growth rate of 456% from the first recorded P/E ratio.

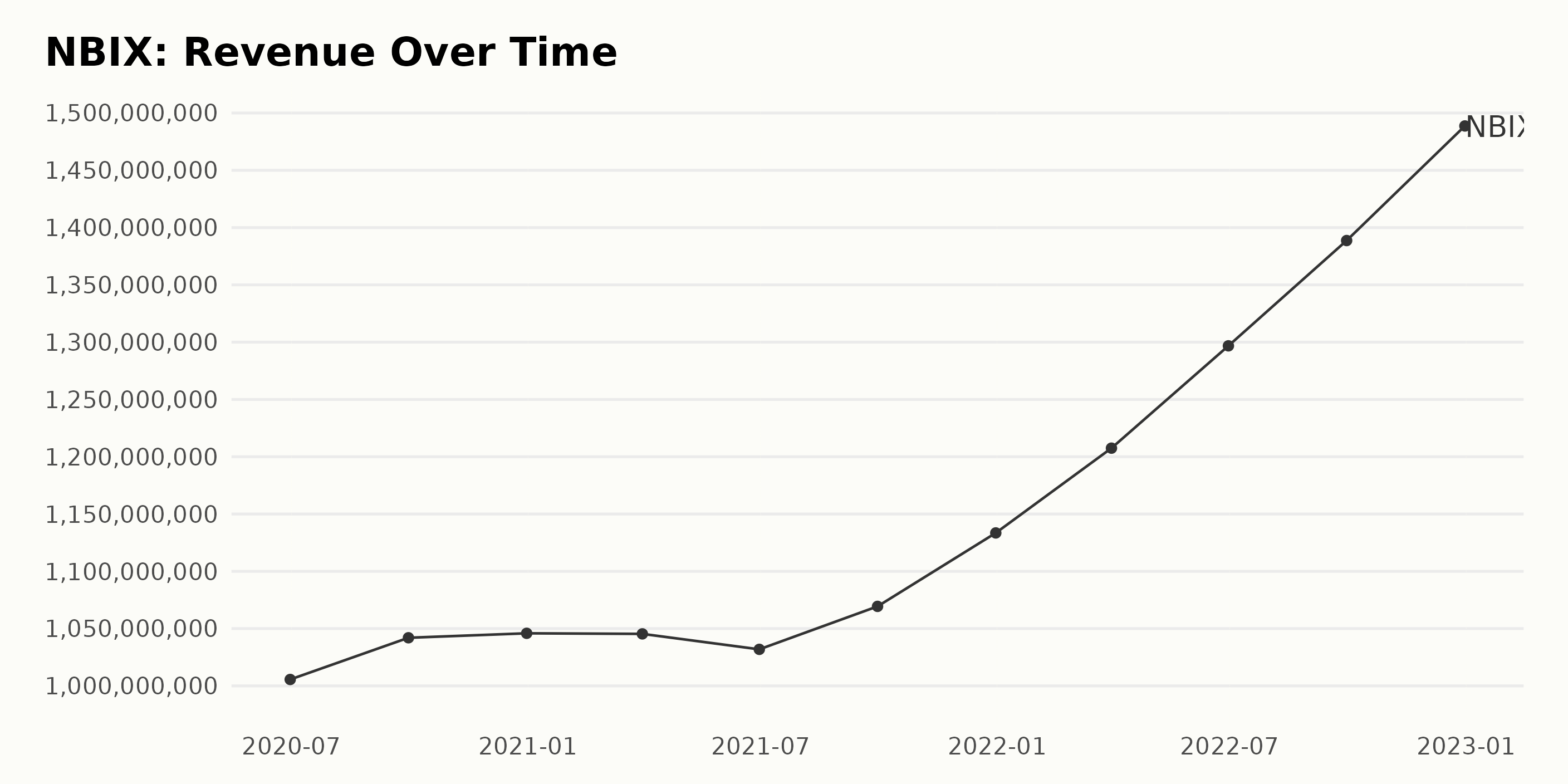

Revenue of NBIX has been steadily increasing since June 2020, when it was $100.56 million, to its current value of $148.87 million in December 2022. This shows an overall growth rate of 48% compared to the initial value. Moreover, there has been continuous growth in revenue over the last two years, with fluctuations in September and March of each year. The highest revenue was observed in September 2022 at $138.87 million.

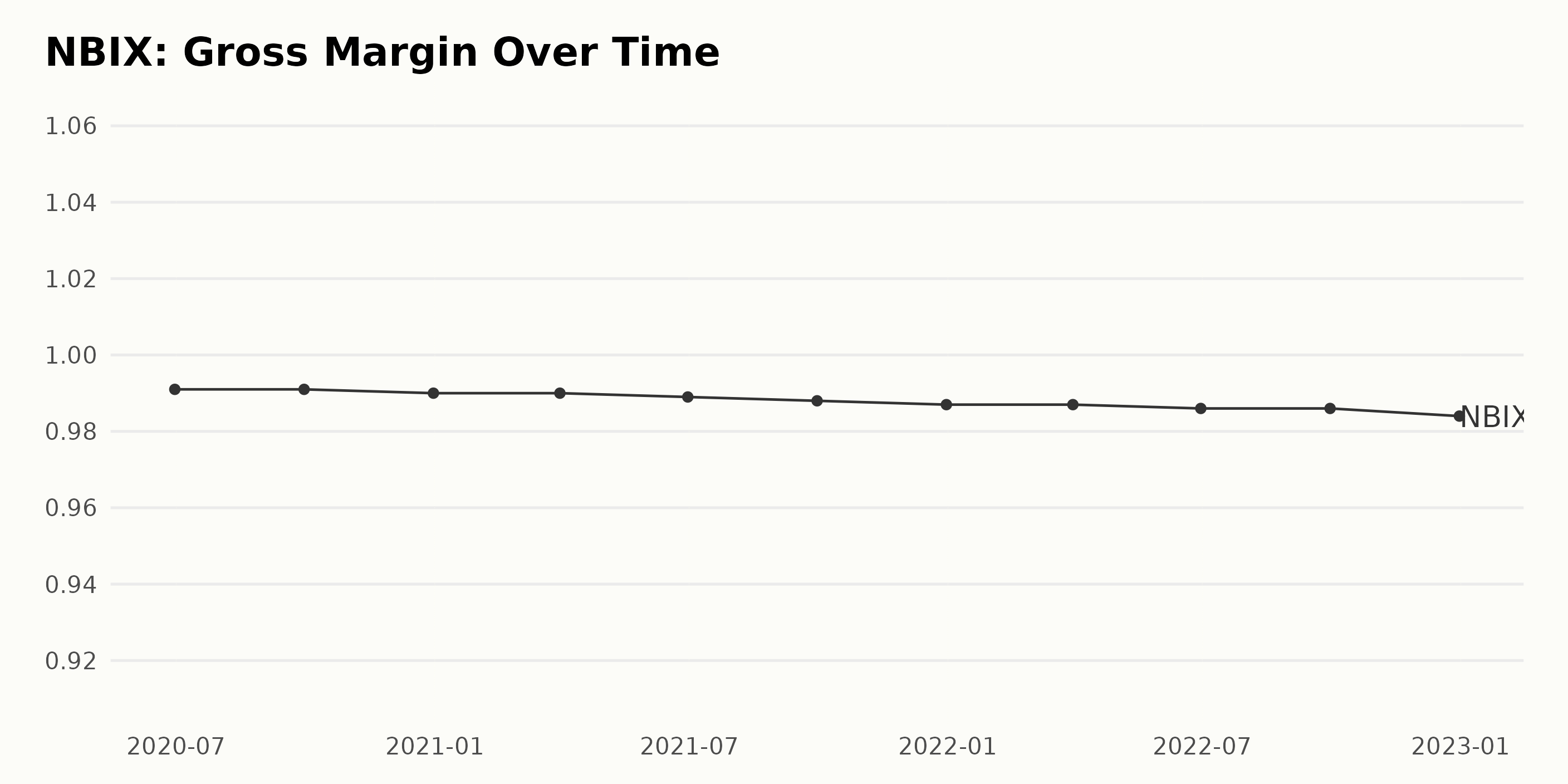

The trend in NBIX’s gross margin over the period from June 30, 2020, to December 31, 2022, is downwards, with a growth rate of -0.8%. The gross margin has fluctuated slightly, albeit downward, between 99.1% on June 30, 2020, and 98.4% on December 31, 2022. The most recent value as of December 31, 2022, is 98.4%.

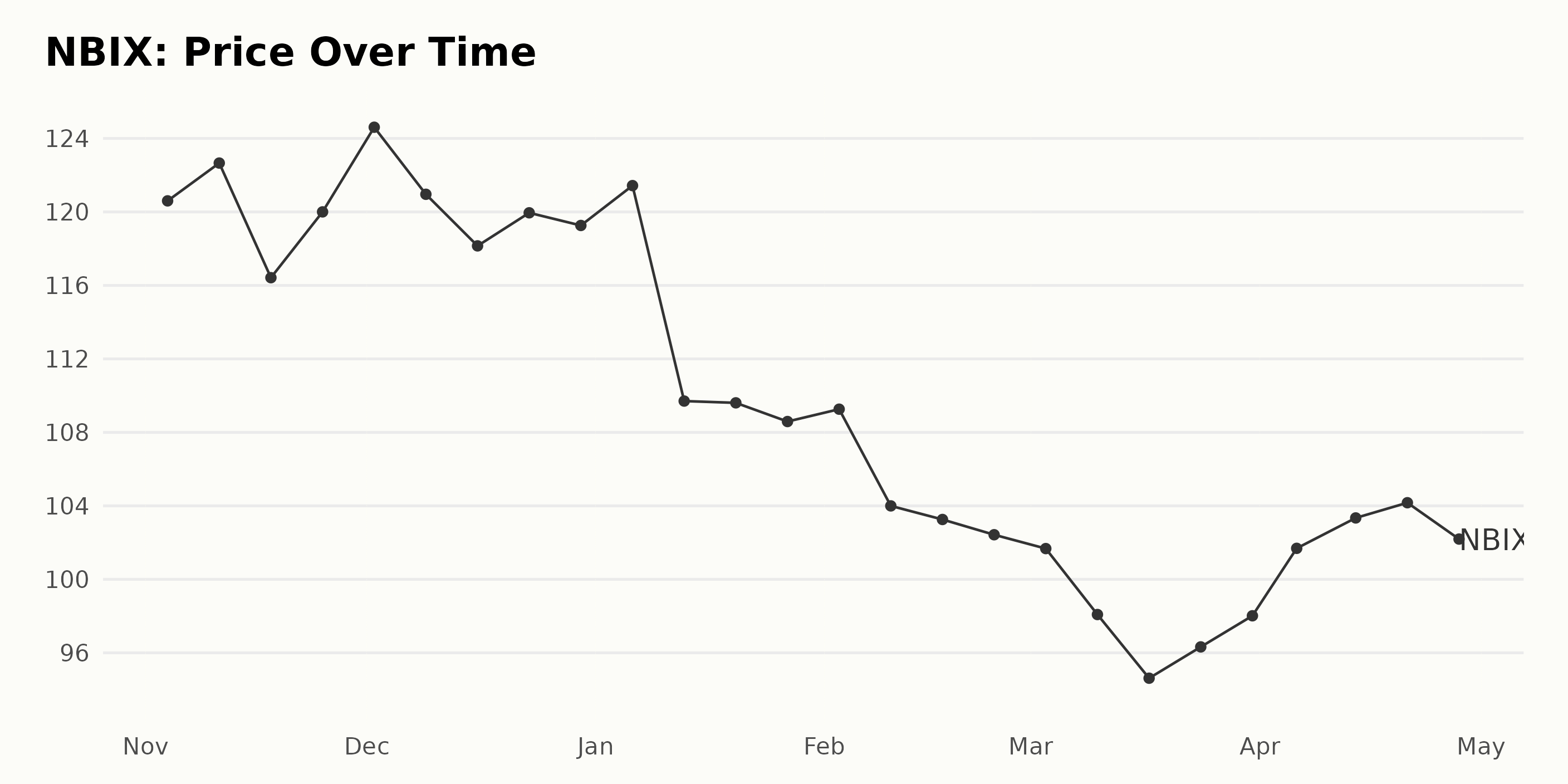

NBIX Share Prices Decline, Then Rebound

There has been an overall decreasing trend in NBIX share prices, from its peak of $122.66 on November 11, 2022, to its bottom of $98.08 on March 10, 2023, before it recovered. Starting with the peak, the price declined by $4.64 over four weeks. After hitting the lowest point of $98.08, the share price rose by $5.18 over the following five weeks. Here is a chart of NBIX's price over the past 180 days.

Neurocrine Biosciences Inc. POWR Ratings Analysis

NBIX has received an overall A rating, translating to a Strong Buy in our proprietary POWR Ratings system. Moreover, it ranks #10 in the industry. This grade denotes that NBIX is at the top tier within the Medical - Pharmaceuticals category among the 164 stocks, as a lower value indicates a superior rank.

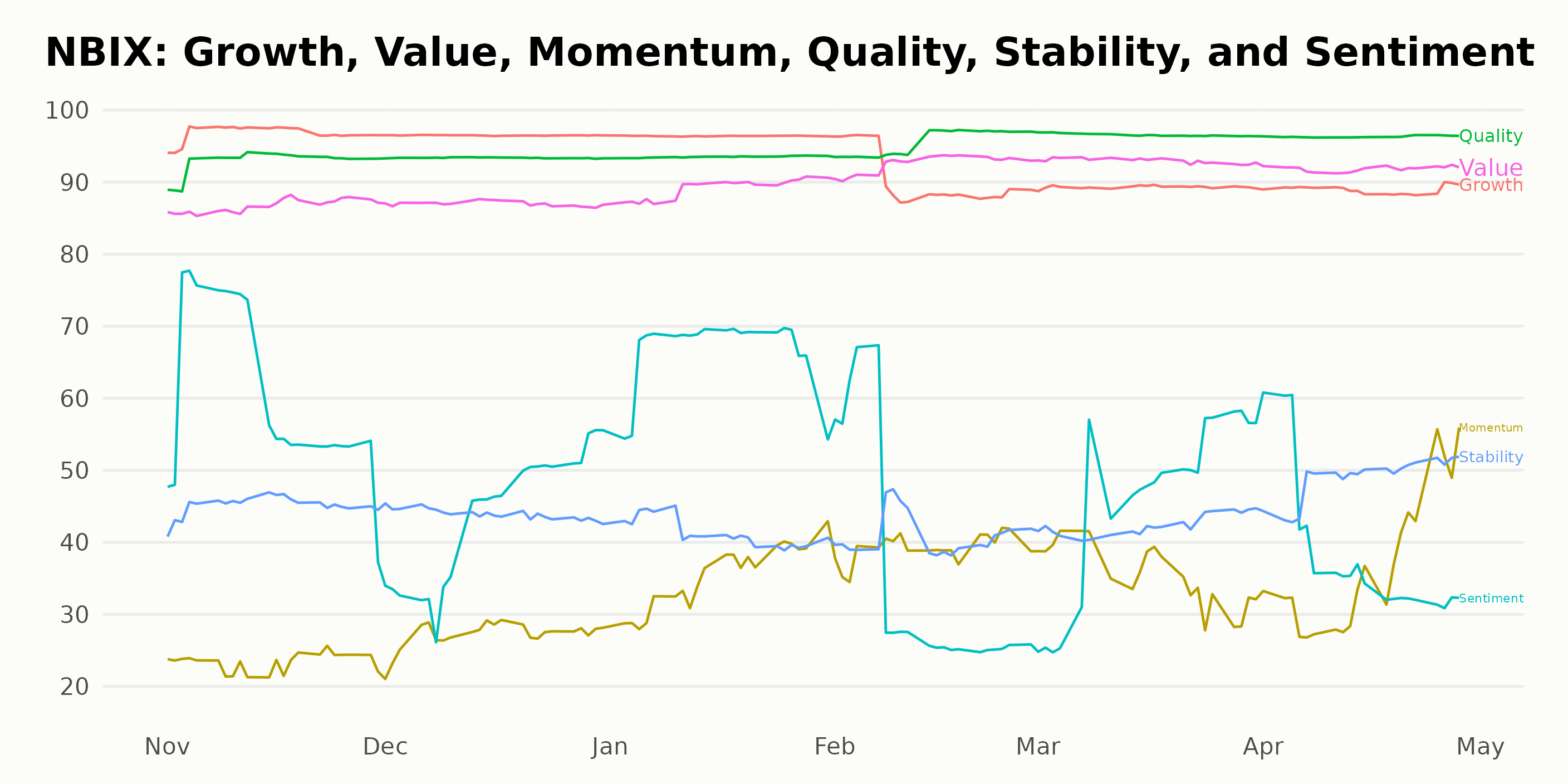

The POWR Ratings for NBIX are most noteworthy for the Growth, Quality, and Value dimensions. Growth has consistently been amongst the highest ratings, with scores between 89 and 97 since November 2022. Quality has also been among the highest scores, with ratings around 93 to 96 through the dates provided.

Value has been relatively consistent, with scores ranging between 87 and 93. Momentum has been slightly decreasing since November 2022, with 27 being the peak and 36 being the lowest. Sentiment has seen fluctuation, with scores ranging from 35 to 67 since November of 2022, and Stability has had ratings between 41 and 49 during that time.

How does Neurocrine Biosciences Inc. (NBIX) Stack Up Against its Peers?

Other stocks in the Medical - Pharmaceuticals sector that may be worth considering are Novartis AG (NVS), Novo Nordisk A/S (NVO), and Takeda Pharmaceutical Company Limited (TAK).

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

NBIX shares were trading at $101.02 per share on Friday afternoon, down $0.88 (-0.86%). Year-to-date, NBIX has declined -15.42%, versus a 8.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Healthy Returns: This A Rated Healthcare Stock Is a Must-Watch for May appeared first on StockNews.com