BlackRock Capital Investment Corporation’s (BKCC) shares have been on a downtrend over the past few months, sinking 15.2% year-to-date and reaching its 52-week low of $3.03 in the last trading session. Let’s look at some of BKCC’s key metrics to understand why the stock might remain under pressure.

BlackRock Capital Investment Corporation: Trends in Net Income, Revenue, ROA, and DPS Over the Past Two Years

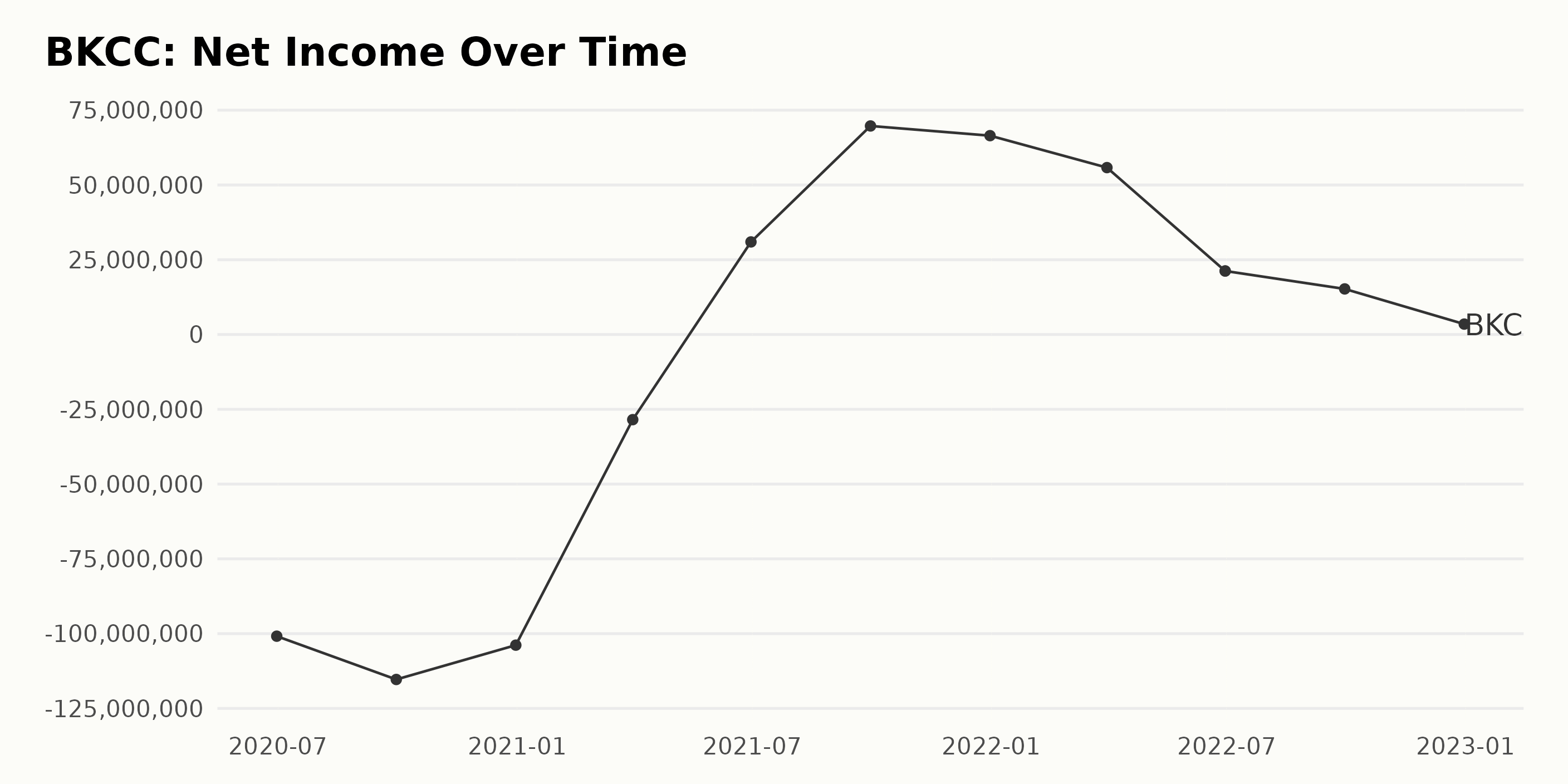

The net income for BKCC has been fluctuating over the past two years. From June 30, 2020, to December 31, 2020, it dropped from -$10.09 million to -$10.39 before taking an even harder hit from March 31, 2021, to June 30, 2021, plummeting from -$2.85 million to $3.1 million. However, the trend reversed, and the net income increased steadily, hitting $6.97 million on September 30, 2021, and finishing at $3.49 million on December 31, 2022. This marked a 149.56% growth rate since June 30, 2020.

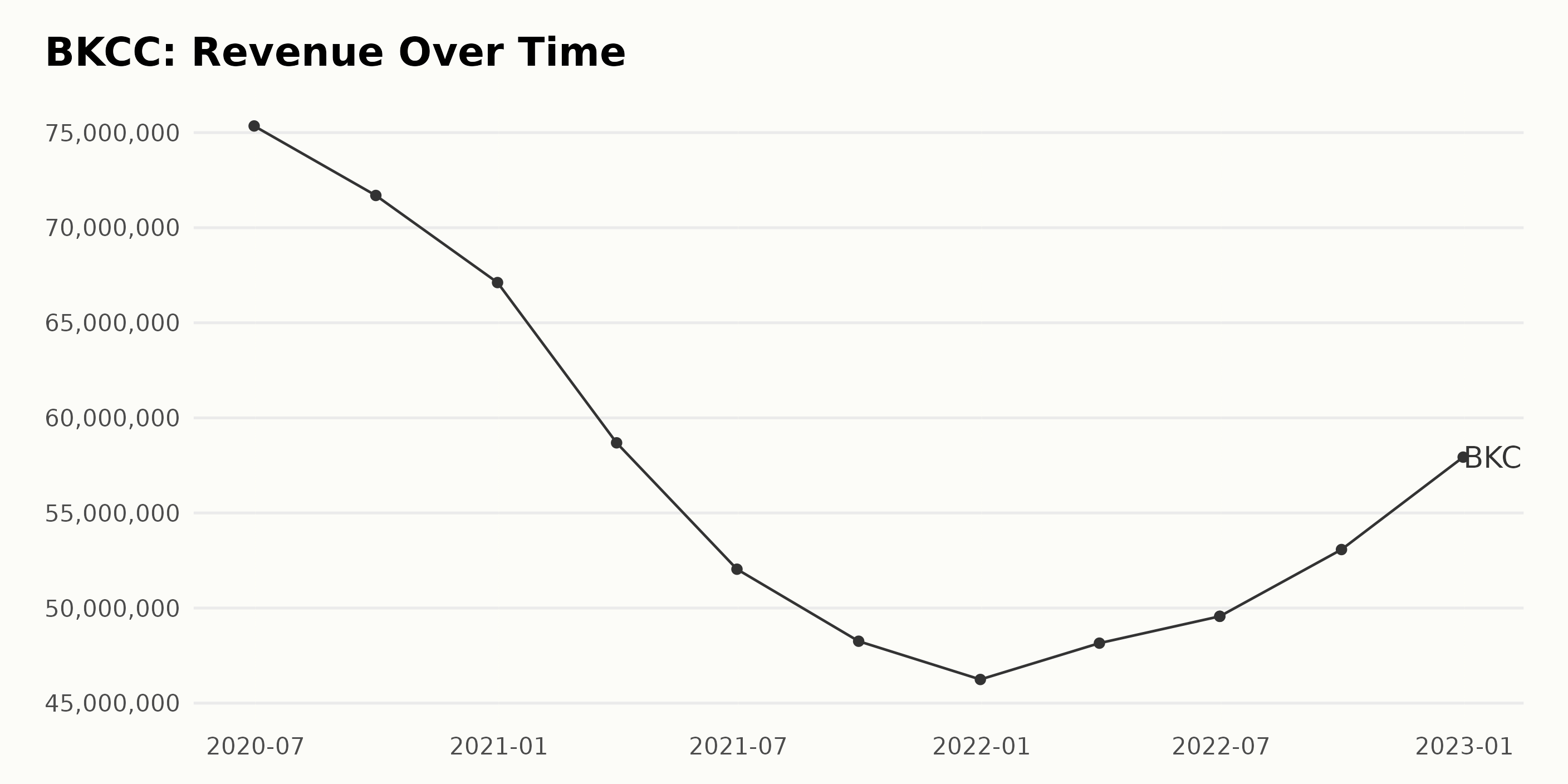

The series data for BKCC’s revenue from June 2020 to December 2022 shows a downward trend from $75.35 million in June 2020 to $5.79 million in December 2022. Over the past two years, revenue dropped by 24% from the first reported value. There were fluctuations in between, with an increase in revenue for the next three consecutive values and a subsequent decrease for the next six consecutive values.

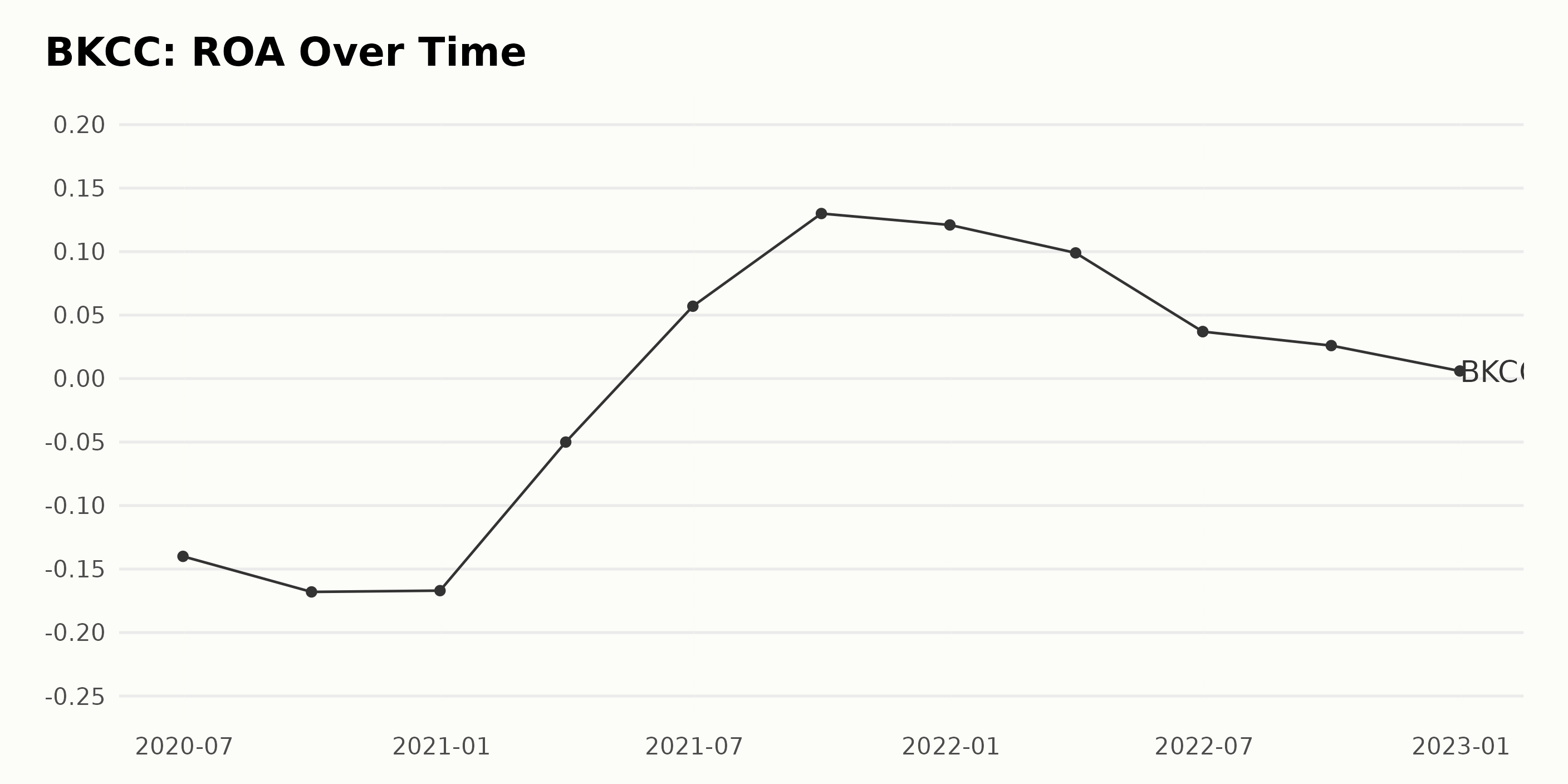

BKCC’s Return on Assets (ROA) has fluctuated since June 2020. The ROA has decreased by 54.5%, from 0.14 in June 2020 to 0.06 in December 2022. The lowest point was -0.168 in September 2020. However, ROA started increasing, and in September 2021, it was at its highest point of 0.13. As of December 2022, the ROA was 0.006, a 6.2% decrease compared to the value at the start of June 2020.

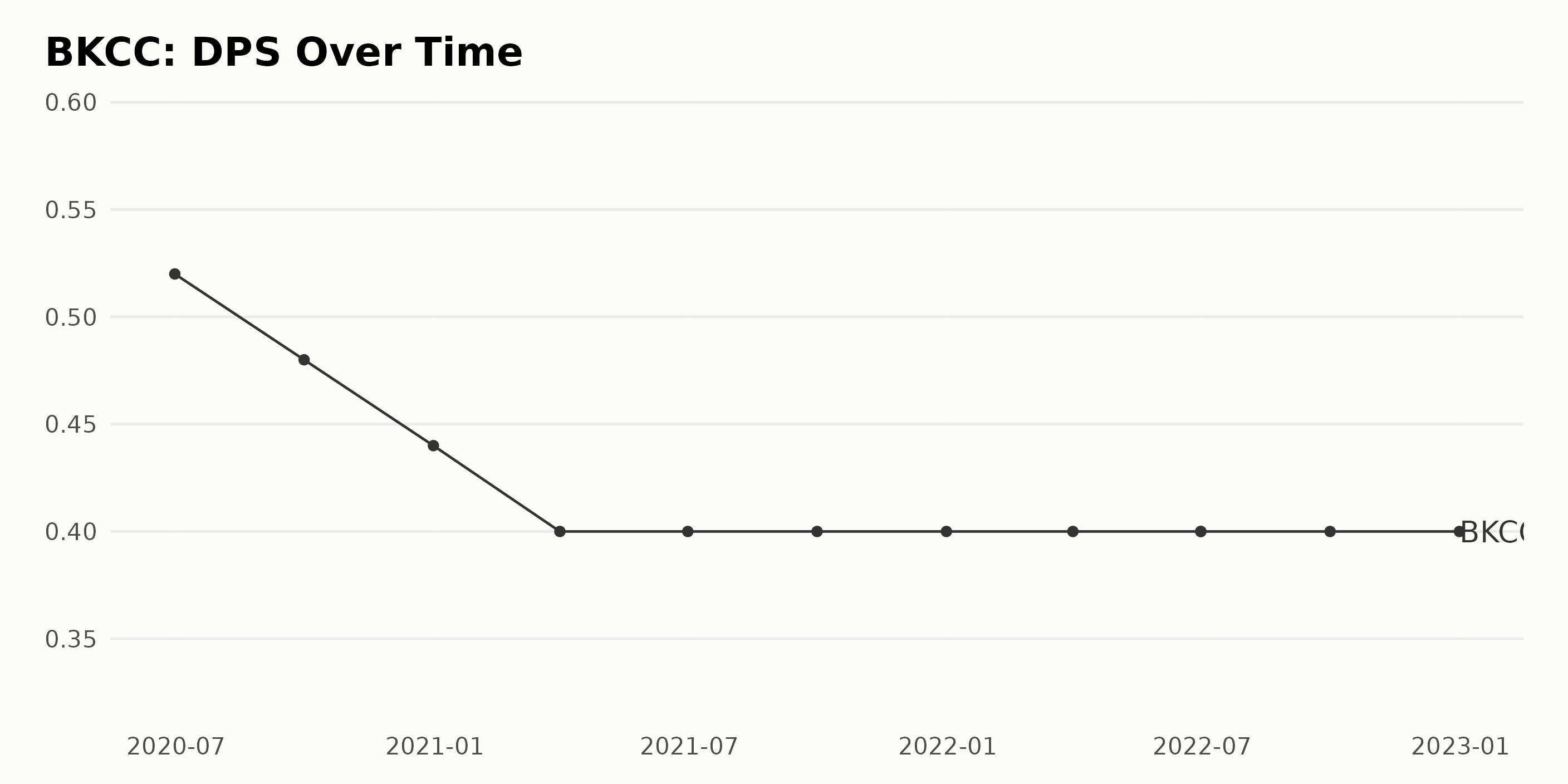

BKCC’s DPS has decreased from $0.52 on June 30, 2020, to $0.40 at the end of December 2022, representing an overall decrease of 23%. However, the trend has been largely steady, with no significant fluctuations.

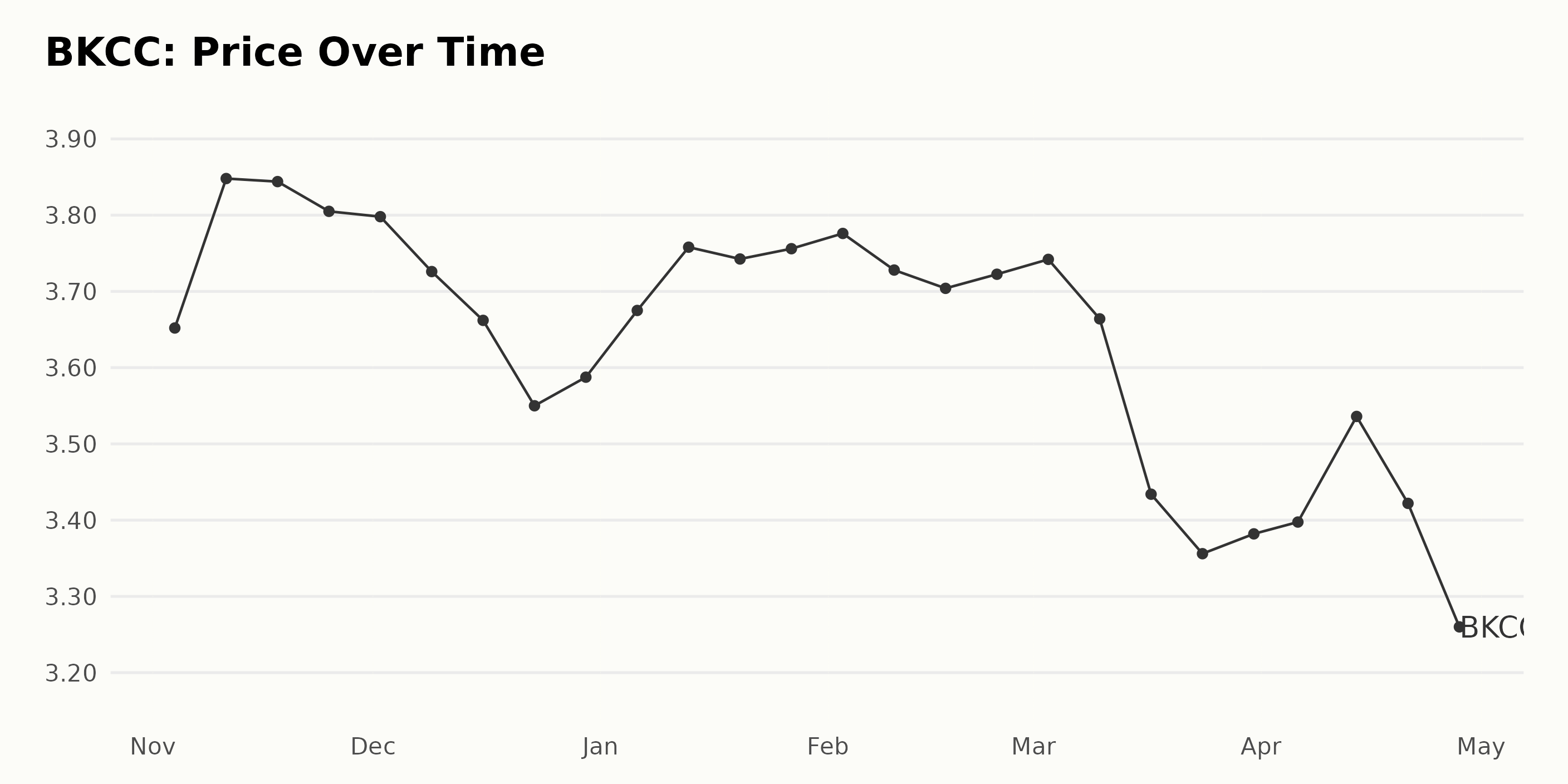

A Look at BKCC Share Price Fluctuations

The share price of BKCC has fluctuated over the given period, from $3.652 on November 4, 2022, to $3.275 on April 27, 2023. The growth rate decreased as the share price generally declined, although there were some spikes up or down along the way. Here is a chart of BKCC’s price over the past 180 days.

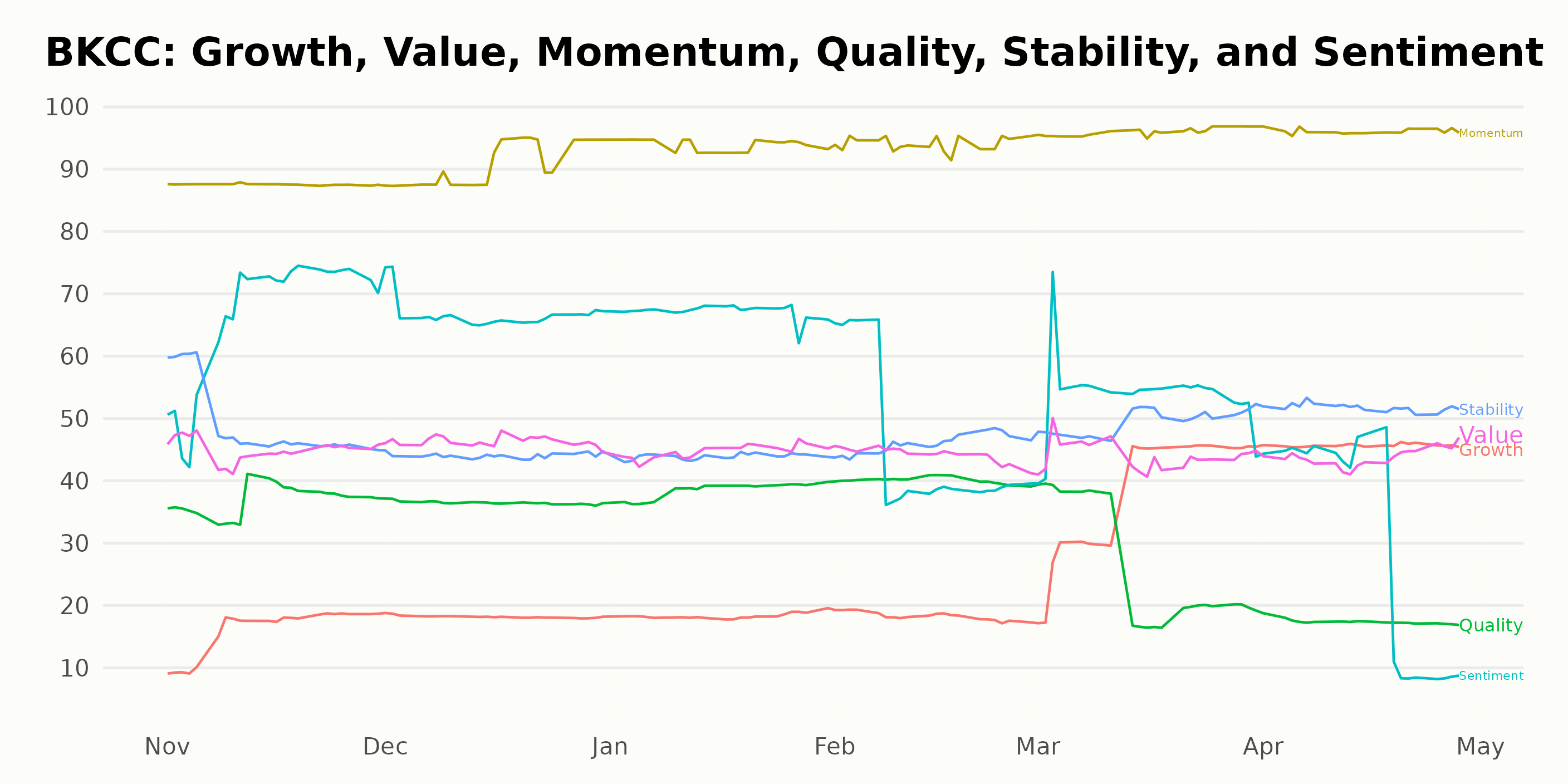

Unfavorable POWR Ratings

BKCC has an overall rating of D, translating to a Sell in our POWR Ratings system. Its rank within the Private Equity category of stocks varies between 16 and 27, reflecting a relatively average status in comparison to the 35 stocks within that category.

It also has a D grade for Sentiment and Quality.

Stock to Consider Instead of BlackRock Capital Investment Corporation (BKCC)

Other stocks in the Private Equity sector that may be worth considering are IRSA Inversiones Y Representaciones S.A. (IRS), WhiteHorse Finance Inc. (WHF), and Hercules Capital Inc. (HTGC) -- they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

BKCC shares were trading at $3.25 per share on Friday afternoon, up $0.18 (+5.86%). Year-to-date, BKCC has declined -7.60%, versus a 8.99% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Don’t Risk Your Investments: Avoid This Stock This Week appeared first on StockNews.com