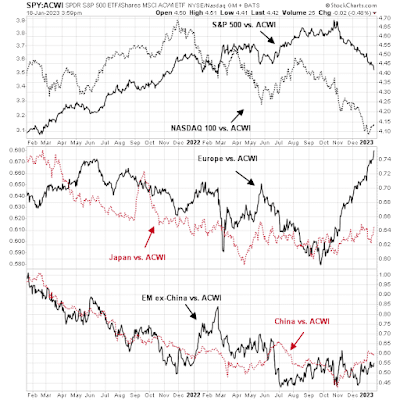

Within their global equity allocations, managers were buying emerging markets (read: China) and eurozone equities and selling US equities, which is consistent with what I have observed in my relative return analysis.

Hidden beneath these obvious headlines is a far more cautious asset allocation positioning that are inconsistent with the macro outlook implied by the risk-on nature of the recent equity stampede. A schism is appearing between the how the asset allocators view the market and how equity managers view the market.

The full post can be found here.