(Please enjoy this updated version of my weekly commentary published August 29th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

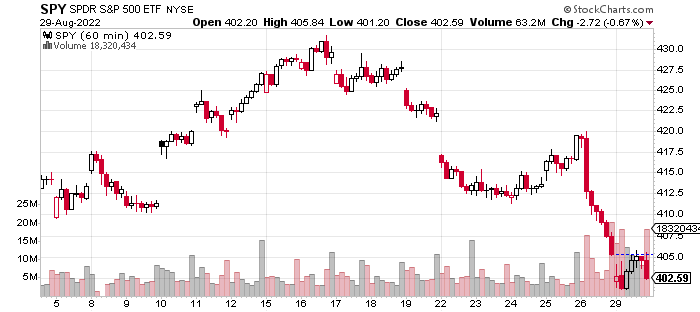

Here is an hourly, 3-week chart of the S&P 500 (SPY):

This week was pretty brutal for the market as we declined about 3%. Of course, most of the losses came in the last 2 days following Fed Chair Powell’s Jackson Hole speech which essentially killed any hopes of a Fed pivot, as he remains steadfastly committed to the goal of bringing down inflation.

This stance was further confirmed by Minneapolis Fed Chair Neel Kashkari who said today that he was displeased by the market rally following the July FOMC meeting. This is another indication of the Fed’s ultra-hawkish stance.

One interesting note about recent market action is that we are seeing strength in the commodity complex as oil is near a 1-month high, even though stocks are lower. This is suboptimal for bulls who want to see oil prices continue to decline. However, I think this is somewhat related to the energy crisis in Europe which is dealing with natural gas shortages, stemming from the Russia-Ukraine war.

And, this is leading to upwards pressures for all types of energy commodities. In turn, this is leaking into other markets like agriculture as natural gas is an input into fertilizer production.

I do believe this is an underrated aspect of the market weakness since we hit the 200 day moving average a couple of weeks ago. Higher energy prices mean more inflation. More inflation is bad on its own, but it also means that we are further away from any Fed pivot.

An Alternative Path…

One resolution for this mix of bullish and bearish headwinds is that we see the market stay stuck in a range. In fact, 2022 could be described as a handful of trending moves and a lot of just choppy, sideways price action.

In fact, I’m increasingly leaning towards this path. In terms of optimal strategy for this environment, we want to focus on the handful of stocks that are actually trending and use periods of market weakness to increase exposure.

On the other hand, we also have to be more disciplined in terms of our positions in terms of stop losses and more modest in terms of our profit targets.

Buffett vs Burry

Two of the most successful investors of our lifetimes are Michael Burry and Warren Buffett. Burry was featured in ‘The Big Short’ and he vaulted to billionaire status by shorting subprime mortgages. Even prior to this, he had an impressive record of outperformance through both bull and bear markets.

Of course, Warren Buffett needs no introduction.

Therefore, I was quite interested to see from recent SEC 13F filings that Burry has sold all of his stocks except for one - GEO - a private prison company. (This is a theme we have discussed extensively as it has huge potential under a ‘red wave’ scenario).

On social media, Burry has been very vocal and very bearish (even changing his username to ‘Cassandra’).

In contrast, Buffett has been a buyer in 2022 of stocks after not buying for much of 2020 and 2021.

There’s not necessarily a simple takeaway from this difference of opinion just a reminder that this is a very challenging and confusing moment in the stock market (SPY).

US Dollar Wrecking the Global Economy

If we looked at previous periods when the Fed was gearing up to ‘normalize’ monetary policy during the past decade, something would happen that would lead them to ‘punt’ on the decision.

Essentially, the US dollar would start going up in anticipation of a Fed tightening cycle. The stronger dollar would hurt emerging market countries with huge account deficits as many of them borrow in dollars but earn tax revenues in their own domestic currencies.

There would also be pain in terms of countries that are reliant on imports for food and energy as the prices of these would rise as well.

This is now playing out as we are seeing riots and pain in many countries who are dealing with inflation and a weakening currency at once. This time, the Fed doesn’t seem compelled to act to ease this pain as it is constrained by high inflation.

Given that the Fed doesn’t’ seem willing to pursue a pause or even a slower pace of hikes at the moment, this pain is only going to intensify. It’s also a reminder that as bad as things are in the US, they are much worse in the rest of the world.

Fed Put is Now a Fed Call

Related to this is something that I’ve been pondering. During the last decade, we had a ‘Fed put’ which meant that any time growth slipped or stocks dropped, investors could be confident that the Fed would intervene, creating a virtuous cycle of confidence and higher prices.

This meant that asset prices kept climbing higher despite a lackluster economy.

Now, we have the ‘Fed call’. And, no better example of this than the last 2 weeks, when Fed speaker after speaker highlighted that the fight against inflation was nowhere close to complete.

In essence, the Fed needs to see financial conditions tighten and asset prices lower as verification that it is actually tightening policy.

This means that despite the real economy being relatively strong, and earnings continuing to grow, asset prices are lower.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares . Year-to-date, SPY has declined -14.60%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Who Wins the Tug-of-War Going on in the Stock Market? appeared first on StockNews.com