Shareholders of Roku would probably like to forget the past six months even happened. The stock dropped 25.4% and now trades at $58.60. This may have investors wondering how to approach the situation.

Is now the time to buy Roku, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on Roku for now. Here are three reasons why we avoid ROKU and a stock we'd rather own.

Why Is Roku Not Exciting?

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

1. Customer Spending Decreases, Engagement Falling?

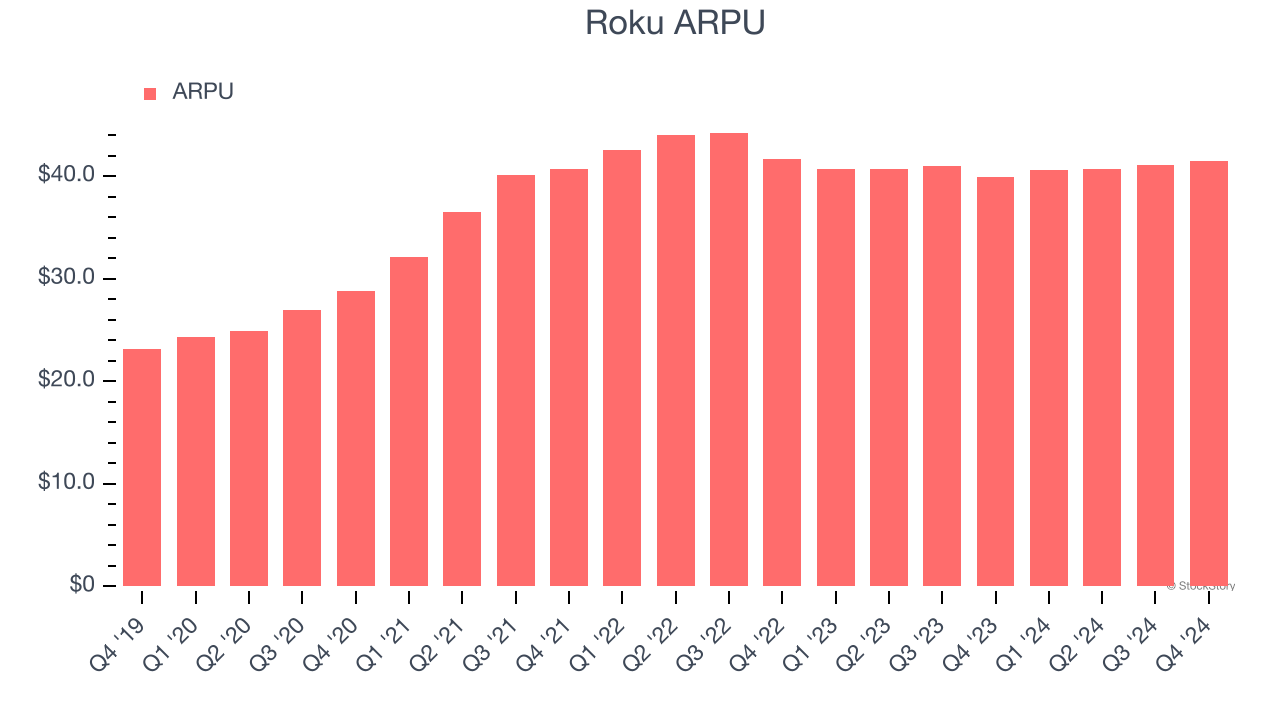

Average revenue per user (ARPU) is a critical metric to track because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Roku’s ARPU fell over the last two years, averaging 2.4% annual declines. This isn’t great, but the increase in active accounts is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roku tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. Shrinking EBITDA Margin

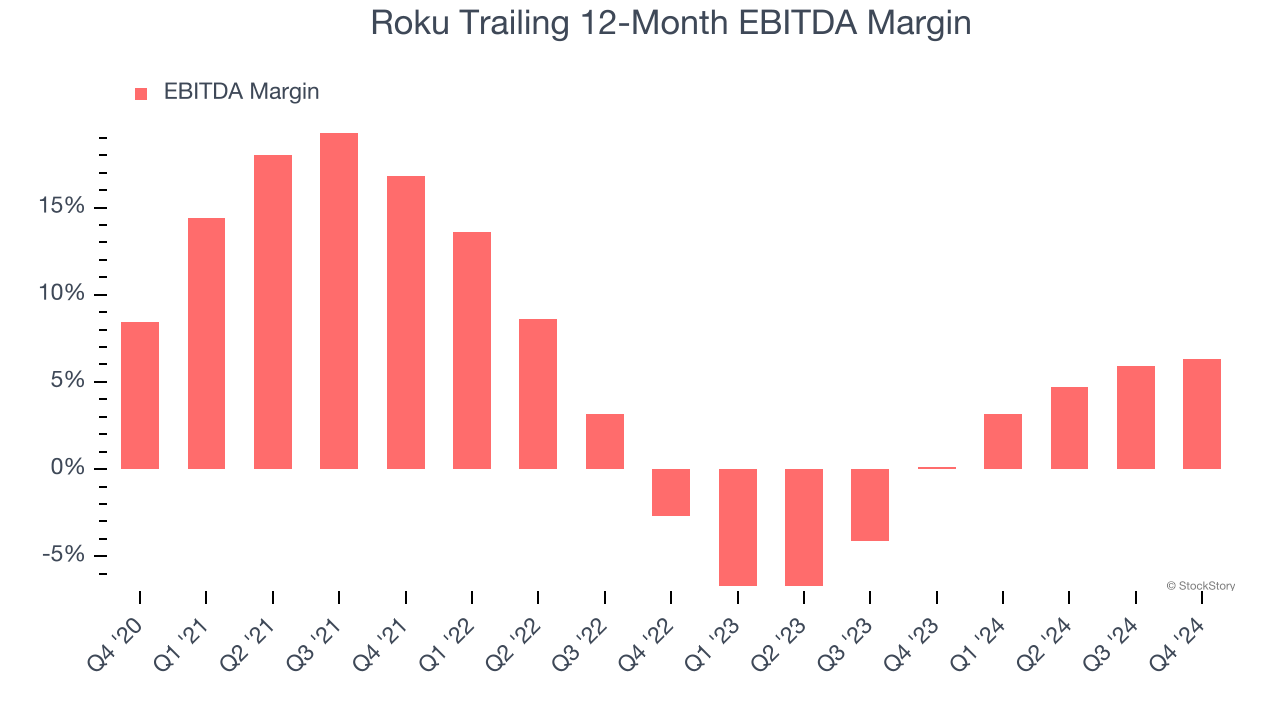

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Looking at the trend in its profitability, Roku’s EBITDA margin decreased by 10.5 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 6.3%.

3. EPS Trending Down

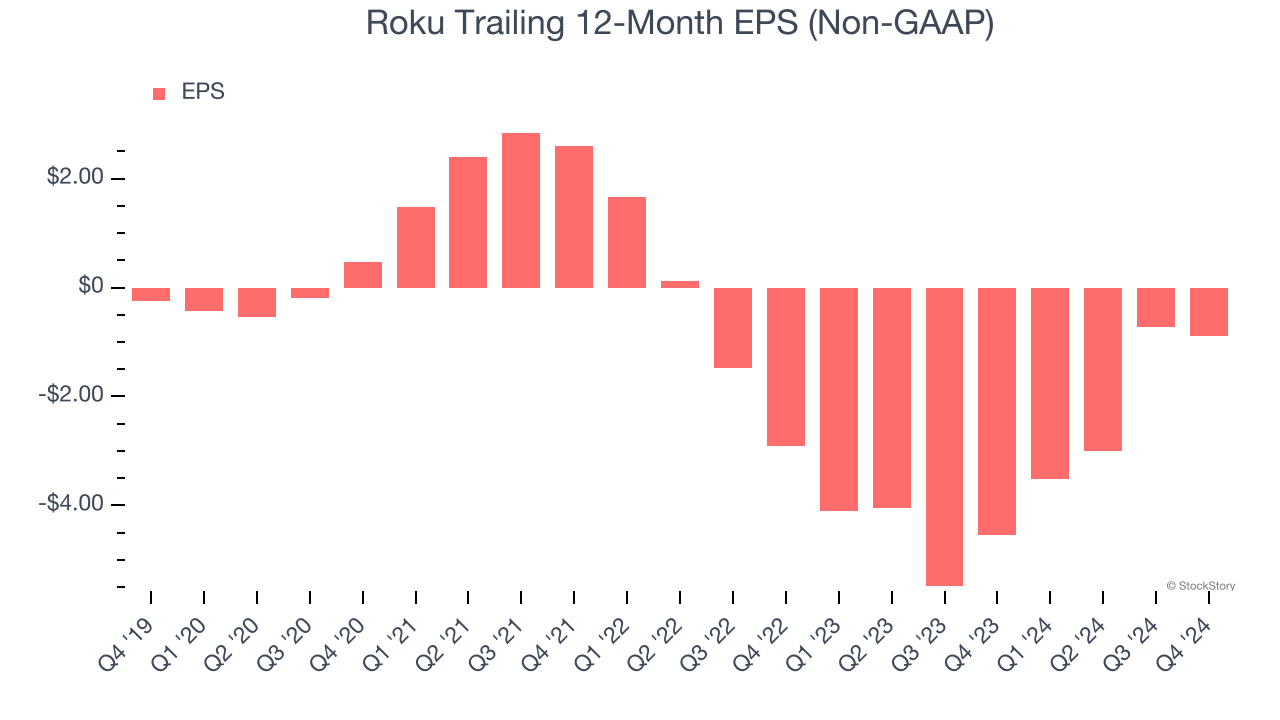

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Roku, its EPS declined by 32.8% annually over the last three years while its revenue grew by 14.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Roku isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 28.7× forward EV-to-EBITDA (or $58.60 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Roku

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.