What a brutal six months it’s been for Medifast. The stock has dropped 29.3% and now trades at $13.05, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Medifast, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we don't have much confidence in Medifast. Here are three reasons why you should be careful with MED and a stock we'd rather own.

Why Do We Think Medifast Will Underperform?

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

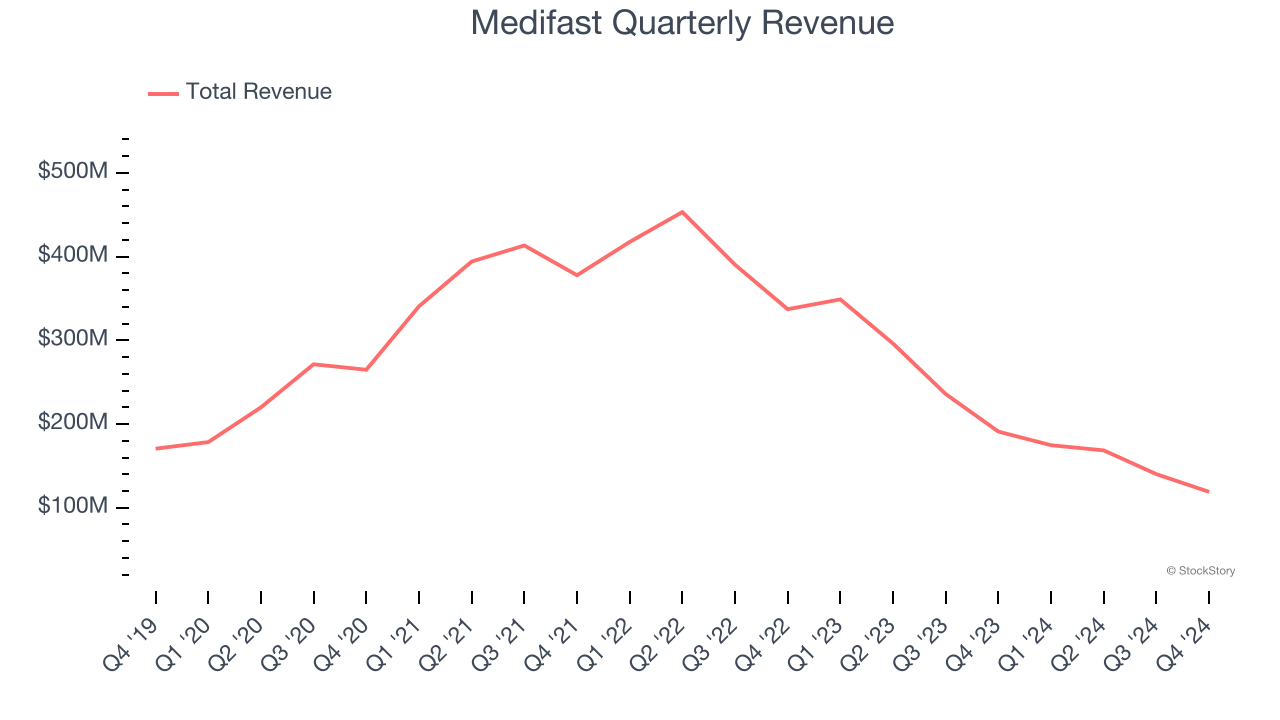

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Medifast’s demand was weak and its revenue declined by 26.6% per year. This was below our standards and signals it’s a low quality business.

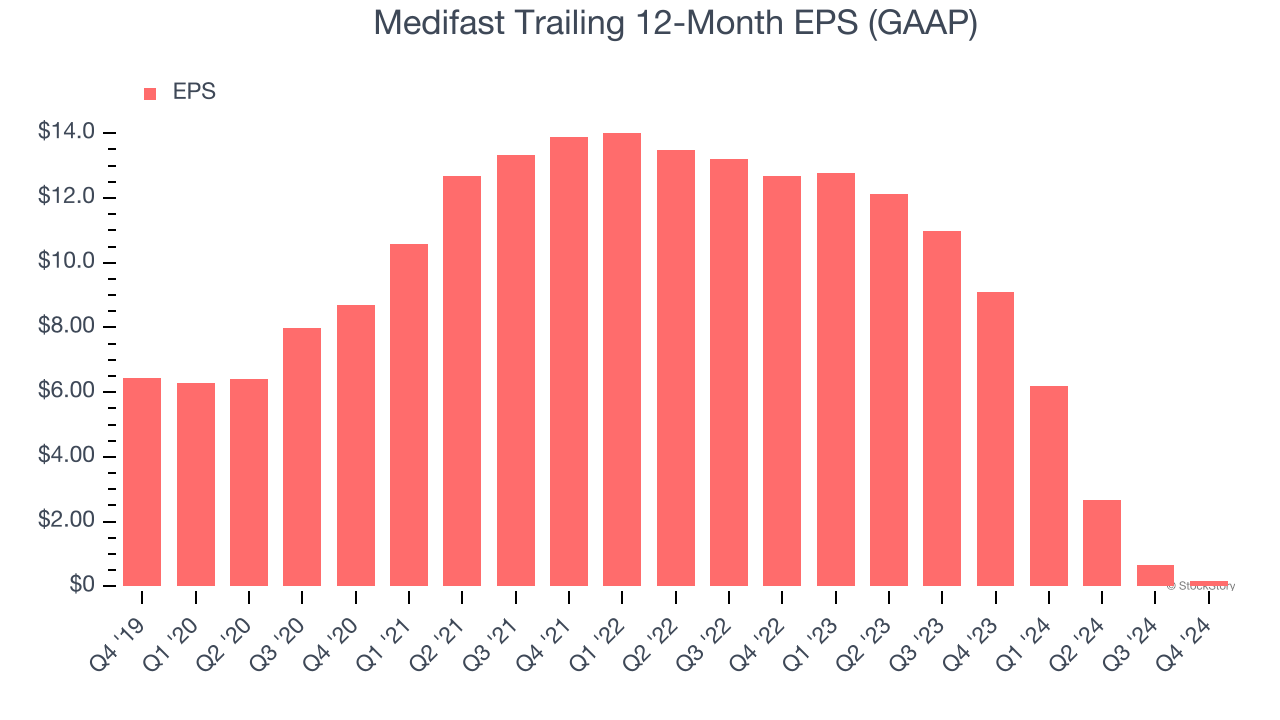

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Medifast, its EPS declined by 76.5% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

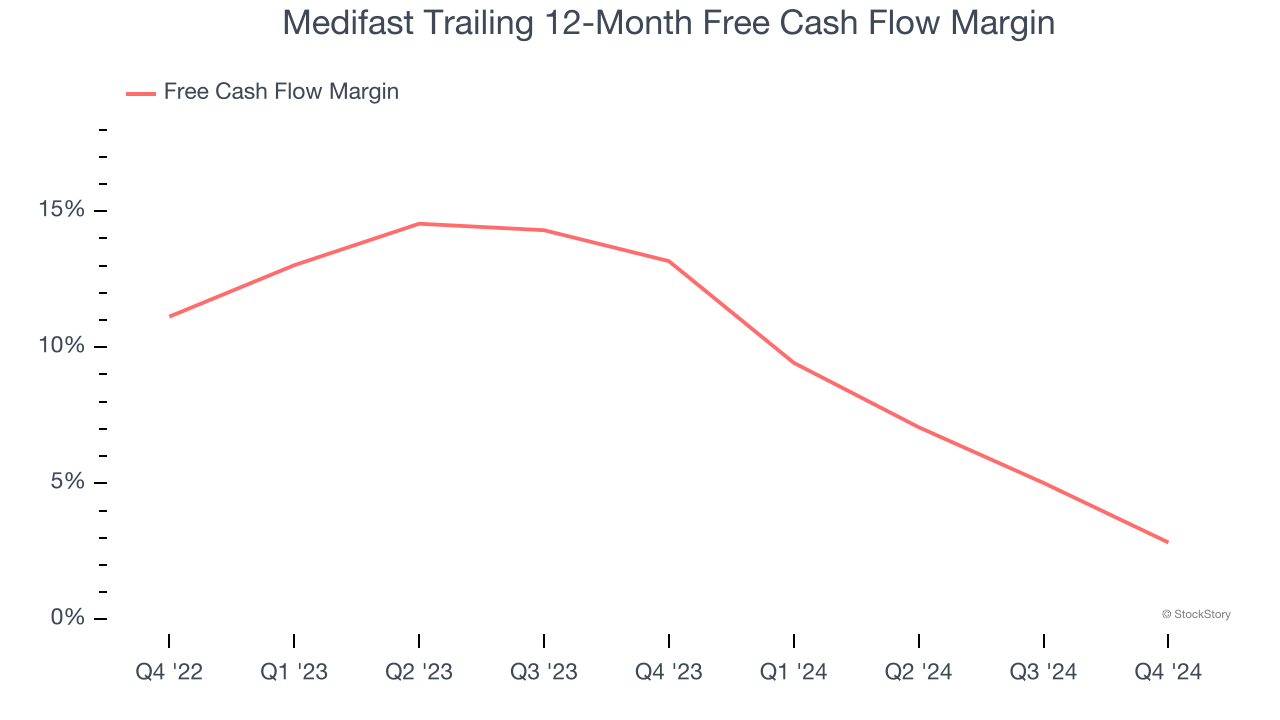

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Medifast’s margin dropped by 10.3 percentage points over the last year. Continued declines could signal it is in the middle of an investment cycle. Medifast’s free cash flow margin for the trailing 12 months was 2.8%.

Final Judgment

We see the value of companies helping consumers, but in the case of Medifast, we’re out. After the recent drawdown, the stock trades at 44× forward price-to-earnings (or $13.05 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Medifast

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.