Looking back on productivity software stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Monday.com (NASDAQ: MNDY) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 19.7% since the latest earnings results.

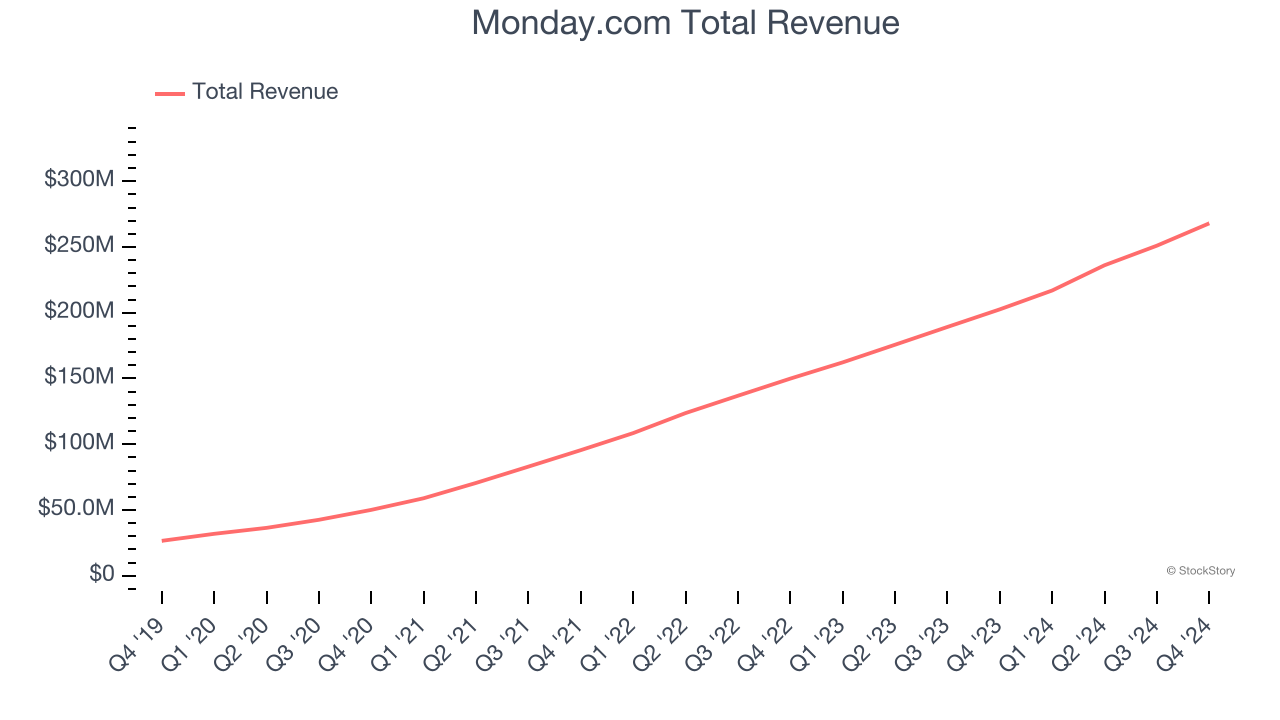

Monday.com (NASDAQ: MNDY)

Founded in 2014 and named after the dreaded first day of the work week, Monday.com (NASDAQ: MNDY) is a software-as-a-service platform that helps organizations plan and track work efficiently.

Monday.com reported revenues of $268 million, up 32.3% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a significant improvement in its net revenue retention rate.

“Our 2024 results reflect our ongoing commitment to driving highly efficient growth through nearly any macroeconomic environment, with record GAAP and non-GAAP operating margins and free cash flow, and surpassing $1 billion in annual recurring revenue (ARR),” said Eliran Glazer, monday.com CFO.

The stock is down 3% since reporting and currently trades at $250.99.

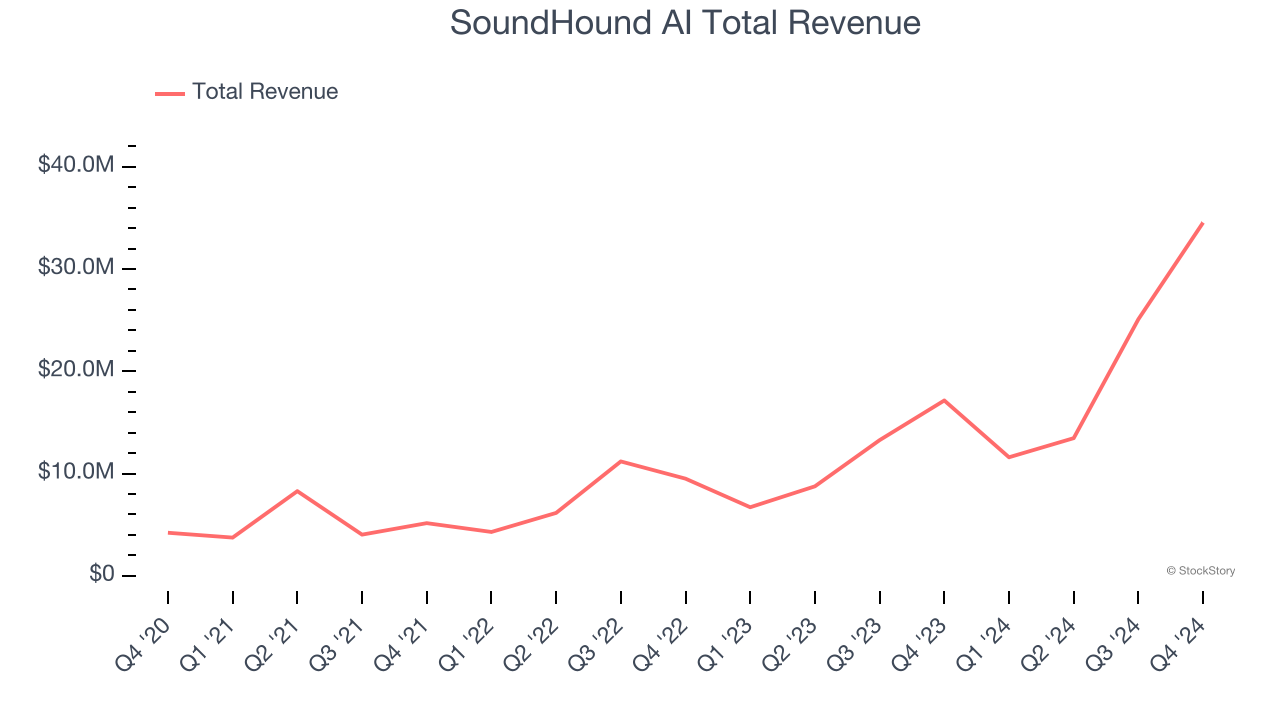

Best Q4: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

SoundHound AI achieved the fastest revenue growth among its peers. The stock is down 12.2% since reporting. It currently trades at $8.09.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Box (NYSE: BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE: BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $279.5 million, up 6.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 14.6% since the results and currently trades at $28.61.

Read our full analysis of Box’s results here.

Appian (NASDAQ: APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $166.7 million, up 14.7% year on year. This print surpassed analysts’ expectations by 1.5%. Taking a step back, it was a satisfactory quarter as it also logged a solid beat of analysts’ billings estimates but EBITDA guidance for next quarter missing analysts’ expectations.

The stock is down 14.7% since reporting and currently trades at $27.38.

Read our full, actionable report on Appian here, it’s free.

Microsoft (NASDAQ: MSFT)

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $69.63 billion, up 12.3% year on year. This result beat analysts’ expectations by 1.1%. It was a strong quarter as it also put up a miss of analysts’ revenue estimates and a solid beat of analysts’ operating income estimates.

The stock is down 13.3% since reporting and currently trades at $382.94.

Read our full, actionable report on Microsoft here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.