Cal-Maine’s 20.1% return over the past six months has outpaced the S&P 500 by 14.9%, and its stock price has climbed to $82.23 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy CALM? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does CALM Stock Spark Debate?

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Two Positive Attributes:

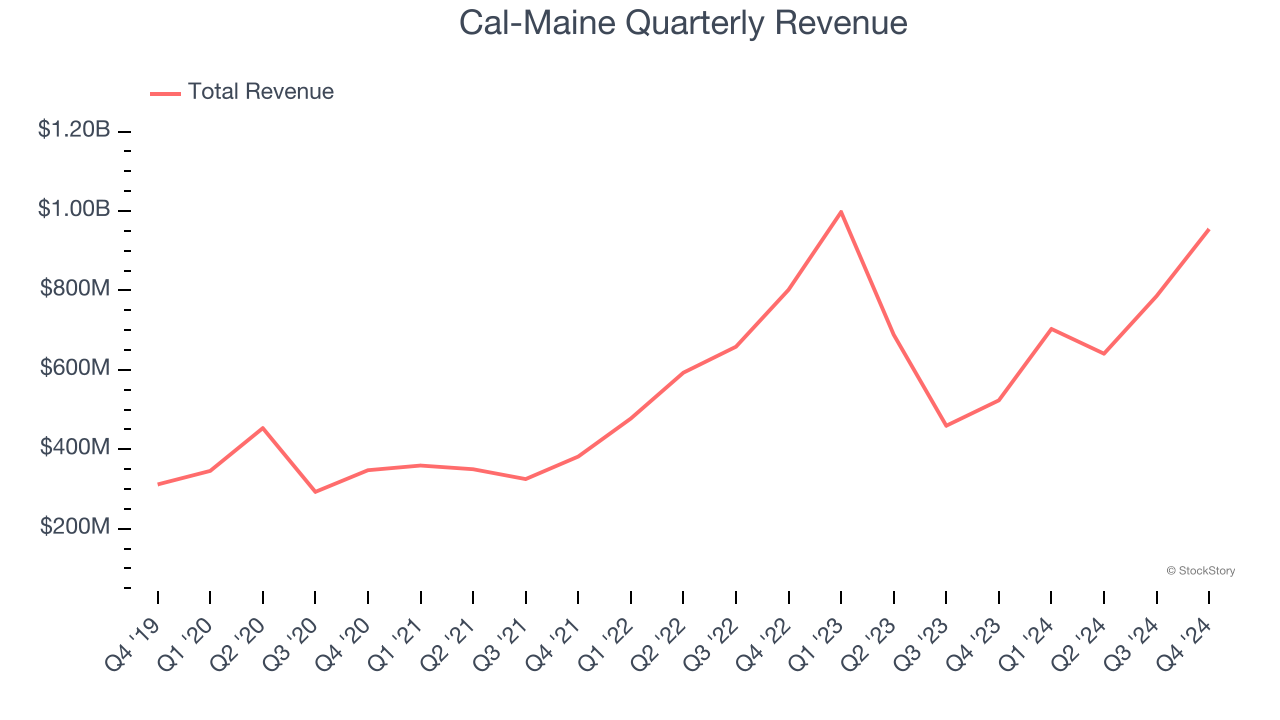

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Cal-Maine’s 29.6% annualized revenue growth over the last three years was exceptional. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

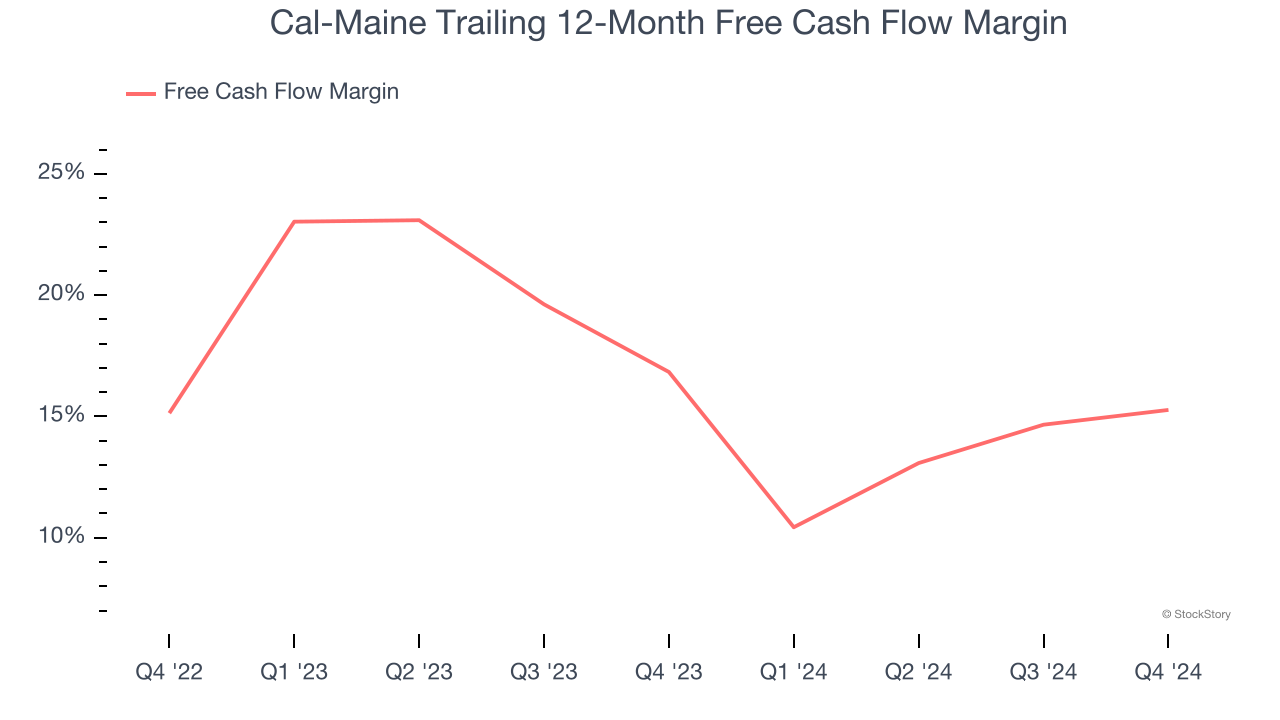

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Cal-Maine has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 16% over the last two years.

One Reason to be Careful:

Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Cal-Maine’s revenue to drop by 8.3%, a decrease from its 29.6% annualized growth for the past three years. This projection doesn't excite us and indicates its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Final Judgment

Cal-Maine’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 9.9× forward price-to-earnings (or $82.23 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Cal-Maine

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.