Tractor Supply has been treading water for the past six months, recording a small return of 1.2% while holding steady at $54.78. The stock also fell short of the S&P 500’s 7% gain during that period.

Is now the time to buy TSCO? Find out in our full research report, it’s free.

Why Does TSCO Stock Spark Debate?

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ: TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Two Positive Attributes:

1. Store Growth Signals an Offensive Strategy

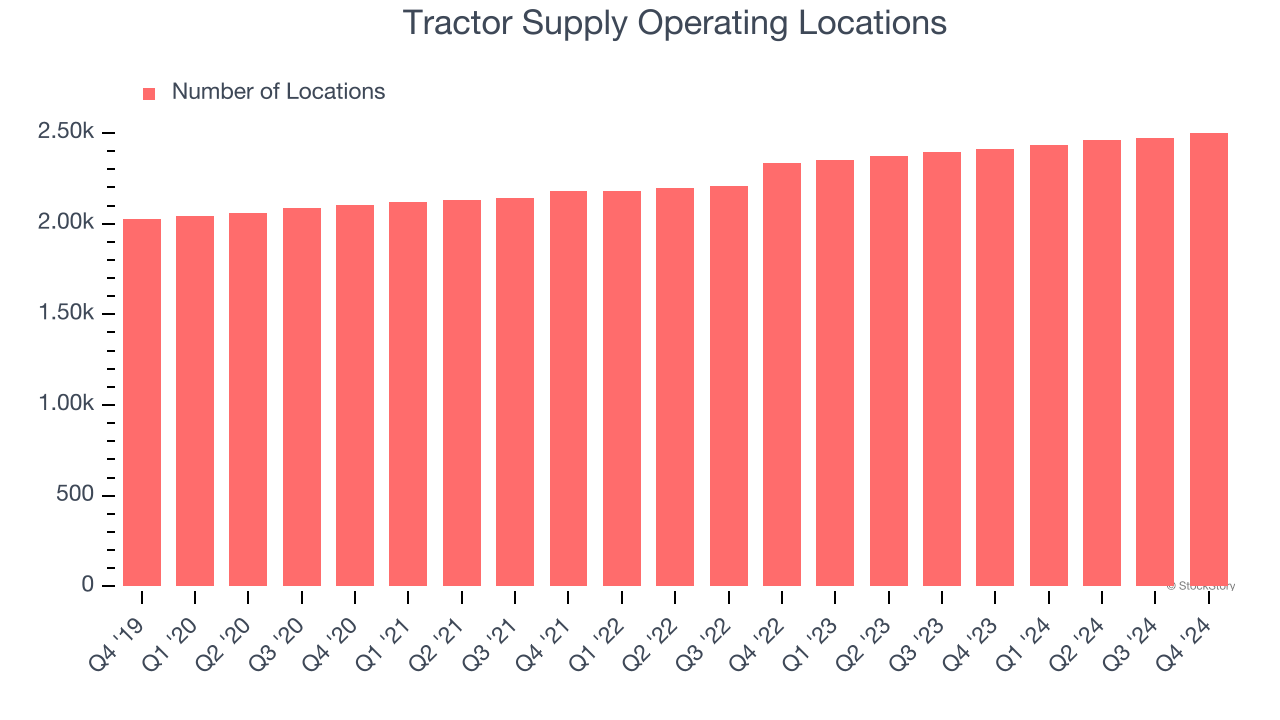

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Tractor Supply operated 2,502 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 5.3% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Tractor Supply’s five-year average ROIC was 35.1%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

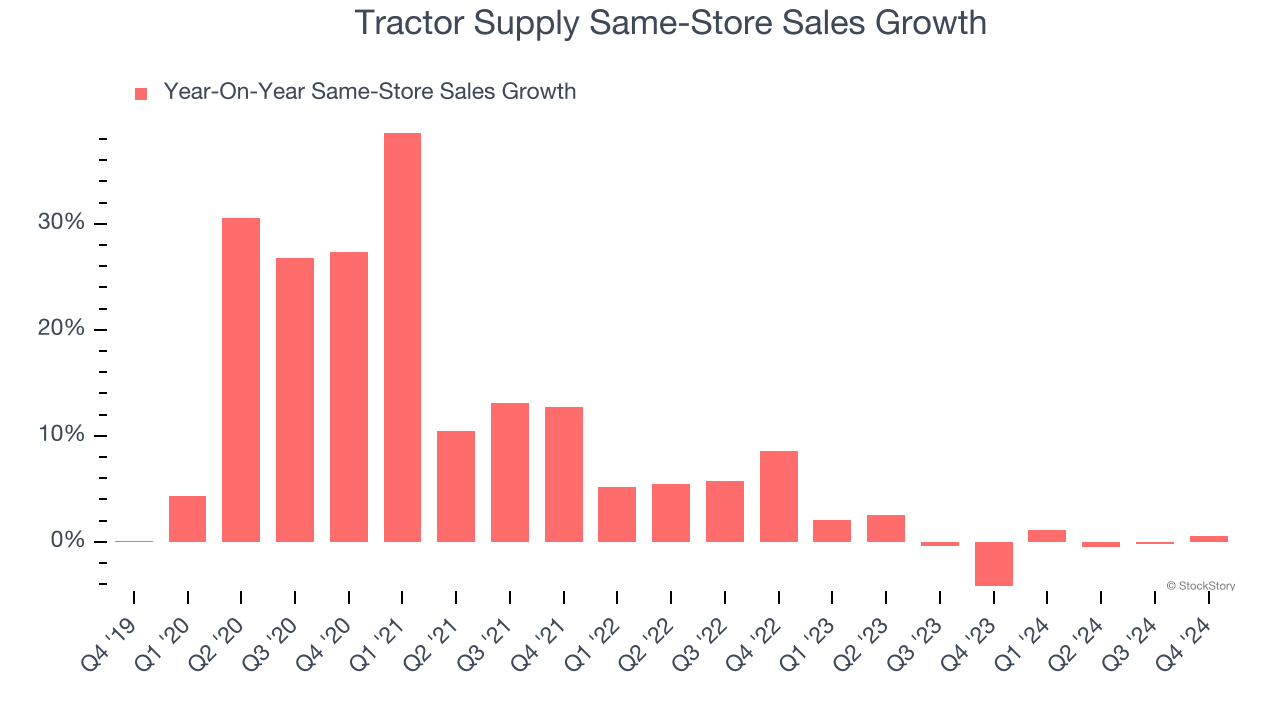

Flat Same-Store Sales Indicate Weak Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

Final Judgment

Tractor Supply has huge potential even though it has some open questions. With its shares underperforming the market lately, the stock trades at 25× forward price-to-earnings (or $54.78 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Tractor Supply

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.