Flowserve trades at $50.84 and has moved in lockstep with the market. Its shares have returned 11.7% over the last six months while the S&P 500 has gained 7%.

Is now the time to buy Flowserve, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We're cautious about Flowserve. Here are three reasons why there are better opportunities than FLS and a stock we'd rather own.

Why Is Flowserve Not Exciting?

Manufacturing the largest pump ever built for nuclear power generation, Flowserve (NYSE: FLS) manufactures and sells flow control equipment for various industries.

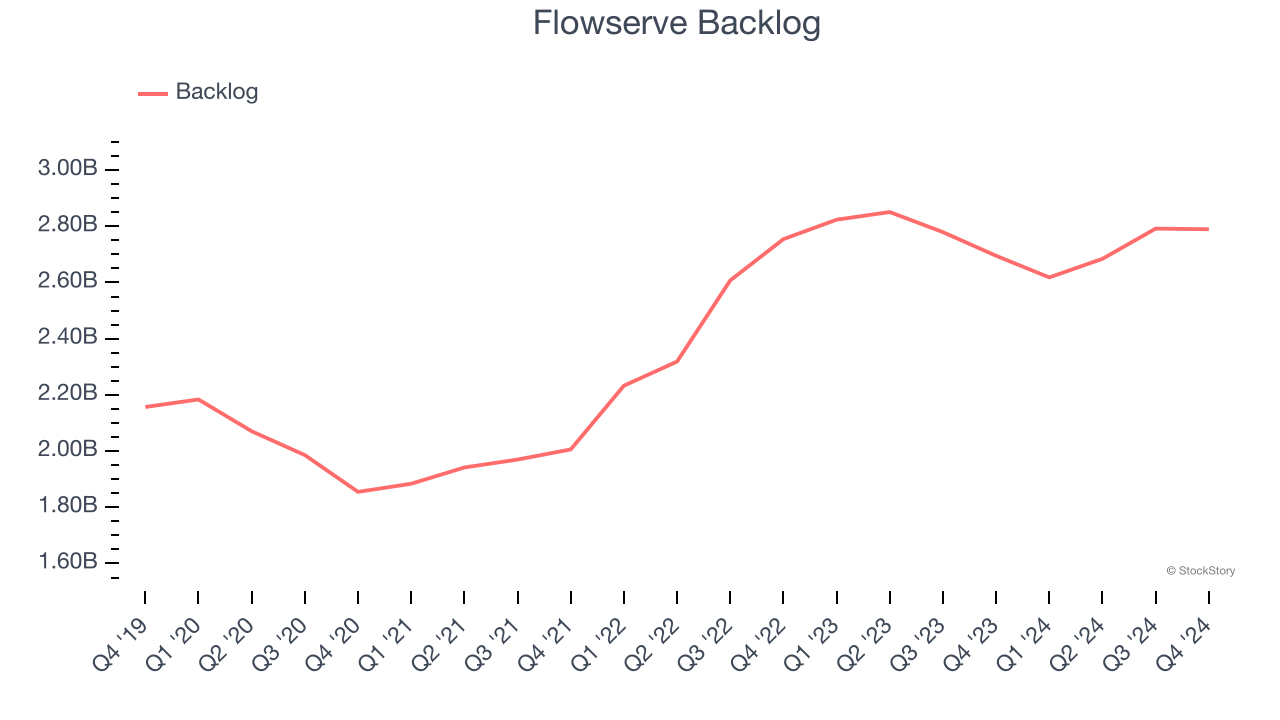

1. Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Gas and Liquid Handling companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Flowserve’s future revenue streams.

Flowserve’s backlog came in at $2.79 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 5.6%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Flowserve’s revenue to rise by 5.8%, a deceleration versus its 12.3% annualized growth for the past two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

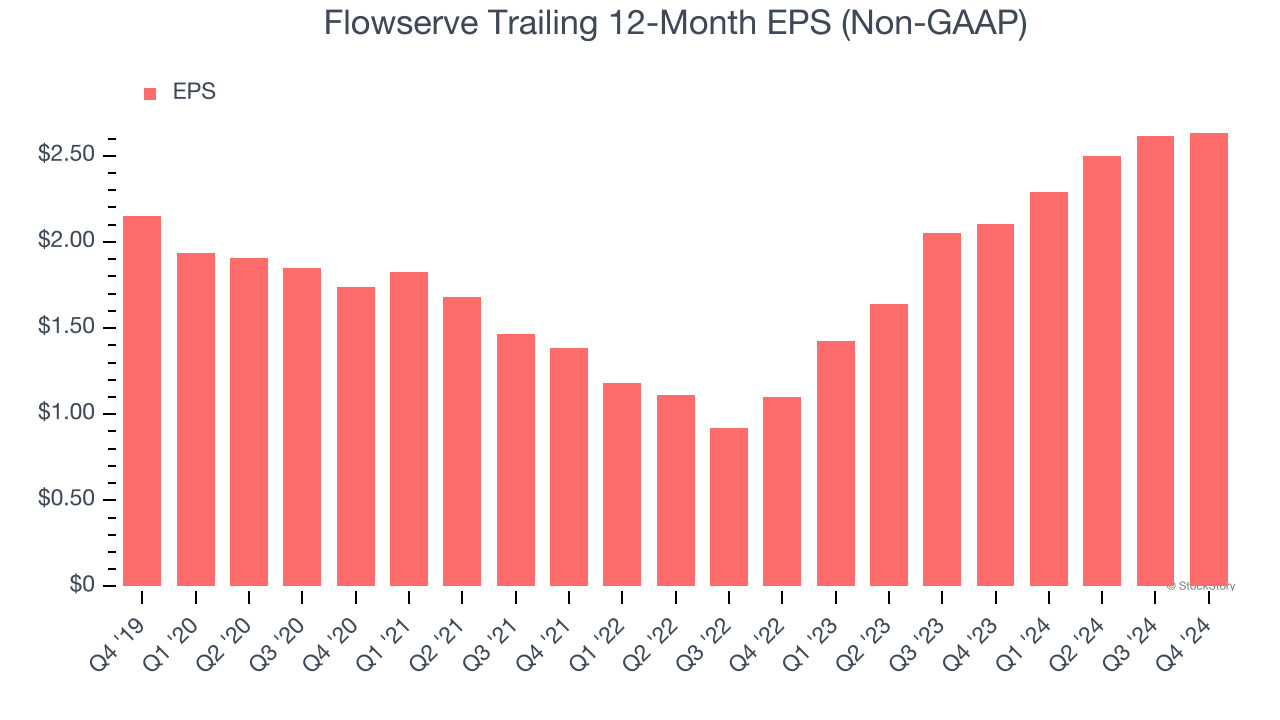

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Flowserve’s EPS grew at an unimpressive 4.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.9% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Flowserve isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 15.5× forward price-to-earnings (or $50.84 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Flowserve

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.