Healthcare diagnostics company Quest Diagnostics (NYSE: DGX) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 14.6% year on year to $2.62 billion. Its non-GAAP profit of $2.23 per share was 2.1% above analysts’ consensus estimates.

Is now the time to buy Quest? Find out by accessing our full research report, it’s free.

Quest (DGX) Q4 CY2024 Highlights:

- Revenue: $2.62 billion vs analyst estimates of $2.57 billion (14.6% year-on-year growth, 1.8% beat)

- Adjusted EPS: $2.23 vs analyst estimates of $2.18 (2.1% beat)

- Adjusted EBITDA: $544 million vs analyst estimates of $486.9 million (20.8% margin, 11.7% beat)

- Operating Margin: 13.8%, up from 11.7% in the same quarter last year

- Free Cash Flow Margin: 13%, down from 19.9% in the same quarter last year

- Sales Volumes rose 13.9% year on year (1.7% in the same quarter last year)

- Market Capitalization: $18.03 billion

"In the fourth quarter, we delivered impressive revenue growth of nearly 15%, including approximately 5% organic growth, while also improving our profitability," said Jim Davis, Chairman, CEO, and President.

Company Overview

Founded in 1967 as MetPath, Quest Diagnostics (NYSE: DGX) is a provider of diagnostic testing services, offering a broad range of tests for medical conditions such as diabetes, heart disease, and infections, as well as genetic testing and drug monitoring services.

Testing & Diagnostics Services

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

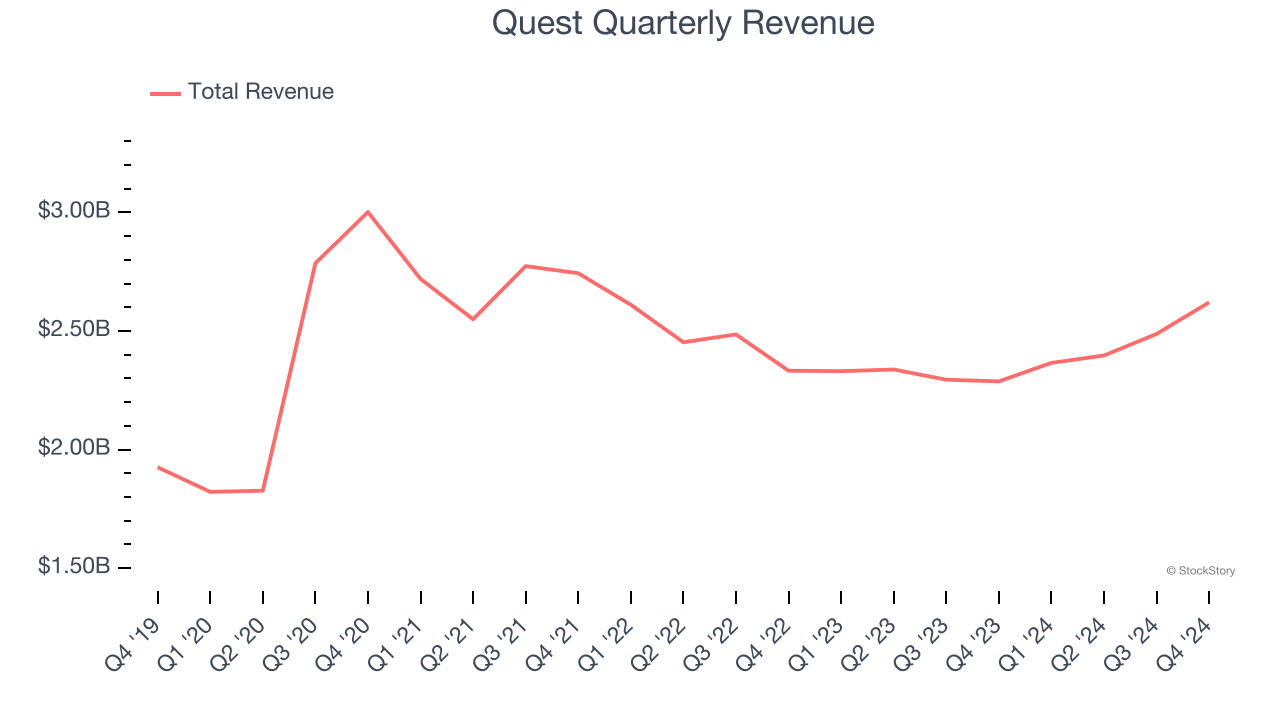

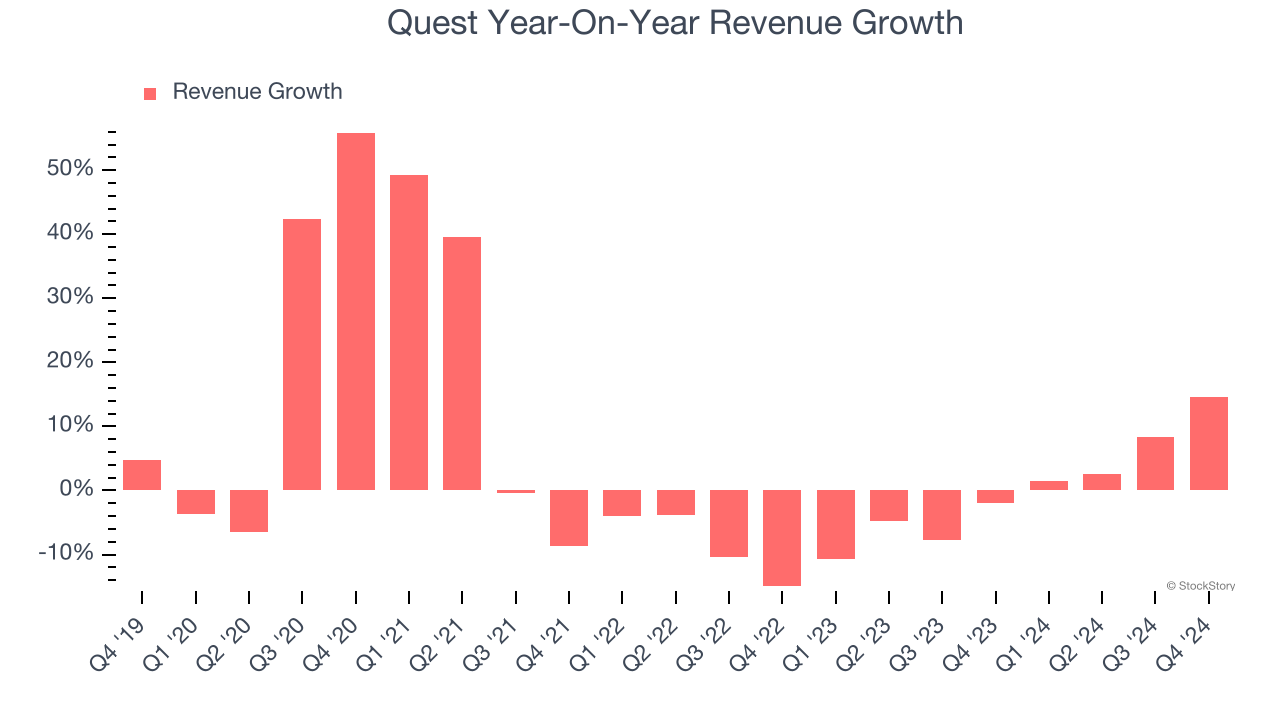

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Quest grew its sales at a mediocre 5% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Quest’s recent history shows its demand slowed as its revenue was flat over the last two years.

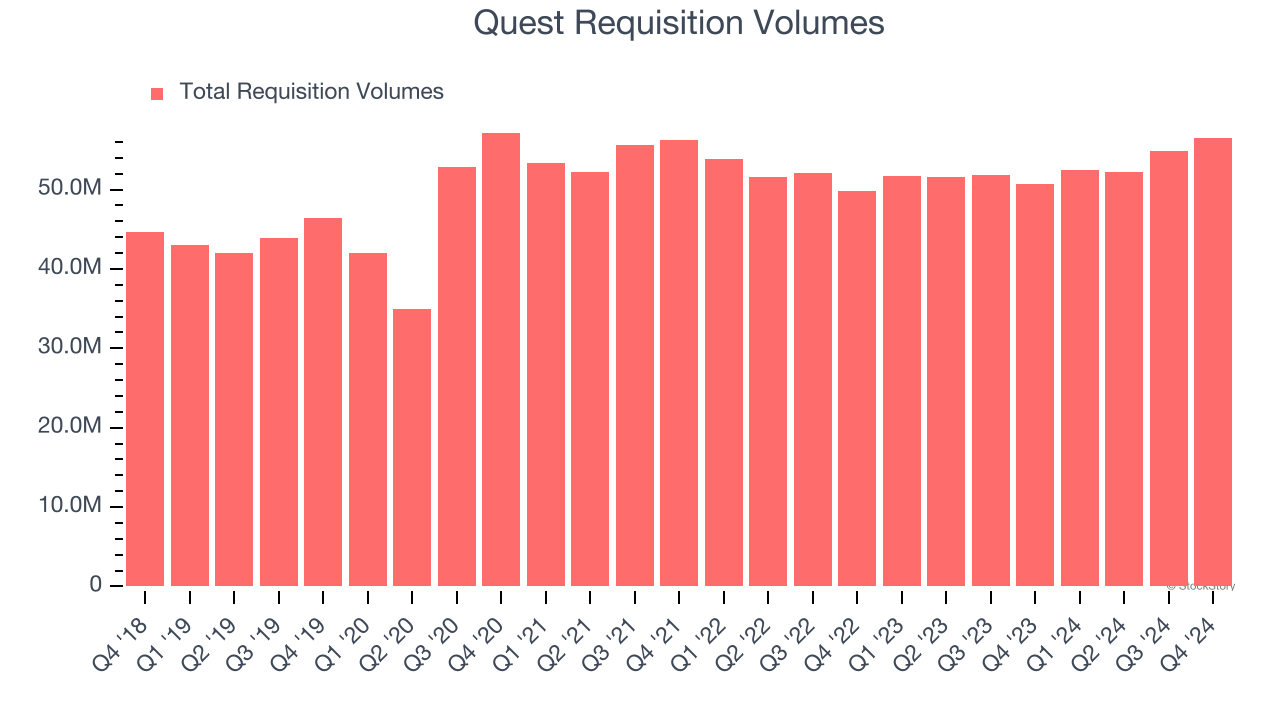

We can better understand the company’s revenue dynamics by analyzing its requisition volumes, which reached 56.52 million in the latest quarter. Over the last two years, Quest’s requisition volumes averaged 2.4% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Quest reported year-on-year revenue growth of 14.6%, and its $2.62 billion of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

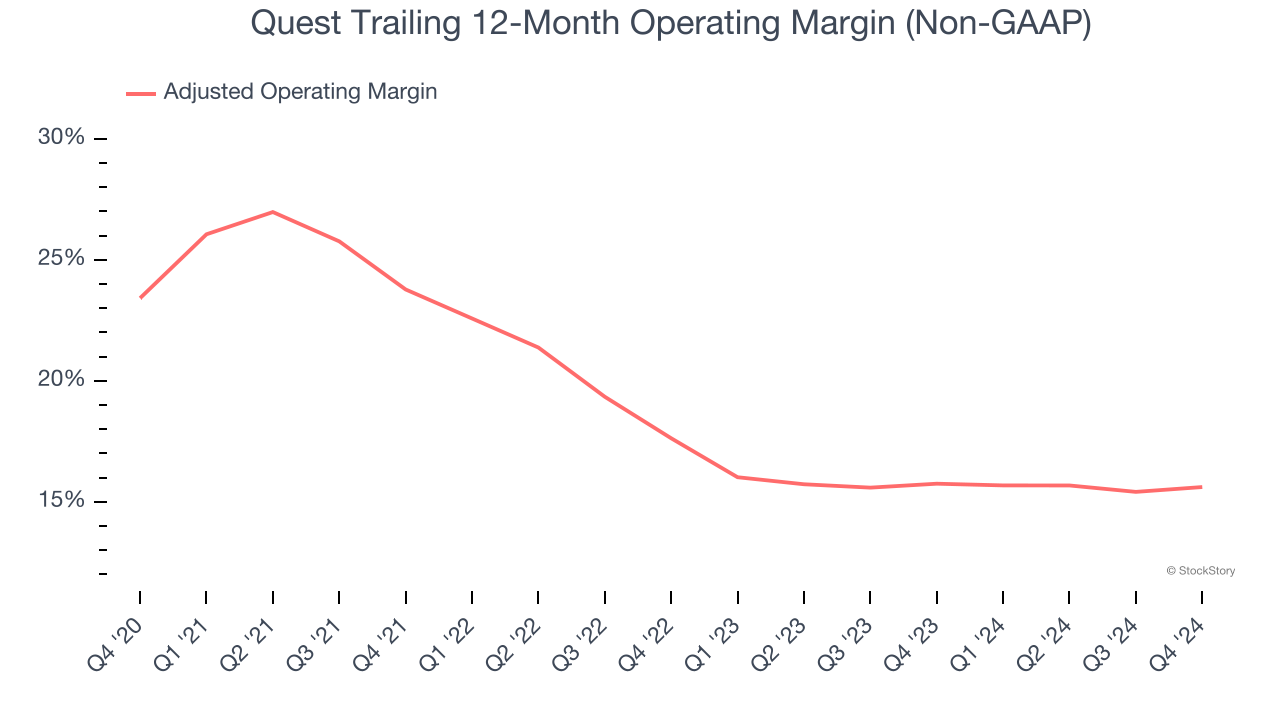

Adjusted Operating Margin

Quest has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 19.3%.

Looking at the trend in its profitability, Quest’s adjusted operating margin decreased by 7.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Quest generated an adjusted operating profit margin of 15.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

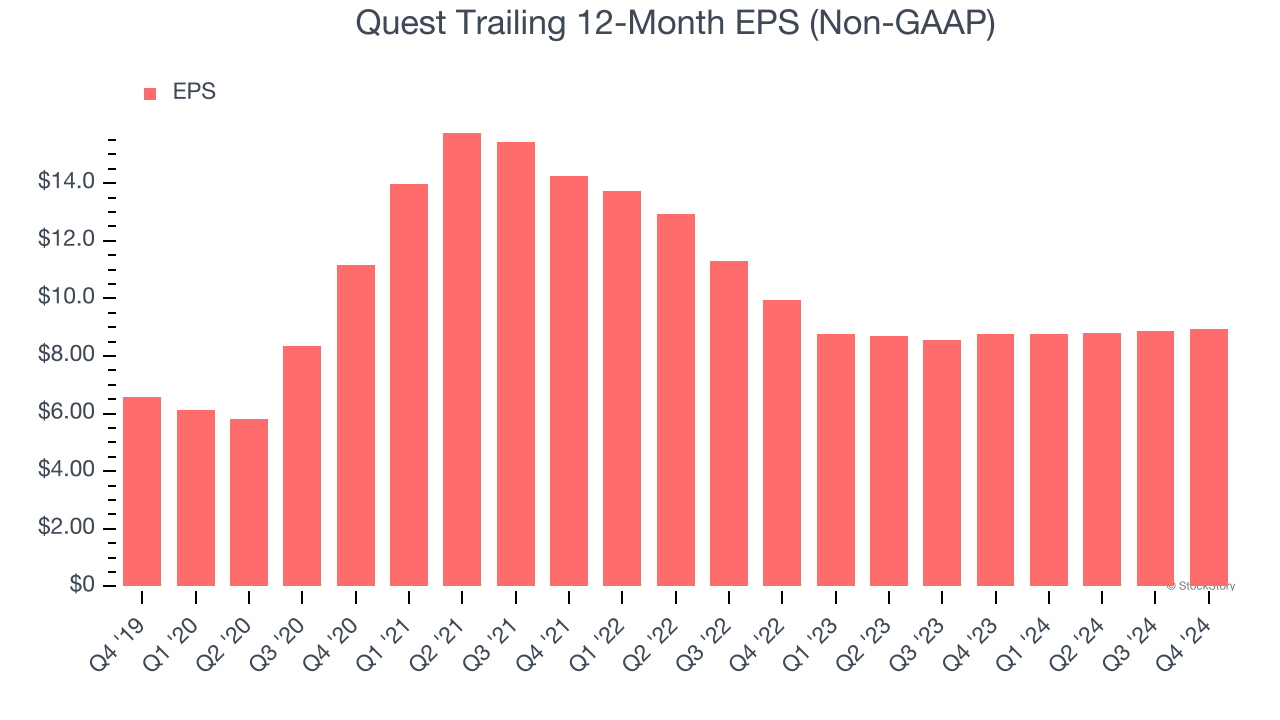

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

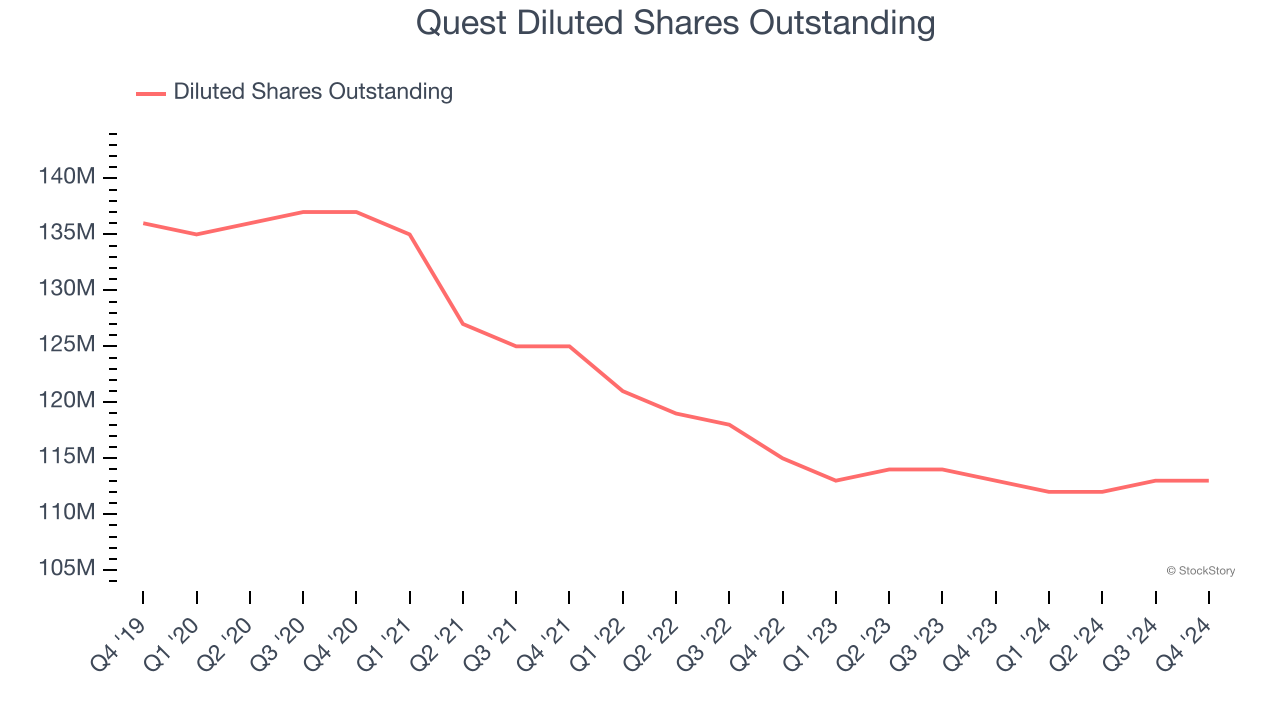

Quest’s EPS grew at a decent 6.3% compounded annual growth rate over the last five years, higher than its 5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t expand.

Diving into Quest’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Quest has repurchased its stock, shrinking its share count by 16.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Quest reported EPS at $2.23, up from $2.17 in the same quarter last year. This print beat analysts’ estimates by 2.1%. Over the next 12 months, Wall Street expects Quest’s full-year EPS of $8.93 to grow 8.7%.

Key Takeaways from Quest’s Q4 Results

It was encouraging to see Quest beat analysts’ revenue expectations this quarter as its sales volume narrowly outperformed. We were also glad its EPS and EBITDA topped Wall Street's estimates. Zooming out, we think this quarter featured some areas of strength.

So should you invest in Quest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.