Dating app company Match (NASDAQ: MTCH) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $860.2 million. On the other hand, next quarter’s revenue guidance of $825 million was less impressive, coming in 3% below analysts’ estimates. Its GAAP profit of $0.59 per share was 6.9% above analysts’ consensus estimates.

Is now the time to buy Match Group? Find out by accessing our full research report, it’s free.

Match Group (MTCH) Q4 CY2024 Highlights:

- Revenue: $860.2 million vs analyst estimates of $856.7 million (flat year on year, in line)

- EPS (GAAP): $0.59 vs analyst estimates of $0.55 (6.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.44 billion at the midpoint, missing analyst estimates by 1.7% and implying -1.2% growth (vs 3.6% in FY2024)

- Operating Margin: 26%, down from 30% in the same quarter last year

- Free Cash Flow Margin: 28.7%, similar to the previous quarter

- Payers: 14.6 million, down 586,000 year on year

- Market Capitalization: $8.89 billion

"We had a strong finish to the year and are seeing solid peak season new user trends. We met our full-year 2024 AOI margin target through disciplined financial management. We're focused on executing the plan we laid out at Investor Day: driving innovation to spur user growth, generating strong free cash flow, and returning significant capital to shareholders. Our 2025 outlook remains unchanged since Investor Day on a FX neutral basis, though the strengthening U.S. dollar continues to put pressure on as reported results," said Steven Bailey, Incoming CFO.

Company Overview

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ: MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

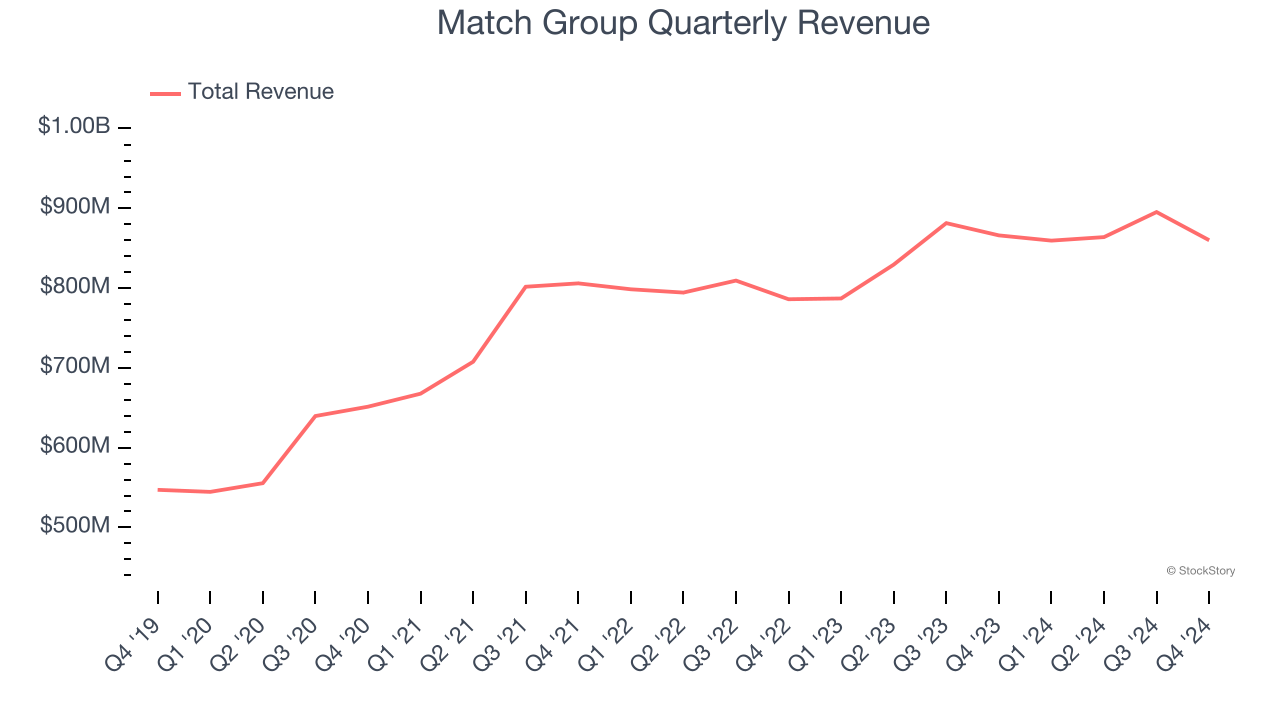

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Match Group’s sales grew at a sluggish 5.3% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Match Group’s $860.2 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

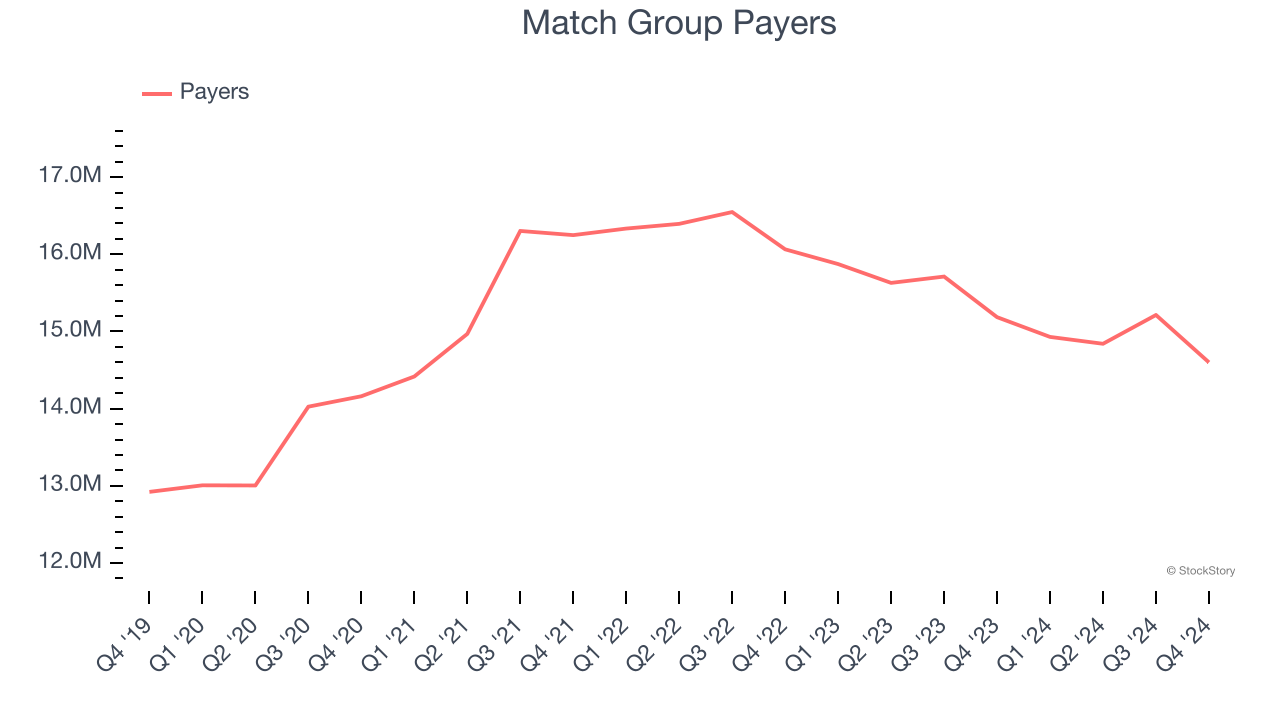

Payers

User Growth

As a subscription-based app, Match Group generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Match Group struggled to engage its audience over the last two years as its payers have declined by 4.5% annually to 14.6 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Match Group wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q4, Match Group’s payers once again decreased by 586,000, a 3.9% drop since last year. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

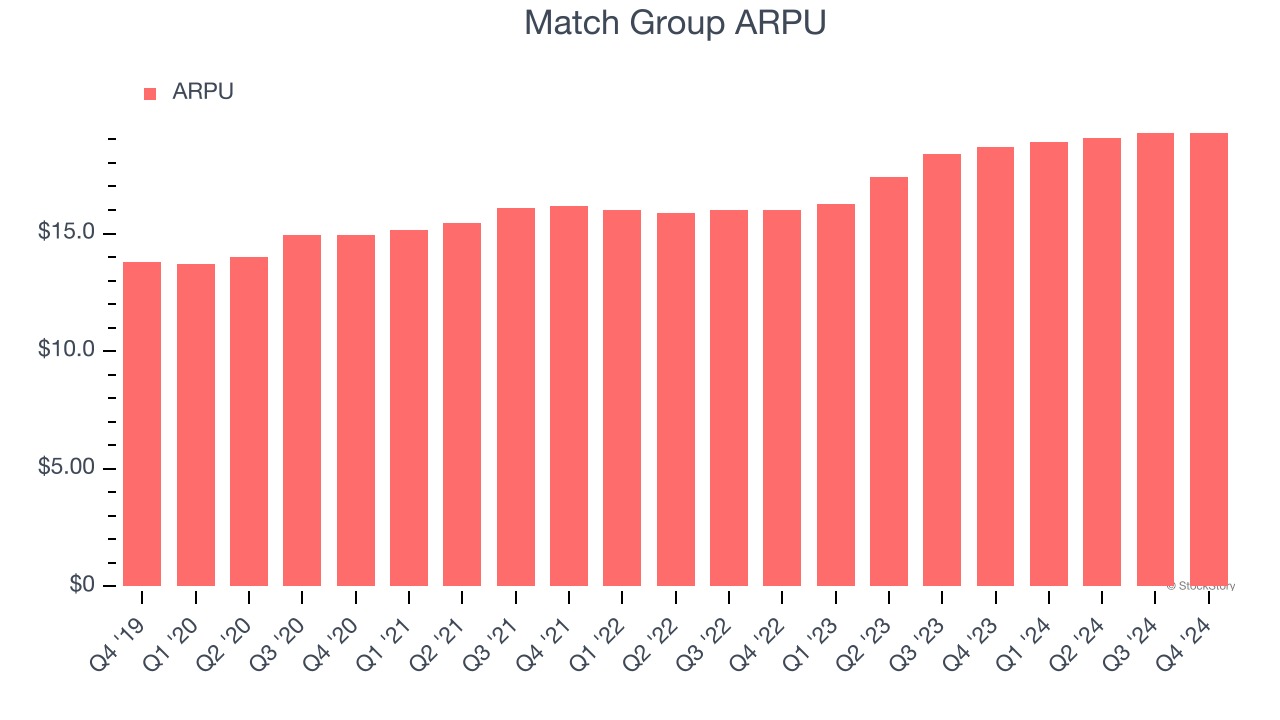

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer subscription businesses like Match Group because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Match Group’s ARPU growth has been excellent over the last two years, averaging 9.6%. Although its payers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

This quarter, Match Group’s ARPU clocked in at $19.29. It grew by 3.3% year on year, faster than its payers.

Key Takeaways from Match Group’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly as its number of payers (the key debate for the stock) continued declining. This was extremely disappointing because management anticipated payer stabilization by the end of 2024. On the bright side, Match continues to generate cash and repurchase its shares at a cheap valuation. Still, this was a weak quarter, and investors may be losing trust in the company's ability to reaccelerate top-line growth. The stock traded down 8.1% to $33.50 immediately following the results.

Match Group underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.