Manufacturing company IDEX (NYSE: IEX) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 9.4% year on year to $862.9 million. Its non-GAAP profit of $2.04 per share was 0.5% above analysts’ consensus estimates.

Is now the time to buy IDEX? Find out by accessing our full research report, it’s free.

IDEX (IEX) Q4 CY2024 Highlights:

- Revenue: $862.9 million vs analyst estimates of $868.1 million (9.4% year-on-year growth, 0.6% miss)

- Adjusted EPS: $2.04 vs analyst estimates of $2.03 (0.5% beat)

- Adjusted EBITDA: $227.5 million vs analyst estimates of $237.2 million (26.4% margin, 4.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $8.27 at the midpoint, missing analyst estimates by 2.4%

- Operating Margin: 19.2%, down from 20.3% in the same quarter last year

- Free Cash Flow Margin: 18.2%, down from 22.7% in the same quarter last year

- Organic Revenue rose 3% year on year (-6% in the same quarter last year)

- Market Capitalization: $16.57 billion

“IDEX teams drove a strong finish to the year and continued to deliver on their commitments to customers in an increasingly uncertain environment. Our company continues to write its next chapter, positioning us for dynamic growth in markets powered by global megatrends. Our 80/20 mindset allows us to adjust resources and self-fund the buildout of scale as we bring newly-acquired and longtime IDEX companies together to grow within advantaged markets,” said Eric D. Ashleman, IDEX Corporation Chief Executive Officer and President.

Company Overview

Founded in 1988, IDEX (NYSE: IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

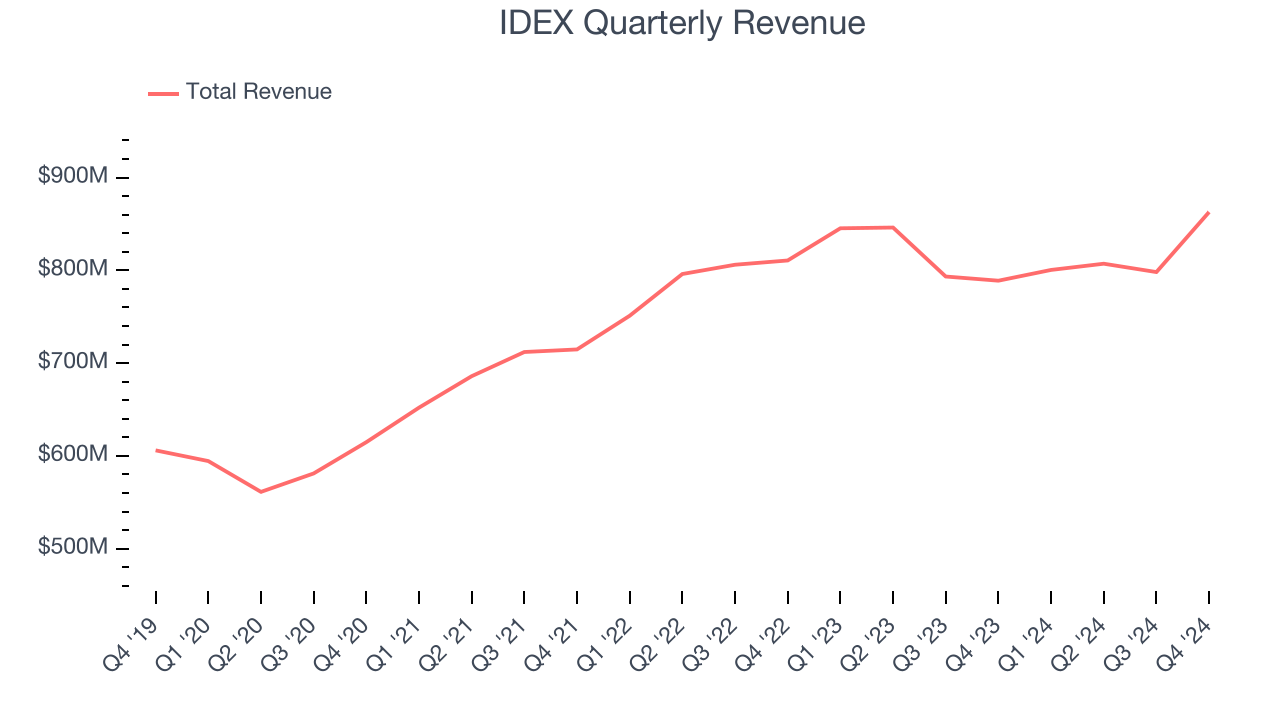

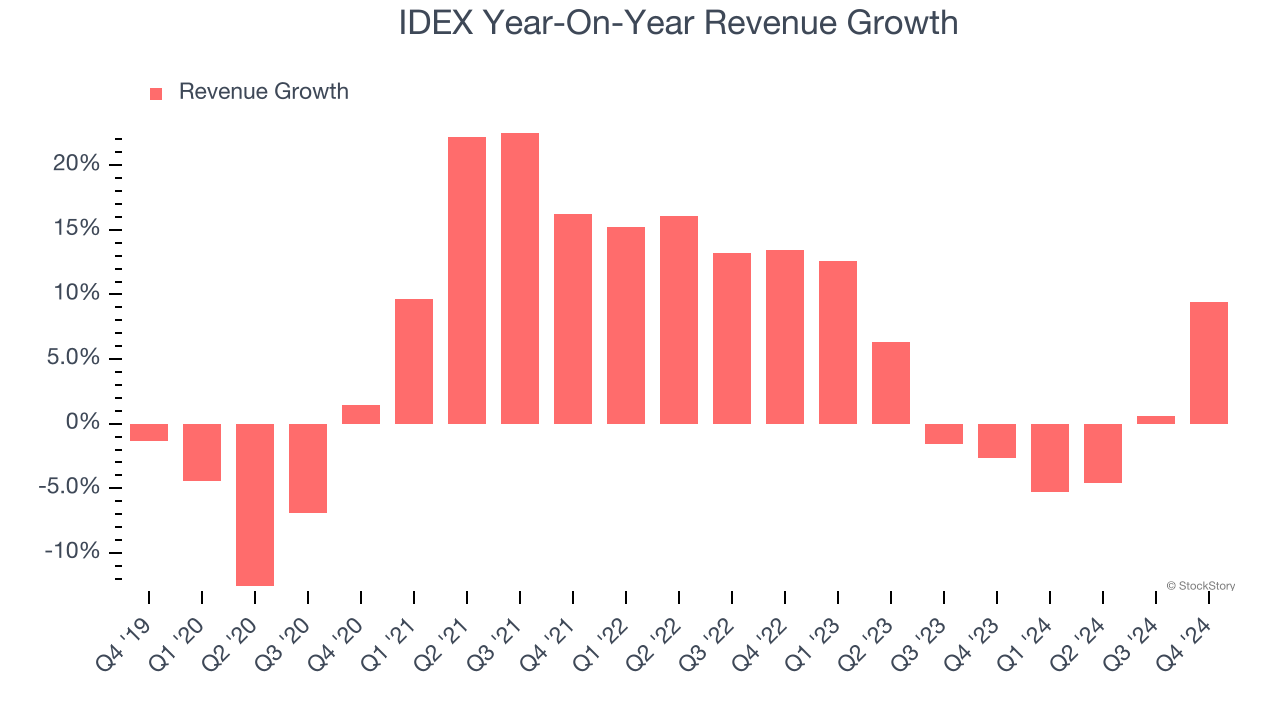

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, IDEX’s 5.6% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. IDEX’s recent history shows its demand slowed as its annualized revenue growth of 1.6% over the last two years is below its five-year trend.

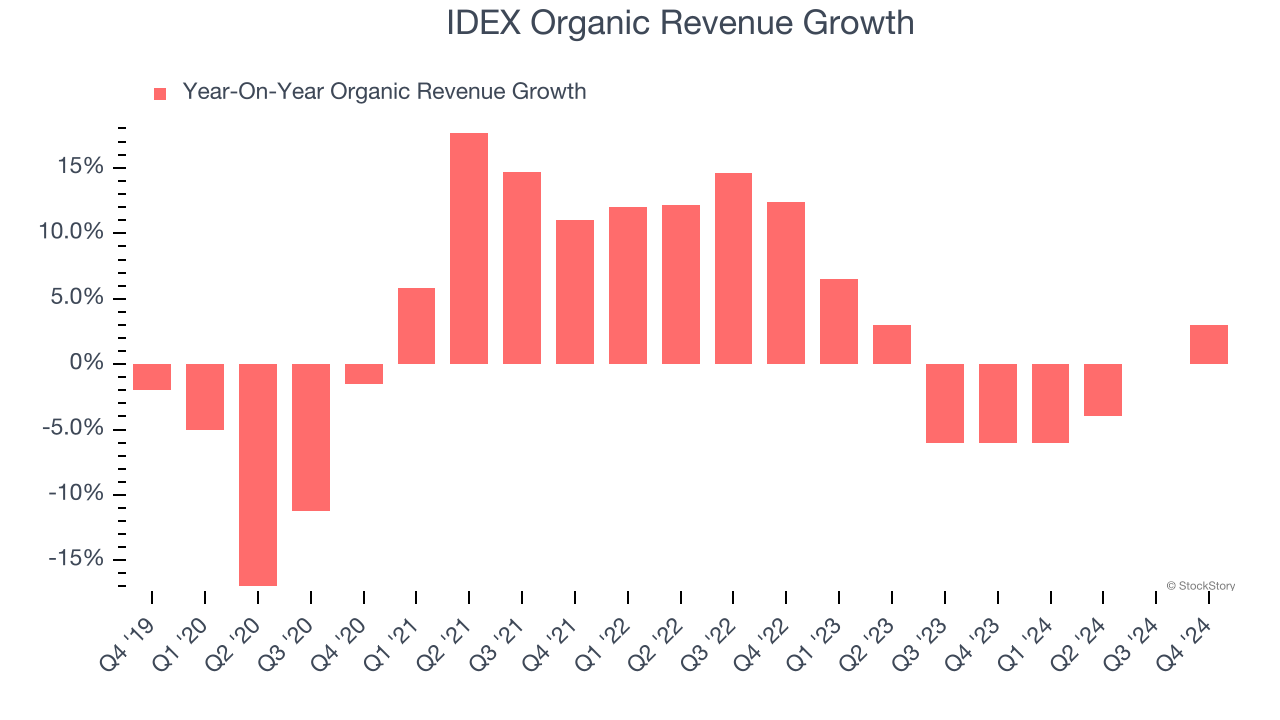

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, IDEX’s organic revenue averaged 1.2% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, IDEX’s revenue grew by 9.4% year on year to $862.9 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

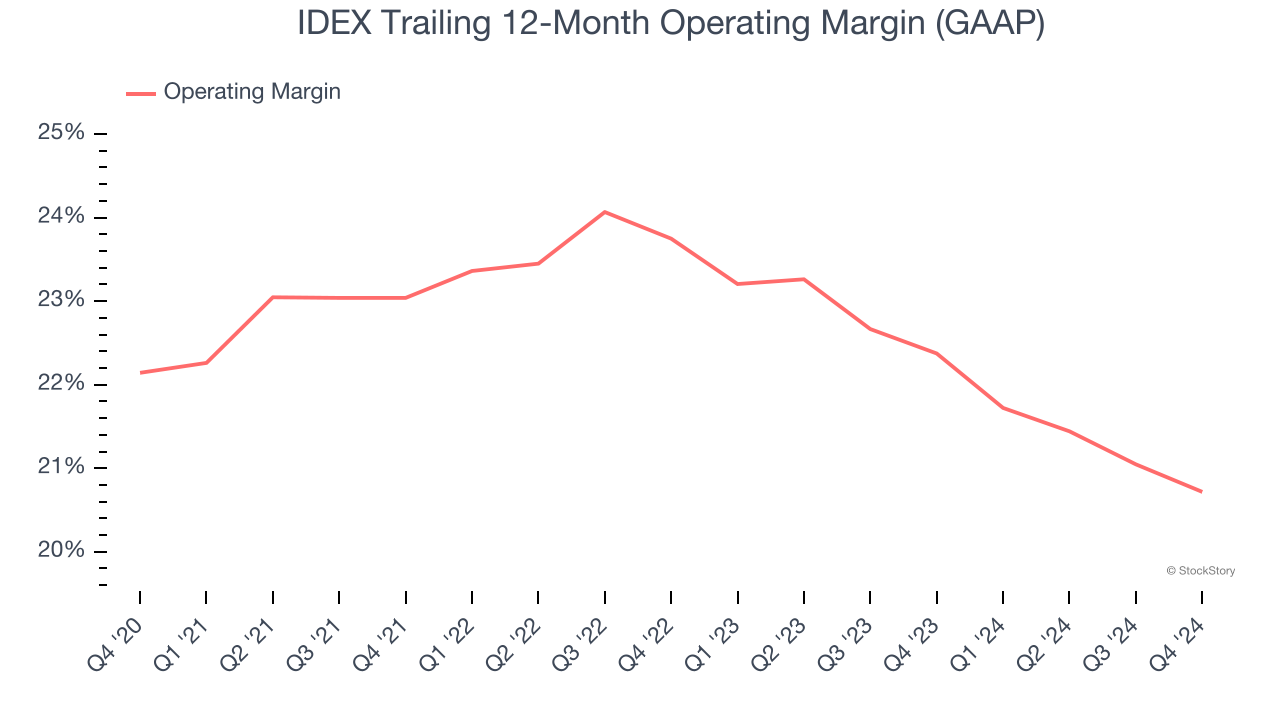

IDEX has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 22.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, IDEX’s operating margin decreased by 1.4 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see IDEX become more profitable in the future.

In Q4, IDEX generated an operating profit margin of 19.2%, down 1.2 percentage points year on year. Since IDEX’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

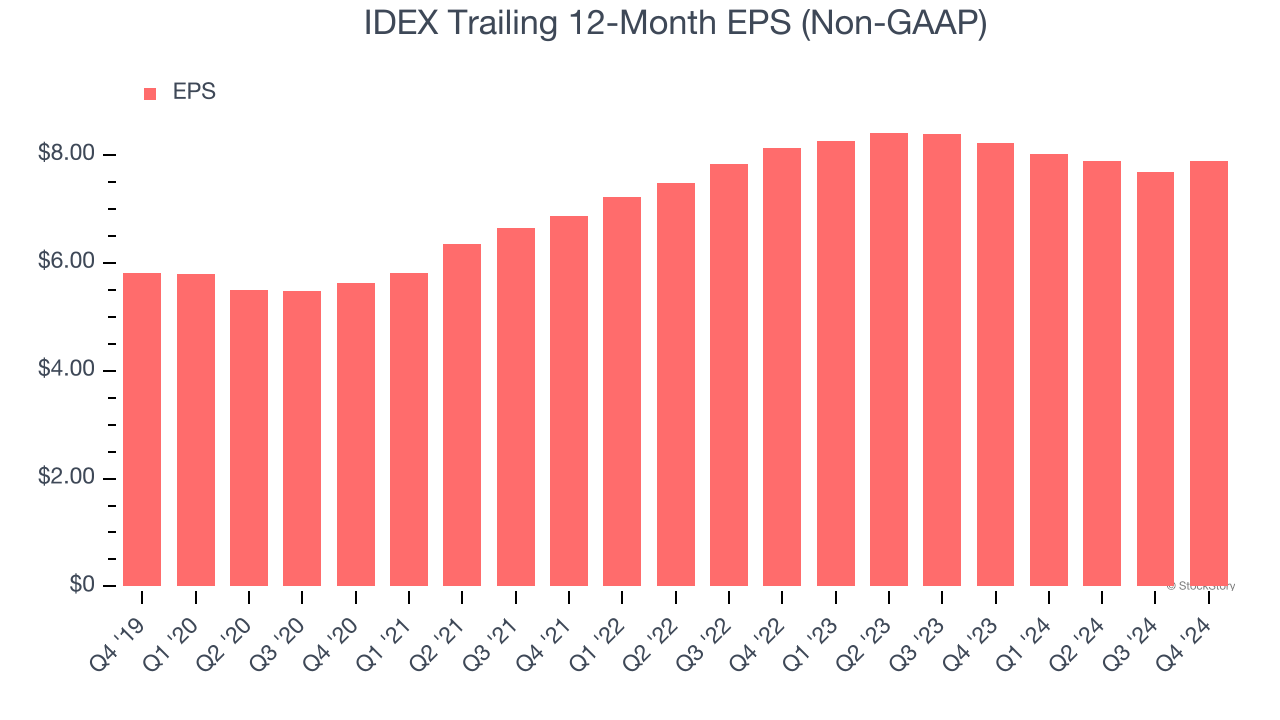

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

IDEX’s unimpressive 6.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

IDEX’s two-year annual EPS declines of 1.5% were bad and lower than its 1.6% two-year revenue growth.

In Q4, IDEX reported EPS at $2.04, up from $1.83 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects IDEX’s full-year EPS of $7.88 to grow 8.3%.

Key Takeaways from IDEX’s Q4 Results

We struggled to find many positives in these results. Its EPS guidance for next quarter missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $218.65 immediately following the results.

So should you invest in IDEX right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.