Altria trades at $51.55 per share and has stayed right on track with the overall market, gaining 10.4% over the last six months. At the same time, the S&P 500 has returned 6.1%.

Is now a good time to buy MO? Find out in our full research report, it’s free.

Why Does MO Stock Spark Debate?

Best known for its Marlboro brand of cigarettes, Altria (NYSE: MO) offers tobacco and nicotine products.

Two Things to Like:

1. Elite Gross Margin Powers Best-In-Class Business Model

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Altria has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 69.7% gross margin over the last two years. That means Altria only paid its suppliers $30.30 for every $100 in revenue.

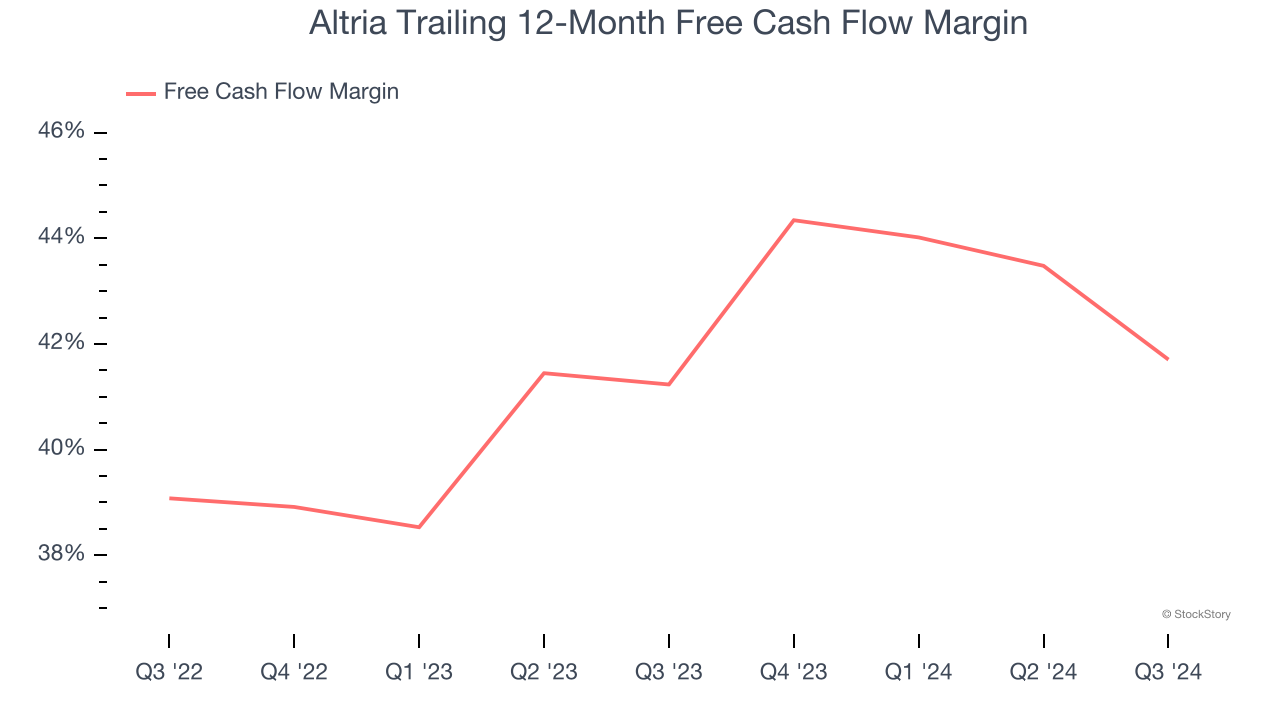

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Altria has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 41.5% over the last two years.

One Reason to be Careful:

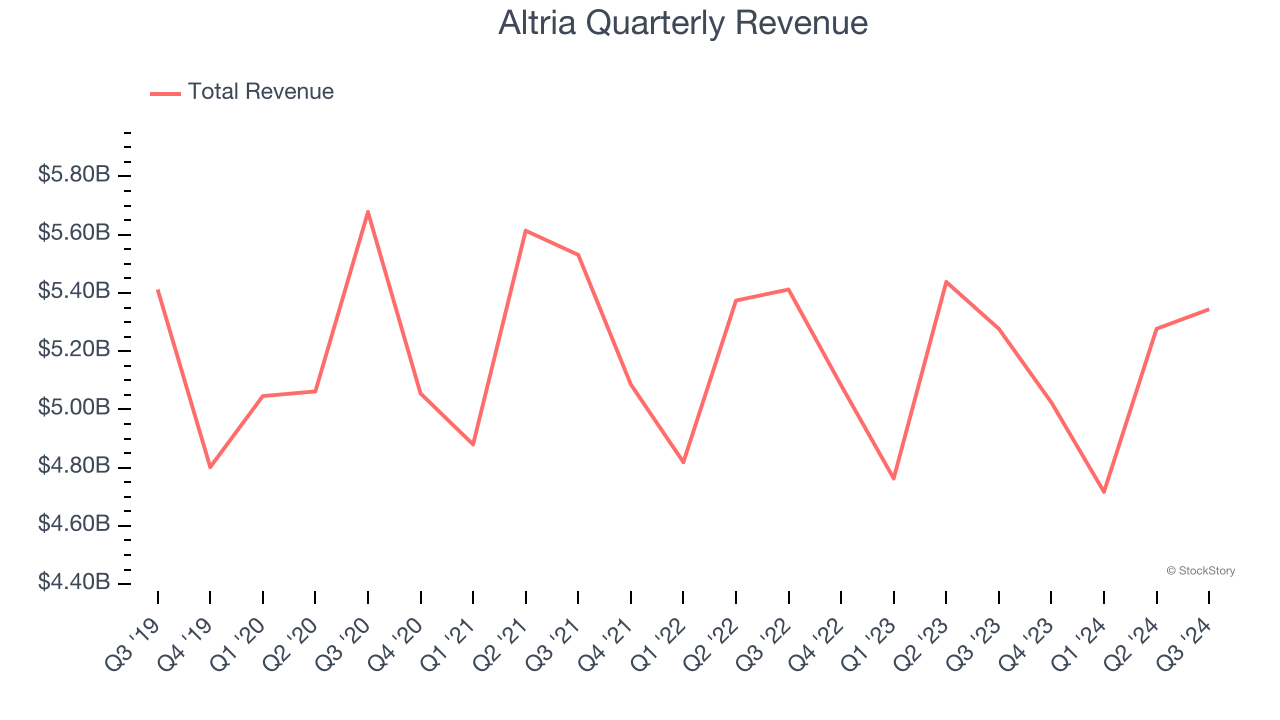

Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Altria’s demand was weak over the last three years as its sales fell at a 1.1% annual rate. This fell short of our benchmarks, but there are still things to like about Altria.

Final Judgment

Altria’s positive characteristics outweigh the negatives, but at $51.55 per share (or 9.7× forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Altria

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.