Since July 2024, H&R Block has been in a holding pattern, posting a small return of 2.5% while floating around $54.32. This is close to the S&P 500’s 6.1% gain during that period.

Given the underwhelming price action, is now a good time to buy HRB? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Are We Positive On HRB?

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE: HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

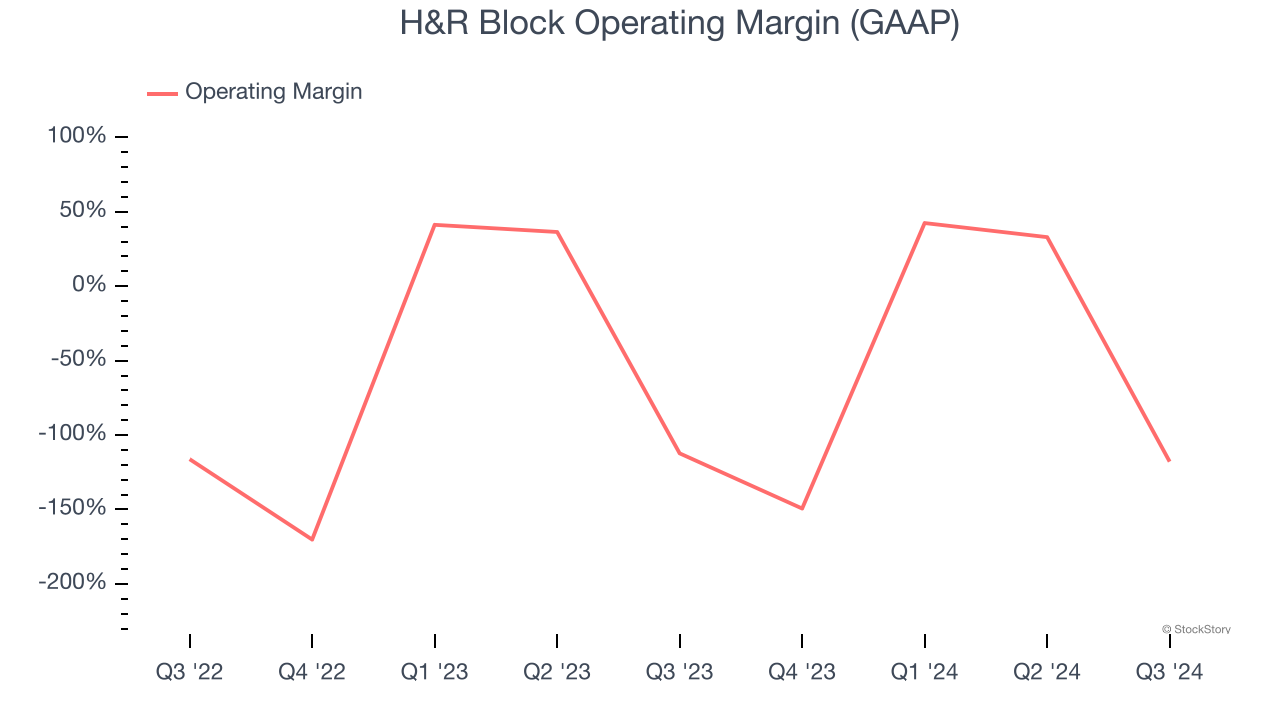

1. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

H&R Block’s operating margin might have seen some fluctuations over the last 12 months but has generally stayed the same, averaging 21.6% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an optimally-run company with an efficient cost structure.

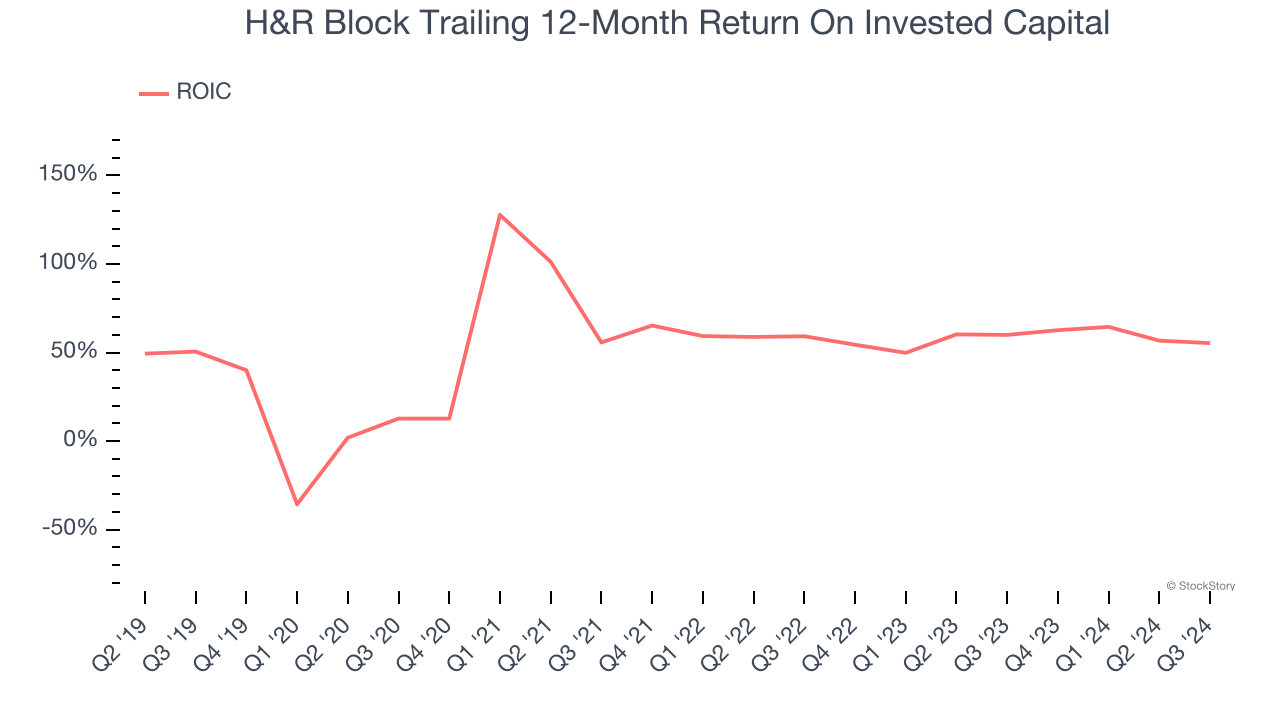

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

H&R Block’s five-year average ROIC was 48.6%, placing it among the best consumer discretionary companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, H&R Block’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons H&R Block is a high-quality business worth owning, but at $54.32 per share (or 6.4× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than H&R Block

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.