Starbucks’s 26.9% return over the past six months has outpaced the S&P 500 by 20.9%, and its stock price has climbed to $92.35 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Starbucks, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the momentum, we're swiping left on Starbucks for now. Here are three reasons why we avoid SBUX and a stock we'd rather own.

Why Is Starbucks Not Exciting?

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ: SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

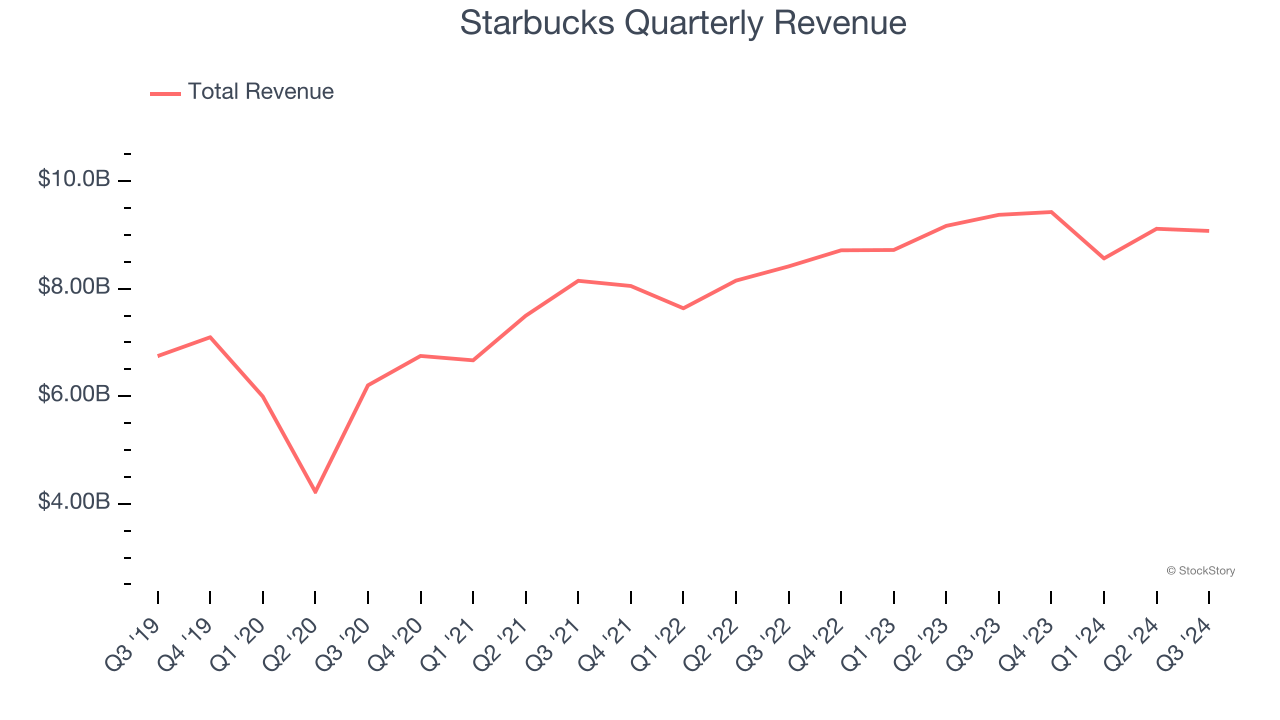

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Starbucks grew its sales at a mediocre 6.4% compounded annual growth rate. This fell short of our benchmark for the restaurant sector.

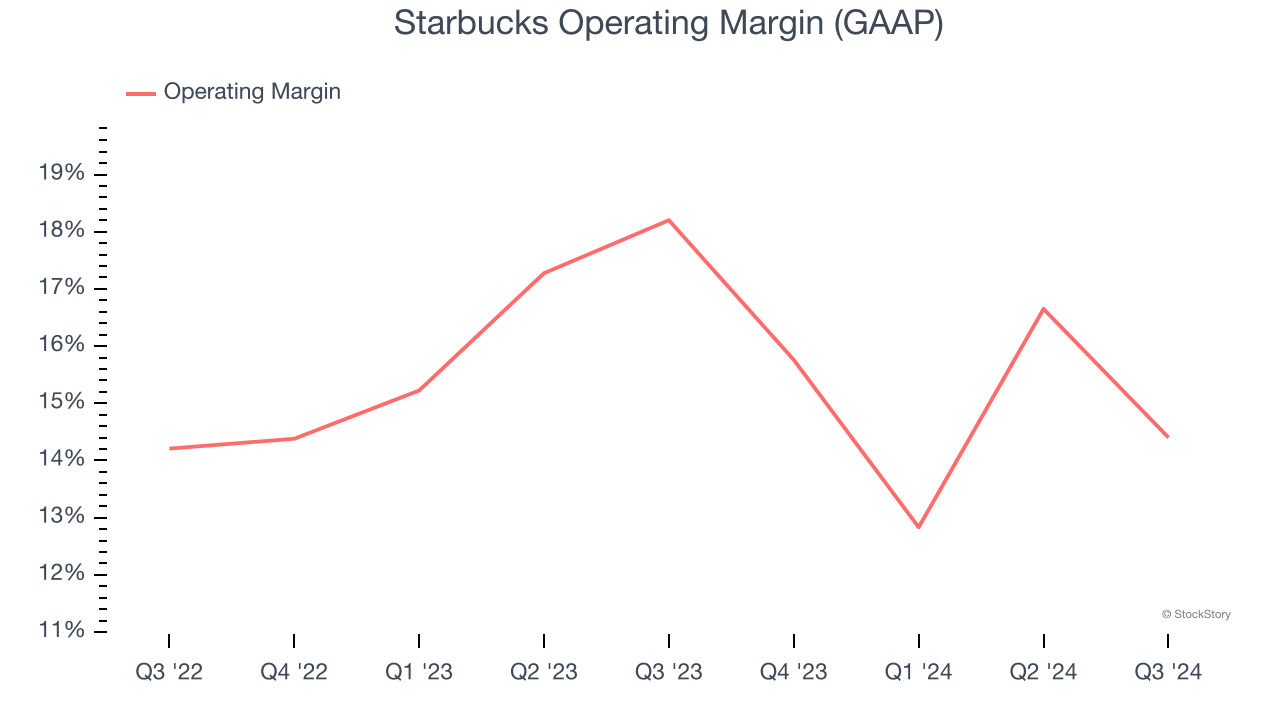

2. Operating Margin Falling

Operating margin is a key profitability metric because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

Looking at the trend in its profitability, Starbucks’s operating margin decreased by 1.4 percentage points over the last year. Even though its historical margin is high, shareholders will want to see Starbucks become more profitable in the future. Its operating margin for the trailing 12 months was 15%.

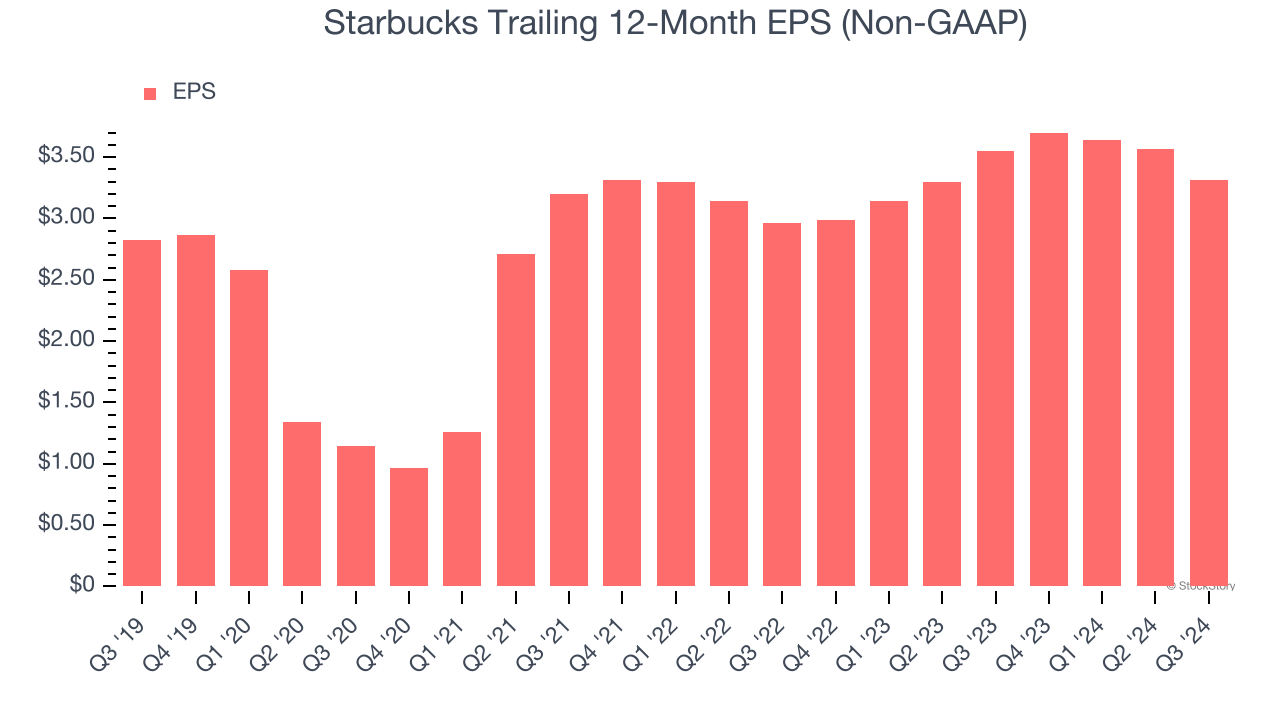

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Starbucks’s EPS grew at an unimpressive 3.2% compounded annual growth rate over the last five years, lower than its 6.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Starbucks isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 26× forward price-to-earnings (or $92.35 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Starbucks

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.