News Corp has been treading water for the past six months, recording a small loss of 0.9% while holding steady at $27.47. The stock also fell short of the S&P 500’s 6.1% gain during that period.

Is now the time to buy News Corp, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We don't have much confidence in News Corp. Here are three reasons why we avoid NWSA and a stock we'd rather own.

Why Do We Think News Corp Will Underperform?

Established in 2013 after a restructuring, News Corp (NASDAQ: NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

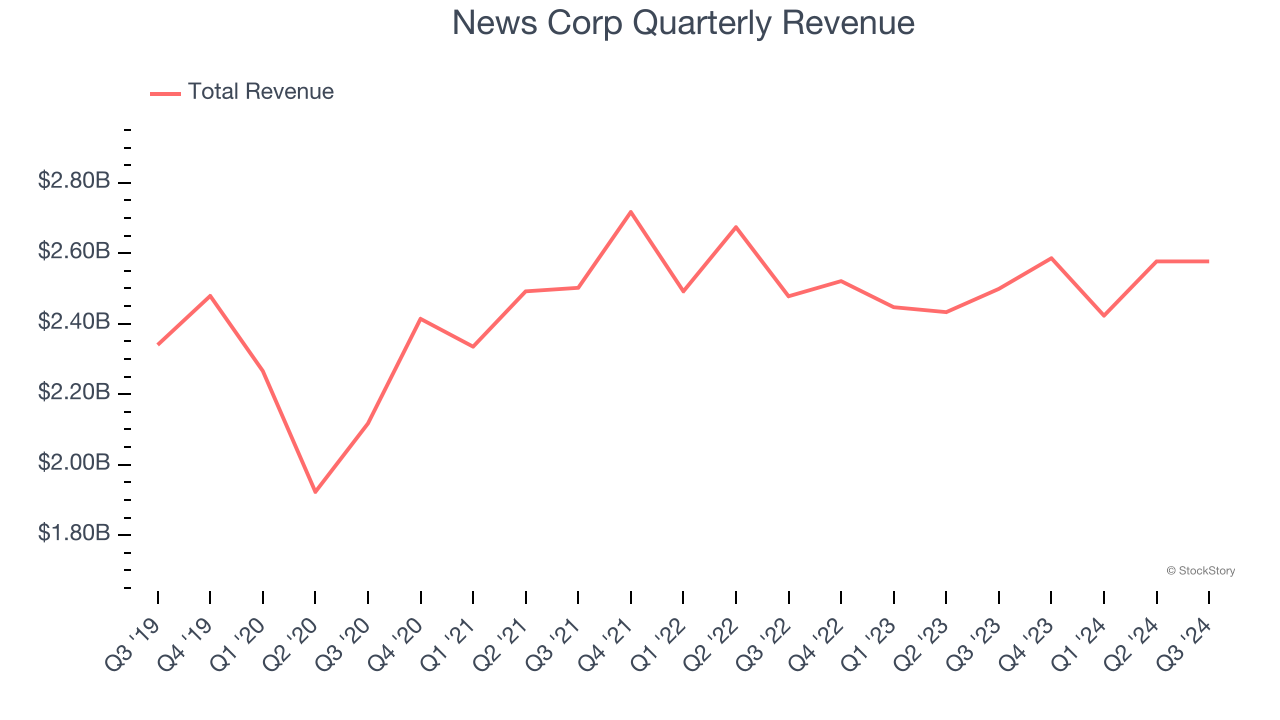

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, News Corp struggled to consistently increase demand as its $10.16 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of poor business quality.

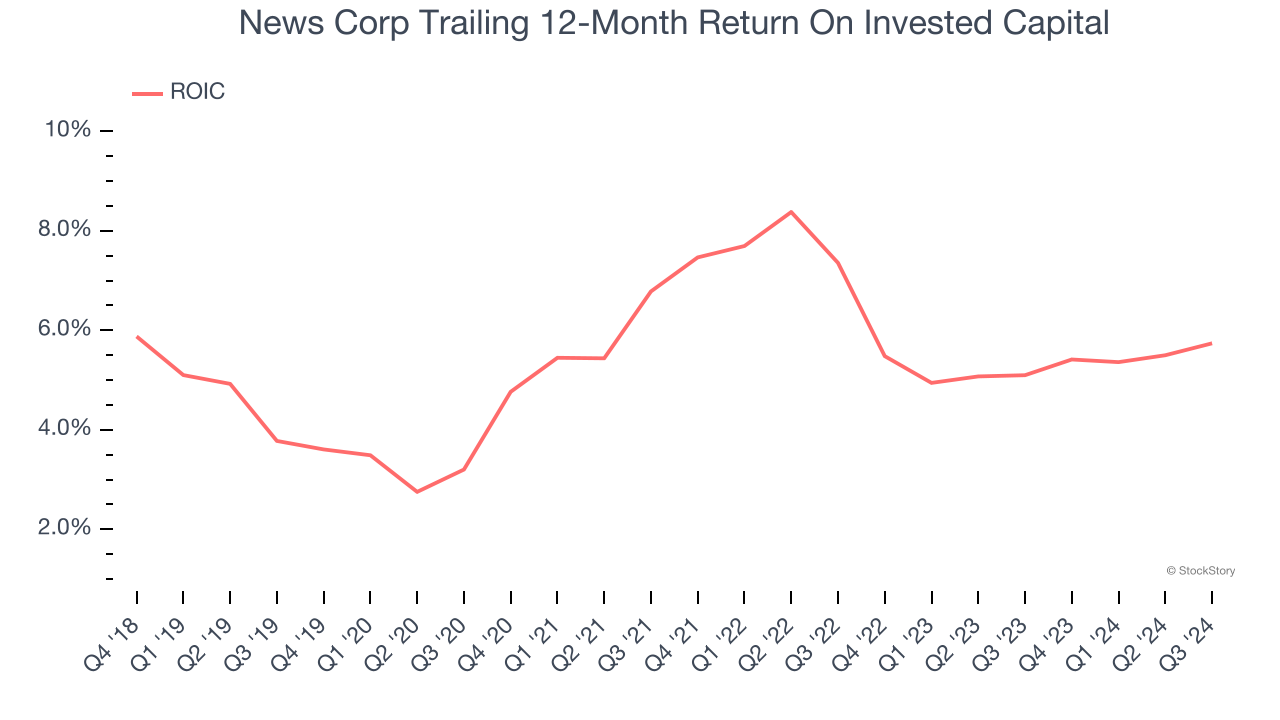

2. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

News Corp historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect News Corp’s revenue to rise by 3.9%. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of News Corp, we’ll be cheering from the sidelines. With its shares trailing the market in recent months, the stock trades at 9× forward EV-to-EBITDA (or $27.47 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Would Buy Instead of News Corp

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.