Over the past six months, Smartsheet has been a great trade, beating the S&P 500 by 24.8%. Its stock price has climbed to $56.20, representing a healthy 30.8% increase. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy SMAR? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Do Investors Watch SMAR Stock?

Founded in 2005, Smartsheet (NYSE: SMAR) is a software as a service platform that helps companies plan, manage and report on work.

Three Positive Attributes:

1. ARR Surges as Recurring Revenue Flows In

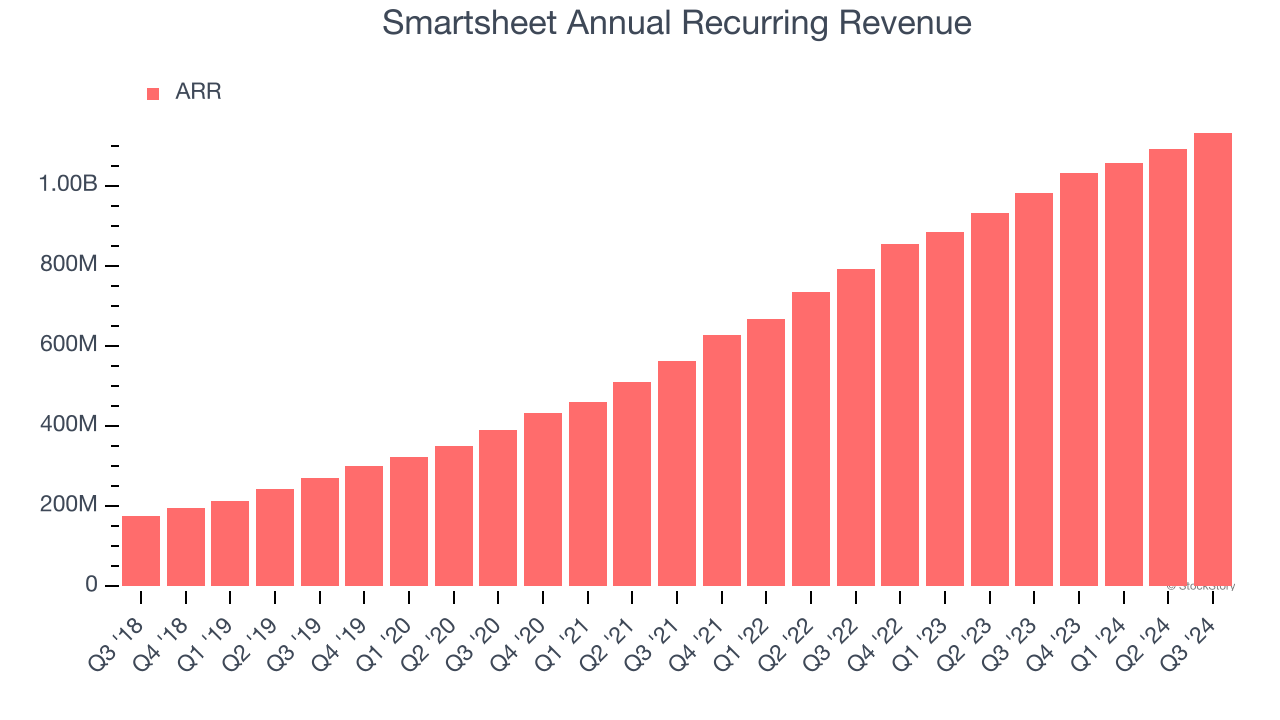

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Smartsheet’s ARR punched in at $1.13 billion in Q3, and over the last four quarters, its year-on-year growth averaged 18.1%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Smartsheet a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

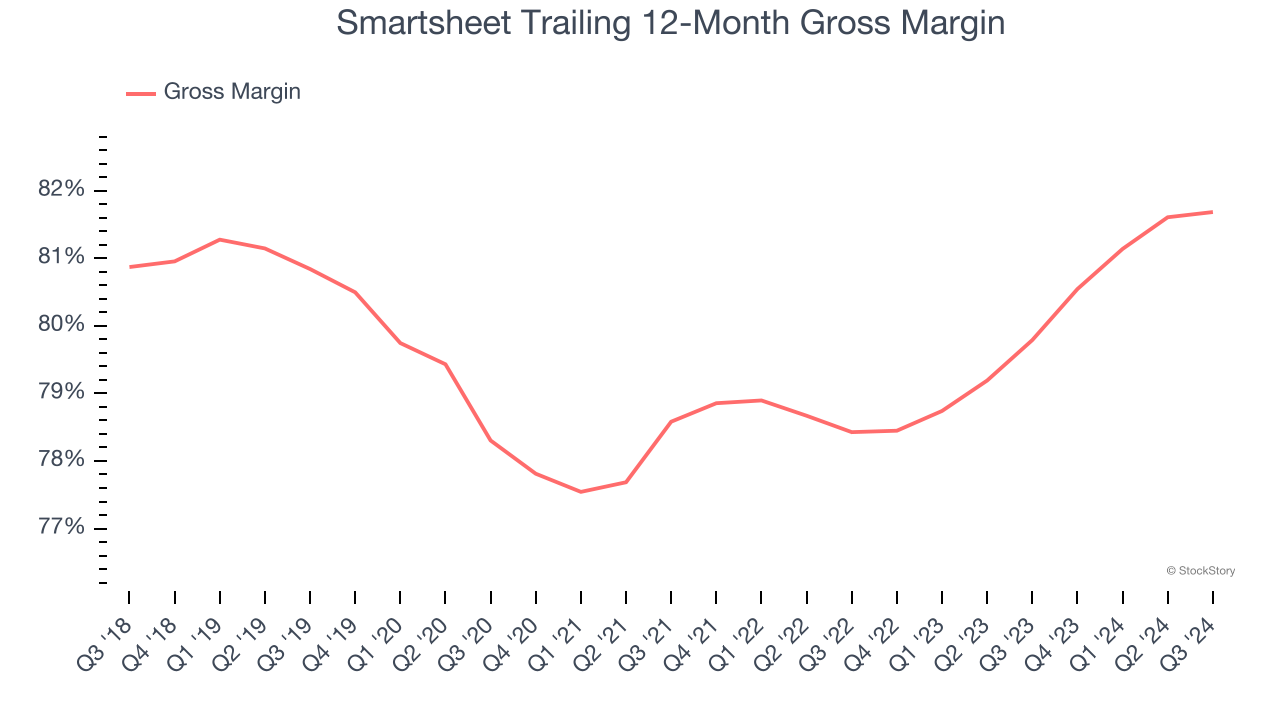

2. Elite Gross Margin Powers Best-In-Class Business Model

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Smartsheet’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 81.7% gross margin over the last year. Said differently, roughly $81.68 was left to spend on selling, marketing, and R&D for every $100 in revenue.

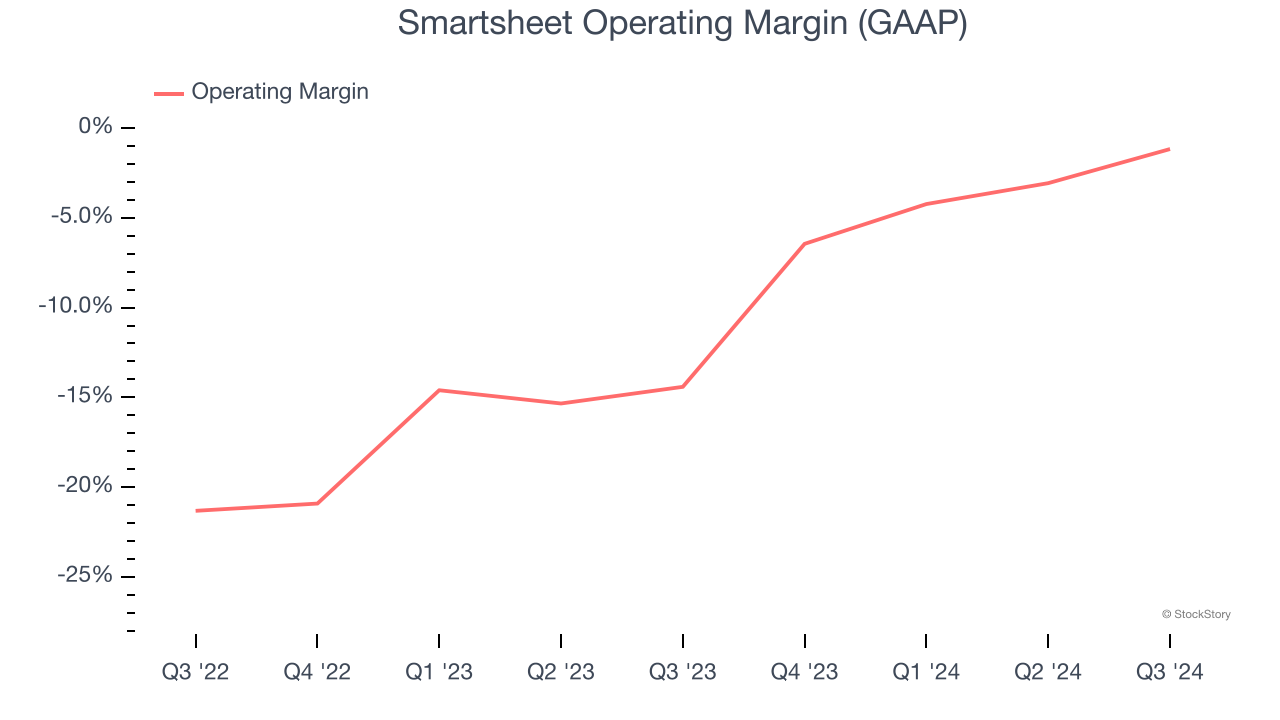

3. Operating Margin Rising, Profits Up

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Over the last year, Smartsheet’s expanding sales gave it operating leverage as its margin rose by 12.6 percentage points. Although its operating margin for the trailing 12 months was negative 3.6%, we’re confident it can one day reach sustainable profitability.

Final Judgment

Smartsheet possesses several positive attributes, and with its shares outperforming the market lately, the stock trades at 6.5× forward price-to-sales (or $56.20 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Smartsheet

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.