Latham has been on fire lately. In the past six months alone, the company’s stock price has rocketed 140%, reaching $6.40 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Latham, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why you should be careful with SWIM and a stock we'd rather own.

Why Do We Think Latham Will Underperform?

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

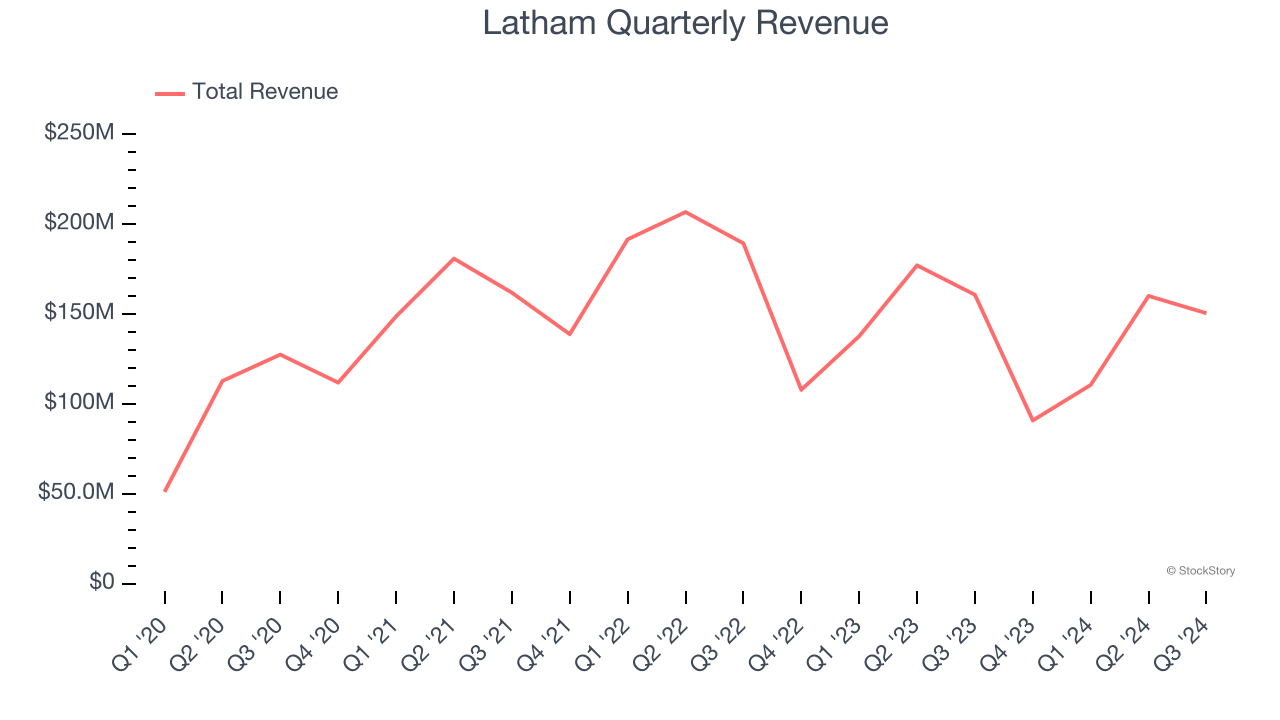

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Latham’s 9.6% annualized revenue growth over the last four years was tepid. This was below our standard for the consumer discretionary sector.

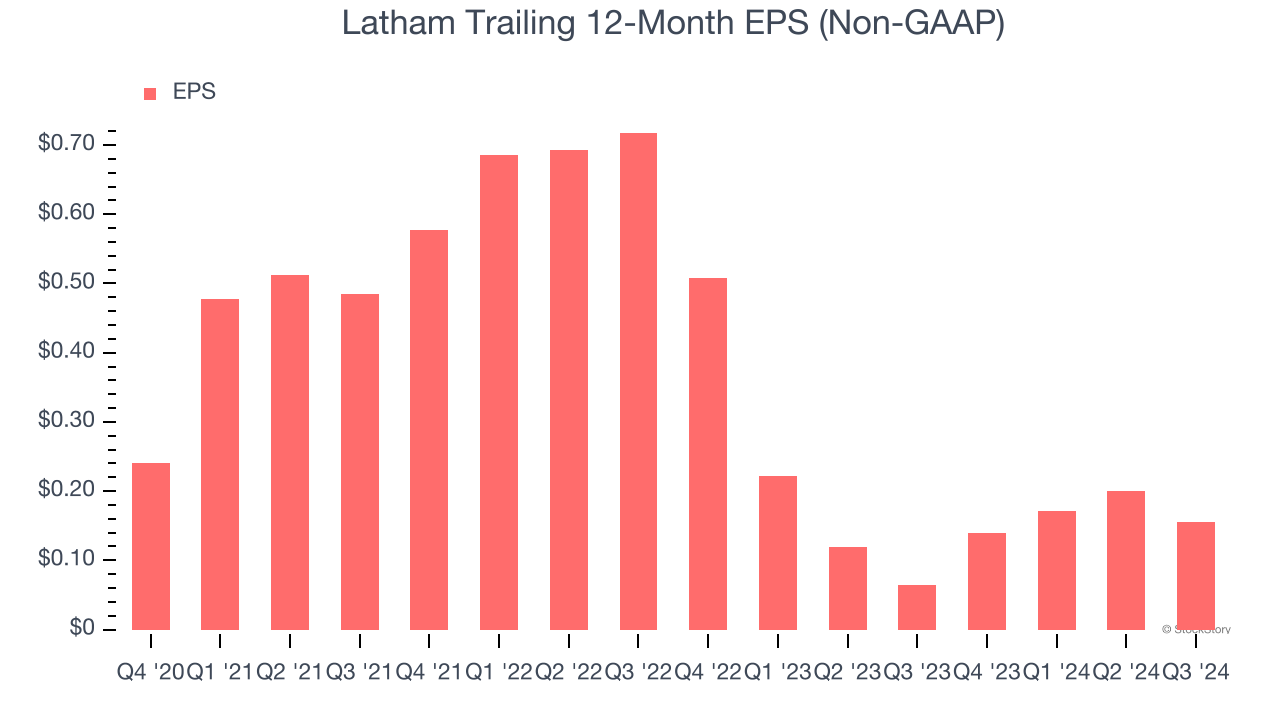

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Latham, its EPS declined by 6.2% annually over the last four years while its revenue grew by 9.6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Latham’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 12.6% for the last 12 months will decrease to 8.8%.

Final Judgment

We see the value of companies helping consumers, but in the case of Latham, we’re out. After the recent rally, the stock trades at 43.5× forward price-to-earnings (or $6.40 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Latham

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.