The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how renewable energy stocks fared in Q3, starting with Plug Power (NASDAQ: PLUG).

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 7.5% while next quarter’s revenue guidance was 7.2% below.

Thankfully, share prices of the companies have been resilient as they are up 8.2% on average since the latest earnings results.

Plug Power (NASDAQ: PLUG)

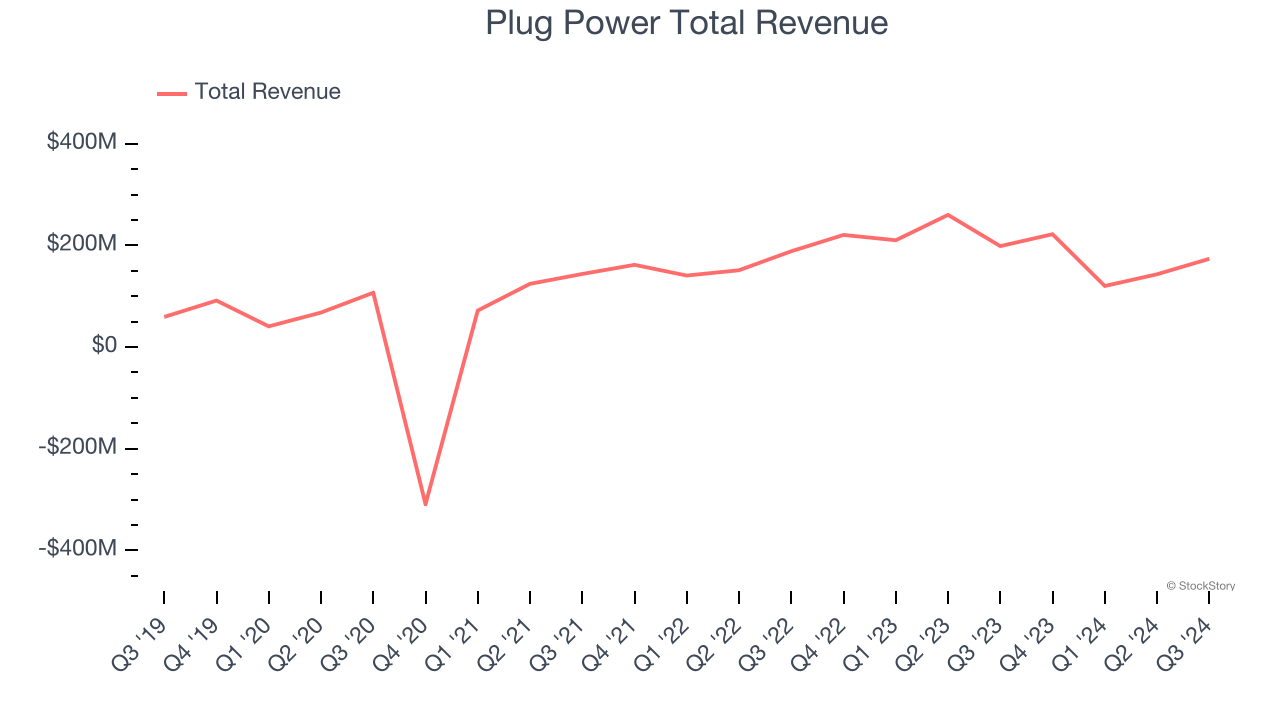

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ: PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $173.7 million, down 12.6% year on year. This print fell short of analysts’ expectations by 17.3%. Overall, it was a disappointing quarter for the company with a miss of analysts’ Power Purchase Agreements revenue estimates and full-year revenue guidance missing analysts’ expectations.

Plug Power CEO Andy Marsh stated: “Plug Power's performance this quarter underscores our commitment to building a sustainable and profitable hydrogen future. Our progress in electrolyzer deployments, advancements in hydrogen production, and expansion into new markets reflect our team's dedication to leading the build out of the hydrogen economy.”

Interestingly, the stock is up 48.6% since reporting and currently trades at $2.95.

Read our full report on Plug Power here, it’s free.

Best Q3: American Superconductor (NASDAQ: AMSC)

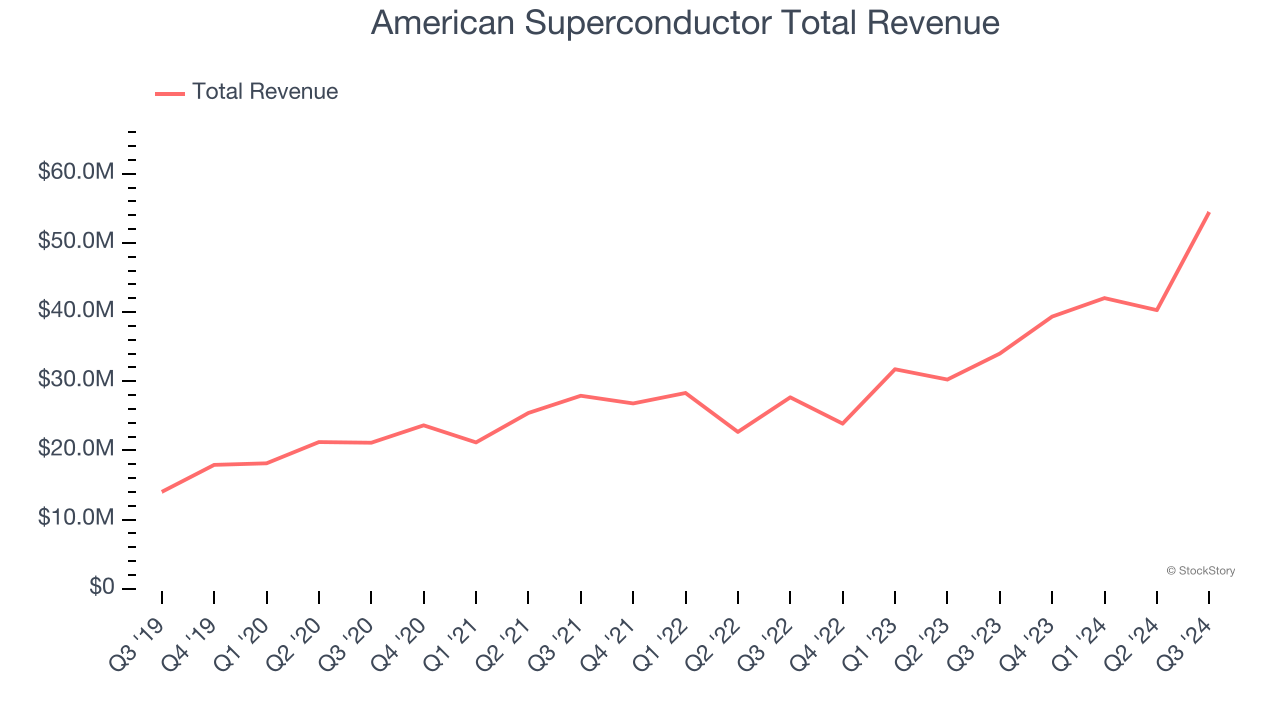

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $54.47 million, up 60.2% year on year, outperforming analysts’ expectations by 6.1%. The business had an exceptional quarter with a solid beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 19.1% since reporting. It currently trades at $28.

Is now the time to buy American Superconductor? Access our full analysis of the earnings results here, it’s free.

Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $25.19 million, down 41.9% year on year, falling short of analysts’ expectations by 28.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Blink Charging delivered the weakest full-year guidance update in the group. As expected, the stock is down 16.9% since the results and currently trades at $1.67.

Read our full analysis of Blink Charging’s results here.

Shoals (NASDAQ: SHLS)

Started in Huntsville, Alabama, Shoals (NASDAQ: SHLS) designs and manufactures products that make solar energy systems work more efficiently.

Shoals reported revenues of $102.2 million, down 23.9% year on year. This result topped analysts’ expectations by 3.4%. Aside from that, it was a mixed quarter as it also logged revenue guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ EBITDA estimates.

The stock is up 10.9% since reporting and currently trades at $6.40.

Read our full, actionable report on Shoals here, it’s free.

FuelCell Energy (NASDAQ: FCEL)

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

FuelCell Energy reported revenues of $49.33 million, up 120% year on year. This print beat analysts’ expectations by 24.4%. Aside from that, it was a slower quarter as it recorded a significant miss of analysts’ adjusted operating income estimates.

FuelCell Energy pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 33.8% since reporting and currently trades at $13.15.

Read our full, actionable report on FuelCell Energy here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.