What a time it’s been for Universal Technical Institute. In the past six months alone, the company’s stock price has increased by a massive 50.3%, reaching $25 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Universal Technical Institute, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the momentum, we're cautious about Universal Technical Institute. Here are three reasons why there are better opportunities than UTI and a stock we'd rather own.

Why Is Universal Technical Institute Not Exciting?

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

1. Weak Operating Margin Could Cause Trouble

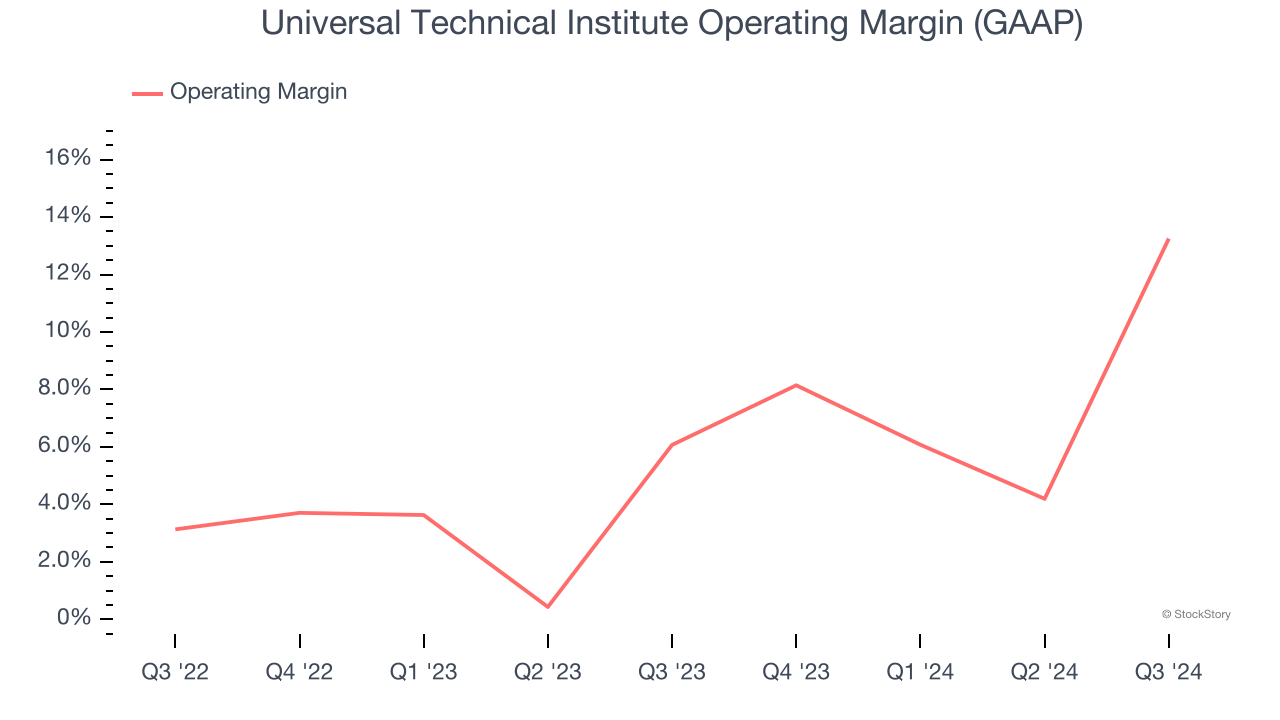

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Universal Technical Institute’s operating margin has risen over the last 12 months and averaged 6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

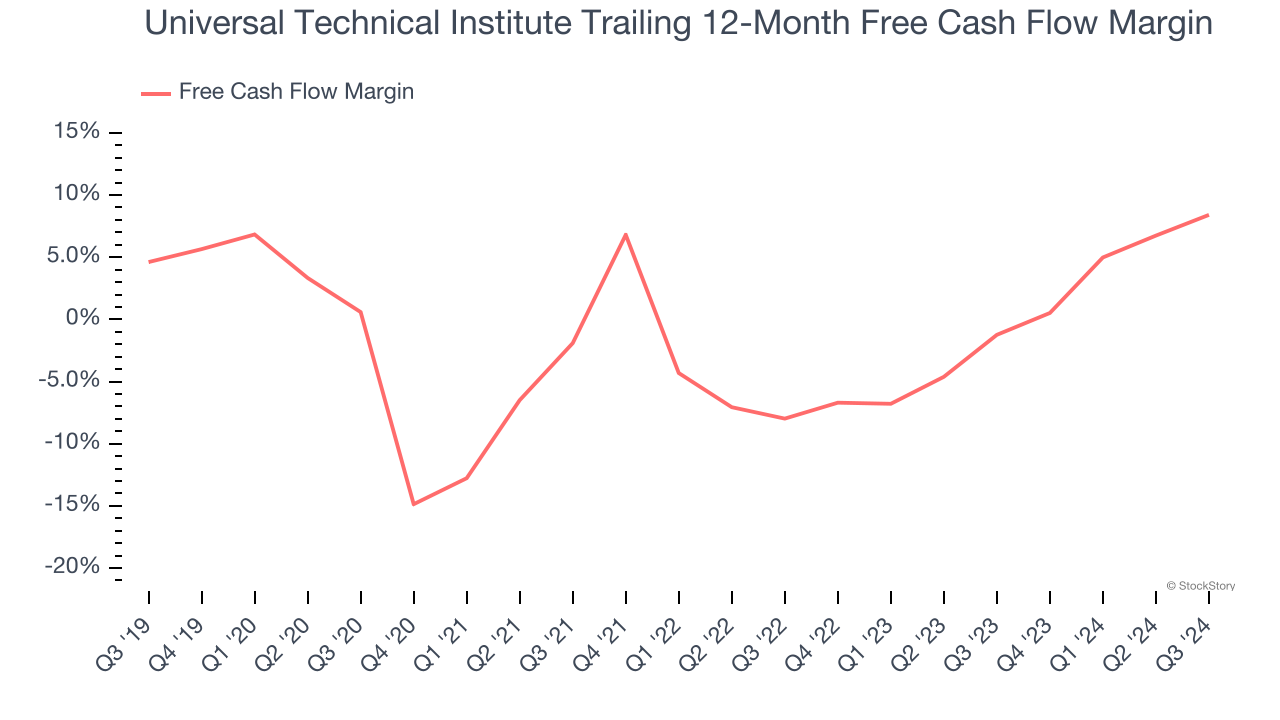

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Universal Technical Institute has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, lousy for a consumer discretionary business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

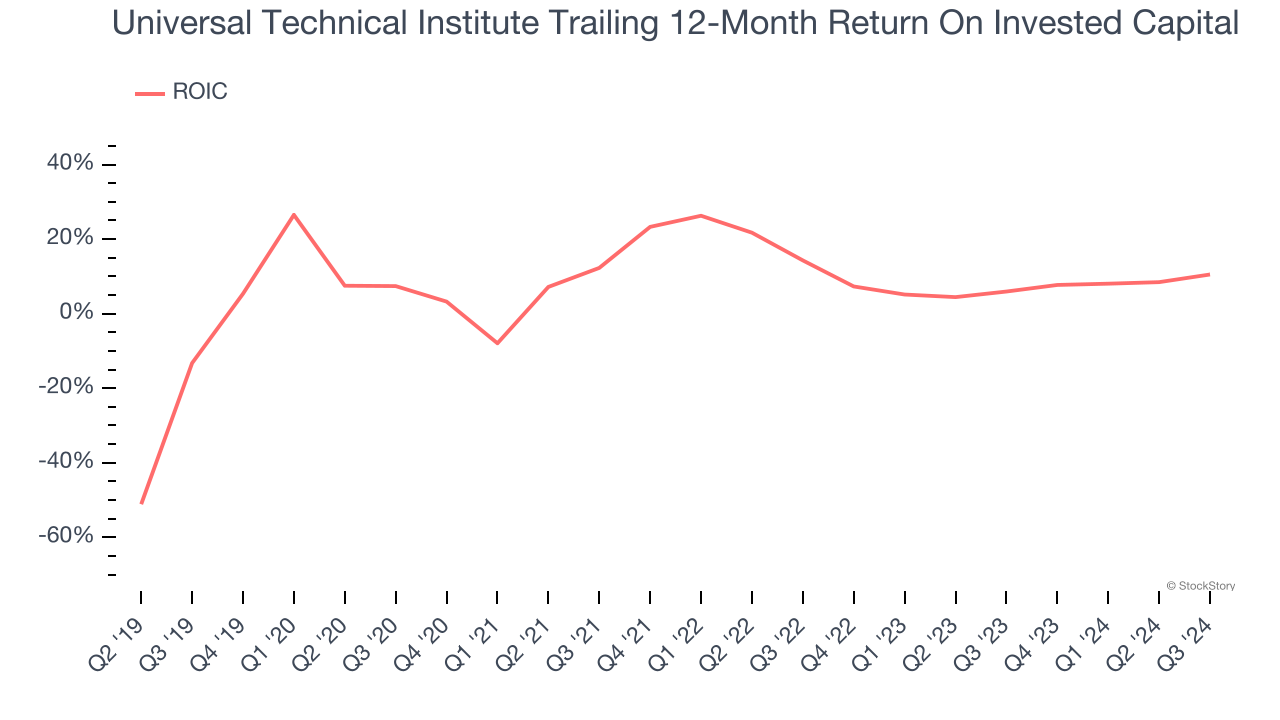

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Universal Technical Institute historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.1%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Universal Technical Institute isn’t a terrible business, but it isn’t one of our picks. Following the recent surge, the stock trades at 25.5× forward price-to-earnings (or $25 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Universal Technical Institute

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.