Over the past six months, Parsons has been a great trade, beating the S&P 500 by 9.7%. Its stock price has climbed to $92.08, representing a healthy 17% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy PSN? Find out in our full research report, it’s free.

Why Does Parsons Spark Debate?

Delivering aerospace technology during the Cold War-era, Parsons (NYSE: PSN) offers engineering, construction, and cybersecurity solutions for the infrastructure and defense sectors.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Parsons’s sales grew at an impressive 11.1% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

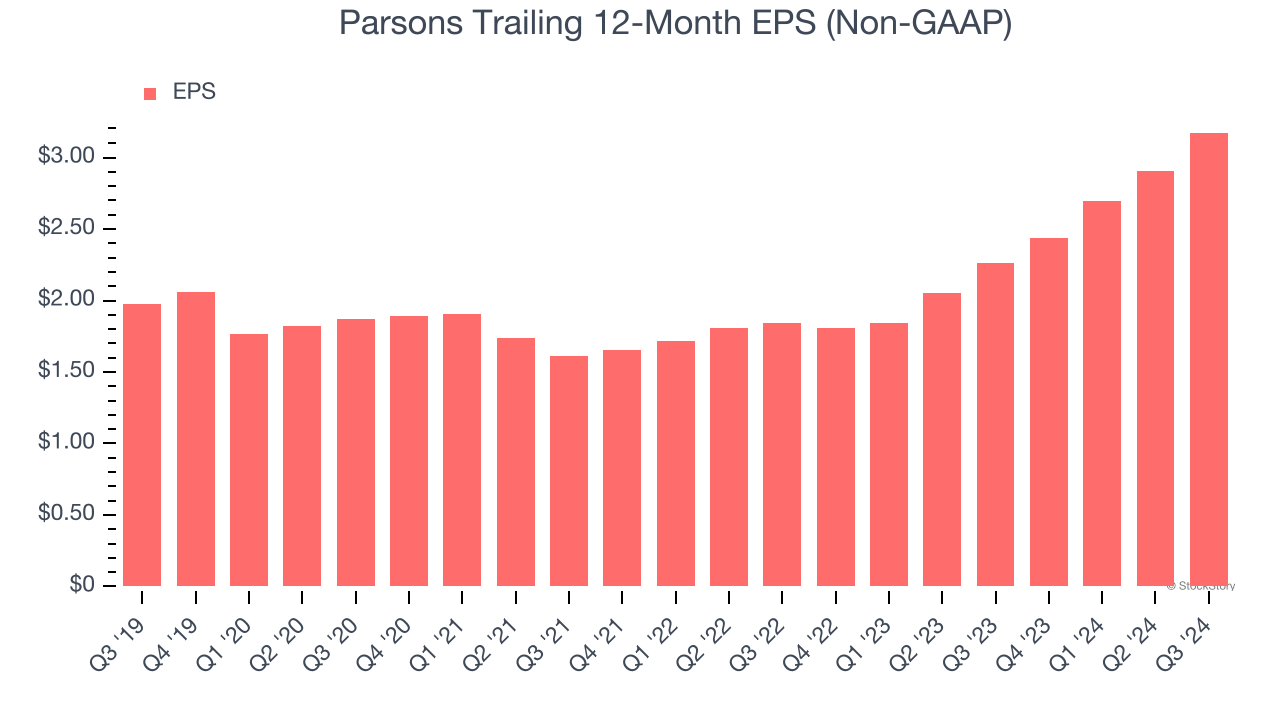

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Parsons’s EPS grew at a solid 10% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

One Reason to be Careful:

Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Defense Contractors companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Parsons’s future revenue streams.

Parsons’s backlog came in at $8.78 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 3.4%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

Final Judgment

Parsons’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 26.7× forward price-to-earnings (or $92.08 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Parsons

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.