What a fantastic six months it’s been for AppLovin. Shares of the company have skyrocketed 316%, hitting $354. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy APP? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does APP Stock Spark Debate?

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ: APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

Two Things to Like:

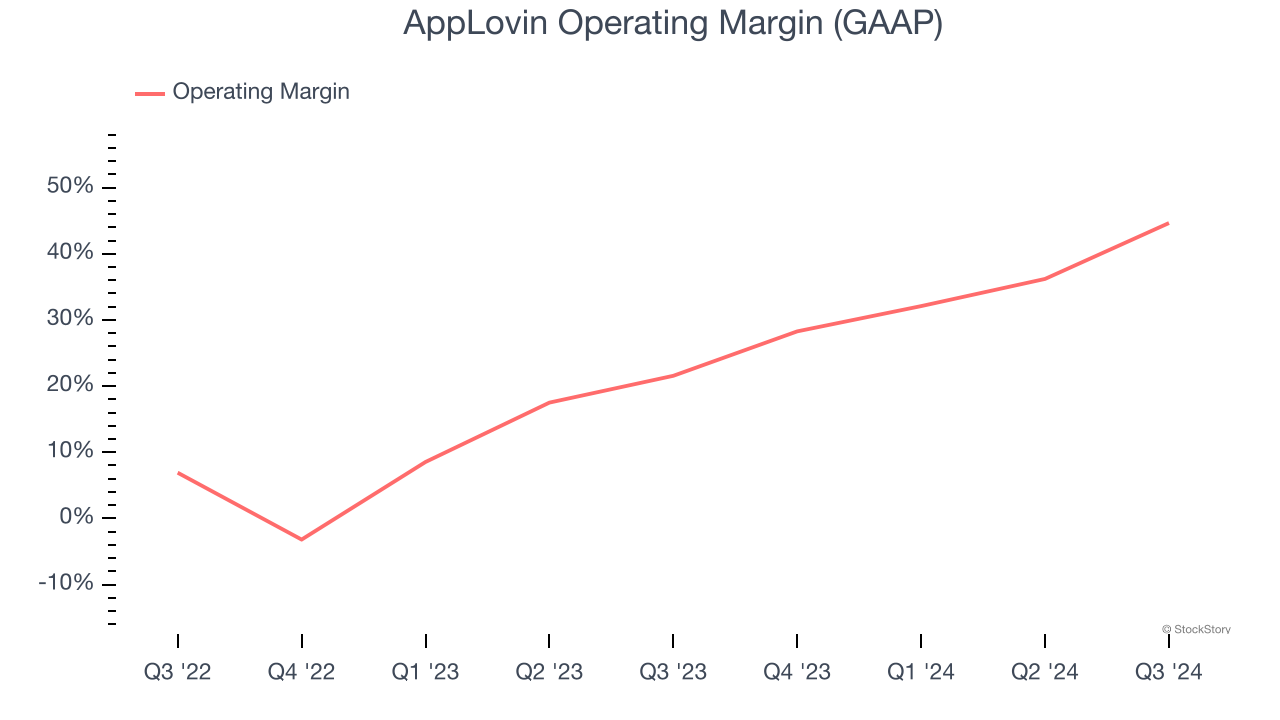

1. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

AppLovin has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 35.8%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

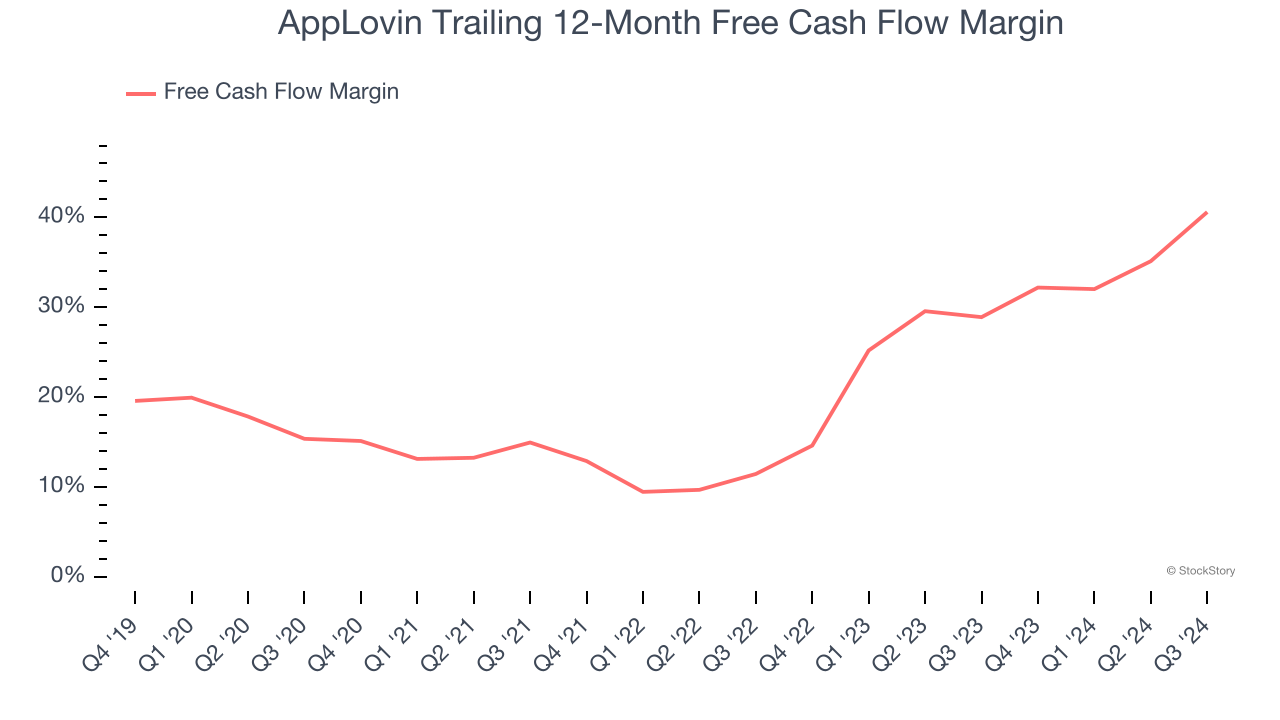

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AppLovin has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 40.6% over the last year.

One Reason to be Careful:

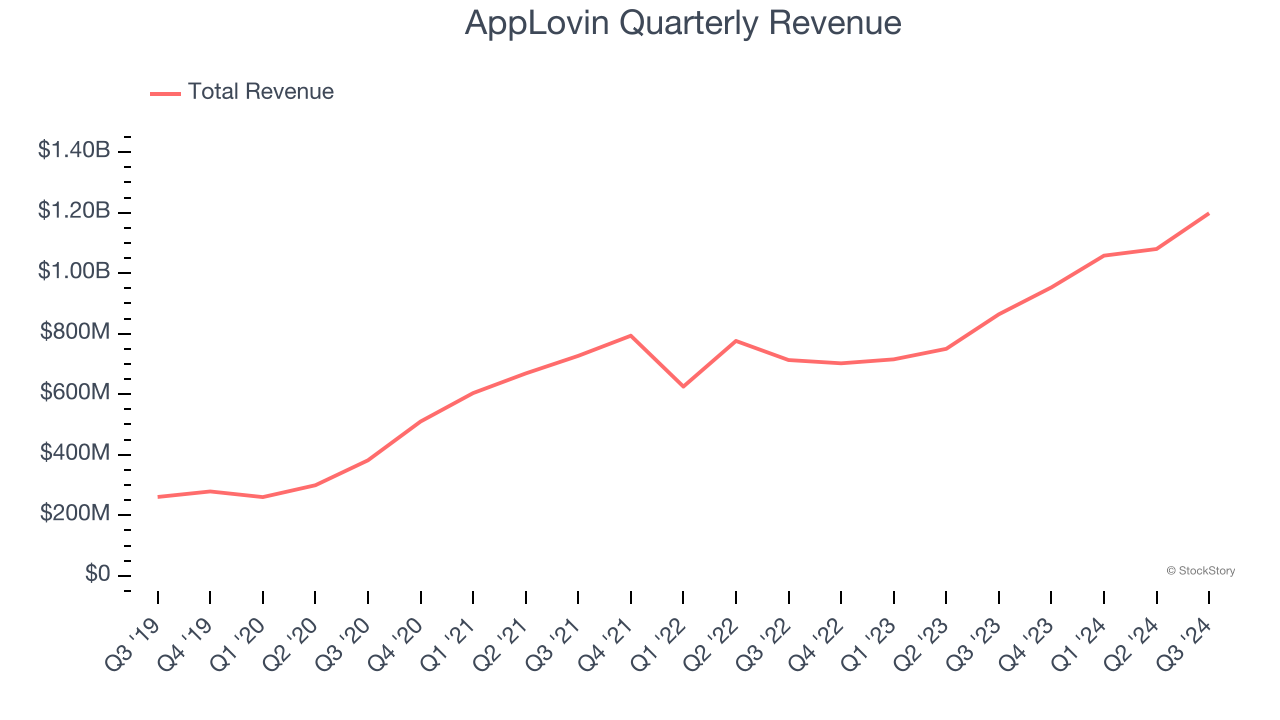

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, AppLovin grew its sales at a 19.6% compounded annual growth rate. Although this growth is solid on an absolute basis, it fell slightly short of our benchmark for the software sector. Luckily, there are other things to like about AppLovin.

Final Judgment

AppLovin has huge potential even though it has some open questions, and with the recent rally, the stock trades at 24.3× forward price-to-sales (or $354 per share). Is now the time to buy despite the apparent froth? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than AppLovin

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.