The past six months have been a windfall for Remitly’s shareholders. The company’s stock price has jumped 81.3%, hitting $22.99 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy RELY? Find out in our full research report, it’s free.

Why Are We Positive On Remitly?

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

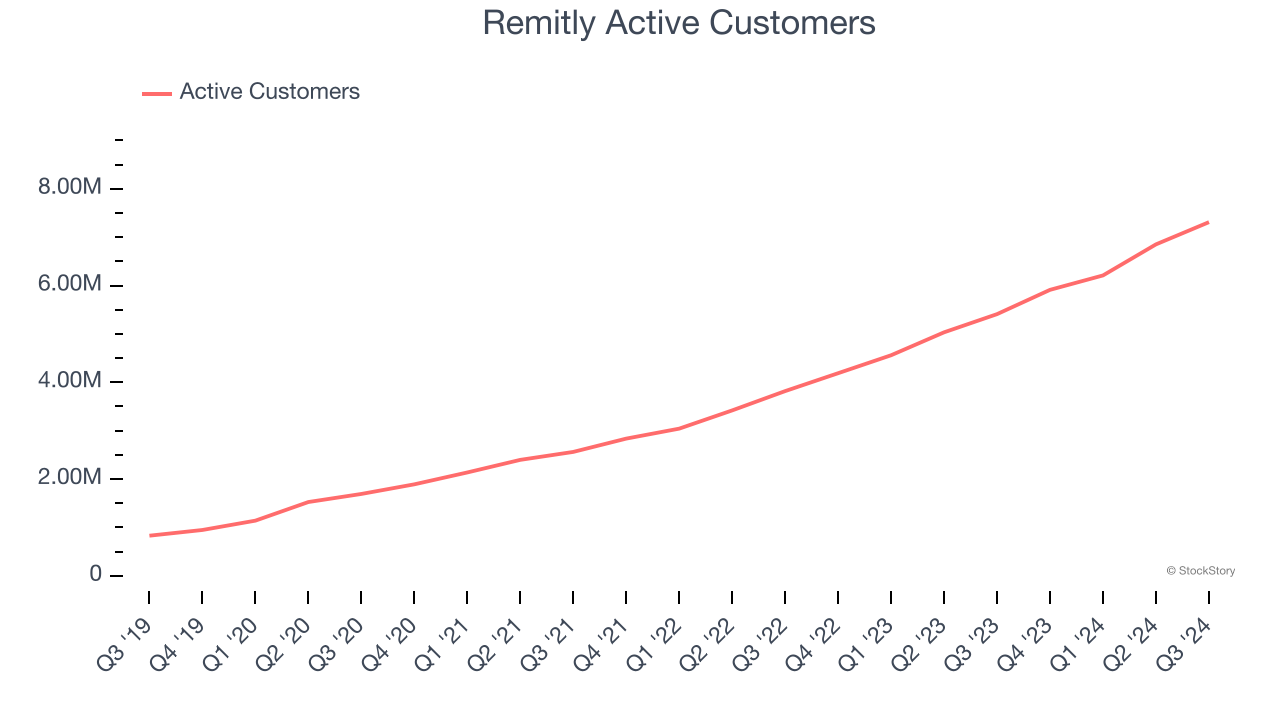

1. Active Customers Skyrocket, Fueling Growth Opportunities

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 41.9% annually to 7.31 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

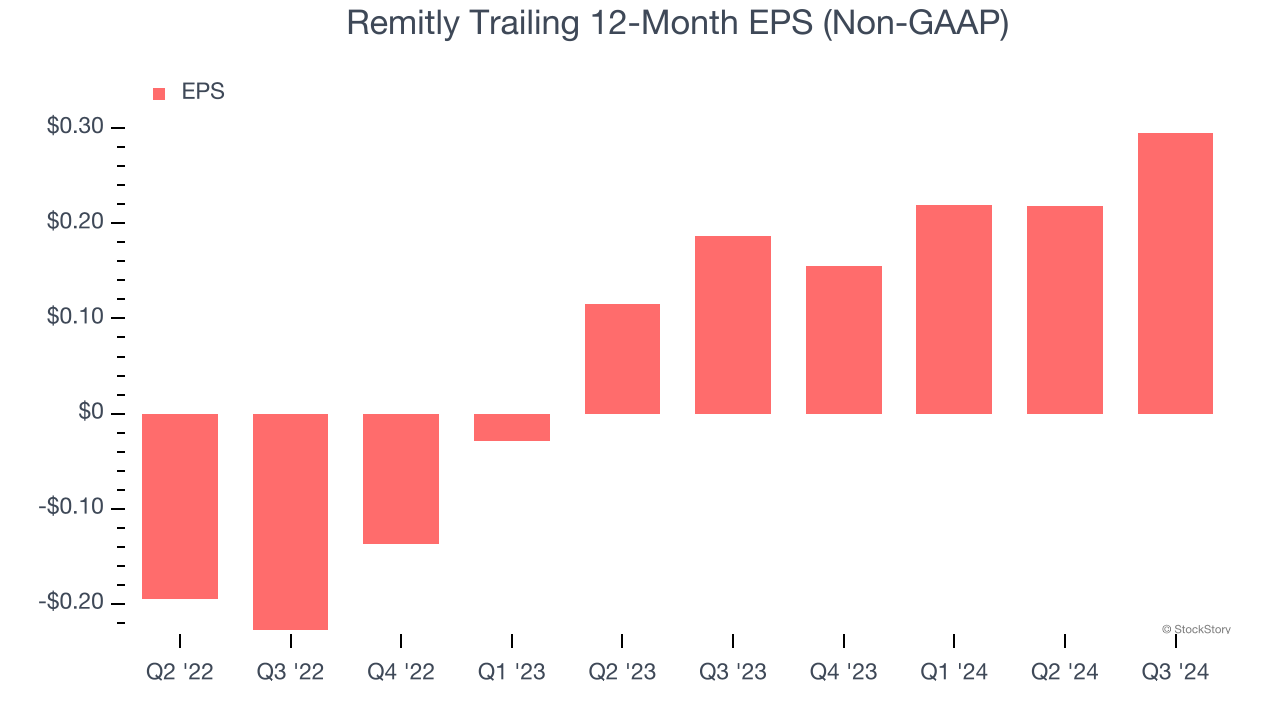

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Remitly’s full-year EPS flipped from negative to positive over the last two years. This is a good sign and shows it’s at an inflection point.

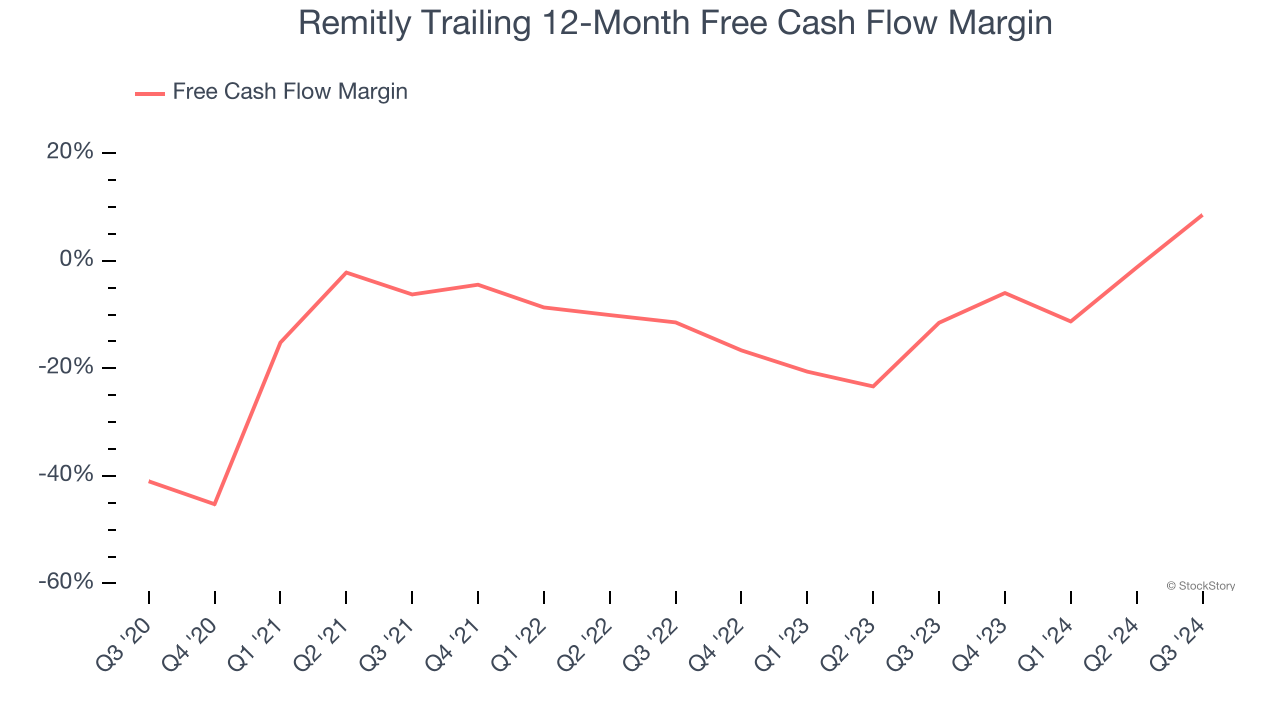

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Remitly’s margin expanded by 14.8 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose by more than its operating profitability. Remitly’s free cash flow margin for the trailing 12 months was 8.5%.

Final Judgment

These are just a few reasons why we think Remitly is a high-quality business, and with the recent rally, the stock trades at 32× forward EV-to-EBITDA (or $22.99 per share). Is now the time to buy despite the apparent froth? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Remitly

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.