The ONE Group’s stock price has taken a beating over the past six months, shedding 29.6% of its value and falling to $2.92 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in The ONE Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why STKS doesn't excite us and a stock we'd rather own.

Why Is The ONE Group Not Exciting?

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ: STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

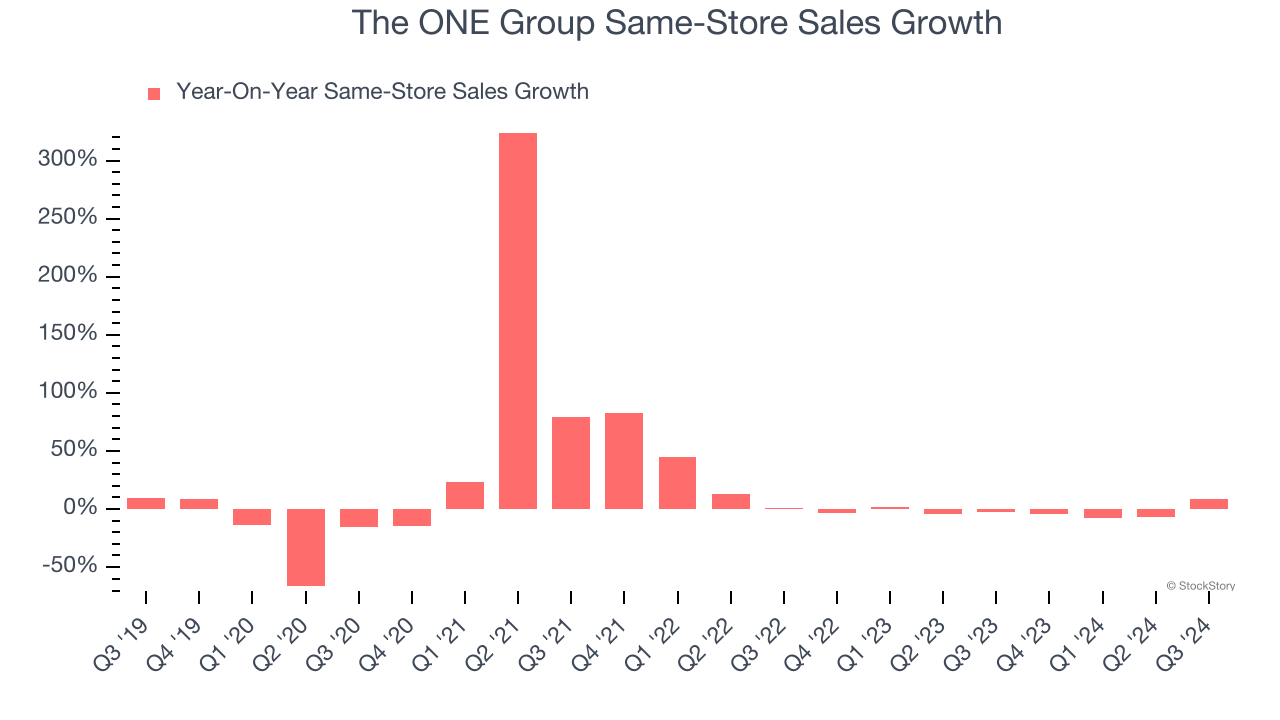

1. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 2.4% annual declines.

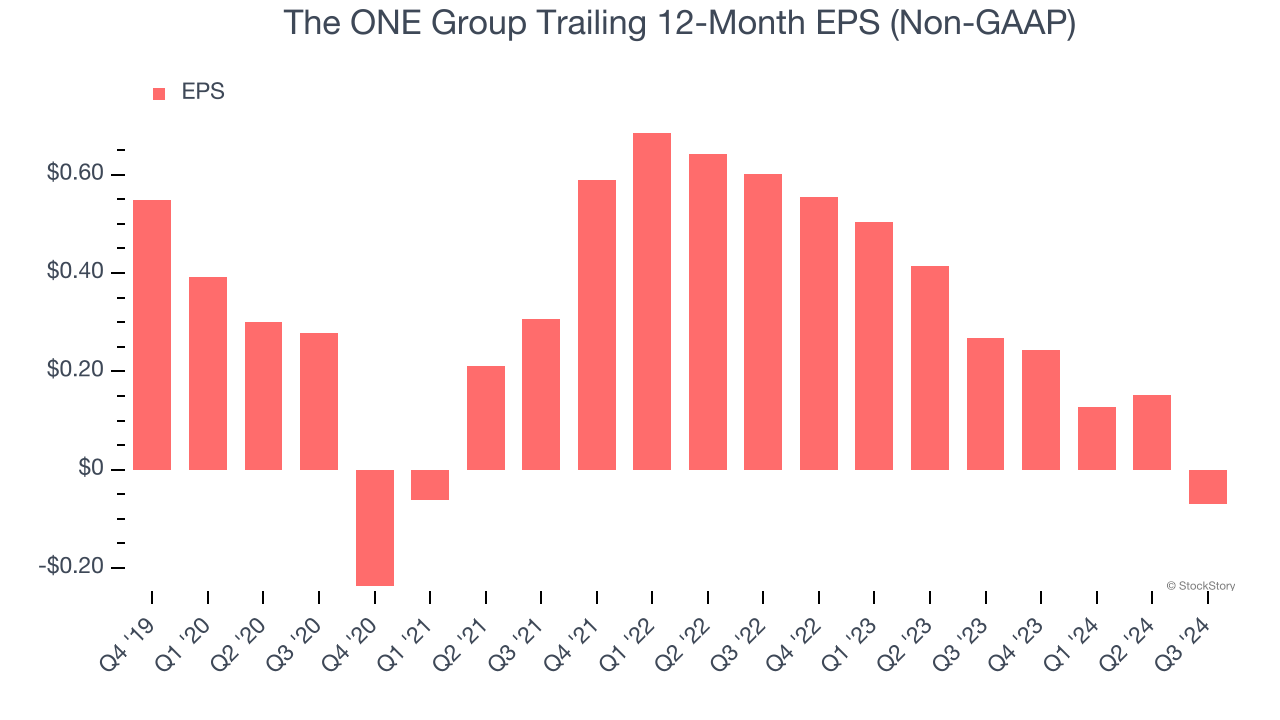

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for The ONE Group, its EPS declined by 39.5% annually over the last five years while its revenue grew by 41.8%. This tells us the company became less profitable on a per-share basis as it expanded.

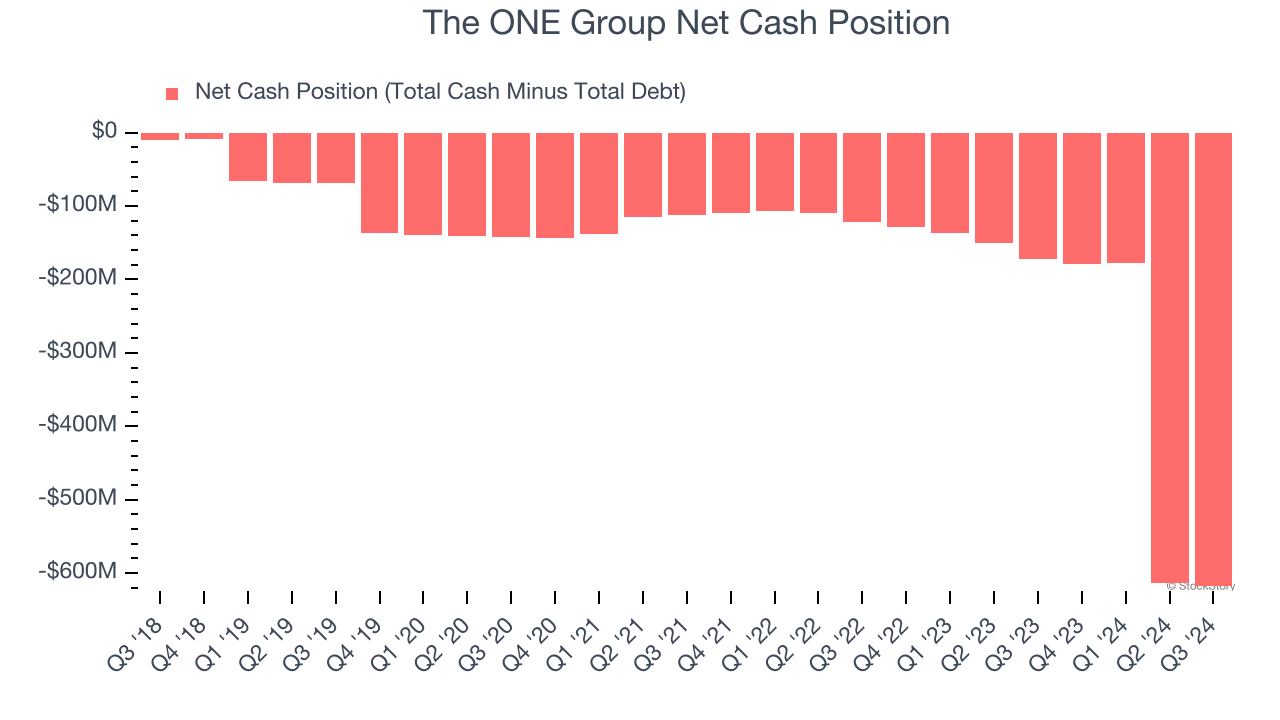

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

The ONE Group’s $646.2 million of debt exceeds the $28.19 million of cash on its balance sheet. Furthermore, its 10× net-debt-to-EBITDA ratio (based on its EBITDA of $63.36 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. The ONE Group could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope The ONE Group can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

The ONE Group isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 4.8× forward price-to-earnings (or $2.92 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Would Buy Instead of The ONE Group

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.