Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Walgreens (NASDAQ: WBA) and the best and worst performers in the consumer retail industry.

Consumer retail companies operate the brick-and-mortar stores where consumers have shopped for centuries. The way people shop is changing with increased penetration of technology, but these retailers are adapting and still very much a part of the consumer fabric.

The 61 consumer retail stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 2.1% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Walgreens (NASDAQ: WBA)

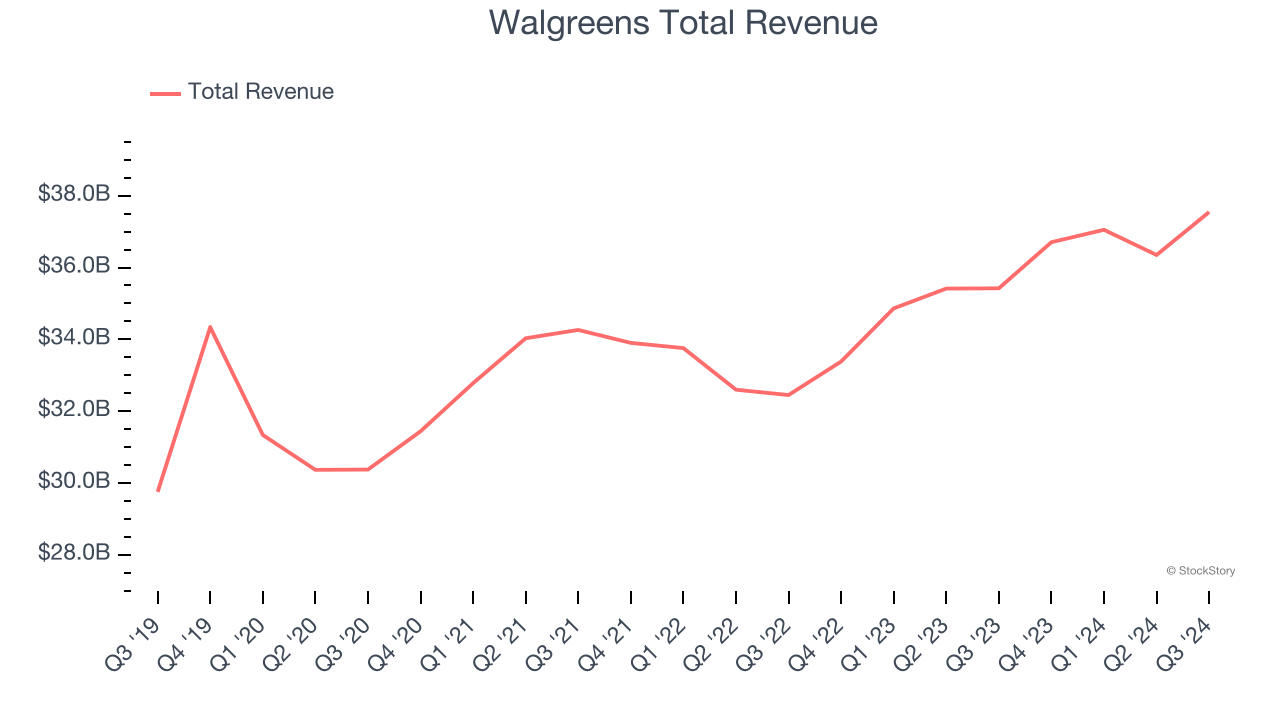

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ: WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

Walgreens reported revenues of $37.55 billion, up 6% year on year. This print exceeded analysts’ expectations by 5.6%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ same-store sales estimates.

“Our financial results in the fiscal fourth quarter and full year 2024 reflected our disciplined execution on cost management, working capital initiatives and capex reduction. In fiscal 2025, we are focusing on stabilizing the retail pharmacy by optimizing our footprint, controlling operating costs, improving cash flow, and continuing to address reimbursement models to support dispensing margins and preserve patient access for the future,” said Tim Wentworth, Chief Executive Officer, Walgreens Boots Alliance.

Interestingly, the stock is up 6% since reporting and currently trades at $9.53.

Is now the time to buy Walgreens? Access our full analysis of the earnings results here, it’s free.

Best Q3: Sportsman's Warehouse (NASDAQ: SPWH)

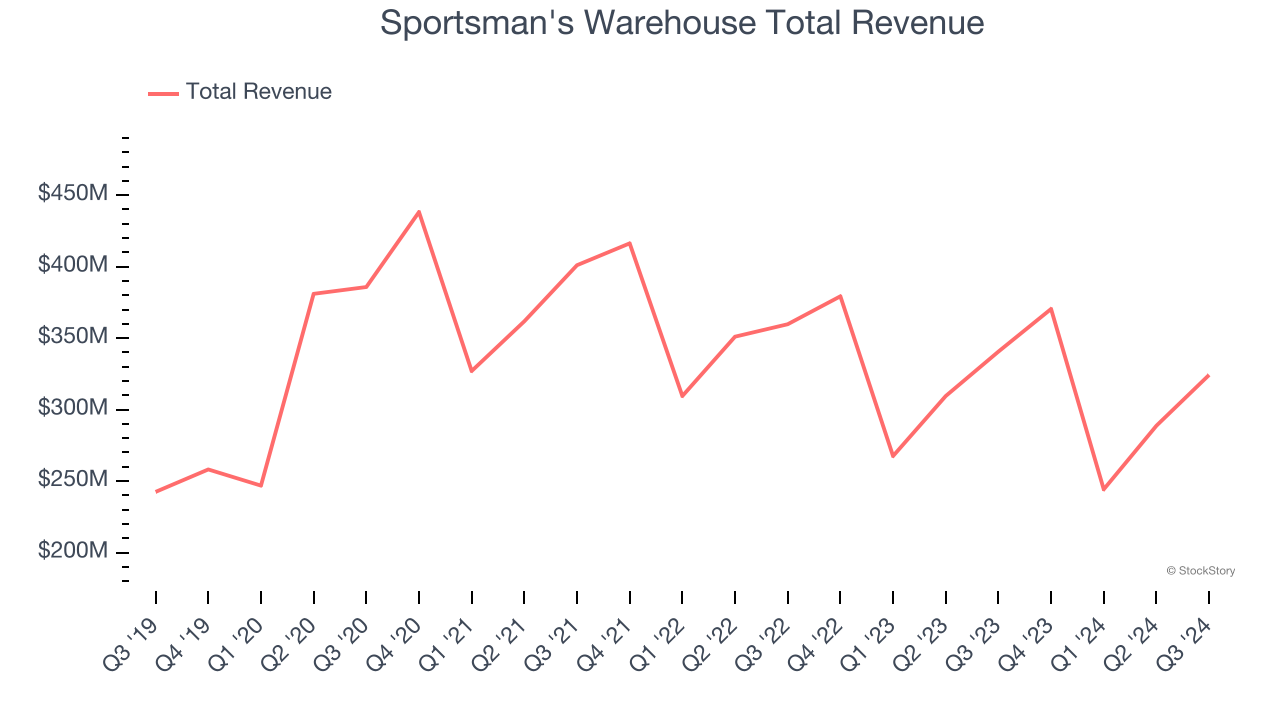

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ: SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $324.3 million, down 4.8% year on year, outperforming analysts’ expectations by 7.9%. The business had a stunning quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

Sportsman's Warehouse scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 7.8% since reporting. It currently trades at $2.64.

Is now the time to buy Sportsman's Warehouse? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: OneWater (NASDAQ: ONEW)

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

OneWater reported revenues of $377.9 million, down 16.2% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

OneWater delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 29.5% since the results and currently trades at $16.76.

Read our full analysis of OneWater’s results here.

TJX (NYSE: TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE: TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $14.06 billion, up 6% year on year. This print surpassed analysts’ expectations by 0.8%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is flat since reporting and currently trades at $120.25.

Read our full, actionable report on TJX here, it’s free.

Five Below (NASDAQ: FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ: FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $843.7 million, up 14.6% year on year. This result beat analysts’ expectations by 5.3%. It was a very strong quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Five Below achieved the fastest revenue growth among its peers. The stock is down 7.4% since reporting and currently trades at $97.07.

Read our full, actionable report on Five Below here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.