ADT currently trades at $7.12 per share and has shown little upside over the past six months, posting a small loss of 3.3%. The stock also fell short of the S&P 500’s 7% gain during that period.

Is there a buying opportunity in ADT, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're swiping left on ADT for now. Here are three reasons why ADT doesn't excite us and a stock we'd rather own.

Why Is ADT Not Exciting?

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE: ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

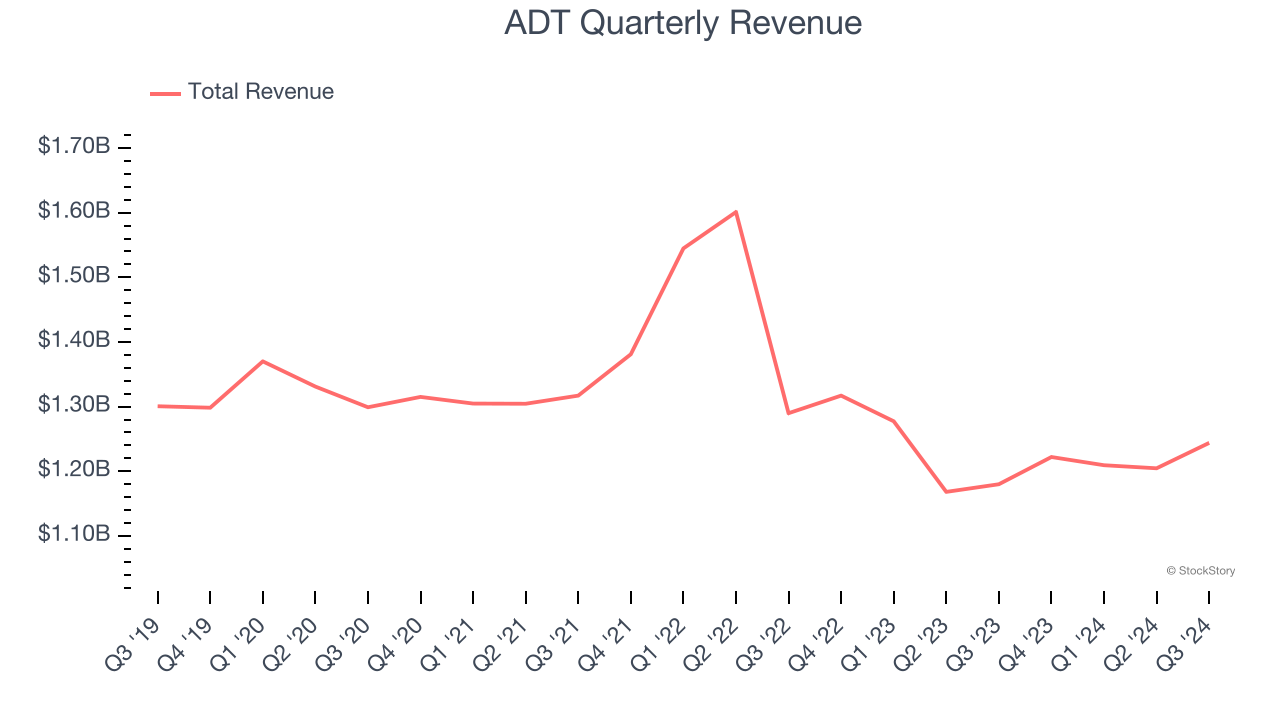

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, ADT struggled to consistently increase demand as its $4.88 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

2. Decline in Customers Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like ADT, our preferred volume metric is customers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

ADT’s customers came in at 6.4 million in the latest quarter, and over the last two years, averaged 2.3% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests ADT might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

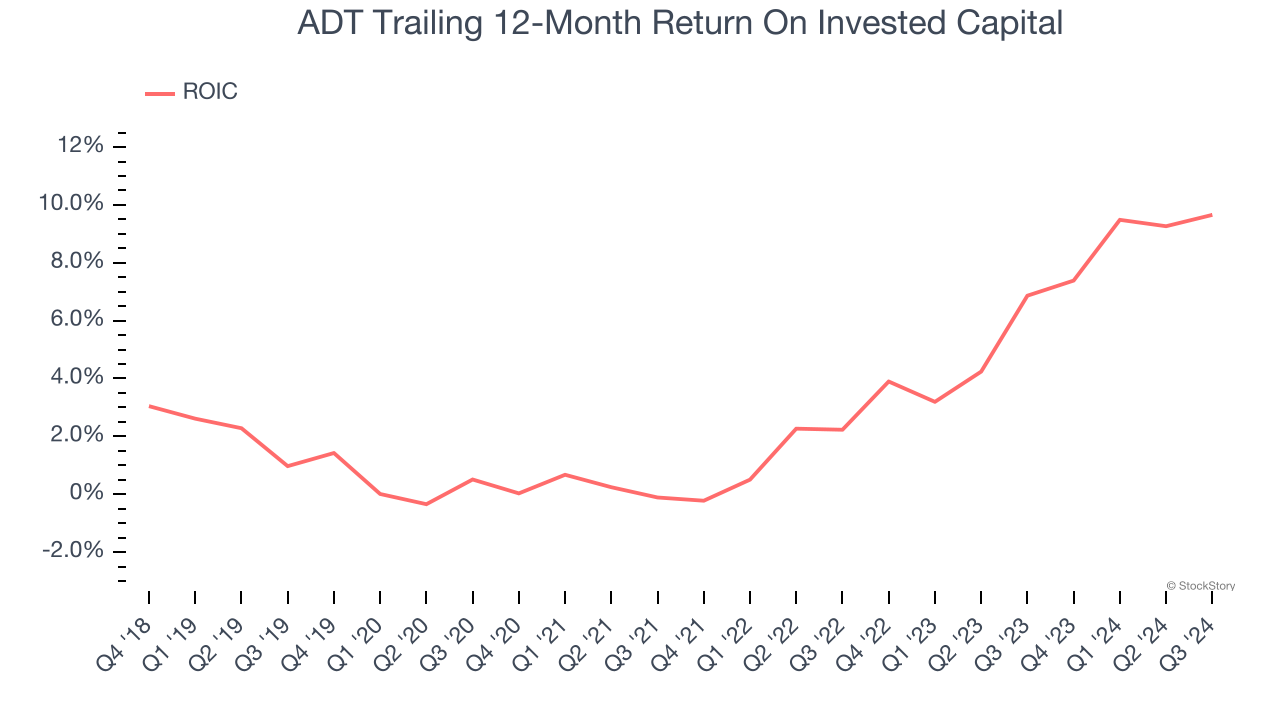

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ADT historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.8%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

ADT isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 8.8× forward price-to-earnings (or $7.12 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. Let us point you toward Uber, whose profitability just reached an inflection point.

Stocks We Like More Than ADT

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.