Sanmina has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.6%. The stock now trades at $75.47, marking a 13.9% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Sanmina, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we're sitting this one out for now. Here are three reasons why we avoid SANM and a stock we'd rather own.

Why Do We Think Sanmina Will Underperform?

Founded in 1980, Sanmina (NASDAQ: SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

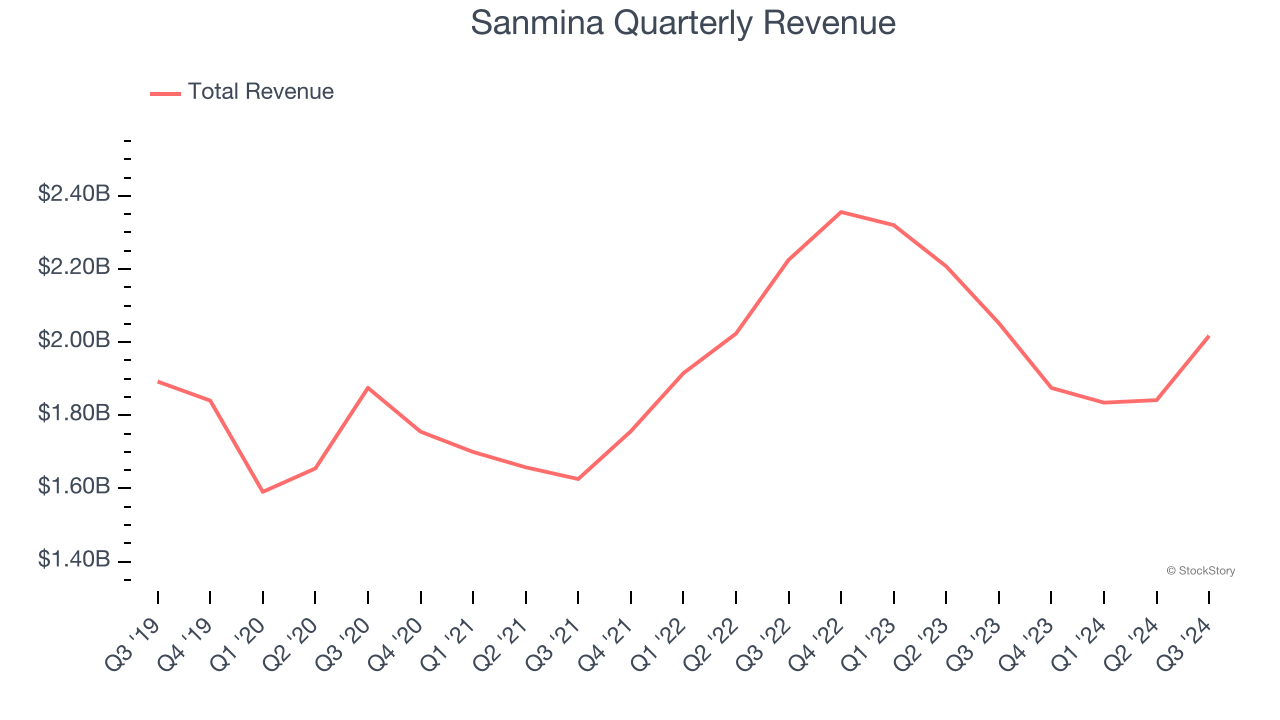

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Sanmina’s demand was weak and its revenue declined by 1.2% per year. This was below our standards and signals it’s a low quality business.

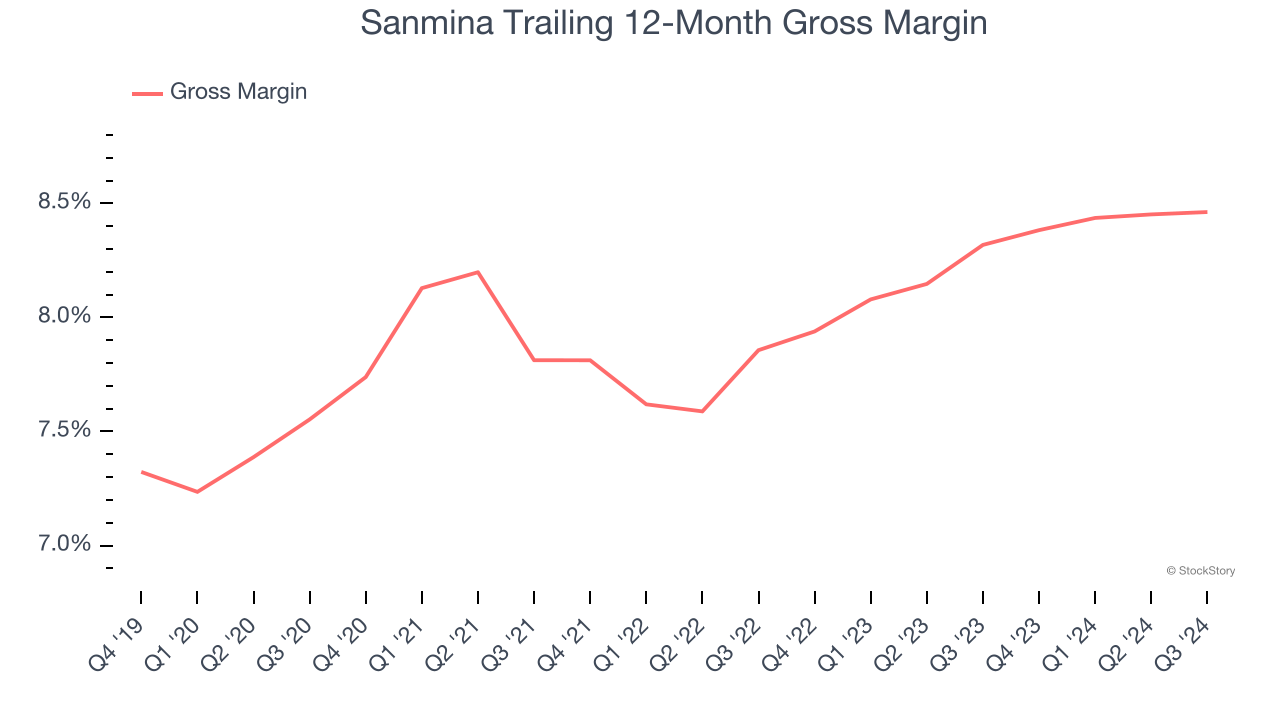

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Sanmina has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 8% gross margin over the last five years. Said differently, Sanmina had to pay a chunky $91.98 to its suppliers for every $100 in revenue.

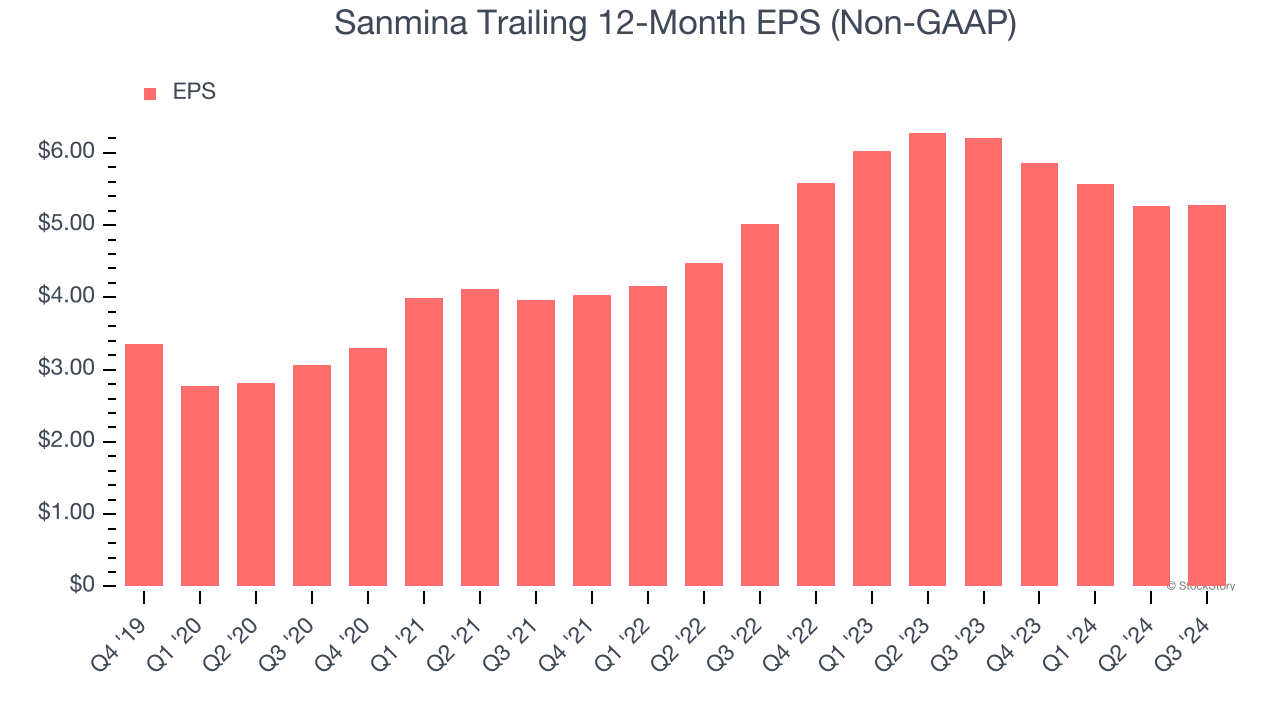

3. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sanmina’s EPS grew at a weak 2.6% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 2.2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

We see the value of companies helping their customers, but in the case of Sanmina, we’re out. With its shares outperforming the market lately, the stock trades at 13.5× forward price-to-earnings (or $75.47 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now. We’d recommend looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Sanmina

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.