Endeavor’s 14.9% return over the past six months has outpaced the S&P 500 by 8.6%, and its stock price has climbed to $31.26 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Endeavor, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we don't have much confidence in Endeavor. Here are three reasons why you should be careful with EDR and a stock we'd rather own.

Why Do We Think Endeavor Will Underperform?

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE: EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

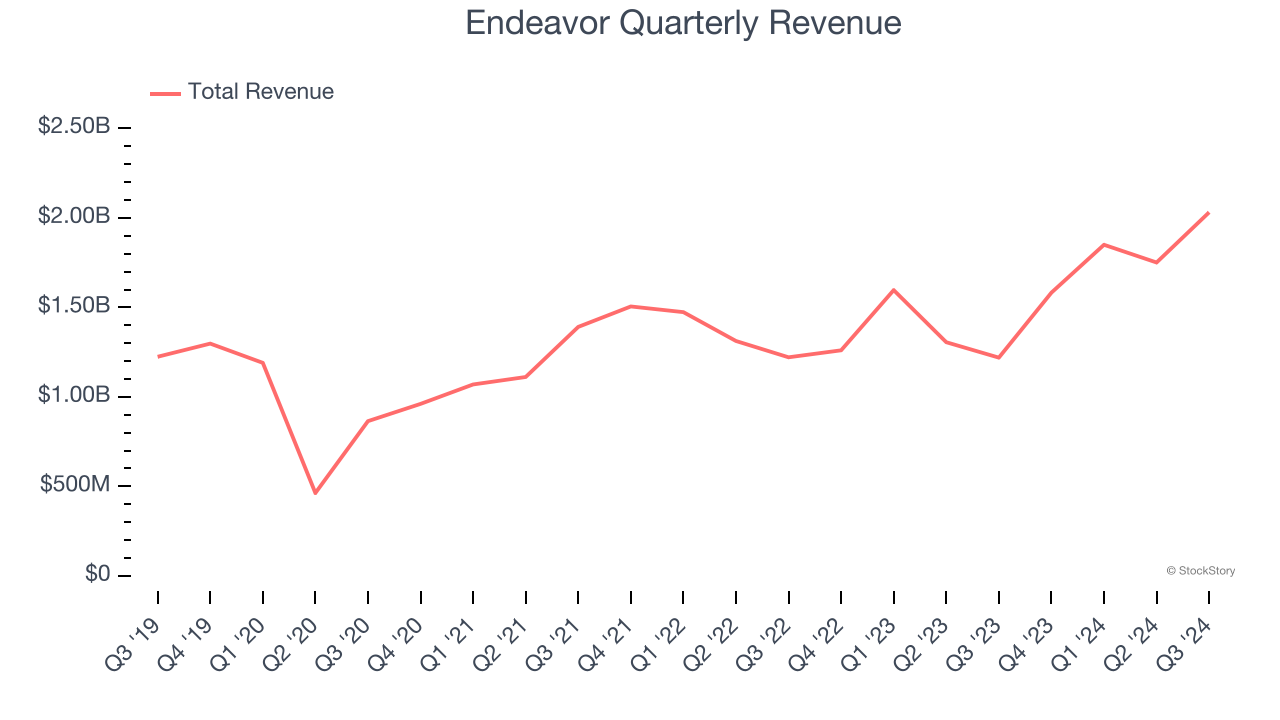

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Endeavor grew its sales at a 11.5% compounded annual growth rate. Although this growth is solid on an absolute basis, it fell short of our benchmark for the consumer discretionary sector.

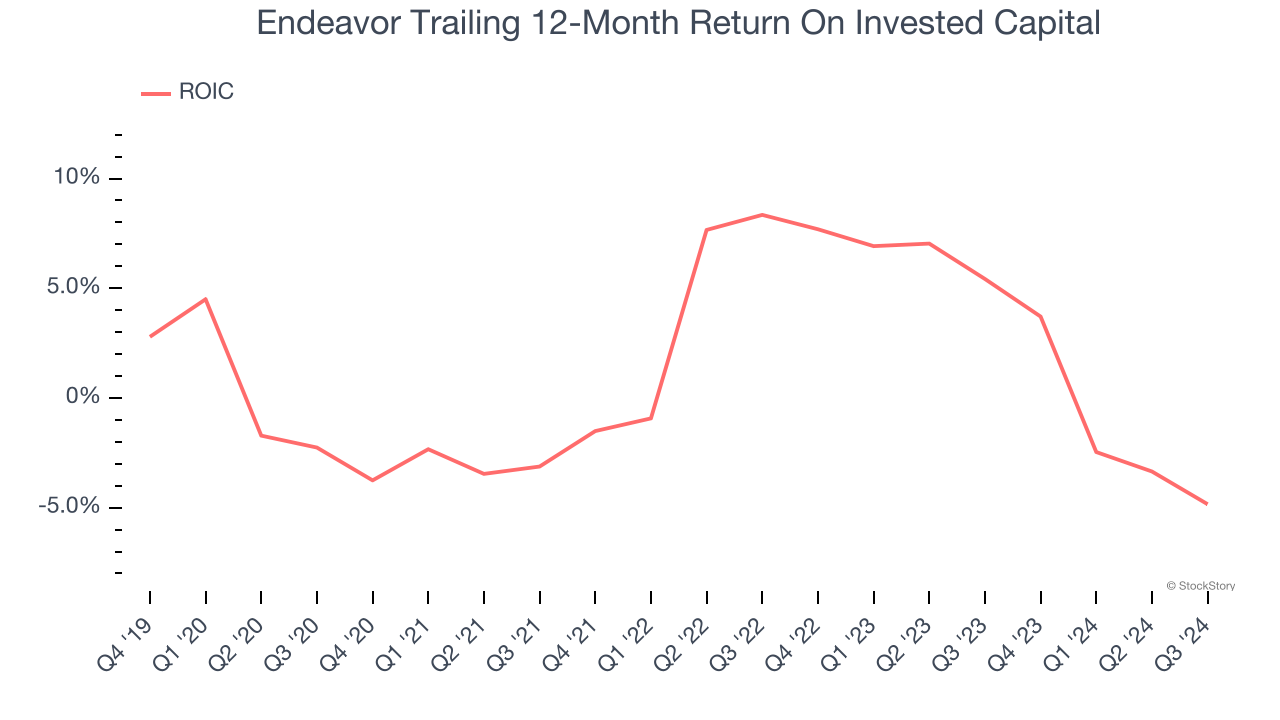

2. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Endeavor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.7%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Endeavor’s revenue to stall, a deceleration versus its 14.4% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Endeavor, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 15× forward price-to-earnings (or $31.26 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. Let us point you toward Uber, whose profitability just reached an inflection point.

Stocks We Like More Than Endeavor

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.