Emerson Electric has been treading water for the past six months, holding steady at $117. This is close to the S&P 500’s 2.5% gain during that period.

Is now the time to buy Emerson Electric, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We're cautious about Emerson Electric. Here are three reasons why EMR doesn't excite us and a stock we'd rather own.

Why Is Emerson Electric Not Exciting?

Founded in 1890, Emerson Electric (NYSE: EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

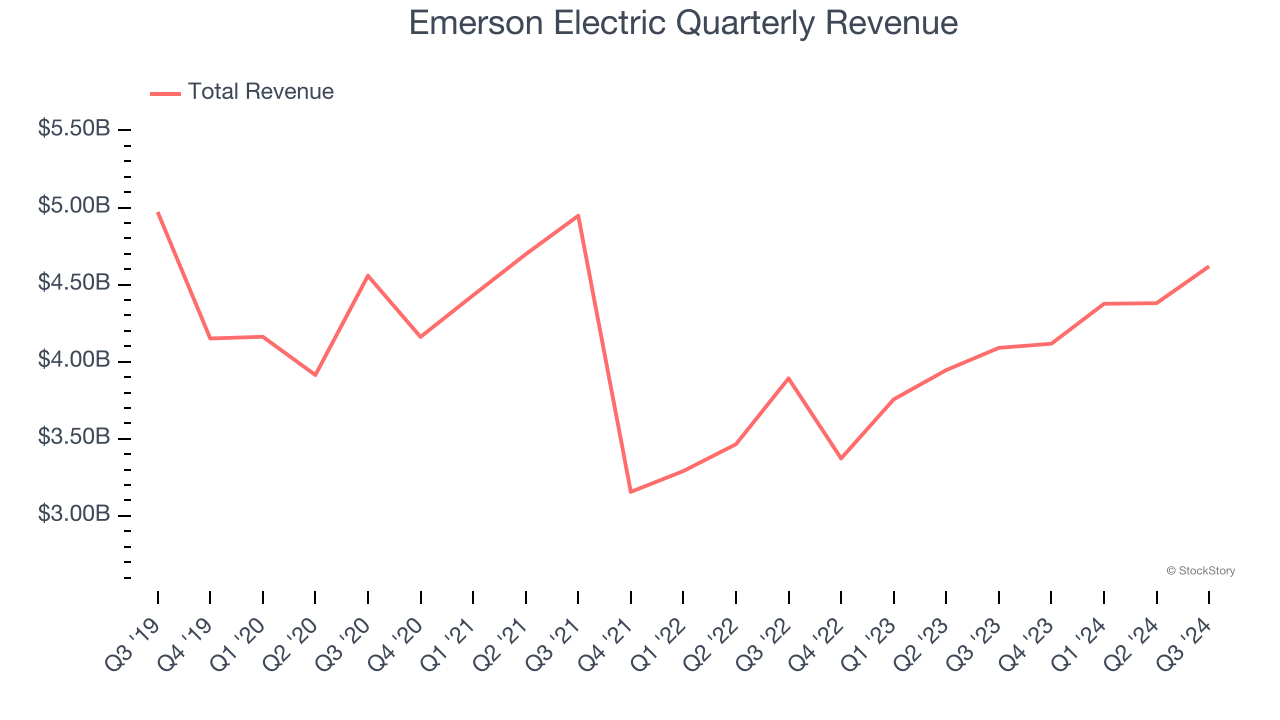

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Emerson Electric struggled to consistently increase demand as its $17.49 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and signals it’s a lower quality business.

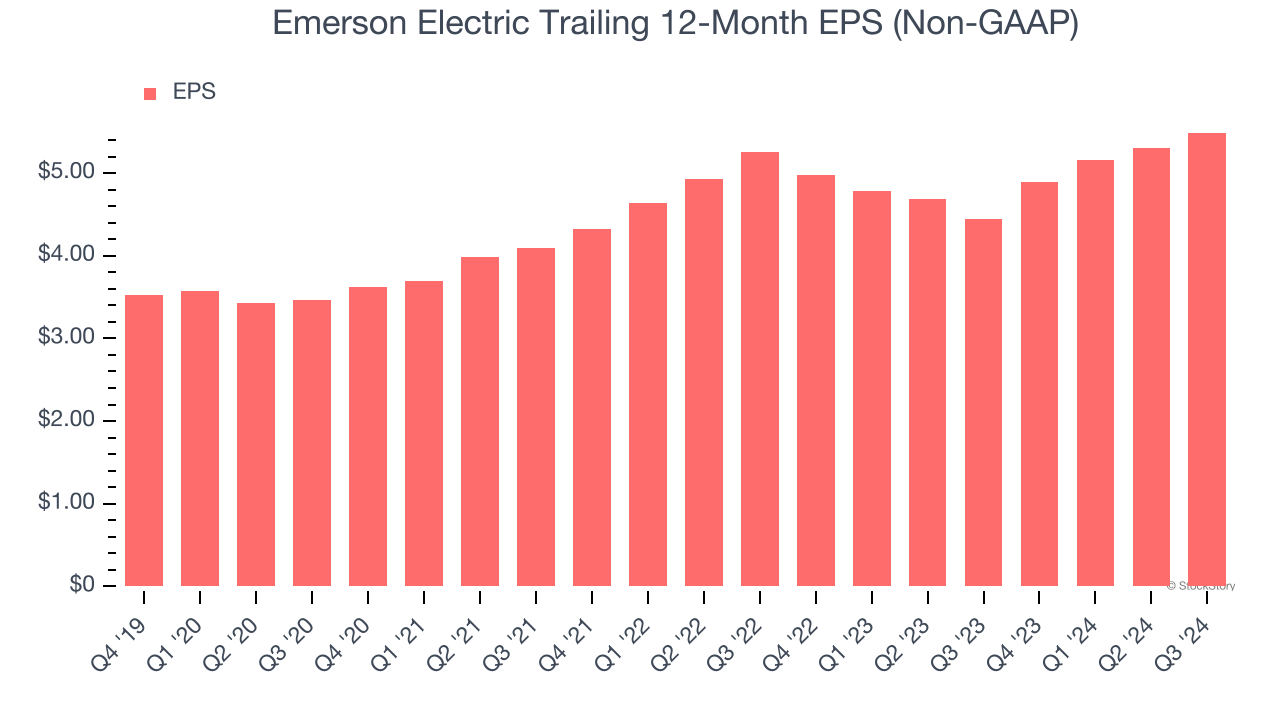

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Emerson Electric’s EPS grew at a weak 2.3% compounded annual growth rate over the last two years, lower than its 12.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

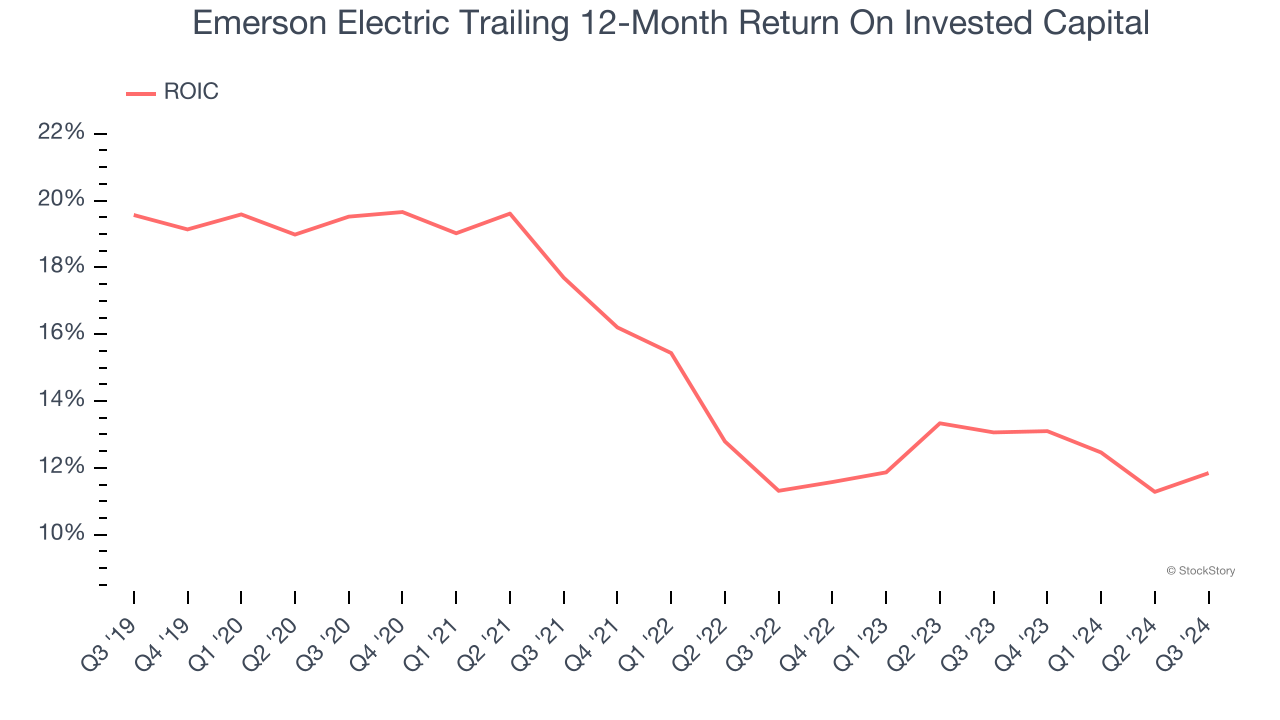

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Emerson Electric’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Emerson Electric isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 20.6× forward price-to-earnings (or $117 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. Let us point you toward Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than Emerson Electric

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.