Over the last six months, AeroVironment’s shares have sunk to $163, producing a disappointing 7.1% loss - a stark contrast to the S&P 500’s 4.7% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in AeroVironment, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid AVAV and a stock we'd rather own.

Why Is AeroVironment Not Exciting?

Focused on the future of autonomous military combat, AeroVironment (NASDAQ: AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

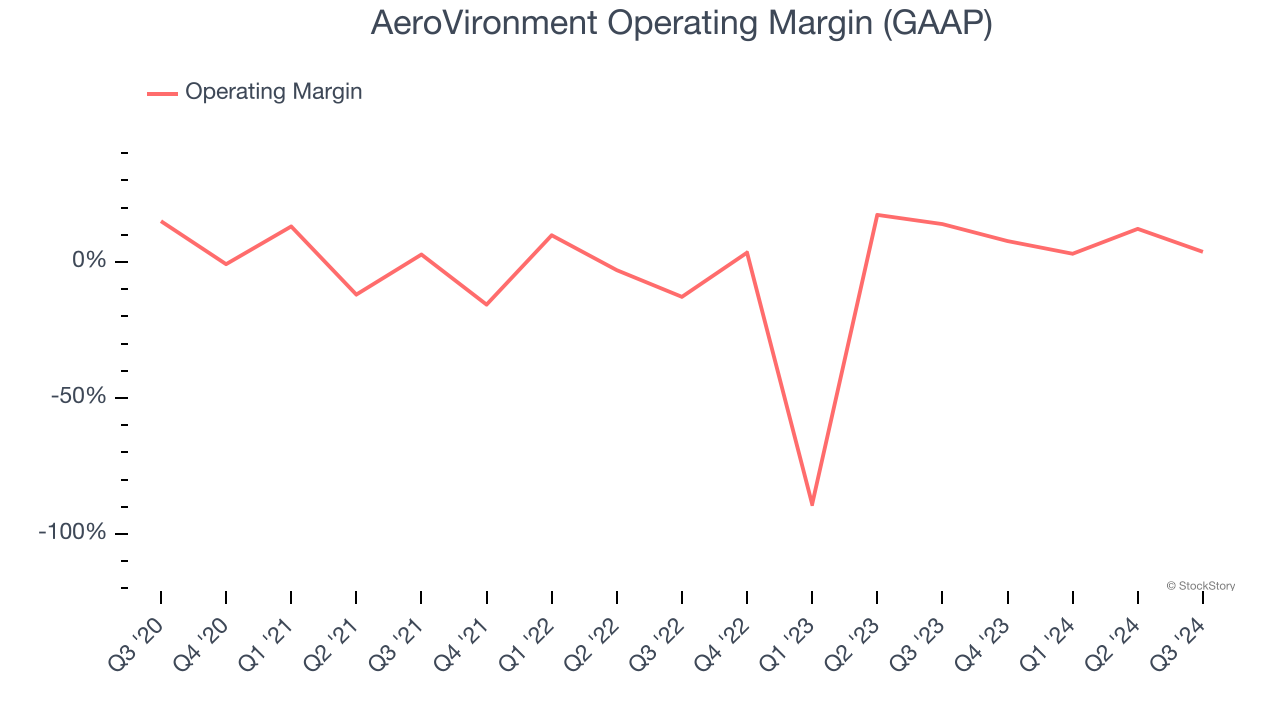

1. Operating Margin Falling

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, AeroVironment’s operating margin decreased by 5.7 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its operating margin for the trailing 12 months was 6.6%.

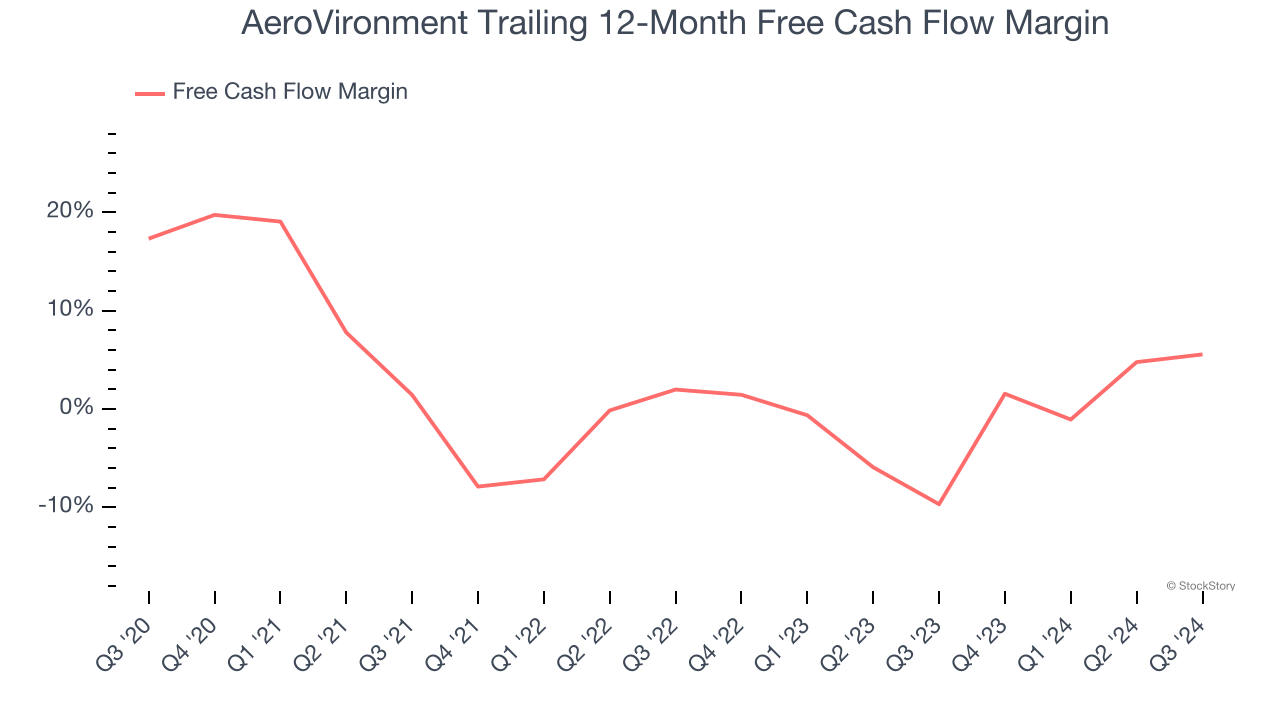

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, AeroVironment’s margin dropped by 11.8 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. AeroVironment’s free cash flow margin for the trailing 12 months was 5.6%.

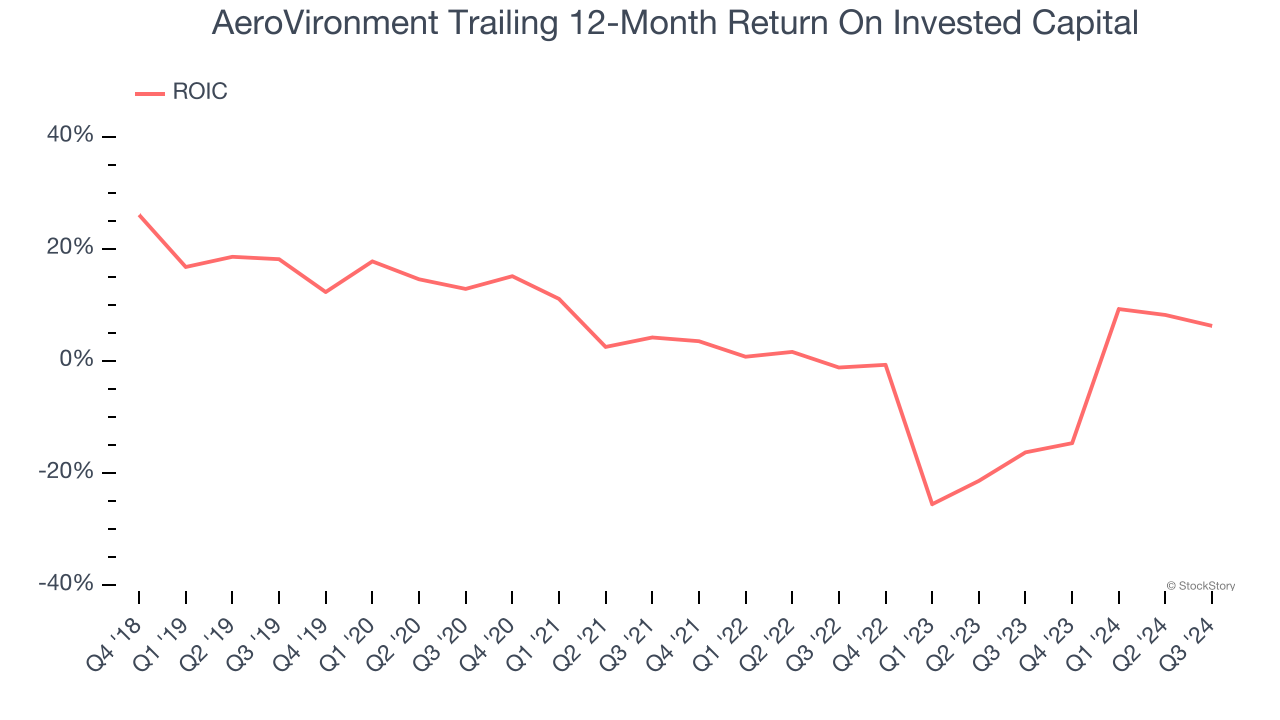

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, AeroVironment’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

AeroVironment isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 43.2× forward price-to-earnings (or $163 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of AeroVironment

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.